The Suffolk New York Debt Conversion Agreement with exhibit A is a legally binding contract that outlines the terms and conditions for the conversion of debt in the Suffolk County region of New York. This agreement is specifically designed for situations where exhibit A provides all the necessary information regarding the debt being converted. In Suffolk County, there could be different types of Debt Conversion Agreements, each tailored to specific circumstances. Some of these variations may include: 1. Suffolk New York Debt Conversion Agreement for Outstanding Loans: This type of agreement is used when there are outstanding loans that need to be converted into a different form of debt, such as bonds or equity shares. Exhibit A in this case would include the details of the original loans and the terms of the conversion. 2. Suffolk New York Debt Conversion Agreement for Municipal Debt: Municipalities within Suffolk County may enter into this type of agreement to convert their existing debt, such as municipal bonds or notes, into new obligations with revised terms. Exhibit A would provide a comprehensive breakdown of the existing debt being converted. 3. Suffolk New York Debt Conversion Agreement for Personal Loans: Individuals or businesses residing in Suffolk County may utilize this agreement to convert personal loans into alternative debt instruments. Exhibit A in this case would specify the nature of the original loans, including the lenders, principal amounts, interest rates, and any other relevant details. Regardless of the specific type, every Suffolk New York Debt Conversion Agreement with exhibit A only will include essential provisions such as the effective date of the agreement, conversion terms, payment schedules, interest rates, and any potential penalties or charges for non-compliance. It is important to note that this description is for informative purposes only and should not be considered as legal advice. It is advisable to consult with a qualified attorney or legal professional to ensure compliance with all applicable laws and regulations when entering into any Debt Conversion Agreement in Suffolk County, New York.

Suffolk New York Debt Conversion Agreement with exhibit A only

Description

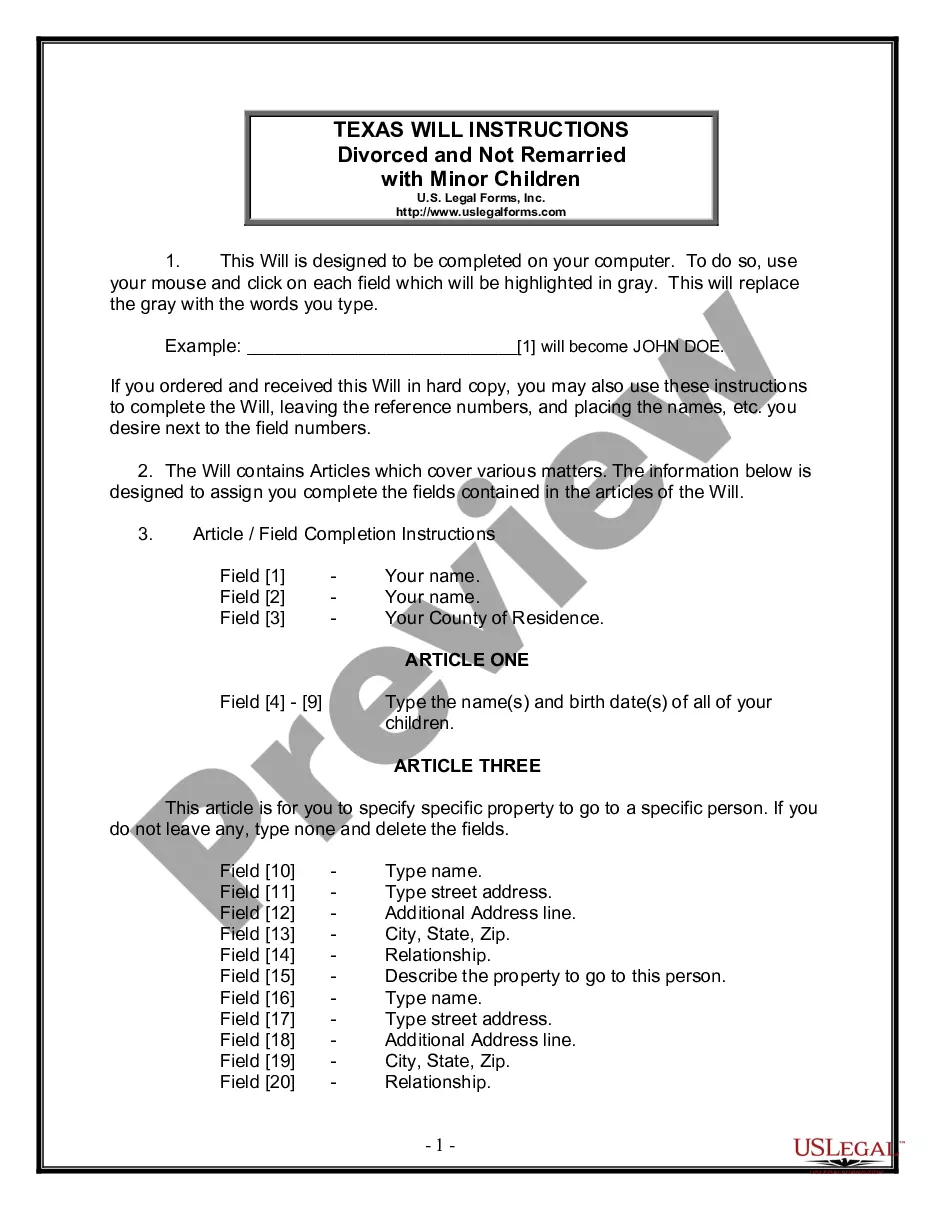

How to fill out Suffolk New York Debt Conversion Agreement With Exhibit A Only?

Preparing legal paperwork can be difficult. Besides, if you decide to ask an attorney to draft a commercial agreement, documents for ownership transfer, pre-marital agreement, divorce papers, or the Suffolk Debt Conversion Agreement with exhibit A only, it may cost you a lot of money. So what is the most reasonable way to save time and money and draw up legitimate forms in total compliance with your state and local laws? US Legal Forms is a great solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is the most extensive online collection of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any use case collected all in one place. Therefore, if you need the recent version of the Suffolk Debt Conversion Agreement with exhibit A only, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Suffolk Debt Conversion Agreement with exhibit A only:

- Look through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the right one in the header.

- Click Buy Now when you find the needed sample and select the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a transaction with a credit card or via PayPal.

- Opt for the document format for your Suffolk Debt Conversion Agreement with exhibit A only and download it.

When finished, you can print it out and complete it on paper or import the template to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the paperwork ever obtained many times - you can find your templates in the My Forms tab in your profile. Try it out now!

Form popularity

FAQ

In its simplest form, a creditor's existing debt (including principal and accrued interest) is converted into shares in the borrower. New shares are issued to the lender in satisfaction of the debt and the loan is no longer owed.

A procedure for CONVERTING A LOAN INTO EQUITY is set down in Section 62(3) of the Companies Act 2013 resolution: Before taking out a loan, approve a special resolution approving the terms of the loan, and file the special resolution in e-Form MGT-14 within 30 days.

A Company may opt for conversion of loan to equity where there is an obligation on the part of the company to pay its debt as per the loan agreement within the time limit. At times companies are not in a position to satisfy its debt obligations, they exercise for conversion of such loan into equity.

Convert loan into shares by passing a resolution in Board Meeting & File E-form PAS3 for allotment of shares Companies Act 2013 within 30 days. Also, issue share certificate by passing Board resolution & file e-form MGT 14 within 30 days for the procedure for issue of shares by the private limited company.

In its simplest form, a creditor's existing debt (including principal and accrued interest) is converted into shares in the borrower. New shares are issued to the lender in satisfaction of the debt and the loan is no longer owed.

Debt conversion is the exchange of debt - typically at a substantial discount - for equity, or counterpart domestic currency funds to be used to finance a particular project or policy. Debt for equity, debt for nature and debt for development swaps are all examples of debt conversion.

Before taking out a loan, approve a special resolution approving the terms of the loan, and file the special resolution in e-Form MGT-14 within 30 days. By making a resolution at the Board Meeting, convert the loan into shares, and file e-form PAS-3 for allotment of shares under the Companies Act, 2013, within 30 days.

Therefore, for conversion of loan into equity it must be noted that the company has accepted the loan on such terms and conditions that the loan will be converted into share capital anytime in future. For this purpose, special resolution has been passed by the company at the time of acceptance of such loan.

A conversion agreement allows spouses to transfer ownership of their separate property to their spouse in a marriage.

As per Section 62(3) of the Companies Act 2013 resolution, there is a procedure for conversion of loan into preference shares: Approve terms of the loan by passing a special resolution before taking of loan & file special resolution in e-Form MGT-14 within 30 days.