A Broward Florida Form of Security Agreement is a legally binding document that outlines the terms and conditions of a security agreement between Everest and Jennings International, Ltd., Everest and Jennings, Inc., and BIL, Ltd. This agreement is designed to protect the interests and assets of the involved parties and provide a clear understanding of the rights and obligations of each party. The Broward Florida Form of Security Agreement may include various types depending on the specific requirements of the parties involved. Some common types of security agreements include: 1. Collateralized Security Agreement: This type of agreement involves the borrower providing collateral, such as real estate, equipment, inventory, or accounts receivable, to secure the loan. In case of default, the lender has the right to seize and sell the collateral to recover the outstanding debt. 2. Pledge and Security Agreement: In this type of agreement, the borrower pledges a specific asset as security to the lender. The asset could be shares of stock, certificates of deposit, or other valuable assets owned by the borrower. The lender has the right to take possession of the pledged asset if the borrower fails to fulfill their obligations. 3. Debenture and Security Agreement: This agreement involves the borrower issuing debentures, which are long-term unsecured debt instruments, to the lender. The debentures serve as security for the loan and provide the lender with a claim against the borrower's assets in case of default. 4. Guaranty and Security Agreement: This type of agreement is executed when a third party guarantees the repayment of the borrower's debt. The guarantor becomes liable for the repayment if the borrower defaults. The agreement may include provisions for the lender to take possession of the guarantor's assets in case of default. A Broward Florida Form of Security Agreement between Everest and Jennings International, Ltd., Everest and Jennings, Inc., and BIL, Ltd. will typically include crucial elements such as a detailed description of the collateral, the terms of repayment, the obligations of the borrower, default provisions, and remedies in case of default. To ensure the legality and enforceability of the agreement, it is recommended that the parties involve legal professionals specializing in Broward Florida laws to draft and review the agreement. This will help protect the interests of all parties involved and provide clarity in case of any disputes or issues that may arise during the term of the agreement.

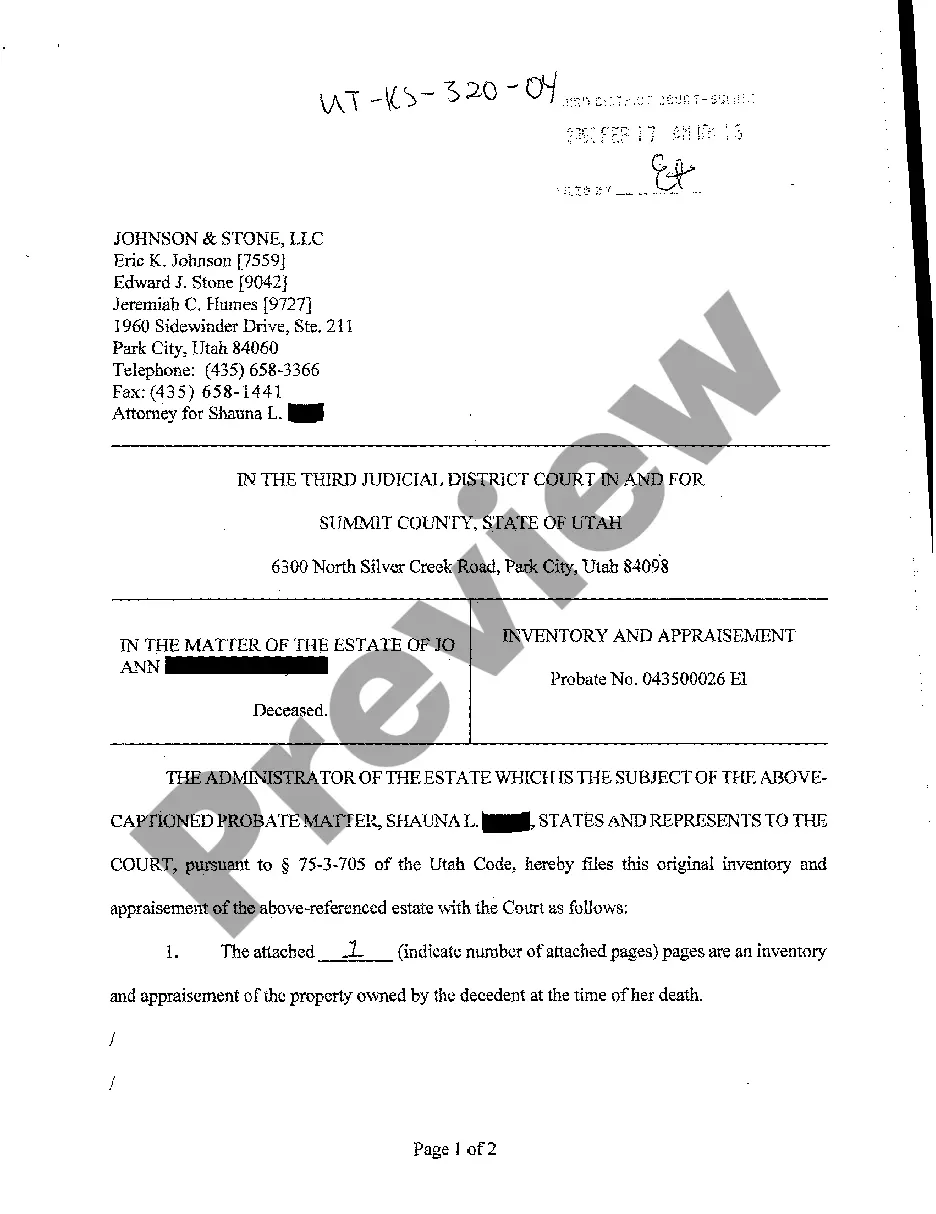

Broward Florida Form of Security Agreement between Everest and Jennings International, Ltd., Everest and Jennings, Inc., and BIL, Ltd.

Description

How to fill out Broward Florida Form Of Security Agreement Between Everest And Jennings International, Ltd., Everest And Jennings, Inc., And BIL, Ltd.?

Laws and regulations in every area vary around the country. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal documentation. To avoid costly legal assistance when preparing the Broward Form of Security Agreement between Everest and Jennings International, Ltd., Everest and Jennings, Inc., and BIL, Ltd., you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal templates. It's a great solution for professionals and individuals looking for do-it-yourself templates for various life and business situations. All the documents can be used many times: once you purchase a sample, it remains accessible in your profile for further use. Thus, if you have an account with a valid subscription, you can simply log in and re-download the Broward Form of Security Agreement between Everest and Jennings International, Ltd., Everest and Jennings, Inc., and BIL, Ltd. from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Broward Form of Security Agreement between Everest and Jennings International, Ltd., Everest and Jennings, Inc., and BIL, Ltd.:

- Analyze the page content to make sure you found the correct sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to obtain the template once you find the right one.

- Opt for one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!