Alameda, California Form of Convertible Promissory Note, Common Stock is a legal agreement used in the city of Alameda, California, specifically for the purpose of facilitating financial transactions involving convertible promissory notes and common stock. A convertible promissory note is a form of debt instrument that can be converted into equity, typically common stock, at a later date. This means that the holder of the note has the option to convert the debt they are owed into shares of the company's common stock. The Alameda, California Form of Convertible Promissory Note, Common Stock includes all the necessary terms and conditions to outline the rights and obligations of both the issuer of the note and the holder. It typically covers the following key aspects: 1. Principal Amount: The initial amount of money borrowed by the issuer from the holder of the note. 2. Interest Rate: The rate at which interest will accrue on the principal amount, usually specified as a percentage per annum. 3. Maturity Date: The date on which the note is due to be repaid in full, including any interest that has accrued. 4. Conversion Terms: The specific terms governing the conversion of the note into common stock, including the conversion ratio, which determines the number of shares the holder receives for each dollar of debt converted. 5. Protective Provisions: Certain protective rights or voting rights that the holder may have, such as the ability to participate in future equity financings or approval rights over certain corporate actions. 6. Events of Default: The conditions that, if triggered, would make the note immediately due and payable, such as bankruptcy or failure to make timely payments. Different types of Alameda, California Form of Convertible Promissory Note, Common Stock may exist, tailored to suit specific transaction requirements or investment terms. These could include variations on interest rates, conversion ratios, or protective provisions, to name a few. However, the basic structure and purpose of these documents remain consistent. In conclusion, the Alameda, California Form of Convertible Promissory Note, Common Stock is a legally binding agreement used in Alameda, California, as a means of structuring financial transactions involving convertible promissory notes and common stock. It outlines the terms and conditions governing the debt-to-equity conversion, protecting the rights of both the issuer and the holder.

Alameda California Form of Convertible Promissory Note, Common Stock

Description

How to fill out Alameda California Form Of Convertible Promissory Note, Common Stock?

A document routine always accompanies any legal activity you make. Staring a company, applying or accepting a job offer, transferring property, and lots of other life situations require you prepare formal paperwork that varies throughout the country. That's why having it all collected in one place is so beneficial.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal forms. On this platform, you can easily locate and download a document for any personal or business objective utilized in your region, including the Alameda Form of Convertible Promissory Note, Common Stock.

Locating forms on the platform is extremely simple. If you already have a subscription to our library, log in to your account, find the sample using the search field, and click Download to save it on your device. After that, the Alameda Form of Convertible Promissory Note, Common Stock will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this simple guideline to obtain the Alameda Form of Convertible Promissory Note, Common Stock:

- Make sure you have opened the correct page with your localised form.

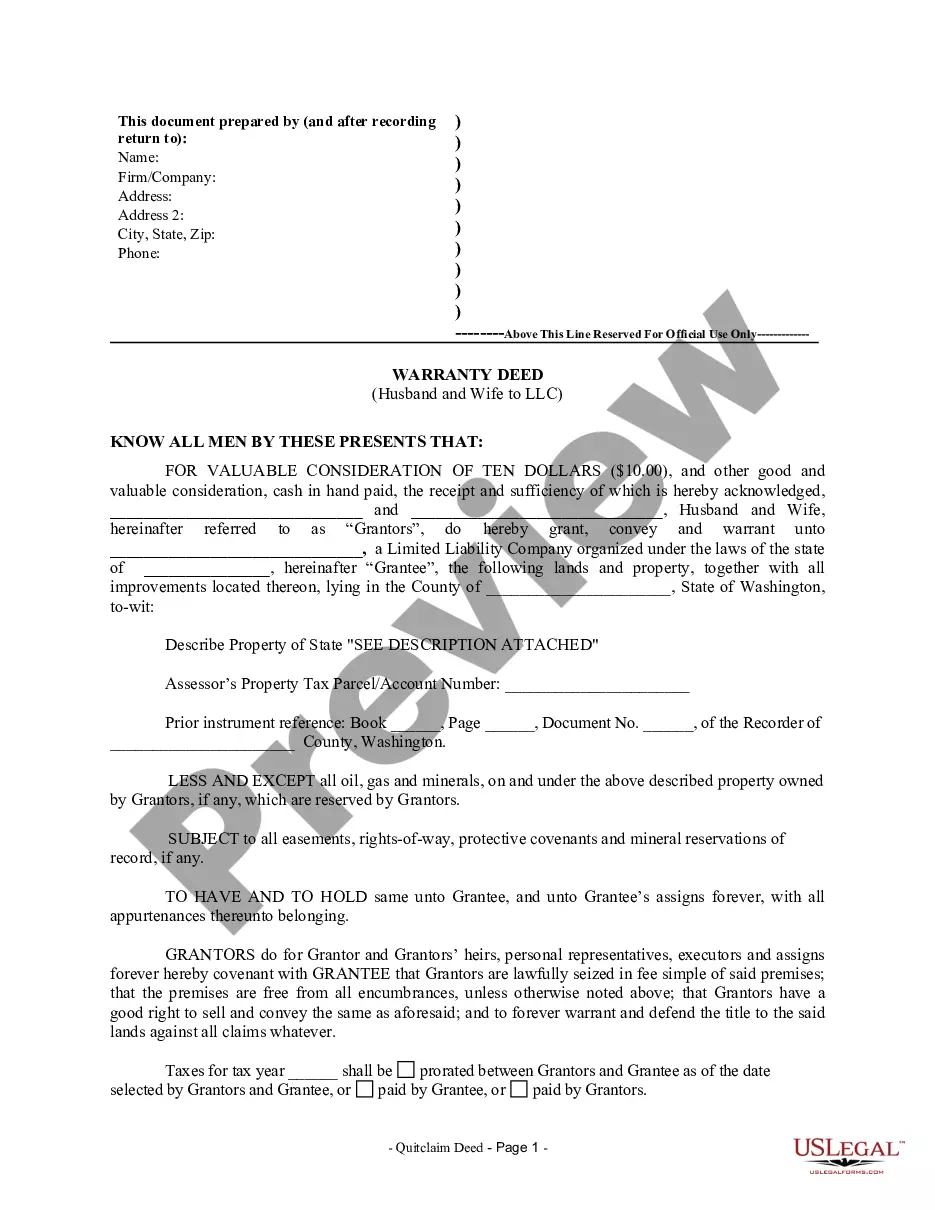

- Make use of the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the form meets your requirements.

- Look for another document via the search option if the sample doesn't fit you.

- Click Buy Now when you locate the required template.

- Decide on the suitable subscription plan, then sign in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and download the Alameda Form of Convertible Promissory Note, Common Stock on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most reliable way to obtain legal paperwork. All the samples provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs properly with the US Legal Forms!