Dallas, Texas is a vibrant city located in the southern United States, known for its rich cultural heritage, strong economy, and bustling metropolitan lifestyle. When it comes to investment opportunities, one common form of financing used by start-ups and growing businesses in Dallas is the Convertible Promissory Note. A Convertible Promissory Note is a debt instrument that allows a lender to provide a loan to a company while having the option to convert it into equity at a later date. It is an attractive option for both lenders and borrowers as it offers flexibility and potential for higher returns. In the case of Dallas, several types of Convertible Promissory Notes are prevalent within the common stock market. 1. Debt to Equity Conversion Note: This type of Convertible Promissory Note lays out the terms and conditions under which the loan can be converted into equity. It typically includes the conversion ratio, which outlines how many shares of common stock will be issued for each dollar of debt converted. This Note aims to protect the lender's interests while providing an opportunity for the borrower to attract additional investment. 2. Discounted Convertible Promissory Note: This particular type of Note provides a benefit to the lender by offering a discount upon conversion into common stock. For example, if the Note includes a 20% discount, upon conversion, the lender will receive common stock at 80% of the future price per share. This incentivizes lenders to provide funding and share in the expected growth of the business. 3. Interest-Bearing Convertible Promissory Note: In some cases, Convertible Promissory Notes may include an interest-bearing feature. This means that in addition to allowing conversion into common stock, the Note accrues interest over time. The interest rate and payment terms are outlined within the Note, ensuring that the lender receives both the principal and the interest upon maturity or conversion. 4. Valuation Cap Convertible Promissory Note: A Valuation Cap Note sets a maximum valuation at which the loan can be converted into equity. This protects the lender's investment by ensuring they receive an appropriate return to the case of high company valuations during subsequent funding rounds. If the company's valuation exceeds the cap, the conversion is still based on the capped valuation, allowing the lender to benefit from the company's growth. These are just a few examples of the various types of Dallas, Texas Form of Convertible Promissory Note, Common Stock available in the market. Each type serves specific purposes and provides different advantages to both lenders and borrowers. It is crucial for investors and businesses in Dallas to understand these options and carefully consider the terms and implications before entering into any financial agreements.

Dallas Texas Form of Convertible Promissory Note, Common Stock

Description

How to fill out Dallas Texas Form Of Convertible Promissory Note, Common Stock?

Whether you intend to open your company, enter into a deal, apply for your ID renewal, or resolve family-related legal issues, you need to prepare certain documentation meeting your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and verified legal templates for any individual or business occasion. All files are collected by state and area of use, so opting for a copy like Dallas Form of Convertible Promissory Note, Common Stock is quick and easy.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a couple of additional steps to obtain the Dallas Form of Convertible Promissory Note, Common Stock. Adhere to the guide below:

- Make sure the sample fulfills your individual needs and state law requirements.

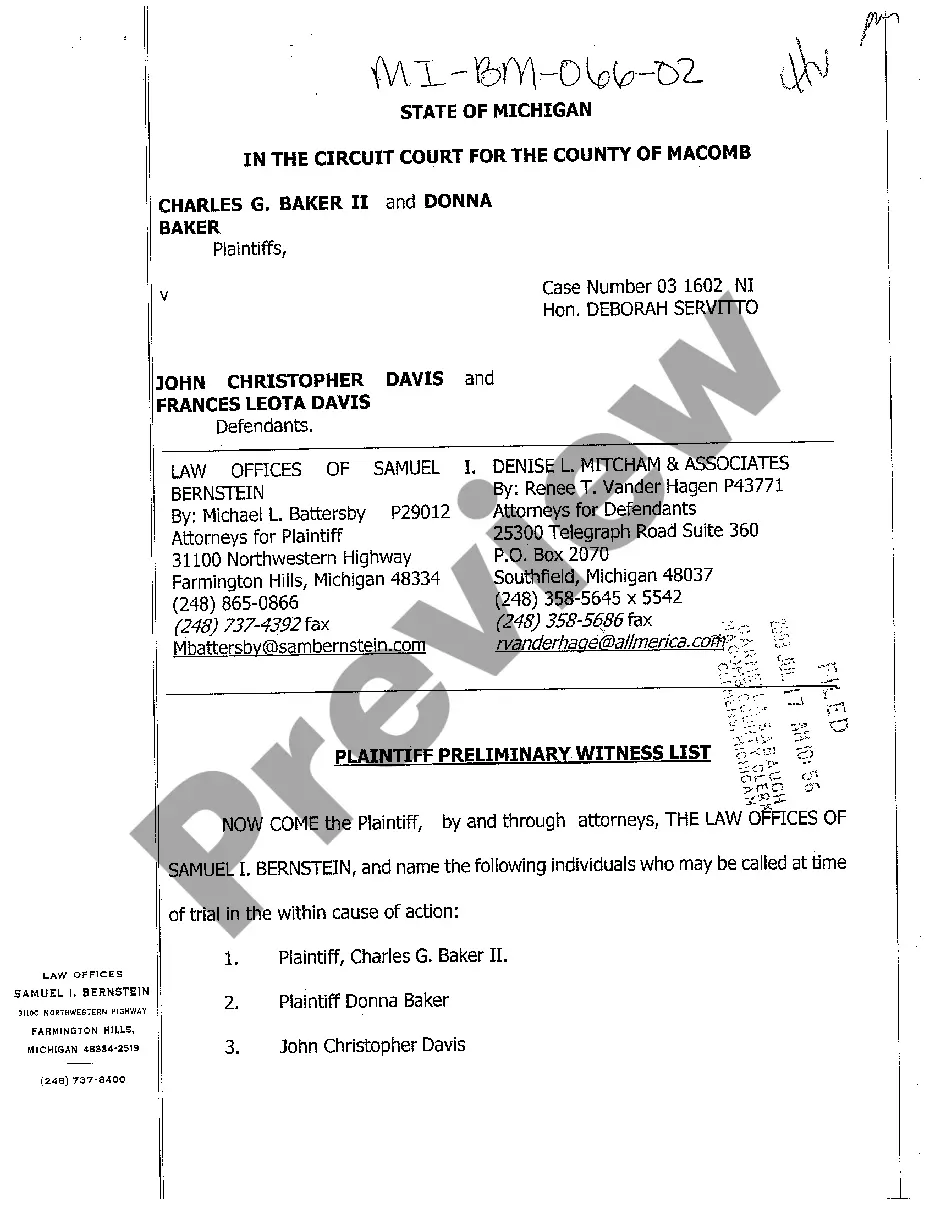

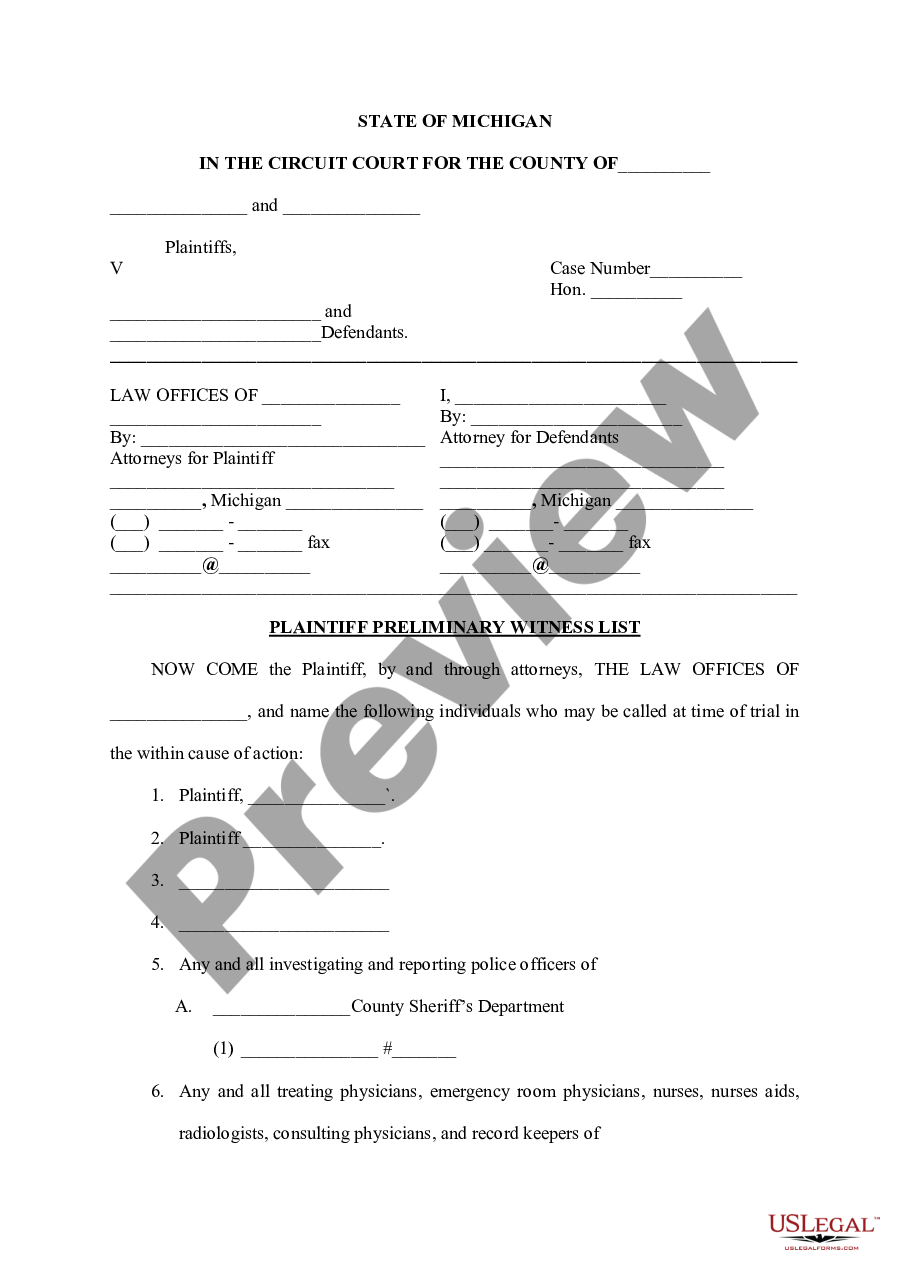

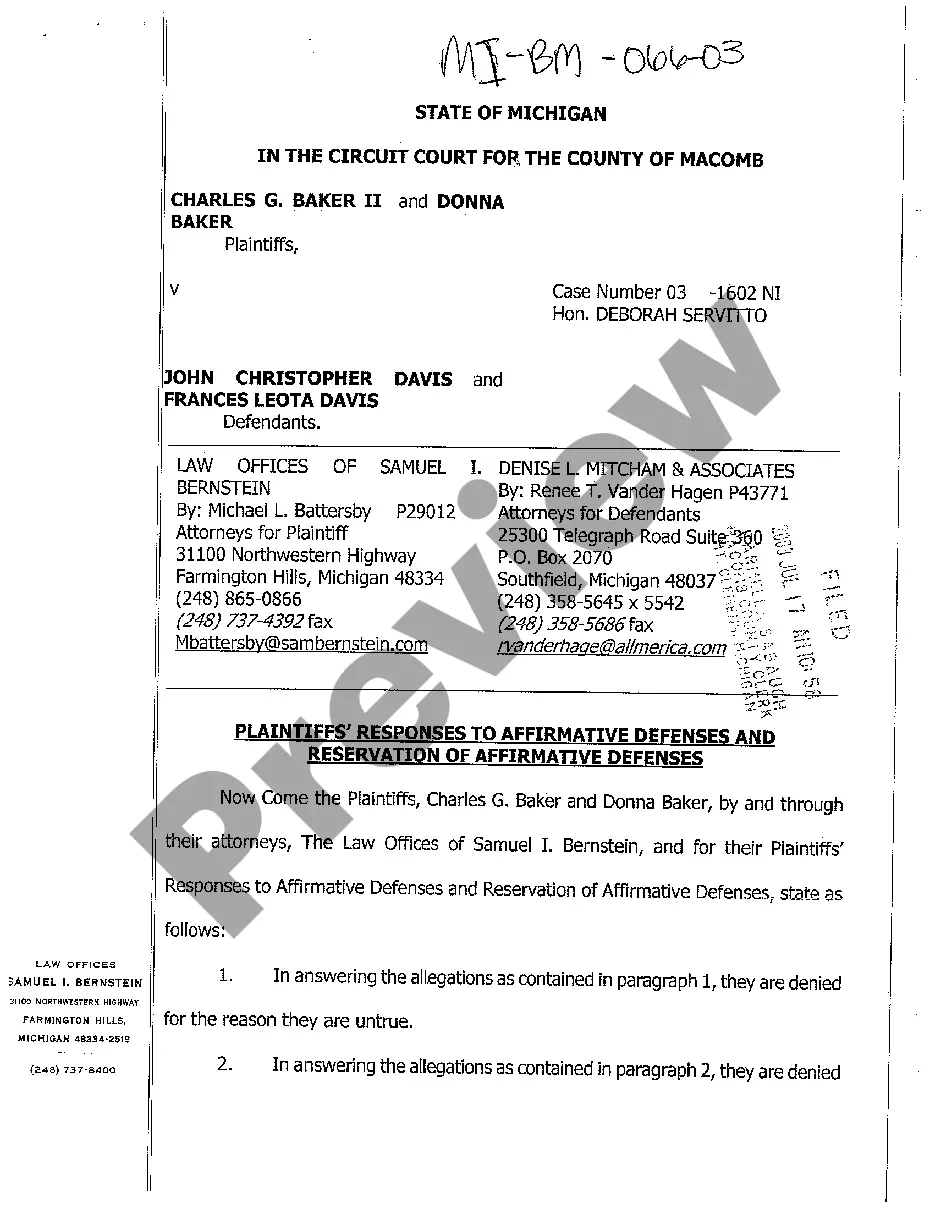

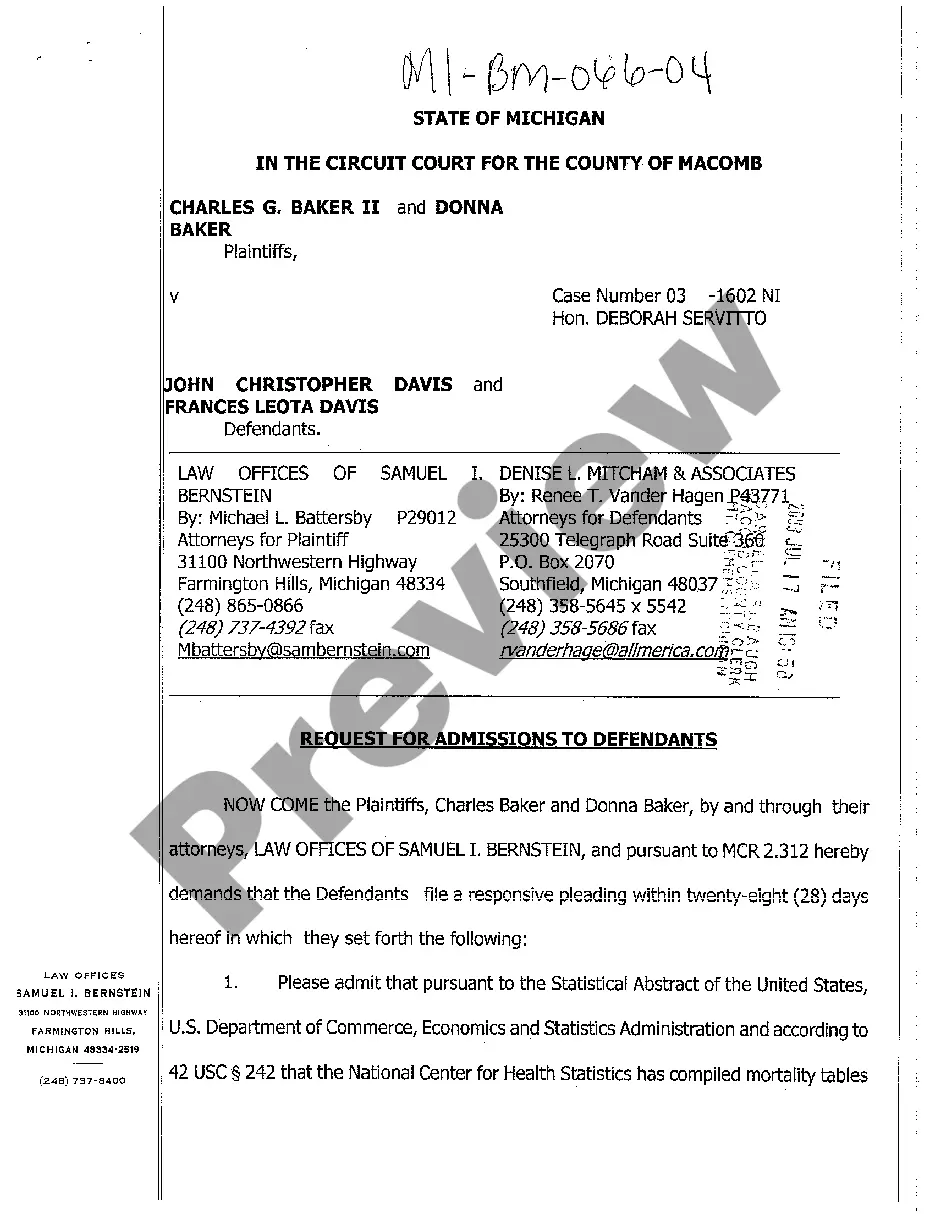

- Look through the form description and check the Preview if there’s one on the page.

- Utilize the search tab providing your state above to find another template.

- Click Buy Now to get the file once you find the right one.

- Opt for the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Dallas Form of Convertible Promissory Note, Common Stock in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our library are reusable. Having an active subscription, you are able to access all of your earlier purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documentation. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!