Harris Texas Form of Convertible Promissory Note, Preferred Stock is a legal document commonly used in business transactions and investments. It outlines the terms and conditions associated with convertible promissory notes that can later be converted into preferred stock. The Harris Texas Form of Convertible Promissory Note, Preferred Stock is typically utilized by companies seeking to raise capital through convertible debt instruments. This form provides a standardized template that ensures transparency and consistency in the creation of these financial agreements. Some relevant keywords related to the Harris Texas Form of Convertible Promissory Note, Preferred Stock include: 1. Convertible Promissory Note: This refers to a debt instrument that can be converted into equity shares of a company. It outlines the terms and conditions under which the conversion can occur. 2. Preferred Stock: As part of the conversion process, the promissory note may be converted into preferred stock. Preferred stockholders have certain privileges and rights over common stockholders, such as priority in dividend distributions and liquidation preferences. 3. Harris Texas: This specifies the jurisdiction in which the form is applicable. Harris County, Texas is a popular location for business transactions, and this form ensures compliance with local laws and regulations. 4. Legal Framework: The Harris Texas Form of Convertible Promissory Note, Preferred Stock provides a legal framework that governs the relationship between the parties involved, including the issuer, investor, and any potential guarantors. 5. Conversion Terms: The form defines the specific terms and conditions for the conversion of the promissory note into preferred stock. This includes details such as conversion ratio, conversion price, and any restrictions or conditions for conversion. 6. Rights and Preferences: The form also outlines the various rights and preferences associated with the preferred stock, such as voting rights, liquidation preferences, and anti-dilution protection. 7. Interest and Repayment: The form specifies the terms for interest payment and repayment of the principal amount, including the interest rate, repayment schedule, and any applicable penalties or default provisions. Different types of Harris Texas Form of Convertible Promissory Note, Preferred Stock may exist with variations in specific terms and provisions based on the requirements of the issuing company and the preferences of the investors involved.

Harris Texas Form of Convertible Promissory Note, Preferred Stock

Description

How to fill out Harris Texas Form Of Convertible Promissory Note, Preferred Stock?

Preparing legal paperwork can be burdensome. In addition, if you decide to ask an attorney to draft a commercial contract, papers for ownership transfer, pre-marital agreement, divorce paperwork, or the Harris Form of Convertible Promissory Note, Preferred Stock, it may cost you a fortune. So what is the best way to save time and money and draw up legitimate forms in total compliance with your state and local regulations? US Legal Forms is a perfect solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is biggest online library of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any scenario gathered all in one place. Consequently, if you need the latest version of the Harris Form of Convertible Promissory Note, Preferred Stock, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Harris Form of Convertible Promissory Note, Preferred Stock:

- Look through the page and verify there is a sample for your region.

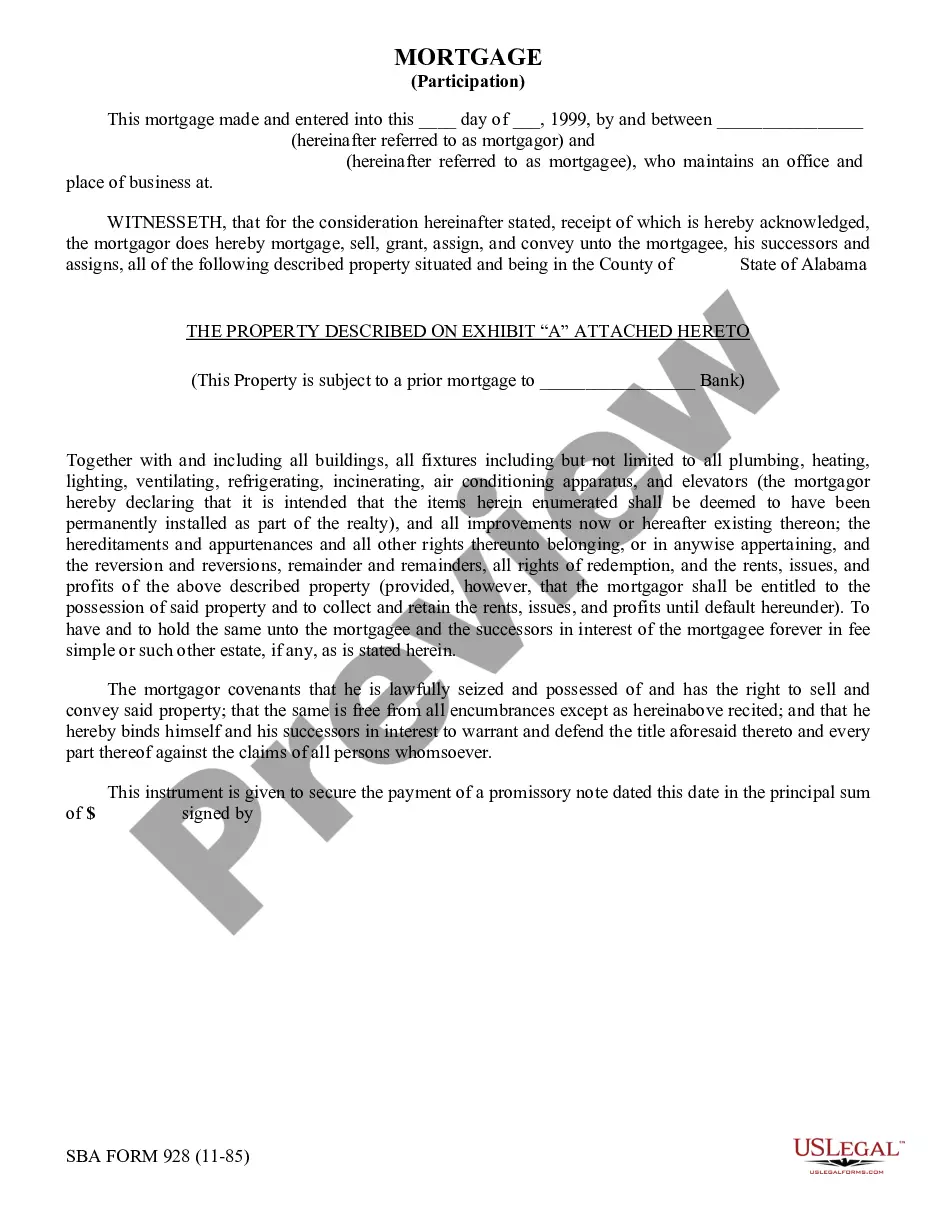

- Examine the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - search for the correct one in the header.

- Click Buy Now once you find the needed sample and pick the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a payment with a credit card or via PayPal.

- Opt for the file format for your Harris Form of Convertible Promissory Note, Preferred Stock and download it.

Once done, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the paperwork ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!