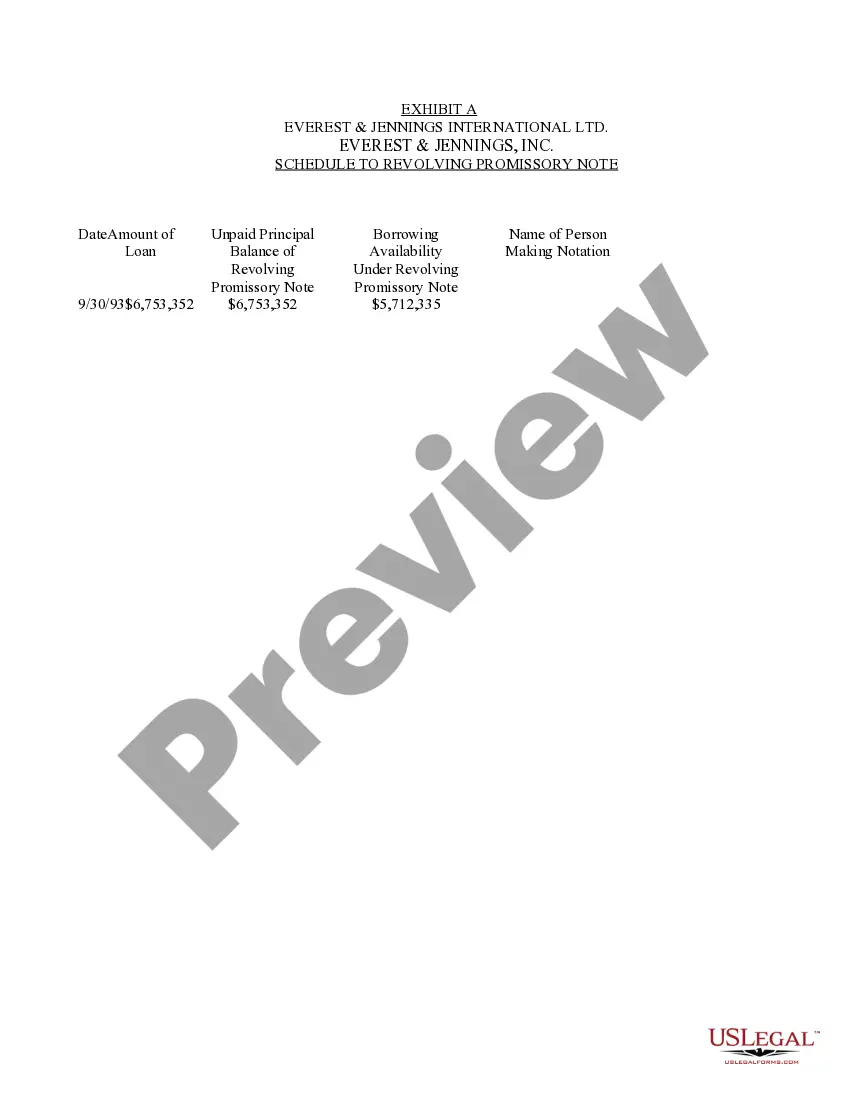

Chicago, Illinois is a bustling city known for its thriving economy, cultural diversity, and architectural marvels. In the financial realm, a Chicago Illinois Form of Revolving Promissory Note is a widely used legal document that outlines the terms and conditions of a revolving promissory note issued within the jurisdiction of Chicago, Illinois. The Chicago Illinois Form of Revolving Promissory Note serves as a binding agreement between a lender and borrower, facilitating the extension of credit for various purposes such as financing business operations, funding expansion plans, or managing cash flow. This legal instrument allows the borrower to access funds up to a specified credit limit, with the ability to borrow, repay, and reborrow within the specified terms. One type of Chicago Illinois Form of Revolving Promissory Note is the secured revolving promissory note, which requires the borrower to provide collateral, typically in the form of assets or property. The collateral serves as security for the loan, reducing the lender's risk and providing a guarantee of repayment. Another type is the unsecured revolving promissory note. Unlike the secured version, this type does not require collateral from the borrower. Instead, the lender relies solely on the borrower's creditworthiness and financial history to assess the risk involved in extending credit. Generally, these types of notes carry higher interest rates due to the increased risk for the lender. When drafting a Chicago Illinois Form of Revolving Promissory Note, several key elements need to be included. These include the principal amount of the loan, the interest rate, repayment terms, late fees, default provisions, and events of default, which trigger the lender's rights in the case of non-payment or breaches of the agreement. Additionally, the note should specify any fees associated with the revolving nature of the loan, such as commitment fees, origination fees, or annual fees. It is important to mention that legal counsel should be sought to ensure compliance with applicable laws and regulations in Chicago, Illinois when creating a Form of Revolving Promissory Note. The language and structure of the document may vary depending on the specific requirements of the lender and borrower. In conclusion, a Chicago Illinois Form of Revolving Promissory Note is a crucial legal agreement that enables borrowers in the city to access revolving credit for their business or personal needs. With different types available, such as secured and unsecured, it is essential to carefully consider the terms and seek professional advice while drafting or signing such a document.

Chicago Illinois Form of Revolving Promissory Note

Description

How to fill out Chicago Illinois Form Of Revolving Promissory Note?

Are you looking to quickly draft a legally-binding Chicago Form of Revolving Promissory Note or probably any other form to manage your personal or corporate affairs? You can go with two options: contact a professional to draft a legal document for you or draft it entirely on your own. Thankfully, there's another option - US Legal Forms. It will help you get neatly written legal papers without paying unreasonable prices for legal services.

US Legal Forms offers a rich collection of over 85,000 state-compliant form templates, including Chicago Form of Revolving Promissory Note and form packages. We provide templates for a myriad of use cases: from divorce paperwork to real estate documents. We've been on the market for more than 25 years and gained a rock-solid reputation among our customers. Here's how you can become one of them and get the needed document without extra troubles.

- First and foremost, double-check if the Chicago Form of Revolving Promissory Note is adapted to your state's or county's laws.

- If the form comes with a desciption, make sure to verify what it's intended for.

- Start the searching process again if the template isn’t what you were seeking by utilizing the search bar in the header.

- Select the plan that best fits your needs and proceed to the payment.

- Select the file format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, find the Chicago Form of Revolving Promissory Note template, and download it. To re-download the form, just head to the My Forms tab.

It's easy to buy and download legal forms if you use our catalog. In addition, the documents we provide are updated by law professionals, which gives you greater peace of mind when writing legal matters. Try US Legal Forms now and see for yourself!