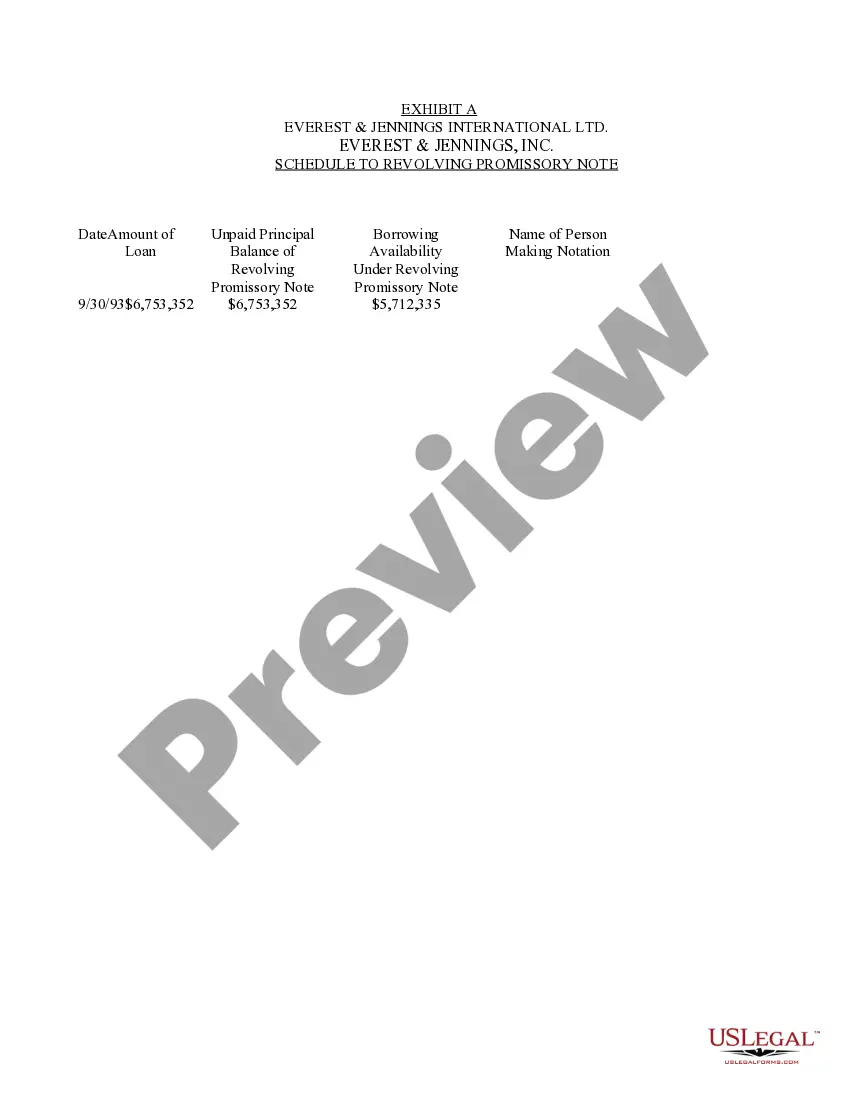

A Phoenix Arizona Form of Revolving Promissory Note refers to a legally binding document commonly used in the state of Arizona to outline the terms and conditions of a revolving promissory note. This promissory note is a type of loan agreement that allows the borrower to borrow funds up to a certain credit limit, repay the borrowed amount, and re-borrow again within the specified period. The Phoenix Arizona Form of Revolving Promissory Note is a versatile financial instrument that can be tailored to meet the specific needs of lenders and borrowers. It typically includes key information such as the names and addresses of the parties involved, the principal amount borrowed, the interest rate, repayment terms, penalties or fees for late payment, and any default provisions. In Phoenix, Arizona, there may be various types of Revolving Promissory Notes, including: 1. Secured Revolving Promissory Note: This type of promissory note requires the borrower to provide collateral, such as real estate or other valuable assets, as security for the loan. In the event of default, the lender has the right to seize the collateral. 2. Unsecured Revolving Promissory Note: Unlike a secured note, an unsecured revolving promissory note does not require any collateral. The lender relies solely on the borrower's creditworthiness and trust to repay the loan. 3. Fixed Interest Rate Revolving Promissory Note: This variation specifies a predetermined interest rate that remains constant throughout the term of the note. Borrowers benefit from the predictability of payment amounts but are unable to take advantage of any potential reductions in interest rates. 4. Variable Interest Rate Revolving Promissory Note: With this type of promissory note, the interest rate fluctuates based on a reference rate, such as the prime rate. As the reference rate changes, the borrower's interest rate and payment obligations may increase or decrease accordingly. Phoenix Arizona Form of Revolving Promissory Notes are crucial for protecting the rights and obligations of both parties involved in a revolving credit arrangement. These documents ensure transparency, clarity, and mutual understanding preventing disputes or legal complications related to repayment terms, interest rates, and other loan-specific provisions. It is important to consult a qualified attorney or financial advisor when drafting or entering into a Phoenix Arizona Form of Revolving Promissory Note to ensure compliance with local laws and regulations and to address any unique circumstances or requirements of the borrower and lender.

Phoenix Arizona Form of Revolving Promissory Note

Description

How to fill out Phoenix Arizona Form Of Revolving Promissory Note?

Are you looking to quickly draft a legally-binding Phoenix Form of Revolving Promissory Note or maybe any other form to manage your personal or business affairs? You can go with two options: hire a professional to write a legal document for you or create it entirely on your own. Luckily, there's another solution - US Legal Forms. It will help you get professionally written legal documents without having to pay unreasonable prices for legal services.

US Legal Forms provides a rich catalog of more than 85,000 state-specific form templates, including Phoenix Form of Revolving Promissory Note and form packages. We provide templates for a myriad of life circumstances: from divorce papers to real estate document templates. We've been on the market for over 25 years and gained a rock-solid reputation among our customers. Here's how you can become one of them and get the needed template without extra hassles.

- To start with, carefully verify if the Phoenix Form of Revolving Promissory Note is tailored to your state's or county's laws.

- If the form has a desciption, make sure to verify what it's suitable for.

- Start the searching process again if the template isn’t what you were hoping to find by using the search box in the header.

- Choose the subscription that is best suited for your needs and proceed to the payment.

- Select the format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, locate the Phoenix Form of Revolving Promissory Note template, and download it. To re-download the form, simply go to the My Forms tab.

It's effortless to buy and download legal forms if you use our services. Additionally, the paperwork we provide are updated by law professionals, which gives you greater peace of mind when dealing with legal matters. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

Do promissory notes hold up in court? They do if the terms of borrowing and repayment are properly stated and signed by the borrower. Promissory notes are used as financial tools to document the terms of borrowing and lending money.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

The promissory note journal entry is recorded by debiting the account that receives value, commonly the cash account, and crediting the notes payable account.

How to Write a Promissory Note Date. Name of the lender and borrower. Loan amount. Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency. Payment due date. Whether the loan has a cosigner, and if so, who.

Does a promissory note have to be notarized? A valid promissory note only needs the signatures of the participating parties involved in the agreement, not necessitating acknowledgment or being witnessed by a notary public to be legitimate.

A Revolving Loan Agreement is a type of credit arrangement made by a financial institution where an account holder can borrow money, repay and borrow again until it expires.

A promissory note includes a specific promise to pay, and the steps required to do so (like the repayment schedule), while an IOU merely acknowledges that a debt exists, and the amount one party owes another.

There is no legal requirement for a promissory note to be witnessed or notarized in Arizona. Still, the parties may decide to have the document certified by a notary public for protection in the event of a lawsuit.

A revolving promissory note is a form of business financing that allows the company to borrow more money when needed. The process starts with an initial loan and then can be used as collateral for future loans that are paid back over time.

Revolving Note means a promissory note made by the Borrower in favor of a Lender evidencing Revolving Loans made by such Lender, substantially in the form of Exhibit C-1.