Queens, New York is a vibrant borough located on Long Island. It is one of the five boroughs of New York City, renowned for its diverse population, cultural richness, and numerous attractions. In the realm of financial transactions, one commonly used document is the Queens New York Form of Revolving Promissory Note. A Revolving Promissory Note serves as a legal agreement between a lender and a borrower, outlining the terms and conditions of a loan that can be accessed repeatedly over a certain period. This type of note is called "revolving" because it allows the borrower to withdraw funds, repay them, and then borrow again up to a predetermined limit, without the need for further paperwork or agreements. The flexibility provided by a Revolving Promissory Note is highly beneficial for individuals or businesses that have ongoing financial needs or fluctuating cash flow requirements. In Queens, New York, there are different versions of the Form of Revolving Promissory Note that may be utilized by lenders and borrowers, varying mainly in terms of specific provisions and clauses. Some notable types include: 1. Standard Queens New York Form of Revolving Promissory Note: This is a typical, widely used form that adheres to the general legal framework and regulations of Queens, New York. It outlines essential details such as the loan amount, interest rate, repayment schedule, late payment penalties, default provisions, and any collateral associated with the loan. 2. Queens New York Form of Revolving Promissory Note for Small Business Loans: This version specifically caters to the needs of small businesses in Queens, New York. It may include additional clauses related to the purpose of the loan, repayment terms based on cash flow, or the potential for loan forgiveness under specific circumstances. 3. Queens New York Form of Revolving Promissory Note for Personal Loans: This variant is tailored to individual borrowers residing in Queens, New York. It may include clauses related to personal financial information, credit history, and any specific provisions that cater to personal loan requirements. Regardless of the specific type, a Queens New York Form of Revolving Promissory Note acts as a legal safeguard for both parties involved in a loan agreement. It ensures that the borrower understands their repayment obligations and protects the lender's rights to collect the loan amount and any associated interest. When engaging in financial transactions in Queens, New York, it is crucial to consult with legal professionals or experienced financial advisors to ensure that the chosen Form of Revolving Promissory Note aligns with both local regulations and individual requirements.

Queens New York Form of Revolving Promissory Note

Description

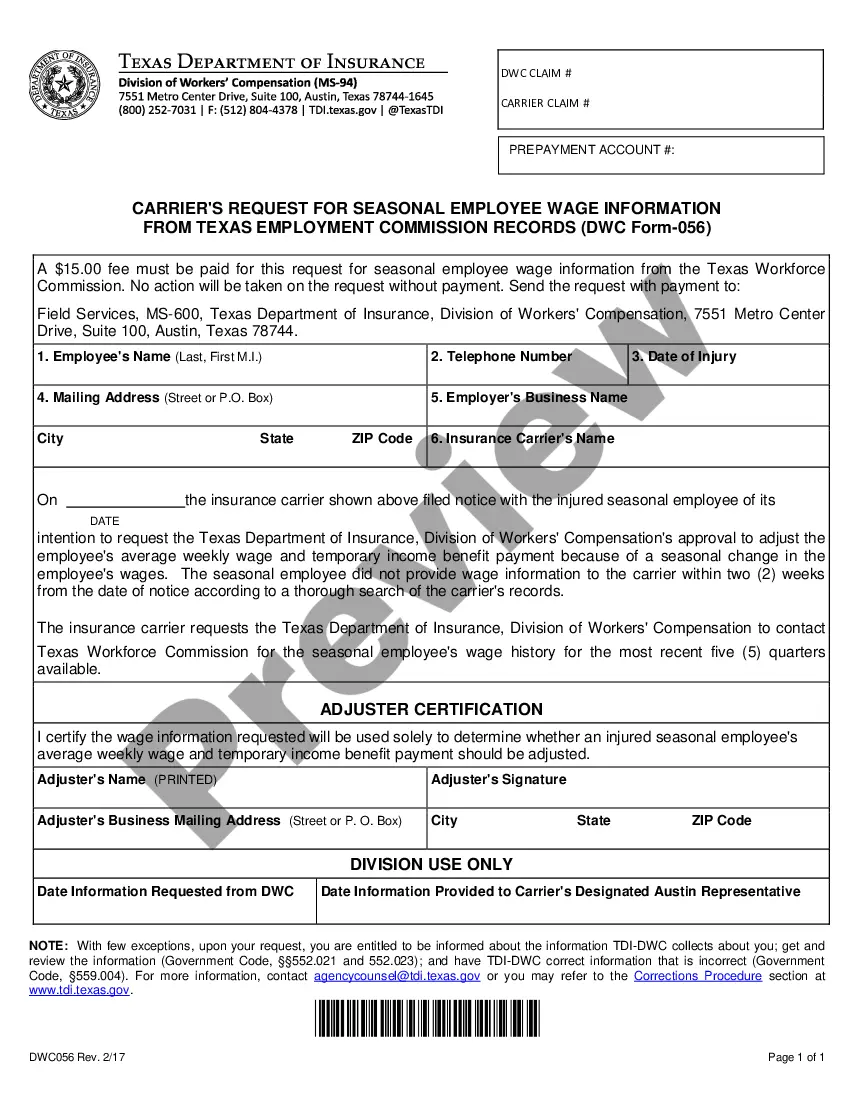

How to fill out Queens New York Form Of Revolving Promissory Note?

Whether you intend to open your business, enter into a contract, apply for your ID renewal, or resolve family-related legal issues, you need to prepare certain documentation corresponding to your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and verified legal templates for any individual or business occurrence. All files are collected by state and area of use, so opting for a copy like Queens Form of Revolving Promissory Note is quick and simple.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you several more steps to get the Queens Form of Revolving Promissory Note. Adhere to the instructions below:

- Make sure the sample meets your personal needs and state law requirements.

- Look through the form description and check the Preview if available on the page.

- Utilize the search tab providing your state above to find another template.

- Click Buy Now to obtain the file once you find the proper one.

- Opt for the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Queens Form of Revolving Promissory Note in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our library are reusable. Having an active subscription, you can access all of your earlier purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!

Form popularity

FAQ

A banknote is frequently referred to as a promissory note, as it is made by a bank and payable to bearer on demand. Mortgage notes are another prominent example. If the promissory note is unconditional and readily saleable, it is called a negotiable instrument.

Types of Promissory Notes Simple Promissory Note.Student Loan Promissory Note.Real Estate Promissory Note.Personal Loan Promissory Notes.Car Promissory Note.Commercial Promissory note.Investment Promissory Note.

Common types of promissory notes include the following: Commercial : These notes are more formal and detail specific conditions of a loan. Investment : A company can decide to issue a promissory note to raise capital. The company can also sell these notes to other investors.

Revolving Credit Promissory Note means a promissory note of the Company payable to the order of any Lender, in substantially the form of Exhibit G, evidencing the aggregate indebtedness of the Company to such Lender resulting from the Revolving Loans made by such Lender.

Types of Promissory Notes Personal Promissory Notes This is a particular loan taken from family or friends.Commercial Here, the note is made when dealing with commercial lenders such as banks.Real Estate This is similar to commercial notes in terms of nonpayment consequences.

Revolving Credit Promissory Note means a promissory note of the Company payable to the order of any Lender, in substantially the form of Exhibit G, evidencing the aggregate indebtedness of the Company to such Lender resulting from the Revolving Loans made by such Lender.

Revolving Note means a promissory note of the Borrower payable to any Revolving Loan Lender, in the form of Exhibit A-1 hereto (as such promissory note may be amended, endorsed or otherwise modified from time to time), evidencing the aggregate Indebtedness of the Borrower to such Revolving Loan Lender resulting from

4 Types of Promissory Notes.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.