Dallas Texas Approval of Standby Equity Agreement signifies the formal agreement between a company or organization based in Dallas, Texas, and an investor or funding entity. This agreement aims to provide financial support and assurance to the company, allowing it to access equity funding when needed. With the Approval of Standby Equity Agreement, the company can rely on the investor's commitment to purchase shares or securities during specific periods, providing a safety net for financial stability. The Approval of Standby Equity Agreement is a crucial document that outlines the terms and conditions of the partnership between the company and the investor. It includes details regarding the number of shares or securities to be purchased, the price at which they will be acquired, and any other specific requirements or provisions. This agreement serves to protect both parties involved, ensuring transparency and safeguarding their interests. Different types of Dallas Texas Approval of Standby Equity Agreements may include: 1. Traditional Standby Equity Agreement: This is the most common type of agreement where the investor agrees to purchase a predetermined number of shares or securities at an agreed-upon price, providing financial support to the company during its times of need. 2. Full-Ratchet Standby Equity Agreement: In this type of agreement, the investor purchases additional shares or securities at a reduced price if the company issues subsequent offerings at a lower price than the initial investment. This protects the investor from dilution and secures their position. 3. Partial-Ratchet Standby Equity Agreement: Similar to the full-ratchet agreement, this type allows the investor to purchase additional shares at a reduced price but only if the subsequent offering is below a certain threshold. 4. Broad-Based Standby Equity Agreement: This agreement provides flexibility to the company in terms of the number of shares or securities to be issued, as well as the pricing and timing. It allows the company to access funding depending on its specific needs and market conditions. It is important for both parties to carefully review and understand the terms and conditions mentioned in the Dallas Texas Approval of Standby Equity Agreement before signing. This ensures a clear understanding of the partnership, minimizing potential disputes and future complications. In summary, this agreement serves as a financial safety net for the company and provides a firm commitment from the investor to support its growth and development.

Dallas Texas Approval of Standby Equity Agreement with copy of agreement

Description

How to fill out Dallas Texas Approval Of Standby Equity Agreement With Copy Of Agreement?

Whether you intend to start your company, enter into a contract, apply for your ID update, or resolve family-related legal concerns, you need to prepare specific documentation corresponding to your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and verified legal templates for any individual or business occasion. All files are collected by state and area of use, so picking a copy like Dallas Approval of Standby Equity Agreement with copy of agreement is quick and straightforward.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a couple of more steps to obtain the Dallas Approval of Standby Equity Agreement with copy of agreement. Adhere to the guidelines below:

- Make sure the sample meets your personal needs and state law requirements.

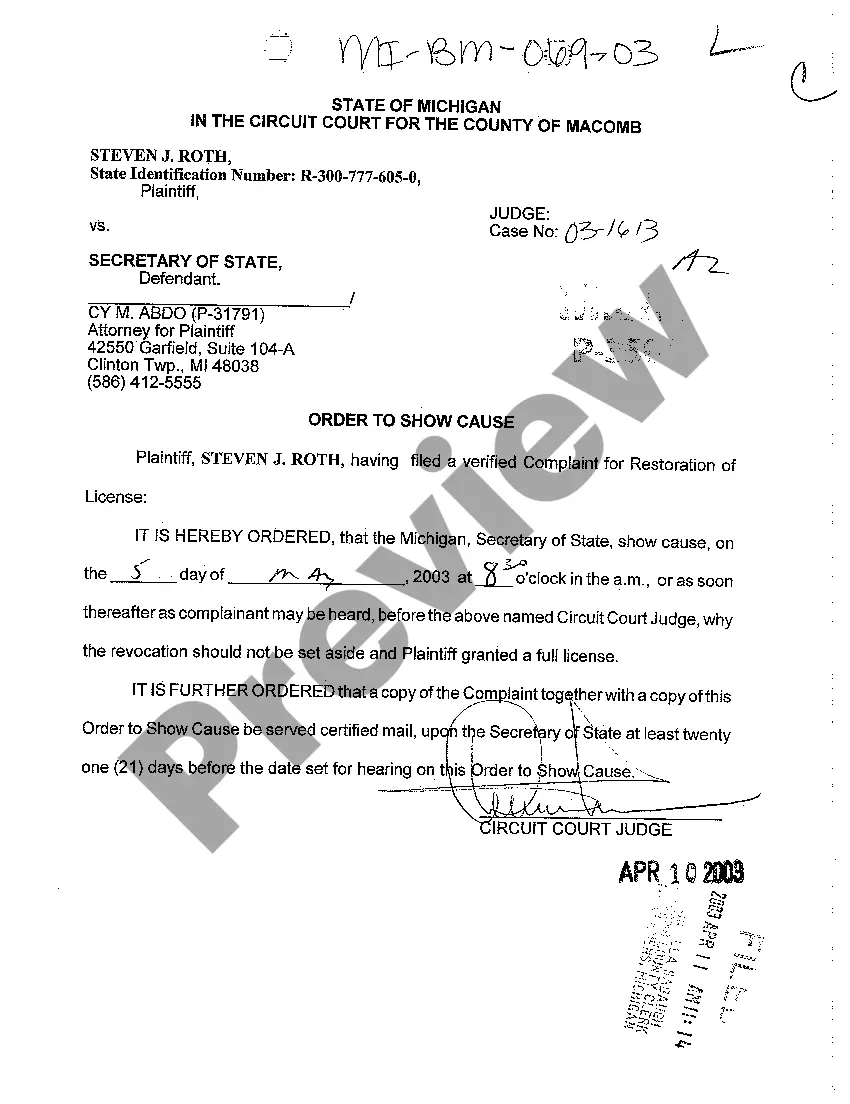

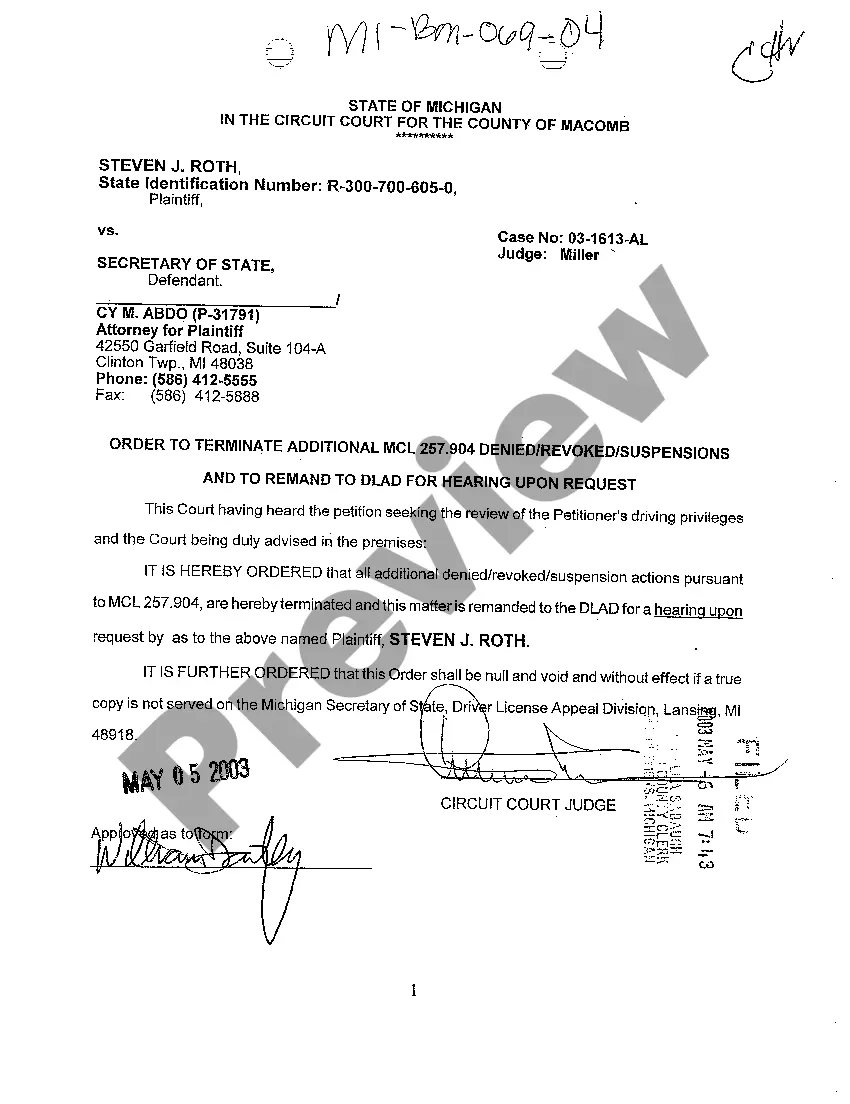

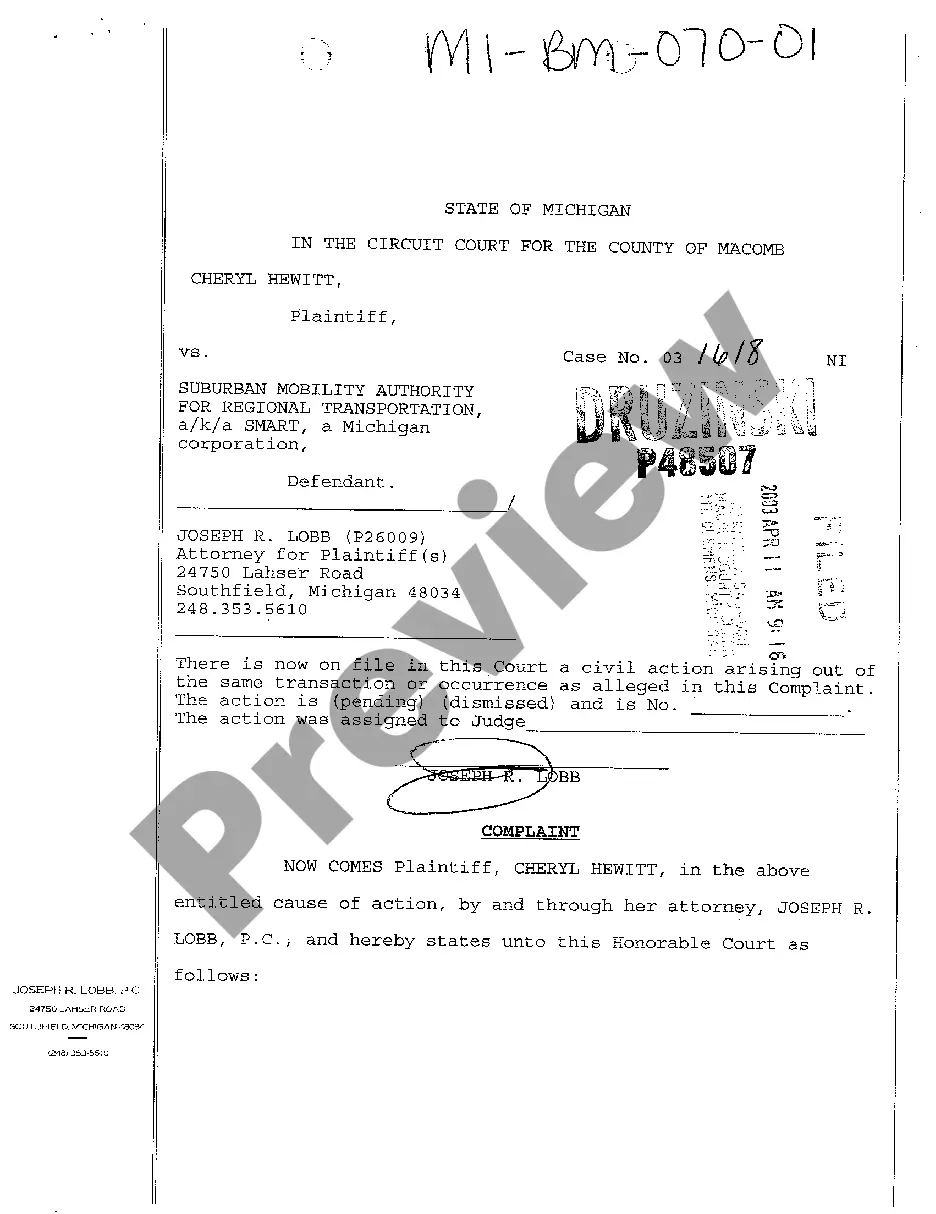

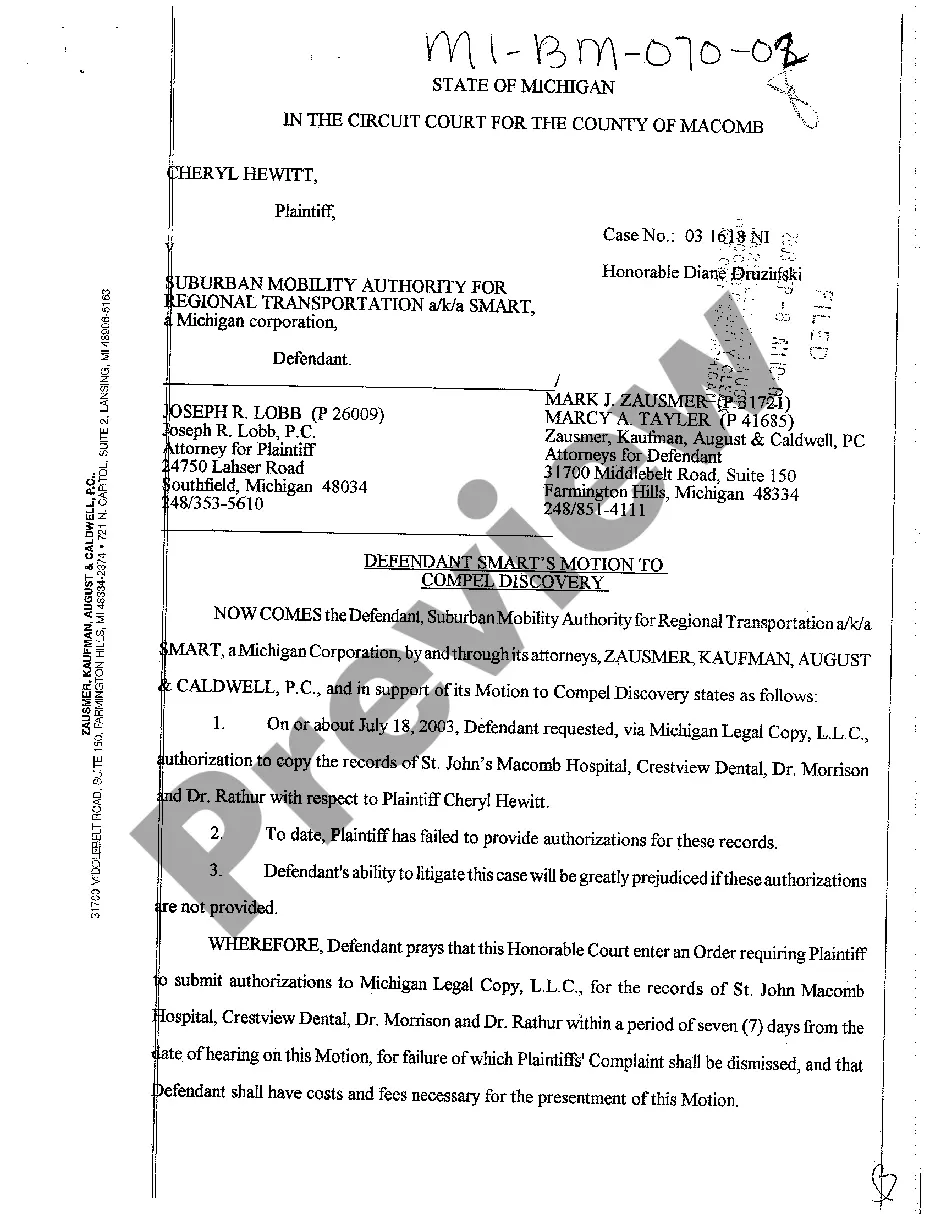

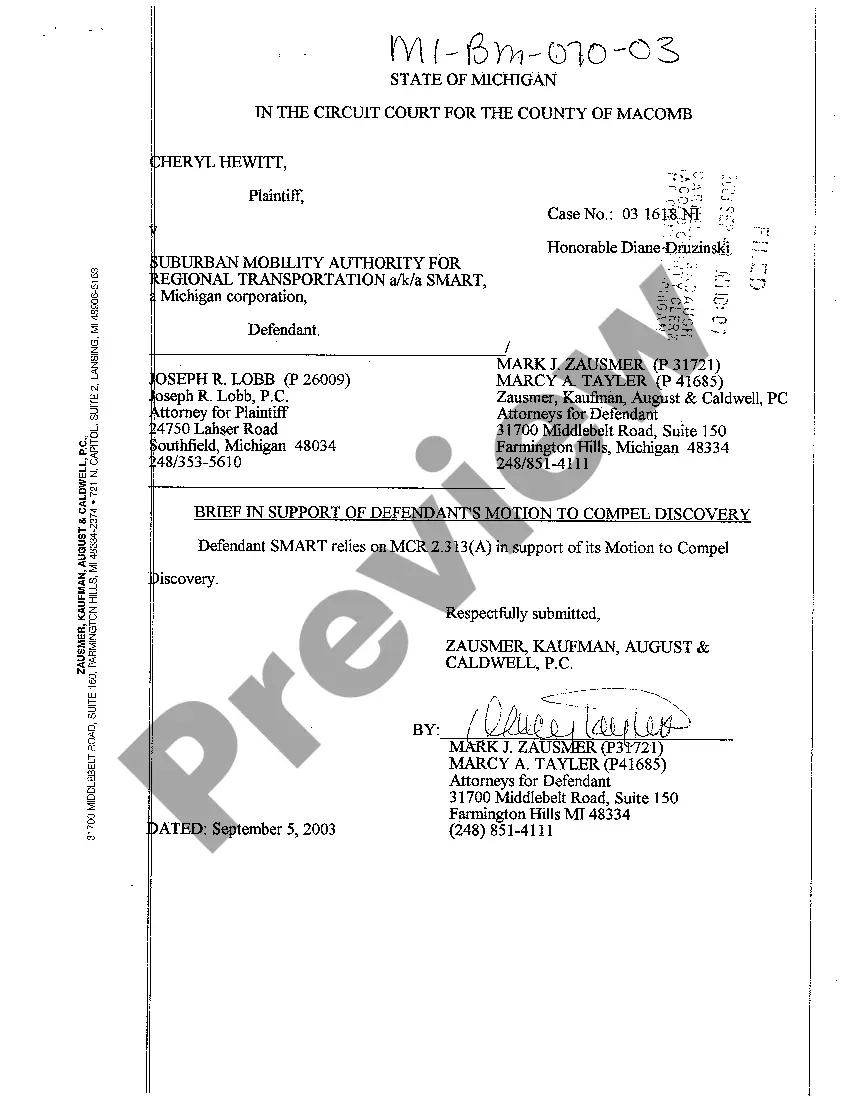

- Read the form description and check the Preview if available on the page.

- Make use of the search tab providing your state above to find another template.

- Click Buy Now to get the file when you find the proper one.

- Select the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Dallas Approval of Standby Equity Agreement with copy of agreement in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our website are multi-usable. Having an active subscription, you can access all of your previously purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!