Nassau New York Exchange Agreement: A Comprehensive Overview The Nassau New York Exchange Agreement refers to a legal contract entered into by Noble Drilling Corp., a prominent global offshore drilling contractor, and the stock exchange located in Nassau, New York. This agreement allows Noble Drilling Corp. to list and trade its common stock on the designated exchange in Nassau, opening up investment opportunities for both institutional and individual investors. Increasing Authorized Common Stock: A Financial Boost for Noble Drilling Corp. Noble Drilling Corp. has recently announced a significant increase in its authorized common stock. This financial move aims to empower the company to raise additional capital for strategic business purposes and drive future growth. By expanding the number of authorized common stocks, Noble Drilling Corp. gains the flexibility to issue new shares in the market, which can be utilized for mergers and acquisitions, financing various projects, debt reduction, or strengthening its balance sheet. Different Types of Nassau New York Exchange Agreement and Increase in Authorized Common Stock by Noble Drilling Corp. 1. Single Listing Agreement: — This type of agreement involves a singular listing of Noble Drilling Corp.'s common stock on the Nassau New York Exchange. — It allows potential investors to access, trade, and purchase the shares through the exchange, ensuring liquidity and marketability. 2. Dual Listing Agreement: — A dual listing agreement signifies that Noble Drilling Corp. will have its common stock listed on multiple stock exchanges, including the Nassau New York Exchange. — This type of agreement provides increased visibility and market access, attracting a broader pool of investors and potentially improving the company's overall valuation. 3. Increase in Authorized Common Stock for General Corporate Purposes: — Noble Drilling Corp. may increase its authorized common stock to bolster its financial flexibility and support various general corporate initiatives. — This includes activities such as financing future exploration projects, expanding its fleet, investing in technology upgrades, or funding research and development for innovative drilling techniques. 4. Increase in Authorized Common Stock for Specific Purposes: — In some cases, Noble Drilling Corp. may opt to increase its authorized common stock for more specific objectives. — Examples of such purposes can include raising capital for a significant acquisition, financing the development of new drilling technologies, or attracting strategic partnerships to drive innovation and growth. In conclusion, the Nassau New York Exchange agreement provides Noble Drilling Corp. with the opportunity to list and trade its common stock on the designated exchange. Simultaneously, the increase in authorized common stock grants the company greater financial flexibility to pursue strategic initiatives and invest in future growth. Such agreements can take the form of single or dual listings, with the objective of maximizing market visibility and attracting a diverse range of investors.

Nassau New York Exchange agreement and increase in authorized common stock by Noble Drilling Corp.

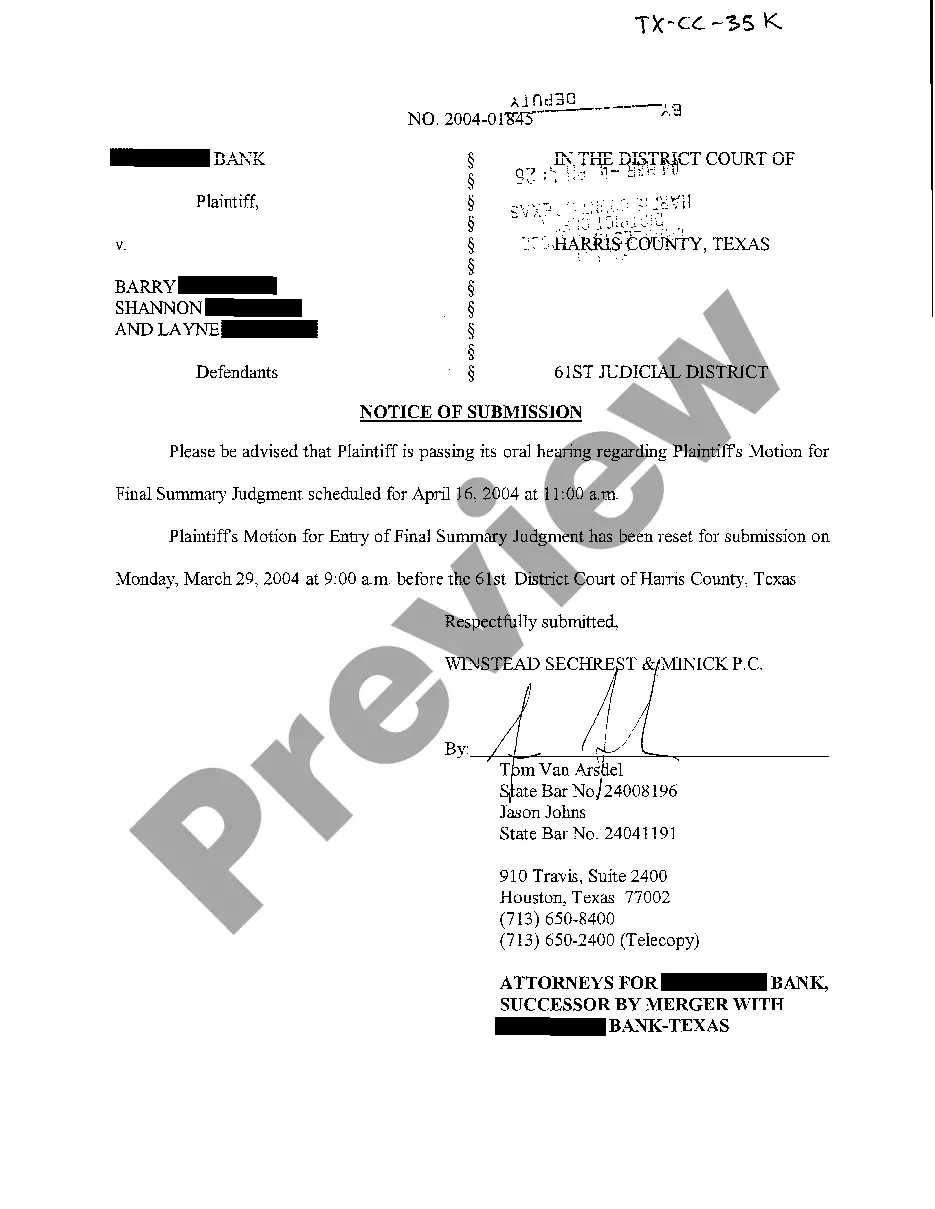

Description

How to fill out Nassau New York Exchange Agreement And Increase In Authorized Common Stock By Noble Drilling Corp.?

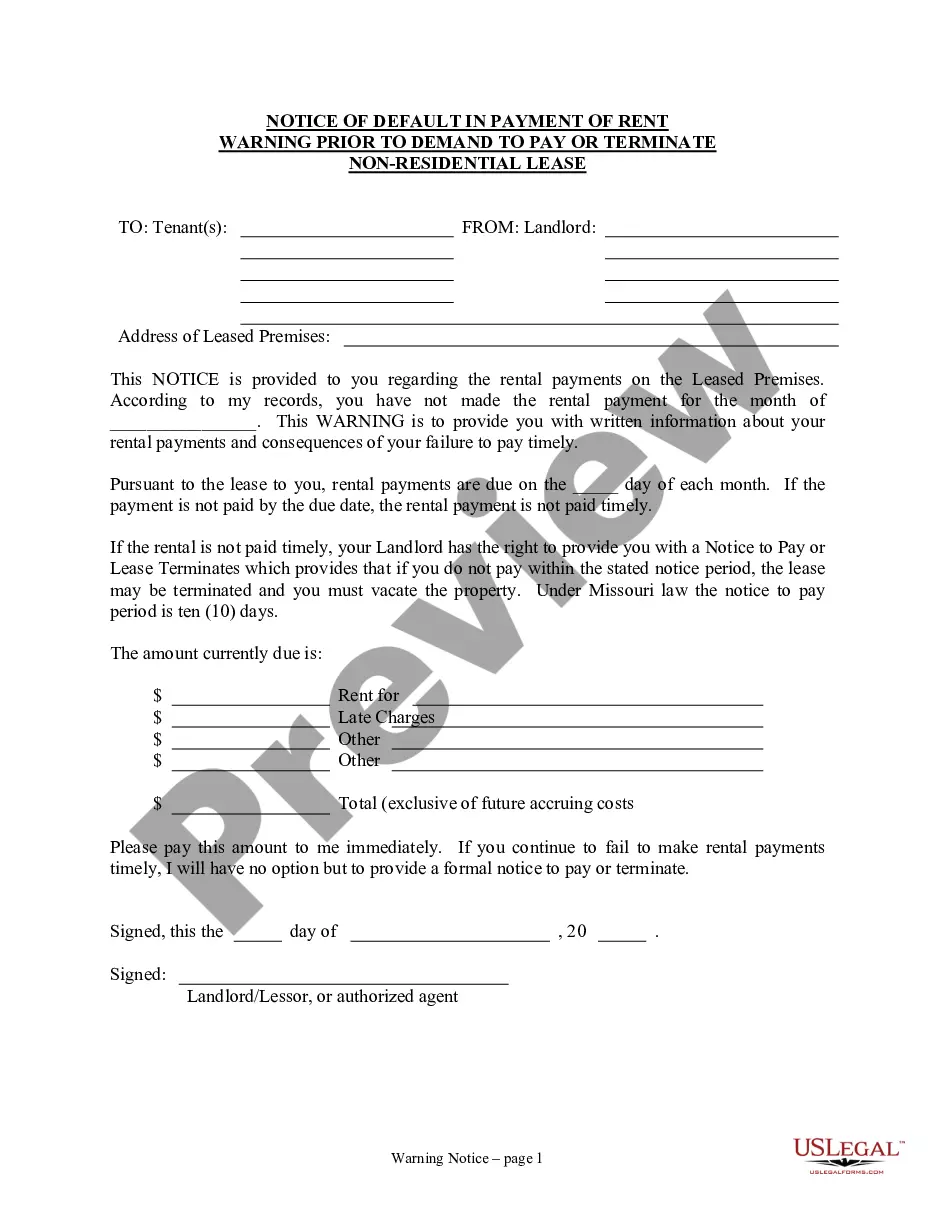

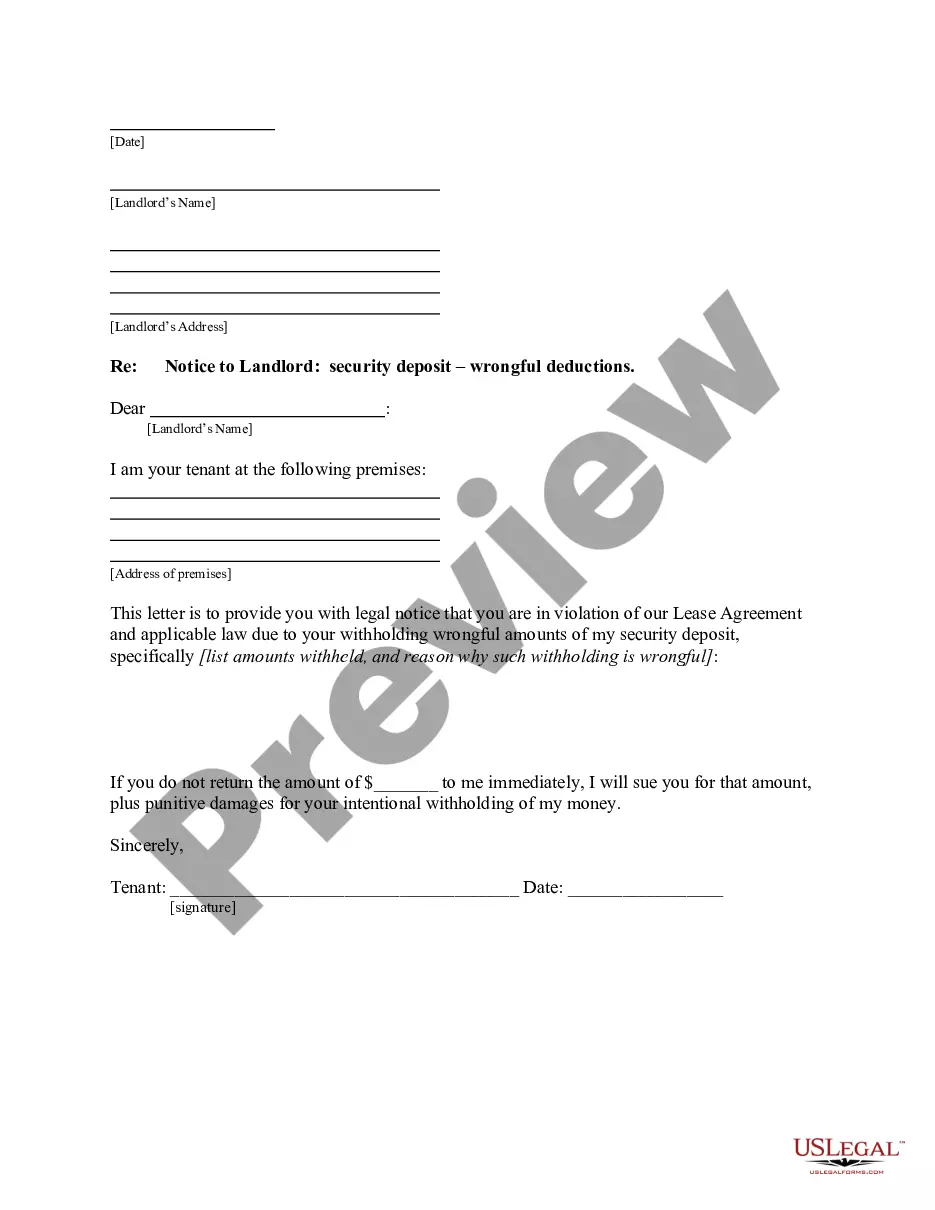

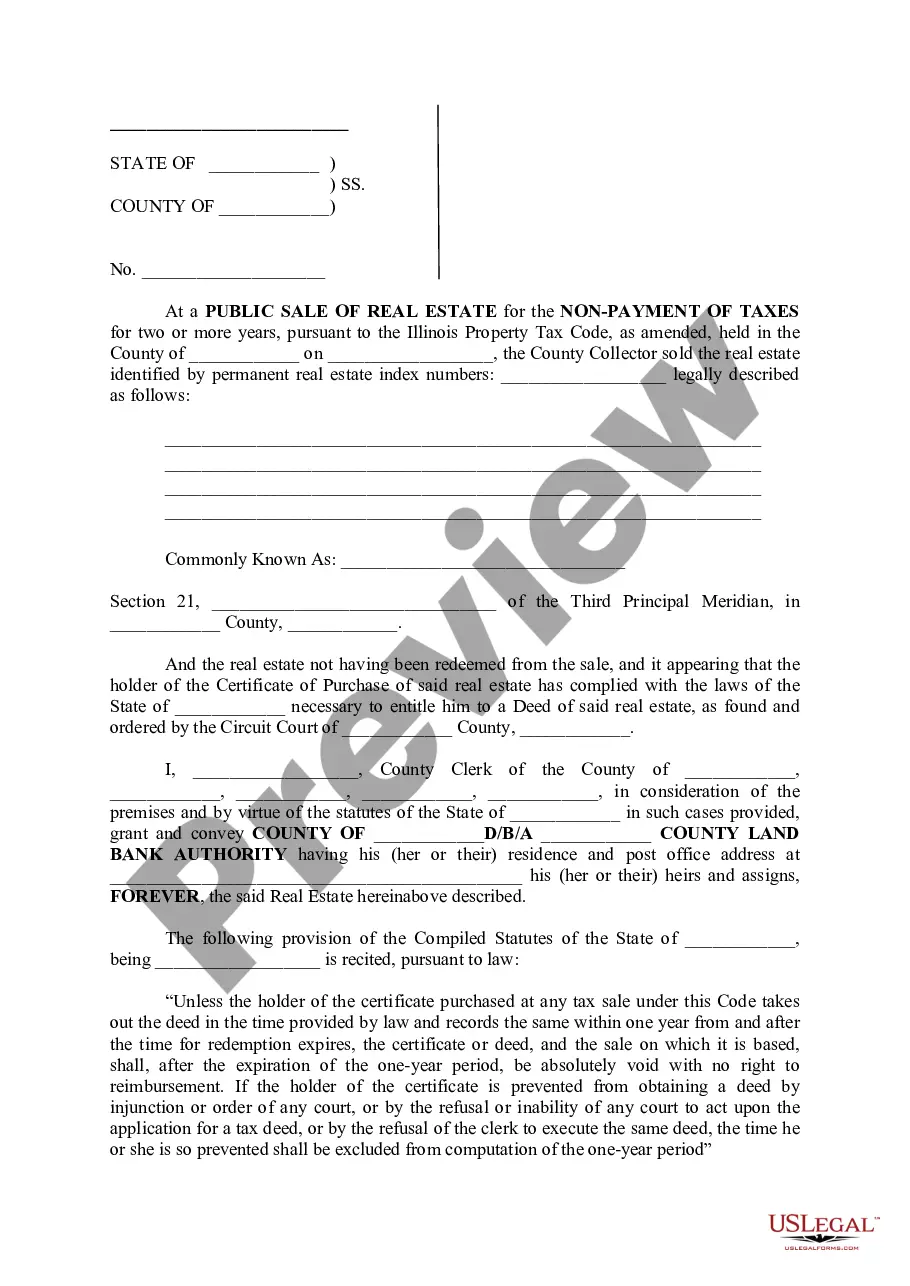

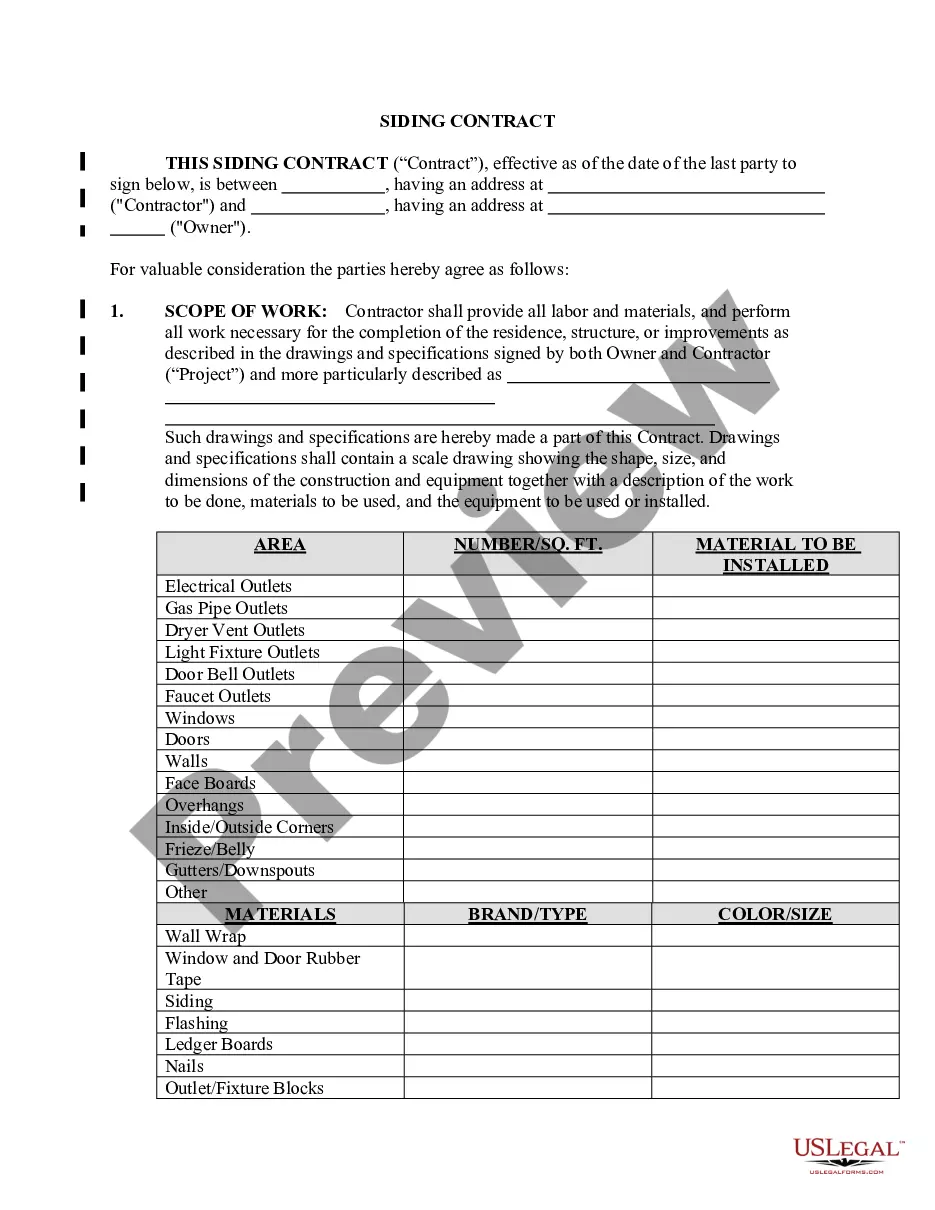

Preparing legal documentation can be cumbersome. Besides, if you decide to ask a legal professional to write a commercial agreement, papers for ownership transfer, pre-marital agreement, divorce papers, or the Nassau Exchange agreement and increase in authorized common stock by Noble Drilling Corp., it may cost you a lot of money. So what is the most reasonable way to save time and money and create legitimate forms in total compliance with your state and local laws? US Legal Forms is a great solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is largest online library of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any use case accumulated all in one place. Therefore, if you need the recent version of the Nassau Exchange agreement and increase in authorized common stock by Noble Drilling Corp., you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Nassau Exchange agreement and increase in authorized common stock by Noble Drilling Corp.:

- Look through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - search for the correct one in the header.

- Click Buy Now once you find the needed sample and choose the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a payment with a credit card or through PayPal.

- Opt for the file format for your Nassau Exchange agreement and increase in authorized common stock by Noble Drilling Corp. and save it.

Once finished, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the documents ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!