Tarrant, Texas Proposed Merger with the Grossman Corporation: A Transformative Business Venture Tarrant, Texas, a thriving city situated in the Dallas-Fort Worth retroflex, is on the cusp of a groundbreaking development — a proposed merger with the Grossman Corporation. This strategic business venture has the potential to redefine the landscape of Tarrant, Texas, and create a formidable force in the market. In this detailed description, we will delve into the overarching benefits, potential types of mergers, and the impact this merger might have on various sectors. The proposed merger between Tarrant, Texas, and the Grossman Corporation is poised to create a synergy that leverages the strengths of both entities. Tarrant, known for its vibrant local economy and business-friendly environment, will provide an ideal platform for Grossman Corporation's expansion plans. The merger will foster new economic opportunities, enhance community development, and attract increased local and foreign investment. Unveiling different types of mergers: 1. Horizontal Merger: — One potential type of merger between Tarrant, Texas, and the Grossman Corporation could be a horizontal merger. In this scenario, both entities, operating within the same industry, would merge their operations to create a more substantial market presence. This would result in increased market share, economies of scale, and improved competitiveness in their respective sectors. 2. Vertical Merger: — Another possible merger type could be a vertical merger. This involves the combination of companies from different stages of the same supply chain. Tarrant, Texas, with its vibrant industrial sector and Grossman Corporation, renowned for its supply chain management expertise, could merge to streamline operations, reduce costs, and gain a competitive advantage by controlling the entire supply chain. 3. Conglomerate Merger: — A third scenario could involve a conglomerate merger. This type of merger occurs when companies from unrelated industries merge to diversify their operations and gain a competitive edge in multiple sectors. Tarrant, Texas, with its diverse economy encompassing various sectors, and the Grossman Corporation, with its wide-ranging business portfolio, could join forces to create a diversified powerhouse. The impact of the proposed merger: The merger between Tarrant, Texas, and the Grossman Corporation promises significant positive implications for various sectors: 1. Economic Growth and Job Creation: — The merger is anticipated to generate substantial economic growth, resulting in increased job opportunities for the local workforce. This infusion of employment prospects will not only benefit the residents but also attract skilled professionals to the region. 2. Industry Innovation and Collaboration: — The merger will foster an environment of innovation and collaboration, combining the expertise of both entities to drive advancements in diverse industries. This growth will stimulate further innovation, attracting research and development activities and establishing Tarrant, Texas, as a hub for cutting-edge technologies. 3. Infrastructure and Community Development: — The merger may lead to significant investments in infrastructure development, enhancing the overall quality of life in Tarrant, Texas. This could encompass the construction of new commercial buildings, improved transportation systems, and enhanced public spaces, thereby enriching the local community. In summary, the proposed merger between Tarrant, Texas, and the Grossman Corporation holds immense potential to redefine Tarrant as a formidable player in the market. With various types of mergers on the table, the collaboration could pave the way for economic growth, industry innovation, and community development. As Tarrant, Texas, embarks on this transformative business venture, it is positioned to reap substantial rewards and establish itself as a regional powerhouse.

Tarrant Texas Proposed merger with the Grossman Corporation

Description

How to fill out Tarrant Texas Proposed Merger With The Grossman Corporation?

How much time does it normally take you to draft a legal document? Because every state has its laws and regulations for every life scenario, locating a Tarrant Proposed merger with the Grossman Corporation meeting all regional requirements can be exhausting, and ordering it from a professional attorney is often expensive. Many web services offer the most common state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive web catalog of templates, gathered by states and areas of use. Apart from the Tarrant Proposed merger with the Grossman Corporation, here you can find any specific form to run your business or individual deeds, complying with your county requirements. Experts verify all samples for their validity, so you can be sure to prepare your documentation properly.

Using the service is fairly easy. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the needed form, and download it. You can retain the file in your profile at any time in the future. Otherwise, if you are new to the website, there will be a few more actions to complete before you get your Tarrant Proposed merger with the Grossman Corporation:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another form using the related option in the header.

- Click Buy Now when you’re certain in the selected file.

- Choose the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Tarrant Proposed merger with the Grossman Corporation.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired template, you can find all the files you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!

Form popularity

FAQ

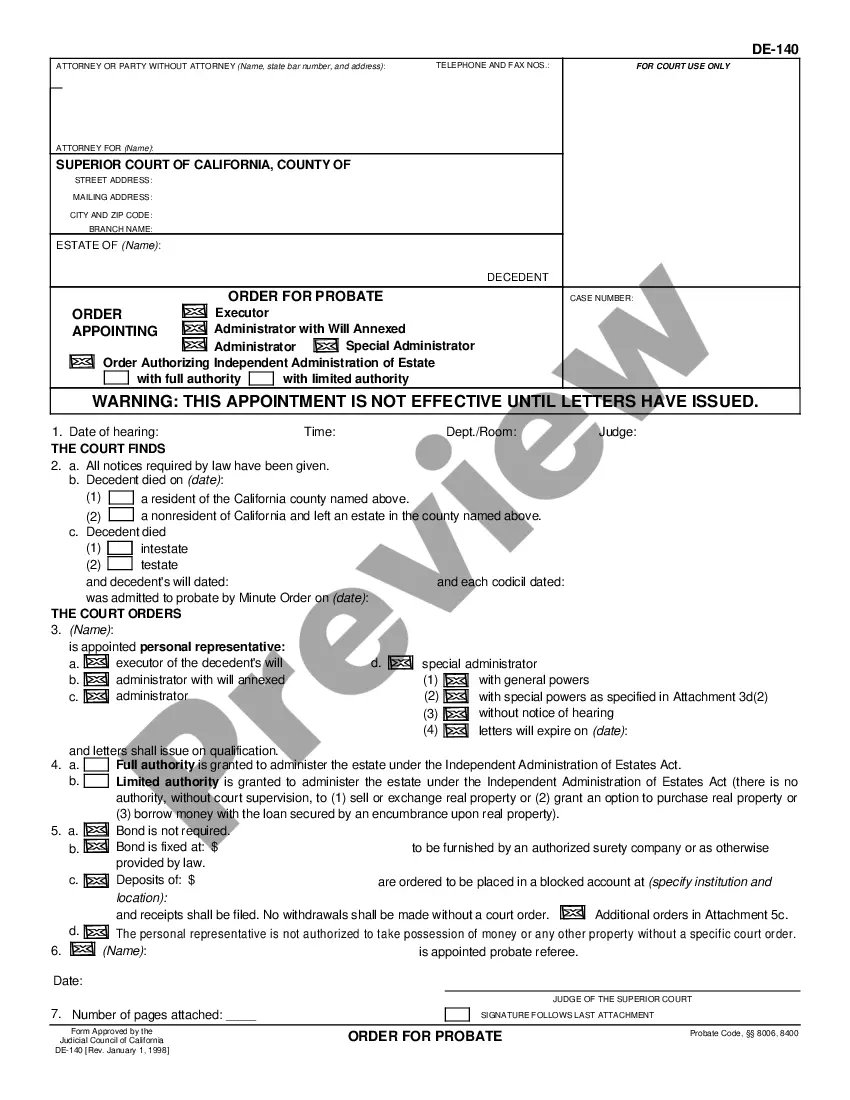

Also known as articles of merger. A certificate evidencing the merger of two or more entities into one entity.

Articles of merger are legal documents outlining the roles and responsibilities of two or more parties as they merge into a single entity. Articles of merger may also be called a certificate of merger. This agreement outlines the intent of multiple parties to merge and outline the merger's operational aspects.

Dear Friends, As Tarrant County's chief elected officer, I preside over the Tarrant County Commissioners Court. I am honored to oversee our diverse county of nearly 2 milliion residents, the nation's 16th most populous county and the third largest in Texas.

7. A statement that the Agreement of Merger will be provided to any stockholder of any constituent corporation or any partner of any constituent limited partnerships. Execution Block - The document must be signed by an Authorized Officer of the surviving Delaware corporation.

The county judge oversees a four-person court of commissioners who each represent a precinct and make decisions on the county's roads and infrastructure. While the position is called a judge, that person in Tarrant County doesn't run the courts, nor can they send you to jail.

Also known as articles of merger. A certificate evidencing the merger of two or more entities into one entity.

The Commissioners Court is the general governing body of Tarrant County. The Court is made up of four (4) County Commissioners (each elected from one of the County's four (4) precincts), and the County Judge who is elected countywide and who presides over the full Court.

Tarrant County Judge Glen Whitley, one of Texas' most prominent Republican local leaders, is backing Lt. Gov.

Can I record a document at one of the Tarrant County Subcourthouses? No, land documents are recorded at 100 W. Weatherford St. Room B20 Fort Worth, TX 76196.

The county judge also receives at least $15,420 in an auto allowance each year bringing the total to over $227,000 annually. According to a Texas Association of Counties 2022 Salary Survey, Tarrant County has the highest county judge salary for counties with over 100,000 people.