The Hillsborough Florida Agreement and Plan of Merger between Gel co Corp. and Grossman Corp. is a significant business transaction that involves the merging of two companies based in Hillsborough, Florida. This merger agreement outlines the terms, conditions, and processes involved in combining the operations, assets, and liabilities of Gel co Corp. and Grossman Corp. The Gel co Corp. and Grossman Corp. merger is aimed at synergizing their capabilities, resources, and market positions to create a stronger and more competitive entity. This agreement lays out a strategic roadmap for integrating the two organizations, streamlining their operations, and leveraging their combined expertise to achieve growth and maximize value for stakeholders. The Hillsborough Florida Agreement and Plan of Merger by Gel co Corp. and Grossman Corp. is a meticulously crafted document that encompasses various aspects of the merger process. It comprises detailed financial terms, share exchange ratios, and procedures for the exchange of shares between the two companies' shareholders. Additionally, the agreement includes provisions related to the governance and management structure of the newly merged entity. It specifies the composition of the board of directors, the appointment of key executives, and their roles and responsibilities. This ensures a smooth transition and integration of leadership within the merged company. Furthermore, the Hillsborough Florida Agreement and Plan of Merger addresses legal, regulatory, and compliance requirements. It outlines the necessary approvals from relevant government bodies, securities commissions, and other regulatory agencies. This helps ensure that the merger is executed in full compliance with the laws and regulations governing such transactions. The Gel co Corp. and Grossman Corp. merger agreement may have different types, each tailored to specific mergers or acquisitions. Some potential variations could include: 1. Horizontal Merger Agreement: This type of agreement is used when Gel co Corp. and Grossman Corp. are direct competitors, and their merger is focused on consolidating market share and eliminating competition. 2. Vertical Merger Agreement: If Gel co Corp. and Grossman Corp. operate in different stages or aspects of the same industry, a vertical merger agreement would outline the consolidation of their supply chains or distribution channels. 3. Conglomerate Merger Agreement: This type of agreement is applicable when Gel co Corp. and Grossman Corp. operate in unrelated industries. It highlights the diversification benefits and strategic value of merging two distinct businesses. In conclusion, the Hillsborough Florida Agreement and Plan of Merger by Gel co Corp. and Grossman Corp. is a comprehensive document that serves as a blueprint for combining the resources, operations, and capabilities of both companies. This agreement outlines the terms and conditions of the merger, ensuring a smooth integration and maximizing value for all parties involved.

Hillsborough Florida Agreement and plan of merger by Gelco Corp. and Grossman Corp.

Description

How to fill out Hillsborough Florida Agreement And Plan Of Merger By Gelco Corp. And Grossman Corp.?

Drafting documents for the business or individual demands is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's crucial to consider all federal and state laws and regulations of the particular region. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these details make it stressful and time-consuming to create Hillsborough Agreement and plan of merger by Gelco Corp. and Grossman Corp. without expert help.

It's possible to avoid spending money on lawyers drafting your paperwork and create a legally valid Hillsborough Agreement and plan of merger by Gelco Corp. and Grossman Corp. on your own, using the US Legal Forms online library. It is the largest online catalog of state-specific legal documents that are professionally verified, so you can be certain of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to download the necessary document.

In case you still don't have a subscription, adhere to the step-by-step guideline below to get the Hillsborough Agreement and plan of merger by Gelco Corp. and Grossman Corp.:

- Examine the page you've opened and check if it has the document you need.

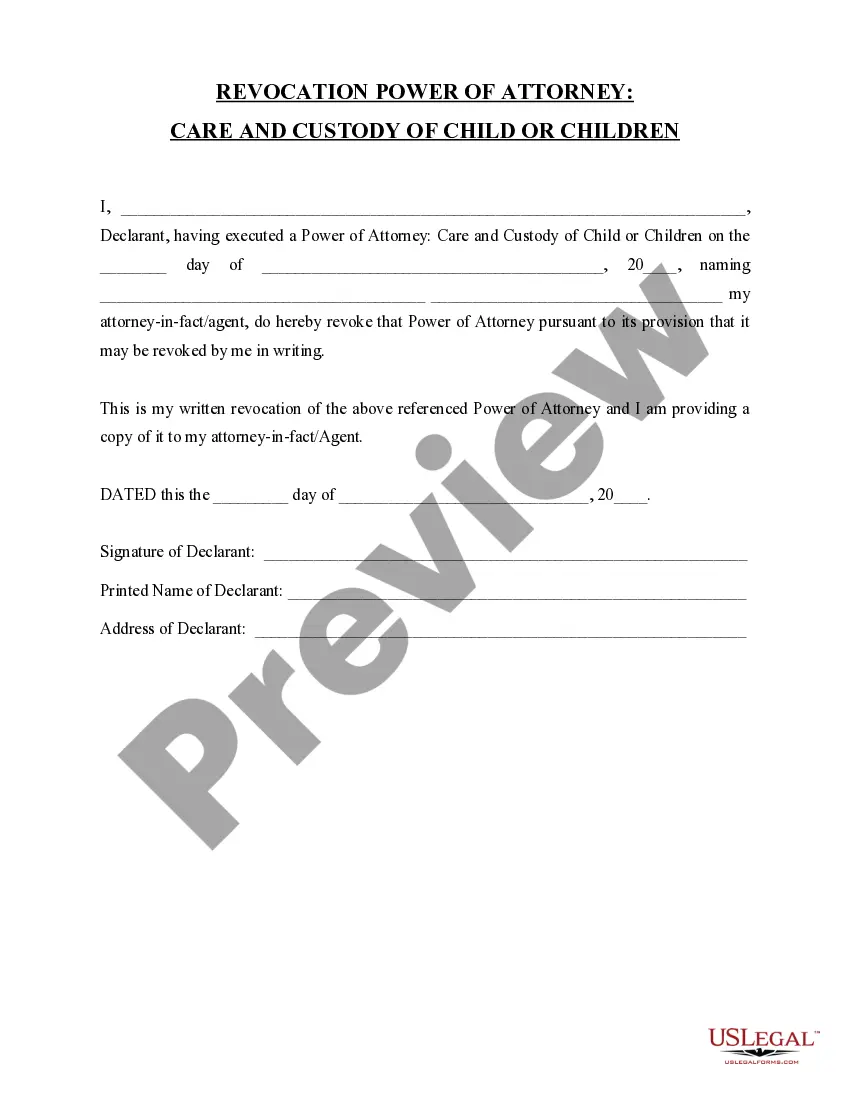

- To do so, use the form description and preview if these options are presented.

- To locate the one that suits your needs, use the search tab in the page header.

- Double-check that the sample complies with juridical standards and click Buy Now.

- Select the subscription plan, then sign in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily obtain verified legal forms for any use case with just a few clicks!