Title: Understanding the Maricopa Arizona Agreement and Plan of Merger by Gel co Corp. and Grossman Corp. Keywords: Maricopa Arizona, Agreement, Plan of Merger, Gel co Corp., Grossman Corp., Detailed Description, Types Introduction: The Maricopa Arizona Agreement and Plan of Merger refers to a legal contract and strategic plan that outlines the terms of integration between Gel co Corp. and Grossman Corp. This comprehensive agreement governs the merger process, ensuring a smooth transition and synergy between the two entities. Let's delve into the details of this agreement and explore any potential variations it might entail. 1. Maricopa Arizona Merger Agreement: The Maricopa Arizona Merger Agreement is a specific type of merger agreement executed between Gel co Corp. and Grossman Corp. It details the legal, financial, and operational aspects of the merger, including the terms and conditions both parties agreed upon. This agreement ensures the consolidation of resources, management, and assets, leading to improved efficiency and competitiveness within the business ecosystem. 2. Merger Plan: The Merger Plan is an integral part of the Maricopa Arizona Agreement, outlining the strategies, steps, and timeline for the successful execution of the merger. It encompasses various essential components such as due diligence, valuation, regulatory compliance, shareholder approvals, integration tasks, and post-merger operations. The plan serves as a roadmap that streamlines the entire process, minimizing potential disruptions and maximizing the combined entities' benefits. 3. Financial Terms: Within the Maricopa Arizona Agreement and Plan of Merger, financial terms play a significant role. This entails determining the exchange ratio of shares, valuation methodologies, treatment of outstanding debt, allocation of resources, and financial reporting requirements for the merged entity. By addressing these financial aspects, Gel co Corp. and Grossman Corp. ensure fairness and transparency throughout the merger process, maintaining the interest of all stakeholders involved. 4. Legal and Governance Considerations: To achieve a successful merger, legal and governance aspects must be accounted for. The Maricopa Arizona Agreement governs matters like corporate structure, board of directors' composition, executive appointments, voting rights, bylaws, and other legal obligations. Both Gel co Corp. and Grossman Corp. must adhere to these stipulations to maintain compliance and establish a solid foundation for the merged enterprise. 5. Integration and Post-Merger Operations: After the merger is completed, the Maricopa Arizona Agreement and Plan of Merger addresses the integration phase and subsequent operations. This includes harmonizing business processes, merging back-office functions, integrating technology systems, employee onboarding, customer retention strategies, brand consolidation, and transitioning to a unified corporate culture. The agreement ensures a well-coordinated integration, generating synergistic benefits for Gel co Corp., Grossman Corp., and their stakeholders. Conclusion: The Maricopa Arizona Agreement and Plan of Merger by Gel co Corp. and Grossman Corp. encapsulates the strategic vision, financial considerations, legal obligations, and operational aspects involved in the merger. By coherently outlining the terms of integration, this agreement empowers both organizations to harmonize their resources, streamline operations, and achieve optimal results. A successful merger under this agreement can lead to enhanced market position, increased competitiveness, and improved value for Gel co Corp., Grossman Corp., as well as their respective shareholders.

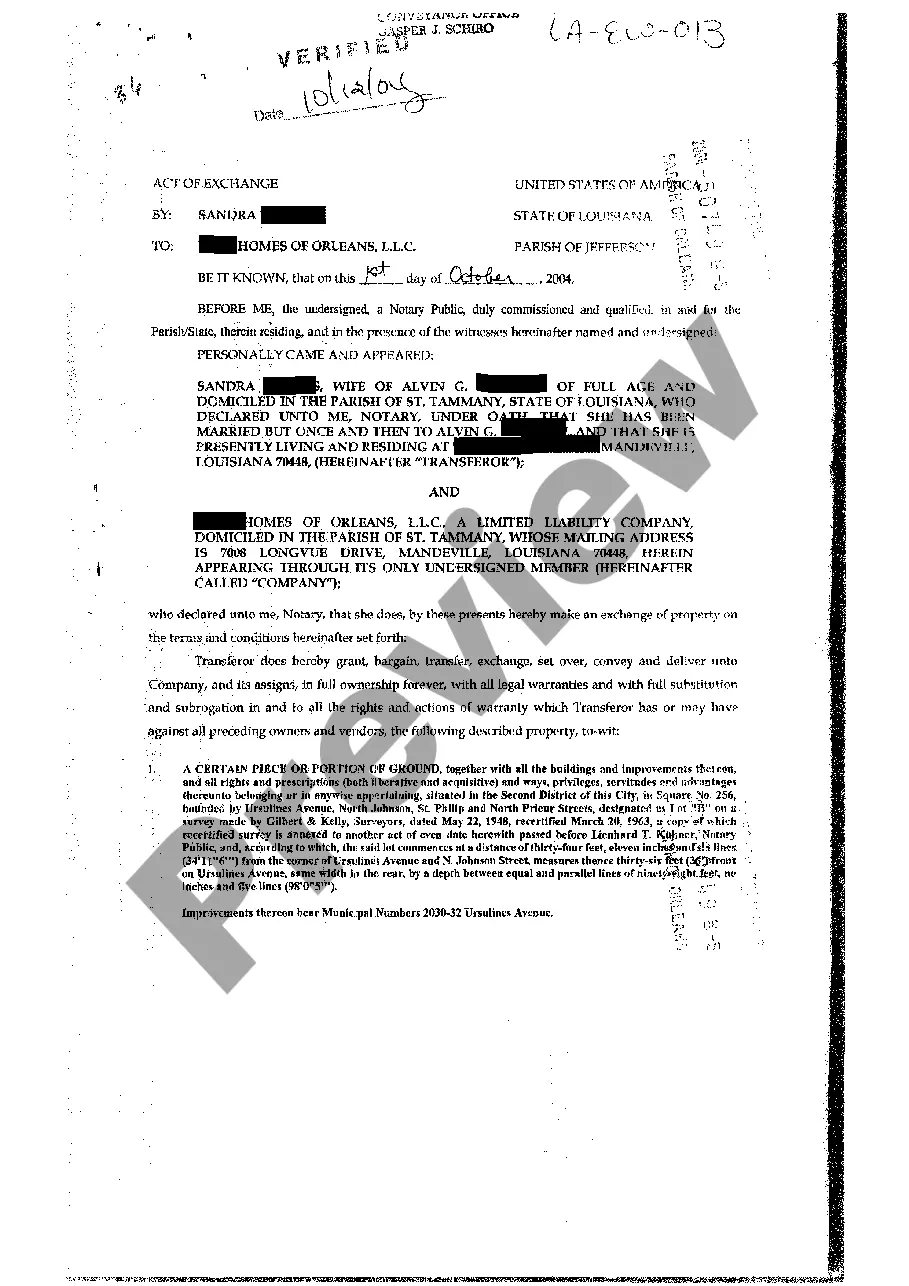

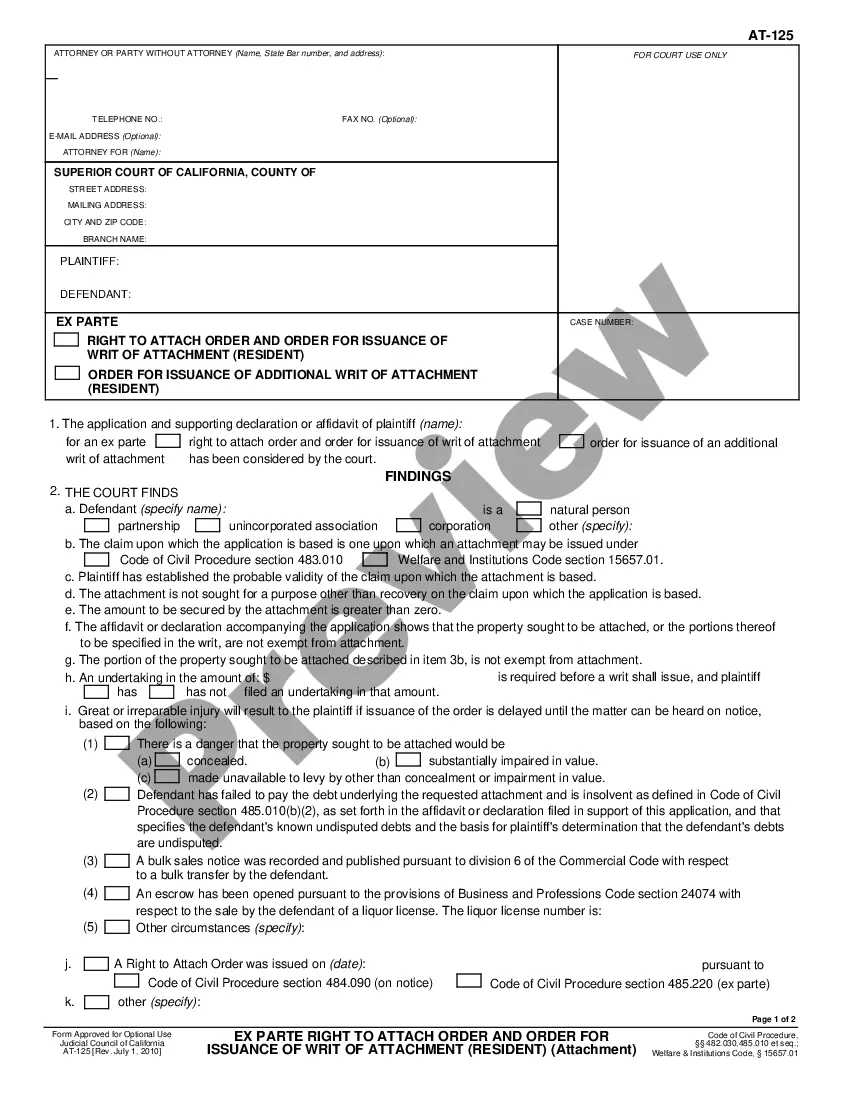

Maricopa Arizona Agreement and plan of merger by Gelco Corp. and Grossman Corp.

Description

How to fill out Maricopa Arizona Agreement And Plan Of Merger By Gelco Corp. And Grossman Corp.?

Drafting documents for the business or individual demands is always a huge responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's important to consider all federal and state laws of the particular area. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these details make it burdensome and time-consuming to create Maricopa Agreement and plan of merger by Gelco Corp. and Grossman Corp. without professional help.

It's easy to avoid spending money on lawyers drafting your paperwork and create a legally valid Maricopa Agreement and plan of merger by Gelco Corp. and Grossman Corp. on your own, using the US Legal Forms web library. It is the largest online catalog of state-specific legal documents that are professionally verified, so you can be certain of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to download the needed form.

In case you still don't have a subscription, adhere to the step-by-step guideline below to obtain the Maricopa Agreement and plan of merger by Gelco Corp. and Grossman Corp.:

- Examine the page you've opened and verify if it has the document you need.

- To do so, use the form description and preview if these options are available.

- To locate the one that satisfies your needs, use the search tab in the page header.

- Double-check that the template complies with juridical standards and click Buy Now.

- Pick the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and easily obtain verified legal forms for any situation with just a couple of clicks!