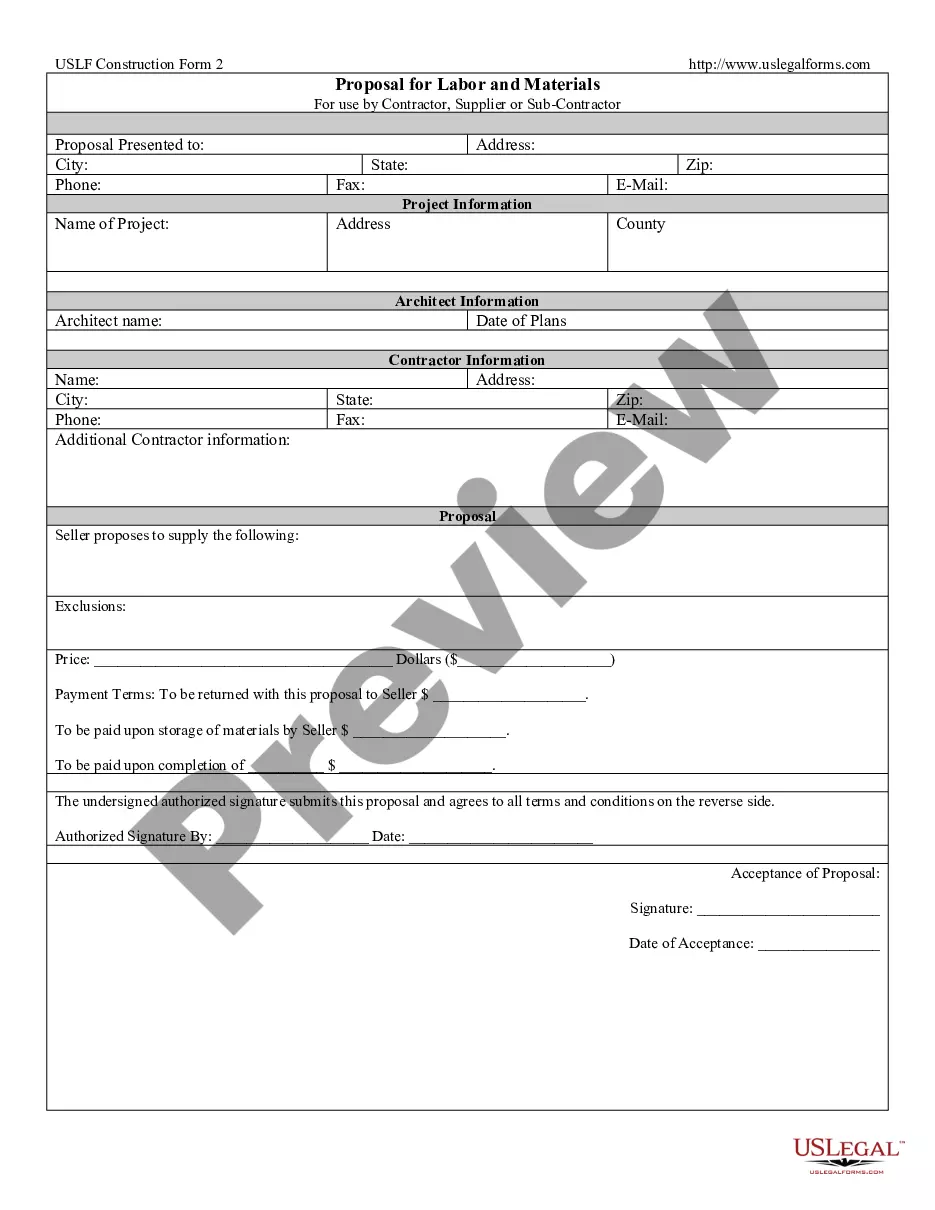

The Cook Illinois Plan and Agreement of Merger was a significant business transaction involving Wheeling Pittsburgh Corp, WHO Corp, and WP Merger Co. This merger agreement aimed to combine the strengths and resources of these companies to create a more sustainable and competitive business entity. This article provides a detailed description of the Cook Illinois Plan and Agreement of Merger by highlighting the key aspects and different types of agreements associated with this merger. The Cook Illinois Plan and Agreement of Merger primarily referred to the merger of Wheeling Pittsburgh Corp, WHO Corp, and WP Merger Co. The merger agreement outlined the terms and conditions under which this consolidation would take place. The primary objective of this merger was to leverage the collective expertise, assets, and market position of the involved companies to drive growth, achieve operational synergies, and enhance shareholder value. The Cook Illinois Plan and Agreement of Merger incorporated various essential components, including the valuation of the companies involved, the share exchange ratio, the governance structure of the merged company, and the treatment of outstanding debts and liabilities. This agreement ensured that the interests of the shareholders, employees, customers, and other stakeholders were duly protected throughout the merger process. Multiple types of Cook Illinois Plan and Agreement of Merger were established, each catering to specific aspects of the consolidation process: 1. Merger Agreement: This document served as the core framework for the merger, articulating the terms and conditions of the transaction, such as the exchange ratio for shares, the management structure of the merged entity, and the integration plan for the combined operations. 2. Share Exchange Agreement: This agreement outlined the exchange ratio at which the shares of Wheeling Pittsburgh Corp, WHO Corp, and WP Merger Co. would be exchanged during the merger process. The share exchange agreement aimed to ensure a fair and equitable distribution of ownership in the newly formed company. 3. Governance Agreement: This agreement defined the governance structure of the merged company, including the composition of the board of directors, the roles and responsibilities of key executives, and the decision-making process going forward. The governance agreement aimed to establish a robust and effective leadership structure for the merged entity. 4. Debt and Liability Agreement: This agreement addressed the treatment of outstanding debts, liabilities, and obligations of the merging companies. It ensured the fair allocation and assumption of financial responsibilities, protecting the interests of creditors and facilitating a seamless transition for business operations. The Cook Illinois Plan and Agreement of Merger by Wheeling Pittsburgh Corp, WHO Corp, and WP Merger Co. represented a strategic move to create a more formidable business entity with enhanced capabilities and market competitiveness. By combining resources, expertise, and market reach, this merger aimed to unlock synergies, drive growth, and deliver long-term value to the shareholders, employees, and customers of the merged company.

Cook Illinois Plan and Agreement of Merger by Wheeling Pittsburgh Corp, WHX Corp, and WP Merger Co.

Description

How to fill out Cook Illinois Plan And Agreement Of Merger By Wheeling Pittsburgh Corp, WHX Corp, And WP Merger Co.?

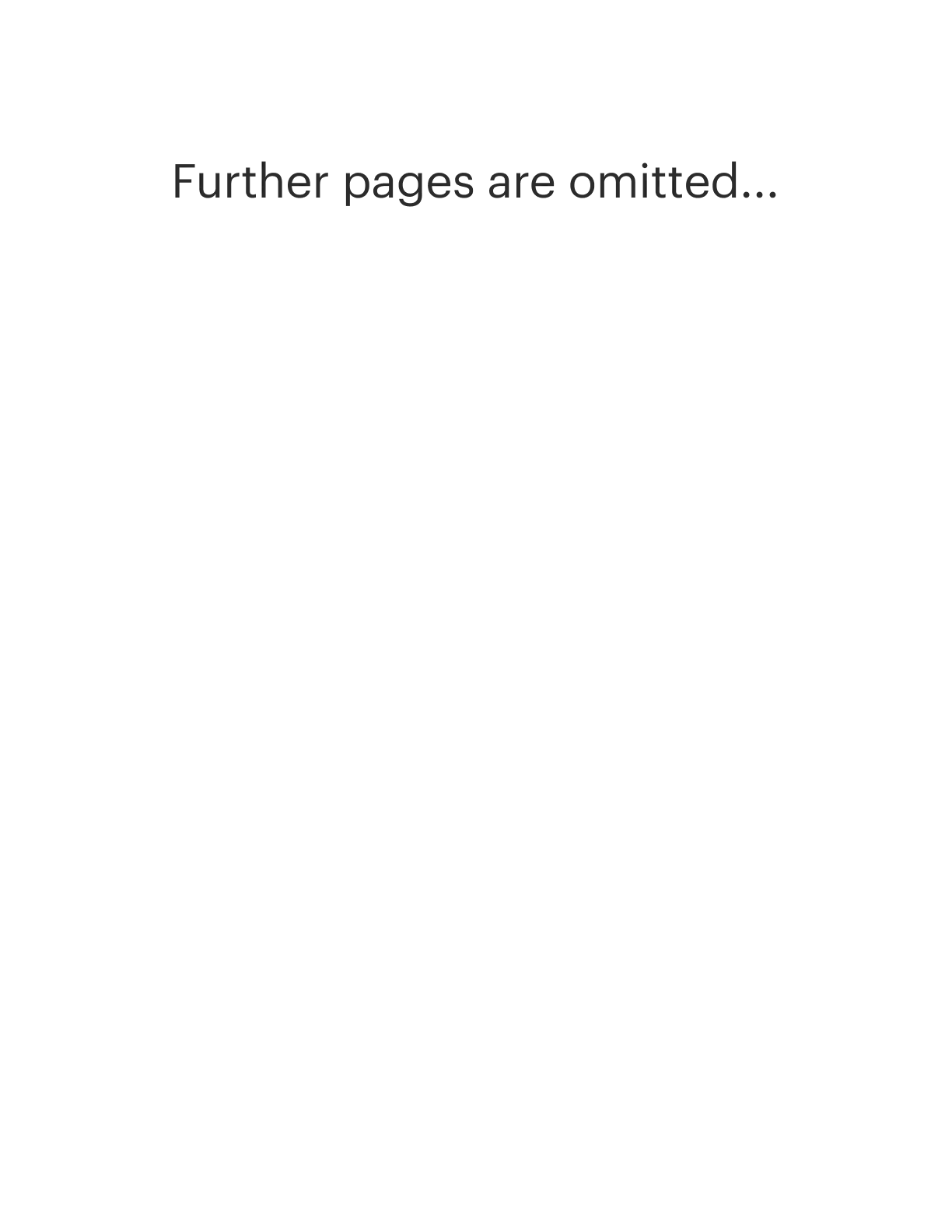

Do you need to quickly create a legally-binding Cook Plan and Agreement of Merger by Wheeling Pittsburgh Corp, WHX Corp, and WP Merger Co. or probably any other document to handle your own or business matters? You can select one of the two options: hire a legal advisor to draft a legal paper for you or draft it entirely on your own. The good news is, there's another solution - US Legal Forms. It will help you receive neatly written legal documents without paying unreasonable prices for legal services.

US Legal Forms provides a rich catalog of more than 85,000 state-specific document templates, including Cook Plan and Agreement of Merger by Wheeling Pittsburgh Corp, WHX Corp, and WP Merger Co. and form packages. We offer documents for a myriad of use cases: from divorce paperwork to real estate documents. We've been on the market for over 25 years and got a rock-solid reputation among our clients. Here's how you can become one of them and obtain the necessary template without extra troubles.

- To start with, carefully verify if the Cook Plan and Agreement of Merger by Wheeling Pittsburgh Corp, WHX Corp, and WP Merger Co. is adapted to your state's or county's laws.

- If the document has a desciption, make sure to check what it's suitable for.

- Start the search over if the form isn’t what you were hoping to find by utilizing the search bar in the header.

- Select the subscription that best suits your needs and proceed to the payment.

- Select the file format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, locate the Cook Plan and Agreement of Merger by Wheeling Pittsburgh Corp, WHX Corp, and WP Merger Co. template, and download it. To re-download the form, just head to the My Forms tab.

It's easy to find and download legal forms if you use our catalog. Additionally, the templates we provide are updated by industry experts, which gives you greater confidence when dealing with legal affairs. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

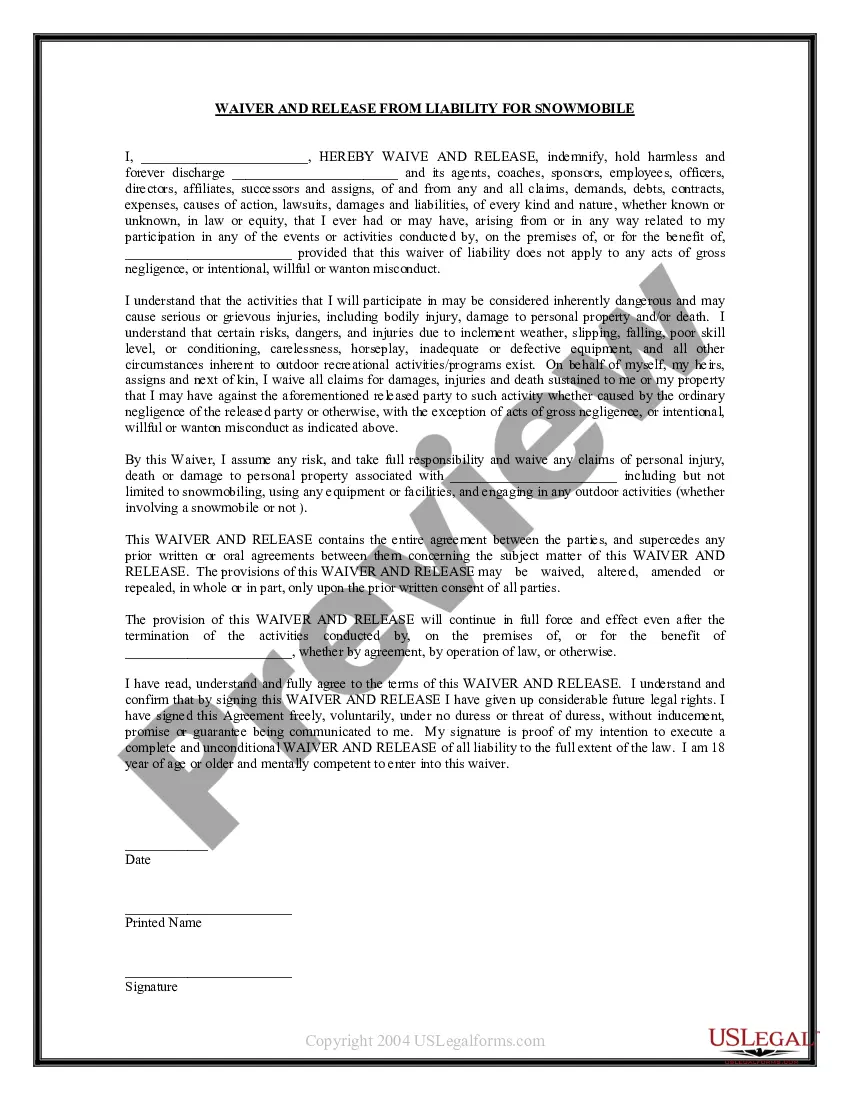

After that, I'll also very briefly introduce you to several other common mergers and acquisitions (M&A) transaction documents, including: Confidentiality Agreements. Letters of Intent. Exclusivity Agreements. Disclosure Schedules. HSR Filings. Third Party Consents. Legal Opinions. Stock Certificates.

Also known as articles of merger. A certificate evidencing the merger of two or more entities into one entity.

A merger is an agreement that unites two existing companies into one new company. There are several types of mergers and also several reasons why companies complete mergers. Mergers and acquisitions (M&A) are commonly done to expand a company's reach, expand into new segments, or gain market share.

Merger refers to a strategic process whereby two or more companies mutually form a new single legal venture. For example, in 2015, ketchup maker H.J. Heinz Co and Kraft Foods Group Inc merged their business to become Kraft Heinz Company, a leading global food and beverage firm.

A merger agreement (or ?definitive merger agreement?) is the legal contract that is drawn up and signed by both parties when two companies merge. Its terms and conditions can be quite detailed, and it usually spells out several parameters regarding staffing actions to be implemented.

A merger agreement (or ?definitive merger agreement?) is the legal contract that is drawn up and signed by both parties when two companies merge. Its terms and conditions can be quite detailed, and it usually spells out several parameters regarding staffing actions to be implemented.

A merger agreement definition is a legal contract governing the combination of two companies into a single business entity. 1.

A merger is an agreement that unites two existing companies into one new company. There are several types of mergers and also several reasons why companies complete mergers. Mergers and acquisitions (M&A) are commonly done to expand a company's reach, expand into new segments, or gain market share.

A merger is an agreement that unites two existing companies into one new company. There are several types of mergers and also several reasons why companies complete mergers. Mergers and acquisitions (M&A) are commonly done to expand a company's reach, expand into new segments, or gain market share.

A company merger is when two companies combine to form a new company. Companies merge to expand their market share, diversify products, reduce risk and competition, and increase profits.