The Orange California Plan and Agreement of Merger by Wheeling Pittsburgh Corp, WHO Corp, and WP Merger Co., is a legally binding document that outlines the terms and conditions of a merger between these three entities. This merger aims to consolidate their resources, expertise, and market presence to create a stronger and more competitive entity in the industry. The Orange California Plan and Agreement of Merger is a comprehensive document that covers various aspects of the merger, including the merger structure, valuation of assets, stock exchange ratios, and governance. It defines how the merger will be executed and the responsibilities and rights of each entity involved. The agreement outlines the terms of the merger, such as the exchange ratio of shares, consideration to be paid to the shareholders of the merging companies, and any necessary regulatory approvals required for the merger to be legally binding. It also specifies the roles and responsibilities of the management team and board of directors in the newly formed company. The Orange California Plan and Agreement of Merger by Wheeling Pittsburgh Corp, WHO Corp, and WP Merger Co. ensures that the interests of all parties involved are protected and that the merger is conducted in a fair and transparent manner. It aims to provide a smooth transition for employees, shareholders, and customers of the merging entities. It is worth noting that there may not be different types of the Orange California Plan and Agreement of Merger by Wheeling Pittsburgh Corp, WHO Corp, and WP Merger Co. as the description suggests. The content might be specifically referring to a particular merger agreement between these three entities in Orange County, California.

Orange California Plan and Agreement of Merger by Wheeling Pittsburgh Corp, WHX Corp, and WP Merger Co.

Description

How to fill out Orange California Plan And Agreement Of Merger By Wheeling Pittsburgh Corp, WHX Corp, And WP Merger Co.?

Drafting documents for the business or personal demands is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's important to take into account all federal and state regulations of the specific region. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it tense and time-consuming to create Orange Plan and Agreement of Merger by Wheeling Pittsburgh Corp, WHX Corp, and WP Merger Co. without expert help.

It's possible to avoid wasting money on attorneys drafting your documentation and create a legally valid Orange Plan and Agreement of Merger by Wheeling Pittsburgh Corp, WHX Corp, and WP Merger Co. on your own, using the US Legal Forms web library. It is the biggest online catalog of state-specific legal documents that are professionally verified, so you can be sure of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to save the needed form.

In case you still don't have a subscription, follow the step-by-step instruction below to get the Orange Plan and Agreement of Merger by Wheeling Pittsburgh Corp, WHX Corp, and WP Merger Co.:

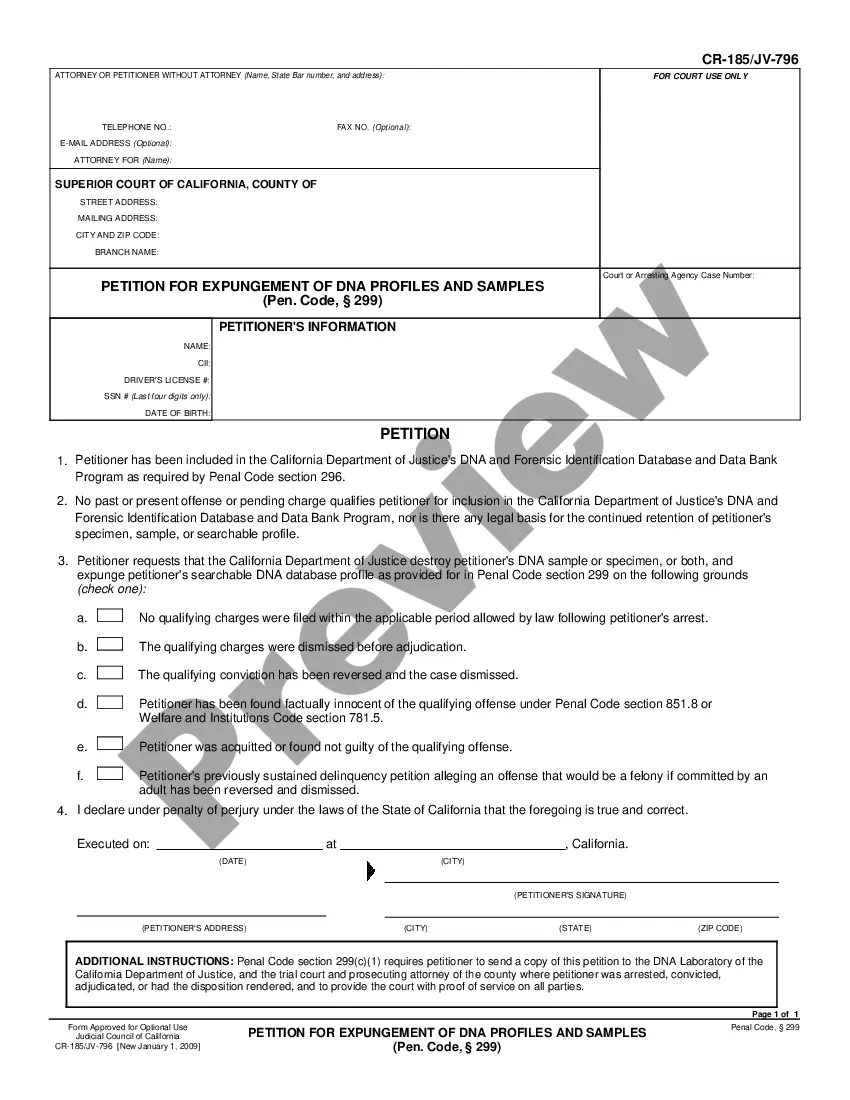

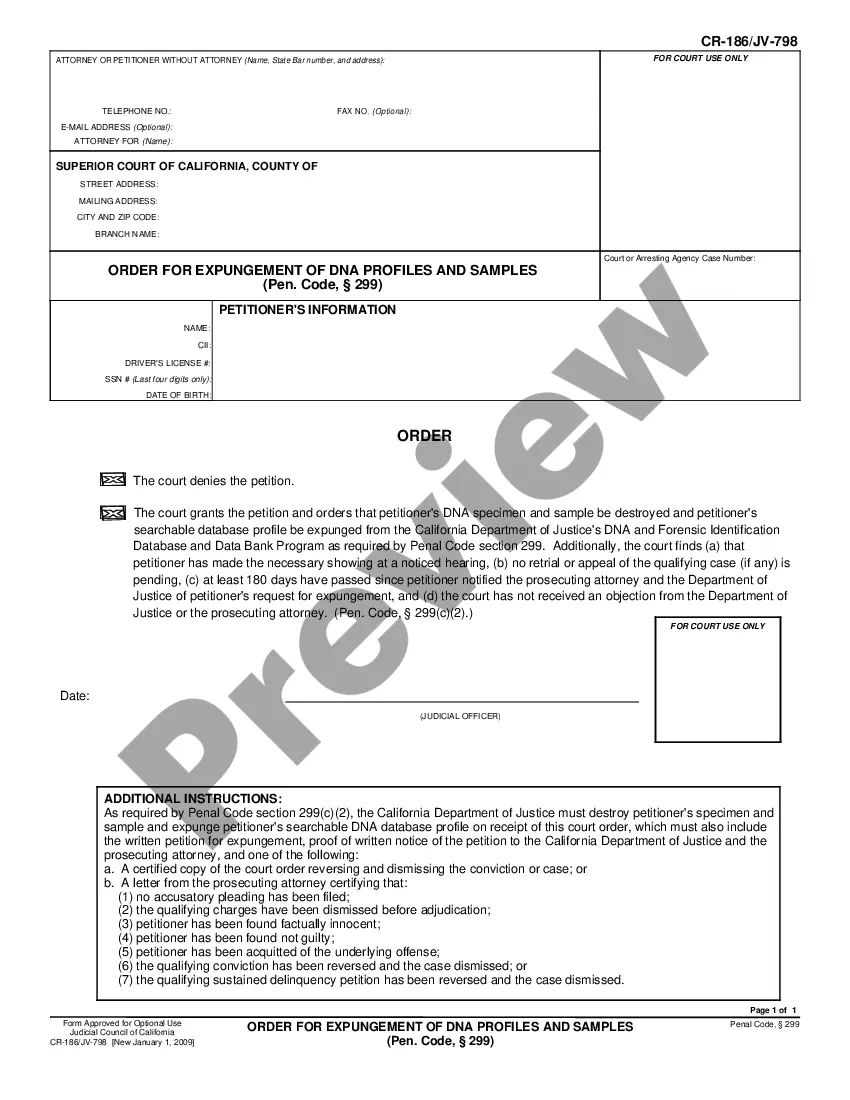

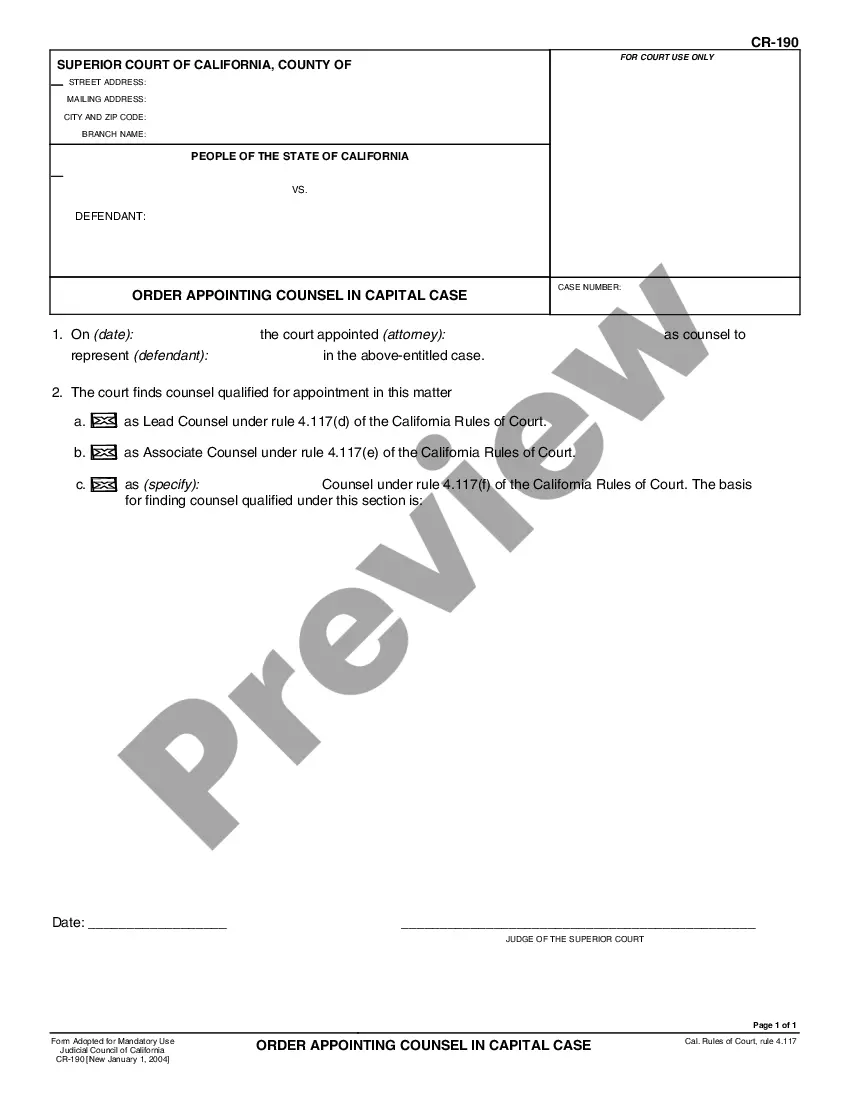

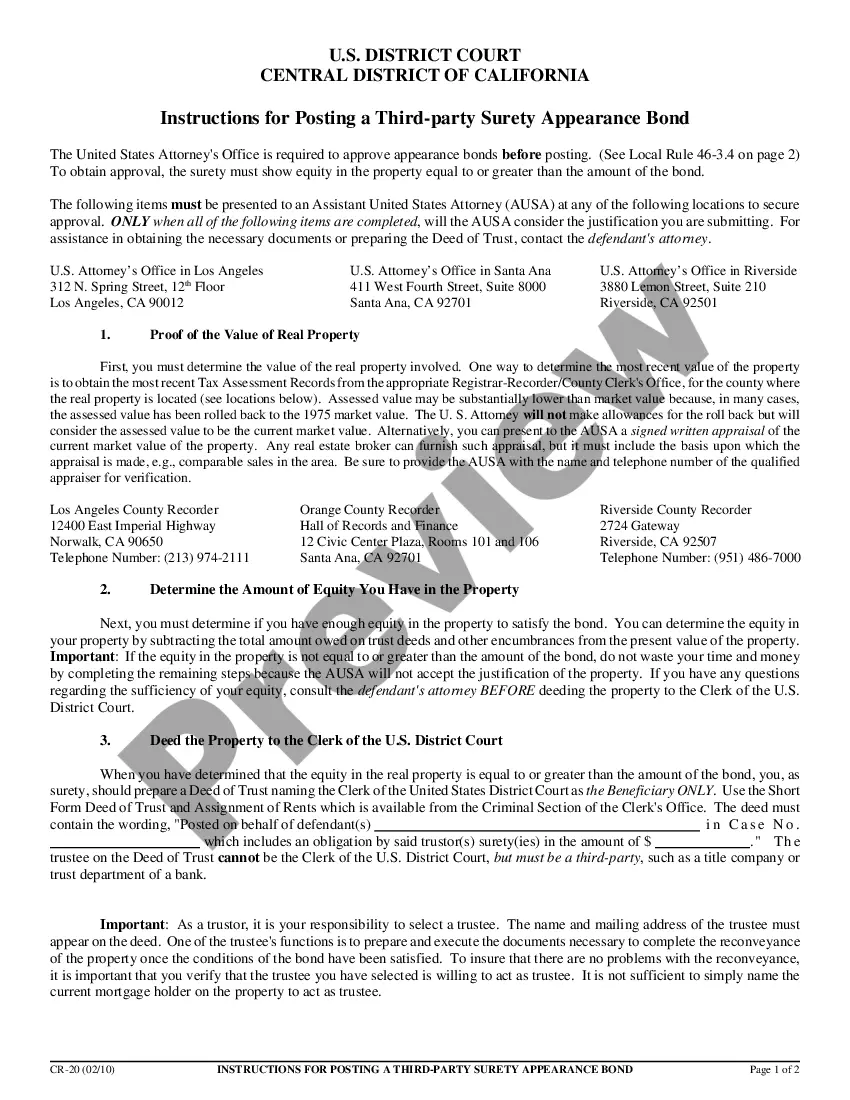

- Look through the page you've opened and check if it has the sample you need.

- To accomplish this, use the form description and preview if these options are available.

- To locate the one that fits your needs, utilize the search tab in the page header.

- Double-check that the template complies with juridical criteria and click Buy Now.

- Choose the subscription plan, then log in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal templates for any scenario with just a few clicks!

Form popularity

FAQ

Cal. Corp. Code § 1110(a). The principal advantage of the procedure is that it can in most cases be effected by approval of the board of directors of the parent.

Once the meeting is held, if a majority of the shareholders vote in favor of the merger agreement, the merger is approved. Keep in mind that Section 251 contains a number of exceptions for when a vote of the shareholders is not required.

An acquirer may also need shareholder approval if it issues more than 20% of its stock in the deal. That's because the NYSE, NASDAQ and other exchanges require it. Buyer shareholder vote is not required if the consideration is in cash or less than 20% of acquirer stock is issued in the transaction.

Accordingly, the SEC has the responsibility of reviewing, approving and regulating mergers, acquisitions, takeovers and all forms of business combinations. (ISA, s. 13.) Thus, every merger, acquisition or business combination between or among companies is subject to the prior review and approval of the SEC.

A merger is the voluntary fusion of two companies on broadly equal terms into one new legal entity. The firms that agree to merge are roughly equal in terms of size, customers, and scale of operations.

Mergers are transactions involving the combination of generally two or more companies into a single entity. The need for shareholder approval of a merger is governed by state law. Typically, a merger must be approved by the holders of a majority of the outstanding shares of the target company.

Merger Plan means a written document that contains the terms, agreements, and information re- garding the merger of two or more independent special districts.

Before a large merger happens, the antitrust regulators at the FTC and the U.S. Department of Justice can allow the merger, prohibit it, or allow it if certain conditions are met. One common condition is that the merger will be allowed if the firm agrees to sell off certain parts.

Upon approval by a majority vote of each of the board of directors or trustees of the constituent corporations of the plan of merger or consolidation, the same shall be submitted for approval by the stockholders or members of each of such corporations at separate corporate meetings duly called for the purpose.

Merger transactions typically require approval of the boards of directors of the constituent companies and a vote of the shareholders of the constituent companies.