The Wake North Carolina Plan and Agreement of Merger by Wheeling Pittsburgh Corp, WHO Corp, and WP Merger Co. is a significant legal document outlining the details of a merger between these three entities. This agreement is of utmost importance as it sets the foundation for the consolidation of businesses and outlines the terms and conditions under which the merger will take place. This particular merger involves Wheeling Pittsburgh Corp, WHO Corp, and WP Merger Co., which are all companies operating in various industries. The agreement encompasses a range of critical aspects, including financial arrangements, governance structure, asset transfers, legal liabilities, and other relevant terms. The Wake North Carolina Plan and Agreement of Merger is a comprehensive and intricate document that requires thorough analysis and legal expertise. It plays a vital role in ensuring a smooth transition of operations, protecting the interests of all stakeholders involved, and maximizing the potential synergies resulting from the merger. As for different types of Wake North Carolina Plan and Agreement of Merger by Wheeling Pittsburgh Corp, WHO Corp, and WP Merger Co., it is important to note that mergers can take different forms based on the objectives and requirements of the involved entities. Some possible variations could be: 1. Stock-for-Stock Merger: In this type of merger, the shareholders of Wheeling Pittsburgh Corp and WHO Corp agree to exchange their shares for shares in WP Merger Co., resulting in the combination of the companies' ownership. 2. Asset Acquisition Merger: This type of merger involves WP Merger Co. acquiring specific assets and liabilities of both Wheeling Pittsburgh Corp and WHO Corp, effectively integrating their operations and consolidating their resources. 3. Joint Venture Merger: In some cases, the merger agreement could outline a joint venture structure, where Wheeling Pittsburgh Corp, WHO Corp, and WP Merger Co. collaborate to form a new entity with shared ownership and control, pooling their expertise and resources to pursue common business goals. In conclusion, the Wake North Carolina Plan and Agreement of Merger by Wheeling Pittsburgh Corp, WHO Corp, and WP Merger Co. is a critical legal document that formalizes the merger between these entities. It covers various aspects such as financial arrangements, governance, asset transfers, and legal liabilities. Different types of mergers, such as stock-for-stock mergers, asset acquisition mergers, and joint venture mergers, can be outlined in the agreement based on specific objectives and requirements.

Wake North Carolina Plan and Agreement of Merger by Wheeling Pittsburgh Corp, WHX Corp, and WP Merger Co.

Description

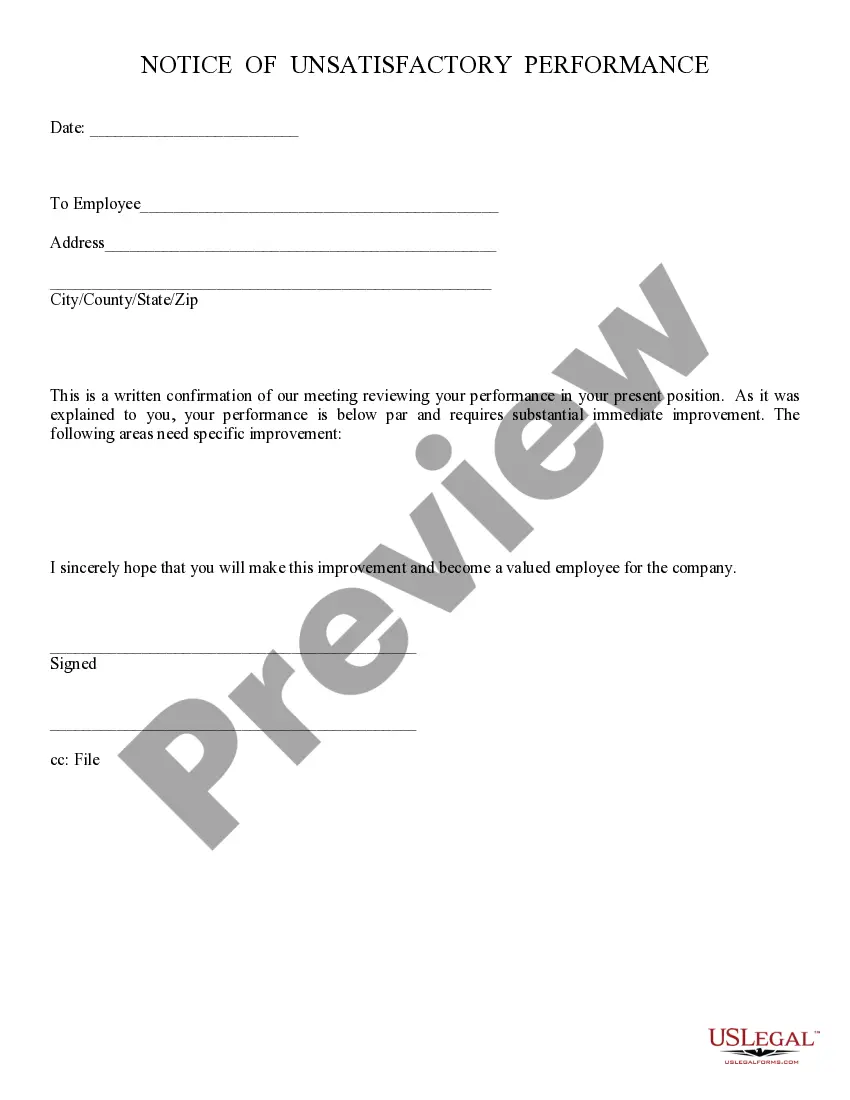

How to fill out Wake North Carolina Plan And Agreement Of Merger By Wheeling Pittsburgh Corp, WHX Corp, And WP Merger Co.?

If you need to find a reliable legal document provider to find the Wake Plan and Agreement of Merger by Wheeling Pittsburgh Corp, WHX Corp, and WP Merger Co., consider US Legal Forms. Whether you need to launch your LLC business or manage your asset distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the needed form.

- You can browse from over 85,000 forms categorized by state/county and situation.

- The self-explanatory interface, number of supporting materials, and dedicated support team make it easy to get and complete various documents.

- US Legal Forms is a trusted service offering legal forms to millions of users since 1997.

You can simply type to look for or browse Wake Plan and Agreement of Merger by Wheeling Pittsburgh Corp, WHX Corp, and WP Merger Co., either by a keyword or by the state/county the document is created for. After finding the needed form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's effortless to start! Simply locate the Wake Plan and Agreement of Merger by Wheeling Pittsburgh Corp, WHX Corp, and WP Merger Co. template and take a look at the form's preview and description (if available). If you're comfortable with the template’s terminology, go ahead and click Buy now. Create an account and select a subscription plan. The template will be instantly available for download as soon as the payment is completed. Now you can complete the form.

Handling your law-related matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our comprehensive collection of legal forms makes this experience less pricey and more affordable. Set up your first company, arrange your advance care planning, draft a real estate contract, or execute the Wake Plan and Agreement of Merger by Wheeling Pittsburgh Corp, WHX Corp, and WP Merger Co. - all from the convenience of your home.

Sign up for US Legal Forms now!