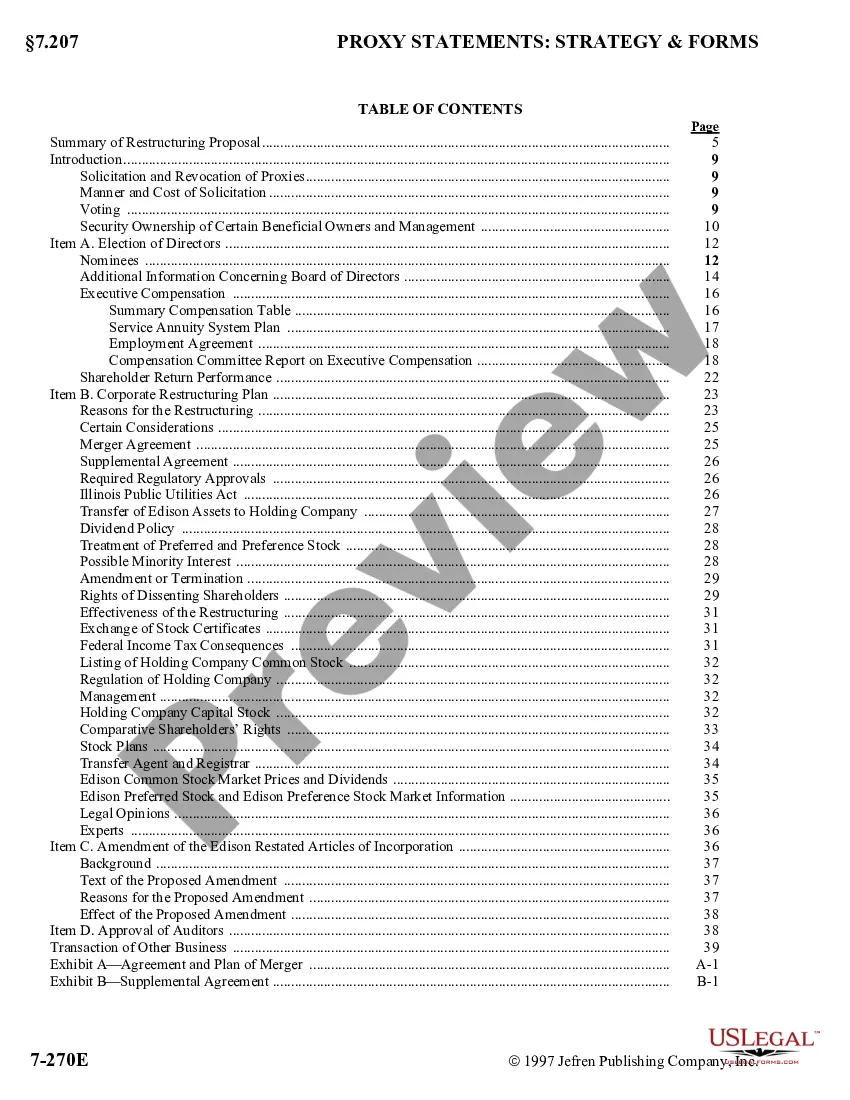

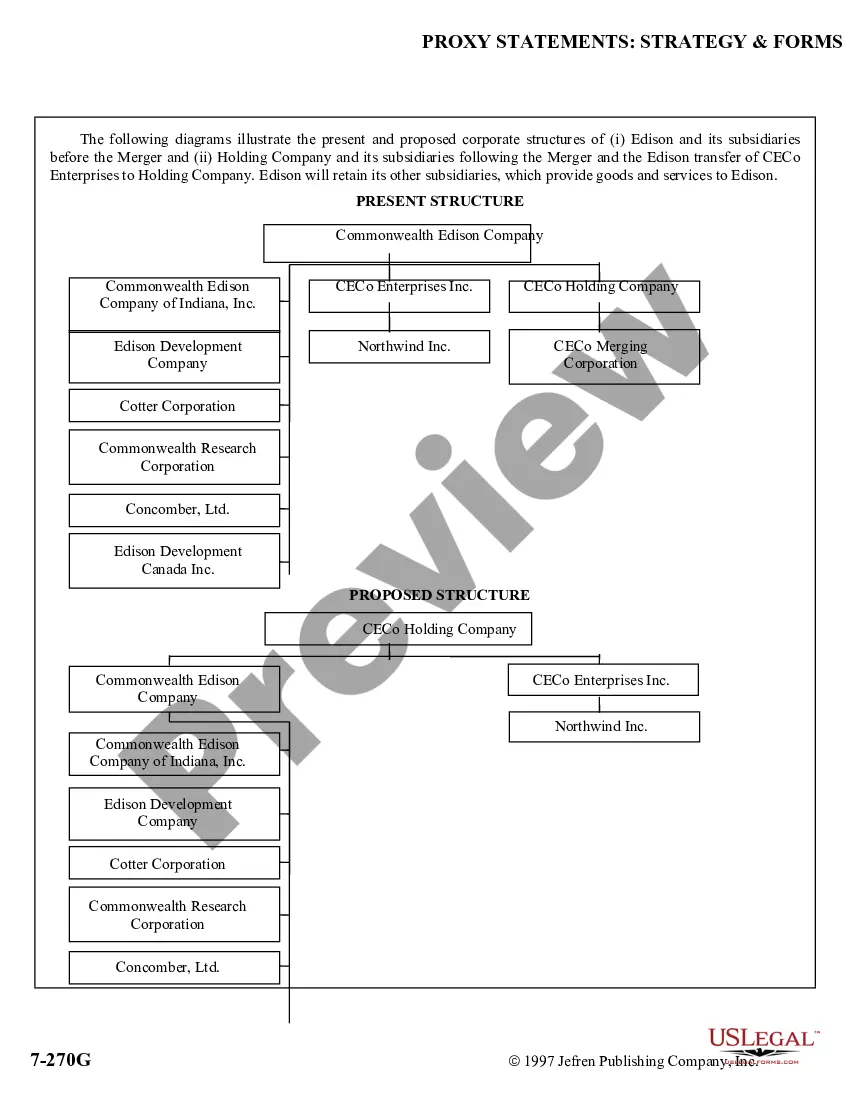

The Nassau New York Proxy Statement and Prospectus with exhibits for Commonwealth Edison Company provides important information about the company's operations, financial performance, and governance structure for the shareholders and potential investors. In this document, shareholders will find comprehensive details about the company's management practices, executive compensation, directors' qualifications, and potential risks associated with investing in the company's common stock. The Prospectus section outlines the offering of new securities, including terms, conditions, and pricing. The exhibits attached to the Proxy Statement and Prospectus may include audited financial statements, management's discussion and analysis (MDA) of financial condition and results of operations, risk factors, legal proceedings, and consolidated financial statements with accompanying notes. Some types of Nassau New York Proxy Statement and Prospectus with exhibits for Commonwealth Edison Company may include: 1. Annual Meeting Proxy Statement: Provides information on the upcoming annual shareholders' meeting, including voting procedures, proxy voting, board nominee election, and any proposed changes to the company's bylaws or charter. 2. Definitive Proxy Statement: Issued when shareholders are required to make definitive decisions on matters such as mergers, acquisitions, major investments, or other significant corporate actions. It includes detailed information about the transaction and its potential impact on the company and shareholders. 3. Prospectus for Initial Public Offering (IPO): Prepared when Commonwealth Edison Company decides to offer its securities to the public for the first time. It discloses key aspects such as the company's business model, financial details, risk factors, and the offering price. 4. Prospectus for Secondary Offering: Created when existing shareholders, including major stakeholders or insiders, decide to sell additional shares to the public. This document provides information about the offering, the selling shareholders, and any dilute effects on existing shareholders. 5. Supplemental Proxy Statement: Released when additional information needs to be provided to shareholders after the initial Proxy Statement has been filed. It can include updates on material matters affecting shareholders' decision-making or any corrections to previously provided information. It is important for shareholders and potential investors to thoroughly review the Nassau New York Proxy Statement and Prospectus with exhibits for Commonwealth Edison Company to make informed decisions about their investments.

Nassau New York Proxy Statement and Prospectus with exhibits for Commonwealth Edison Company

Description

How to fill out Nassau New York Proxy Statement And Prospectus With Exhibits For Commonwealth Edison Company?

Laws and regulations in every area vary around the country. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal documents. To avoid pricey legal assistance when preparing the Nassau Proxy Statement and Prospectus with exhibits for Commonwealth Edison Company, you need a verified template valid for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal templates. It's a great solution for specialists and individuals searching for do-it-yourself templates for various life and business situations. All the documents can be used multiple times: once you obtain a sample, it remains available in your profile for further use. Thus, if you have an account with a valid subscription, you can just log in and re-download the Nassau Proxy Statement and Prospectus with exhibits for Commonwealth Edison Company from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Nassau Proxy Statement and Prospectus with exhibits for Commonwealth Edison Company:

- Examine the page content to make sure you found the correct sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to obtain the document when you find the proper one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the document on paper after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

Interesting Questions

More info

This information is also contained in the materials accompanying the Annual Report on Form 10-Q for the fiscal second quarter ended October 31, 2016 (the “Annual Report”), incorporated herein by reference. (10) COMPANY AFFILIATE SHARES, THEFT AND DIFFICULTIES On September 9, 2016, the Company terminated its agreement with Amgen, Inc., as the financial sponsor for the Company's Gotham program, to operate the Gotham program under the Amgen Gotham program, effective September 9, 2016, and terminated the remaining financial sponsor agreement with Amgen, Inc., dated as of May 5, 2016, as further described below.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.