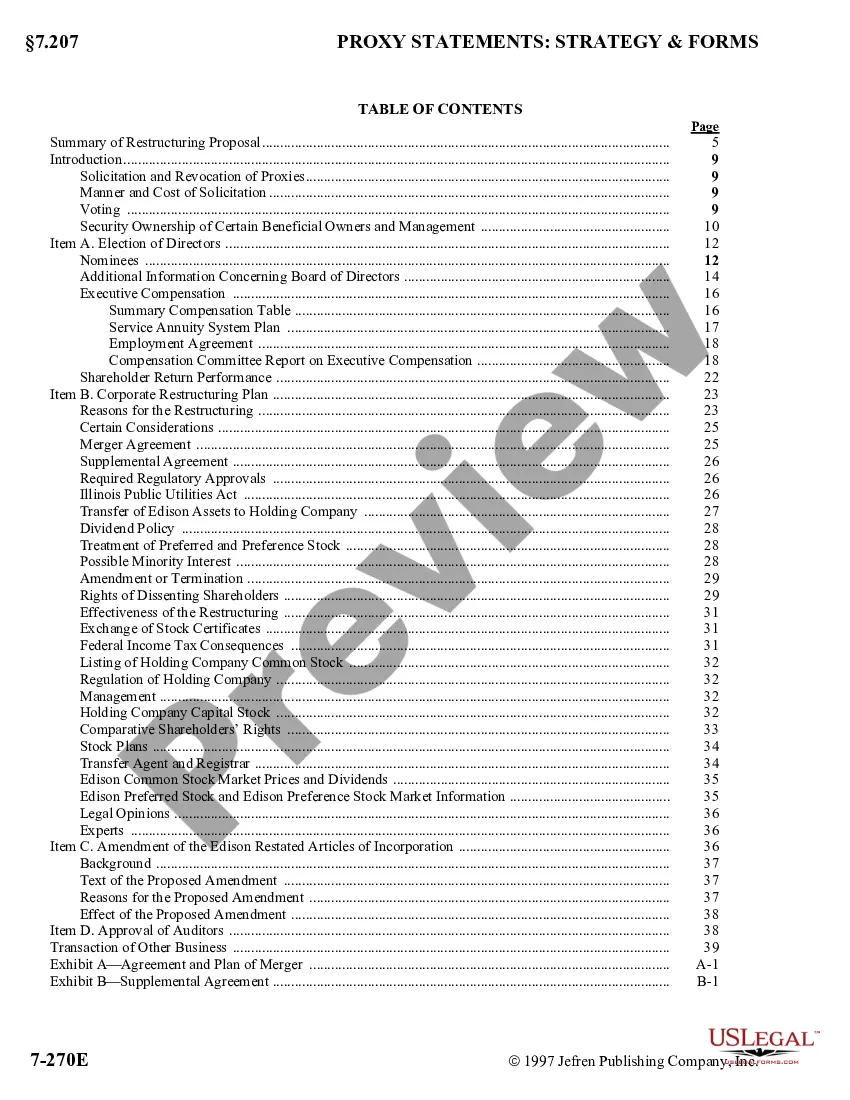

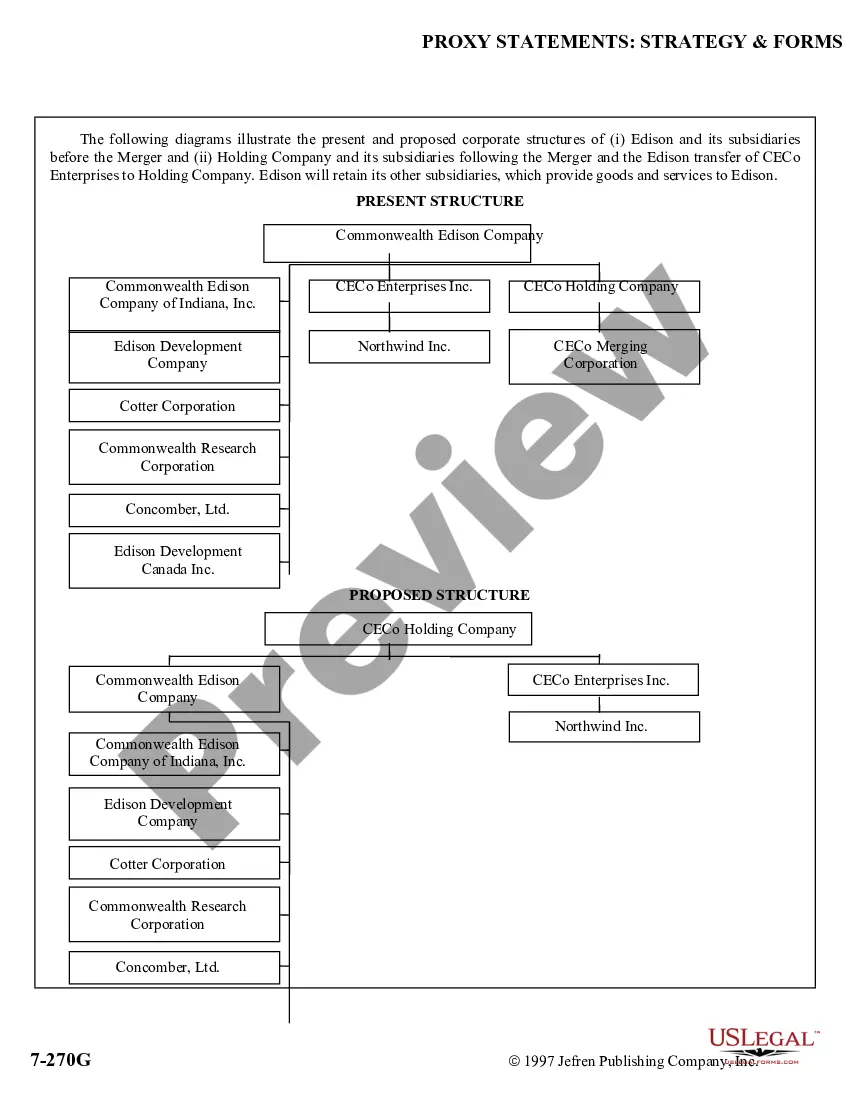

The Oakland Michigan Proxy Statement and Prospectus with exhibits for Commonwealth Edison Company is a vital document that provides crucial information regarding the company's operations, governance, and financial standing. It serves as a communication tool between the company's management and its shareholders, enabling them to make informed decisions during voting and investment processes. The Proxy Statement is a comprehensive document that encompasses various sections and exhibits. It begins with an introductory letter from the company's management, followed by a detailed description of the matters to be voted upon, such as the election of directors, executive compensation, and other pertinent proposals. One of the key components of the Proxy Statement is the background information about Commonwealth Edison Company. It includes details about its history, the industry it operates in, the markets it serves, and its overall performance in recent years. This section helps shareholders and investors understand the company's context and evaluate its potential risks and opportunities. The governance section of the Proxy Statement elaborates on the company's board of directors, their qualifications, and their role in overseeing the business operations. It also explains the committee structures and summarizes the company's governance practices, including its compliance with regulatory requirements. The Proxy Statement further presents details about the compensation structure for the company's executives, including the CEO and other key management personnel. This section outlines the various components of their compensation, such as base salary, annual incentives, and long-term incentives. Additionally, it discloses information about company policies and practices related to executive compensation, ensuring transparency and accountability. The Prospectus section of the document primarily focuses on providing investors with in-depth information about the company's financial condition. It includes audited financial statements, balance sheets, income statements, cash flows, and other financial metrics. These figures convey the company's current financial position, historical performance, and future projections. Exhibits accompanying the Proxy Statement and Prospectus may include legal agreements, contracts, and any additional documents that support and enhance the information provided. These exhibits can vary depending on the specific needs or requirements of the company and its regulatory obligations. Overall, the Oakland Michigan Proxy Statement and Prospectus with exhibits for Commonwealth Edison Company act as essential references for its shareholders and potential investors when making important decisions. It allows them to evaluate the company's governance structure, executive compensation practices, and financial performance, ultimately contributing to their informed participation in shareholder meetings and investment considerations.

Oakland Michigan Proxy Statement and Prospectus with exhibits for Commonwealth Edison Company

Description

How to fill out Oakland Michigan Proxy Statement And Prospectus With Exhibits For Commonwealth Edison Company?

If you need to find a reliable legal document provider to obtain the Oakland Proxy Statement and Prospectus with exhibits for Commonwealth Edison Company, consider US Legal Forms. Whether you need to launch your LLC business or take care of your asset distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the needed template.

- You can select from over 85,000 forms categorized by state/county and situation.

- The intuitive interface, variety of learning materials, and dedicated support make it simple to get and complete different paperwork.

- US Legal Forms is a reliable service providing legal forms to millions of customers since 1997.

Simply type to look for or browse Oakland Proxy Statement and Prospectus with exhibits for Commonwealth Edison Company, either by a keyword or by the state/county the form is created for. After finding the needed template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's easy to get started! Simply locate the Oakland Proxy Statement and Prospectus with exhibits for Commonwealth Edison Company template and check the form's preview and description (if available). If you're confident about the template’s terminology, go ahead and click Buy now. Create an account and choose a subscription option. The template will be instantly ready for download once the payment is processed. Now you can complete the form.

Handling your legal affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our extensive variety of legal forms makes these tasks less costly and more reasonably priced. Set up your first business, organize your advance care planning, create a real estate agreement, or complete the Oakland Proxy Statement and Prospectus with exhibits for Commonwealth Edison Company - all from the convenience of your home.

Join US Legal Forms now!