The Dallas Texas Form of Agreement and Plan of Merger by Regional Ban corp, Inc., Medford Interim, Inc., and Medford Savings Bank is a legally binding contract that outlines the terms and conditions of a merger between Regional Ban corp, Inc., Medford Interim, Inc., and Medford Savings Bank in the city of Dallas, Texas. This document plays a crucial role in the merger process as it regulates the rights, obligations, and responsibilities of all parties involved. The agreement begins with a comprehensive preamble setting forth the background of the merger, including the reasons and objectives for such a transaction. It goes on to define the terms used throughout the contract, ensuring clarity and consistency. The agreement provides a detailed description of the merger structure, outlining the steps to be taken by both Regional Ban corp, Inc. and Medford Savings Bank. It includes provisions for the exchange of shares, the conversion of securities, and the procedures for the integration of operations, assets, and liabilities. Furthermore, the agreement sets forth the corporate governance structure of the merged entity, discussing the composition of the board of directors, executive management, and any other key committees that may be formed. It also outlines the rights and powers of the shareholders and the mechanisms for voting and decision-making. Other significant aspects covered in the agreement include the treatment of outstanding stock options, employee benefits, and any potential regulatory or legal requirements that need to be fulfilled before the merger can be finalized. It addresses the potential termination of the agreement under certain circumstances and lays out the procedures for dispute resolution. Different types or variants of the Dallas Texas Form of Agreement and Plan of Merger may exist depending on the specific terms and conditions negotiated between Regional Ban corp, Inc., Medford Interim, Inc., and Medford Savings Bank. Some possible variants could include variations in the exchange ratio of shares, the treatment of minority shareholders, or unique provisions related to the banking industry. In conclusion, the Dallas Texas Form of Agreement and Plan of Merger by Regional Ban corp, Inc., Medford Interim, Inc., and Medford Savings Bank is a detailed legal document facilitating the merger process. It encompasses all aspects of the transaction, including governance, securities exchange, operational integration, and regulatory compliance.

Dallas Texas Form of Agreement and Plan of Merger by Regional Bancorp, Inc., Medford Interim, Inc., and Medford Savings Bank

Description

How to fill out Dallas Texas Form Of Agreement And Plan Of Merger By Regional Bancorp, Inc., Medford Interim, Inc., And Medford Savings Bank?

Preparing documents for the business or personal needs is always a huge responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's essential to consider all federal and state laws of the specific area. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these details make it burdensome and time-consuming to create Dallas Form of Agreement and Plan of Merger by Regional Bancorp, Inc., Medford Interim, Inc., and Medford Savings Bank without professional help.

It's easy to avoid wasting money on lawyers drafting your documentation and create a legally valid Dallas Form of Agreement and Plan of Merger by Regional Bancorp, Inc., Medford Interim, Inc., and Medford Savings Bank on your own, using the US Legal Forms web library. It is the largest online collection of state-specific legal templates that are professionally cheched, so you can be sure of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to save the needed form.

In case you still don't have a subscription, follow the step-by-step instruction below to obtain the Dallas Form of Agreement and Plan of Merger by Regional Bancorp, Inc., Medford Interim, Inc., and Medford Savings Bank:

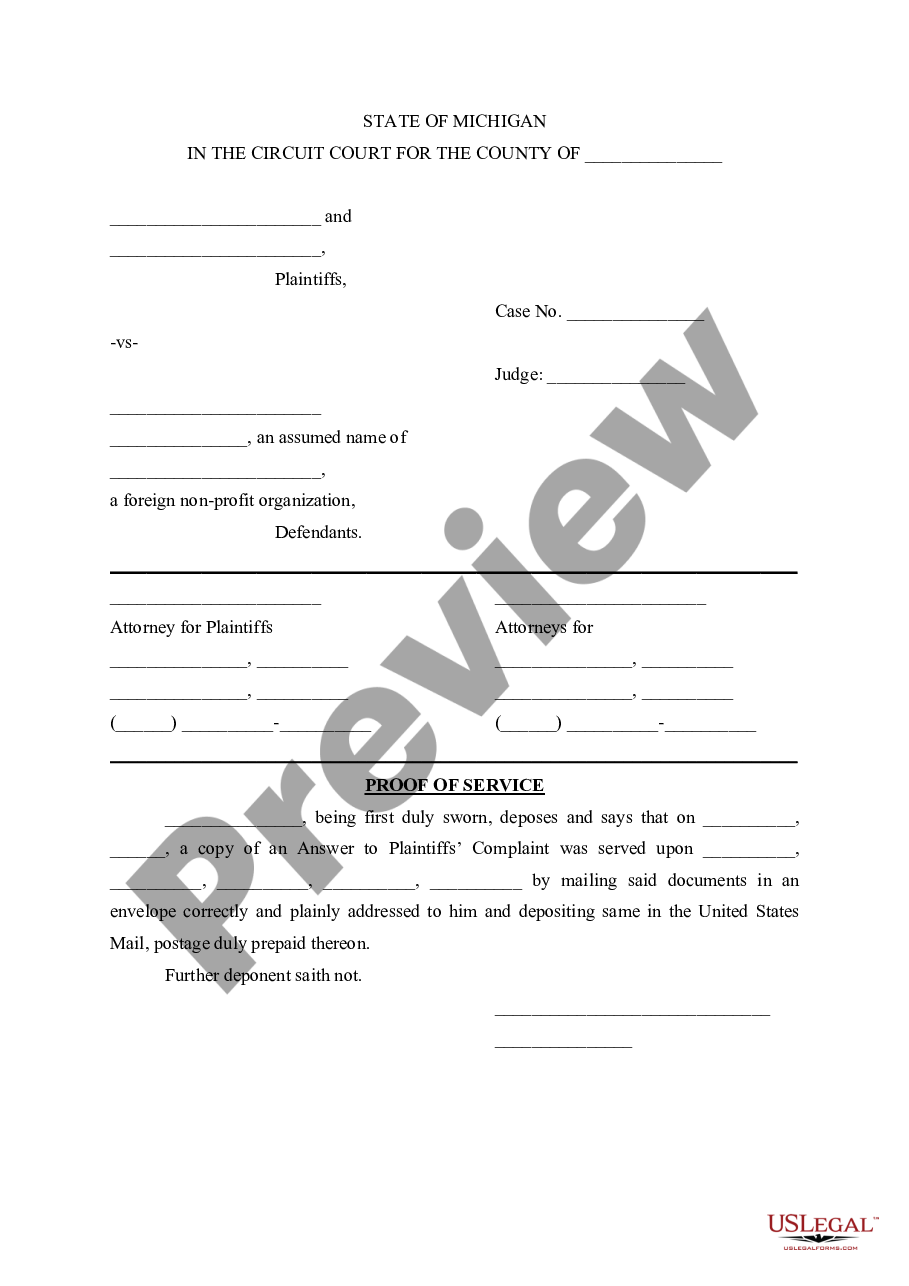

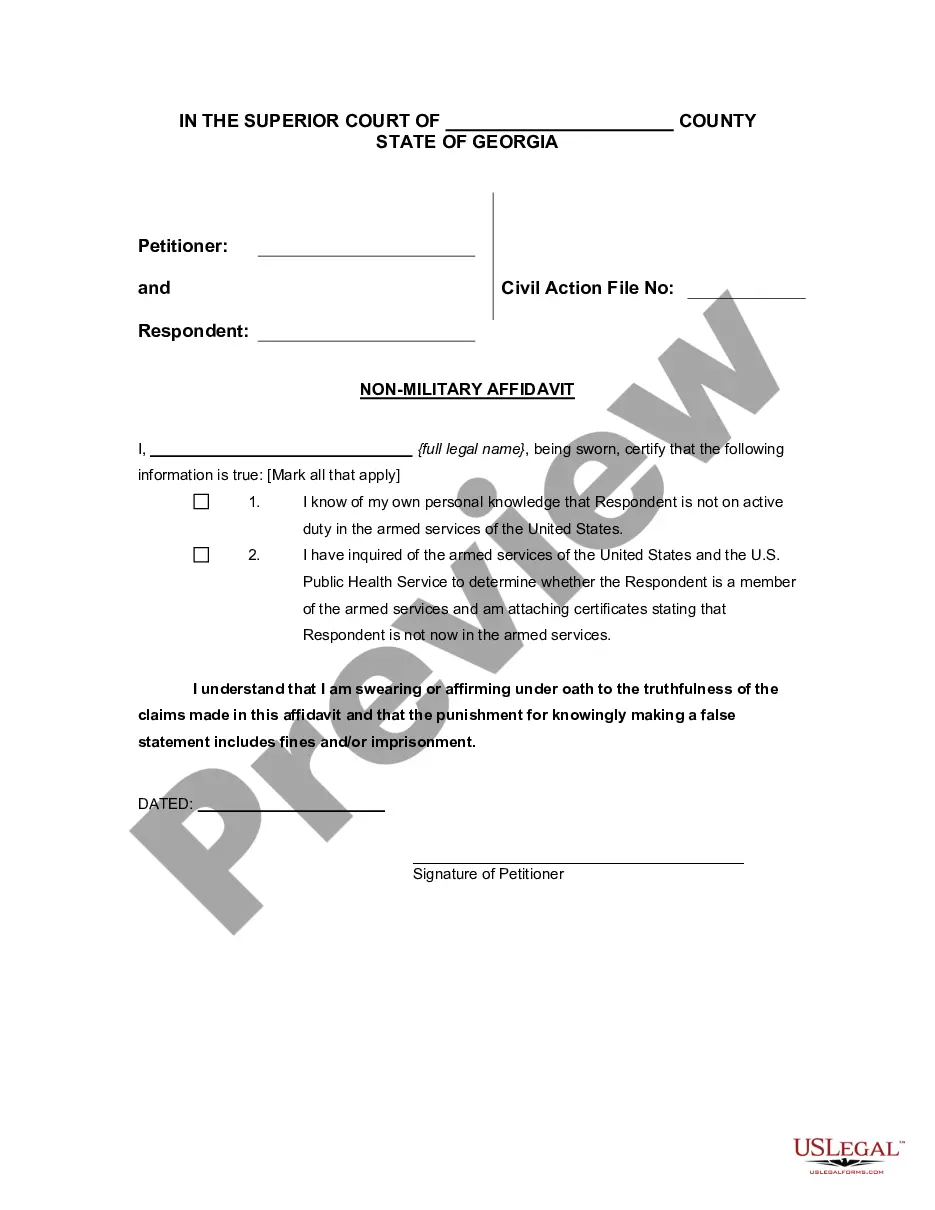

- Look through the page you've opened and verify if it has the document you need.

- To achieve this, use the form description and preview if these options are available.

- To locate the one that suits your needs, utilize the search tab in the page header.

- Recheck that the template complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then log in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal forms for any situation with just a few clicks!

Form popularity

FAQ

Also known as articles of merger. A certificate evidencing the merger of two or more entities into one entity.

The 5-step mergers and acquisitions process Preliminary discussions and non-disclosure agreements.Assessment and evaluation of target.Due diligence within a Data Room.Signing the contract and closing the deal.Post deal integration.

Related Definitions Acquisition Document or ?procurement document? means any document or instrument that effectuates an acquisition of information technology, including but not limited to a contract, agreement, purchase order, statement of work, bill of sale, invoice, or other similar document.

A merger is an agreement that unites two existing companies into one new company. There are several types of mergers and also several reasons why companies complete mergers. Mergers and acquisitions (M&A) are commonly done to expand a company's reach, expand into new segments, or gain market share.

The three main types of merger are horizontal mergers which increase market share, vertical mergers which exploit existing synergies and concentric mergers which expand the product offering.

Merger Parties means, individually and collectively, the Company, the Shareholders, Merger Sub and Buyer.

The key terms include: The Buyer and Seller, Price (per share, or lump sum for private companies), and Type of Transaction.Treatment of Outstanding Shares, Options, and RSUs and Other Dilutive Securities.Representations and Warranties.Covenants.Solicitation (?No Shop? vs.Financing.Termination Fee (or ?Break-Up Fee?)

Mergers are transactions involving the combination of generally two or more companies into a single entity. The need for shareholder approval of a merger is governed by state law. Typically, a merger must be approved by the holders of a majority of the outstanding shares of the target company.

After that, I'll also very briefly introduce you to several other common mergers and acquisitions (M&A) transaction documents, including: Confidentiality Agreements. Letters of Intent. Exclusivity Agreements. Disclosure Schedules. HSR Filings. Third Party Consents. Legal Opinions. Stock Certificates.

A merger agreement (or ?definitive merger agreement?) is the legal contract that is drawn up and signed by both parties when two companies merge. Its terms and conditions can be quite detailed, and it usually spells out several parameters regarding staffing actions to be implemented.