The Dallas Texas Internal Revenue Service (IRS) Ruling Letter is a document provided by the IRS that serves as an official written response to a taxpayer's request for guidance or clarification on specific tax issues. This ruling is used to provide interpretations of tax laws, regulations, and other related topics. The Dallas Texas IRS Ruling Letter can encompass various types of rulings, each addressing a different aspect of taxation. Some different types of ruling letters include: 1. General Ruling Letter: This type of ruling letter provides guidance on general tax issues, such as the interpretation of a specific tax code section or the tax implications of a particular transaction. 2. Industry-Specific Ruling Letter: These letters address tax concerns relevant to specific industries, such as healthcare, real estate, or technology. They offer guidance on industry-specific tax exemptions, deductions, or compliance requirements. 3. Private Letter Ruling (PLR): A PLR is a ruling letter issued to a specific taxpayer in response to their individual request for a particular tax matter. These are binding only to the taxpayer who requested it and cannot be relied upon by other taxpayers. 4. Technical Advice Memorandum (TAM): Tams are issued by the IRS to provide guidance on complex tax issues or situations that may have broad applicability. They clarify gray areas in tax law and provide a comprehensive analysis of the given situation. 5. Revenue Ruling (RR): Revenue rulings are used to provide taxpayers with guidance on tax law interpretations. These rulings are issued based on specific factual situations and serve as precedents in future tax cases. 6. Technical Assistance (TA) Request: A TA request is a type of ruling letter submitted by taxpayers seeking clarification on administrative processes, such as filing requirements, penalties, or audits. The Dallas Texas Internal Revenue Service Ruling Letter, regardless of its type, plays a crucial role in providing taxpayers with authoritative guidance and interpretations regarding their tax obligations. It helps individuals and businesses make informed decisions, ensure compliance, and navigate the complex tax landscape effectively.

Dallas Texas Internal Revenue Service Ruling Letter

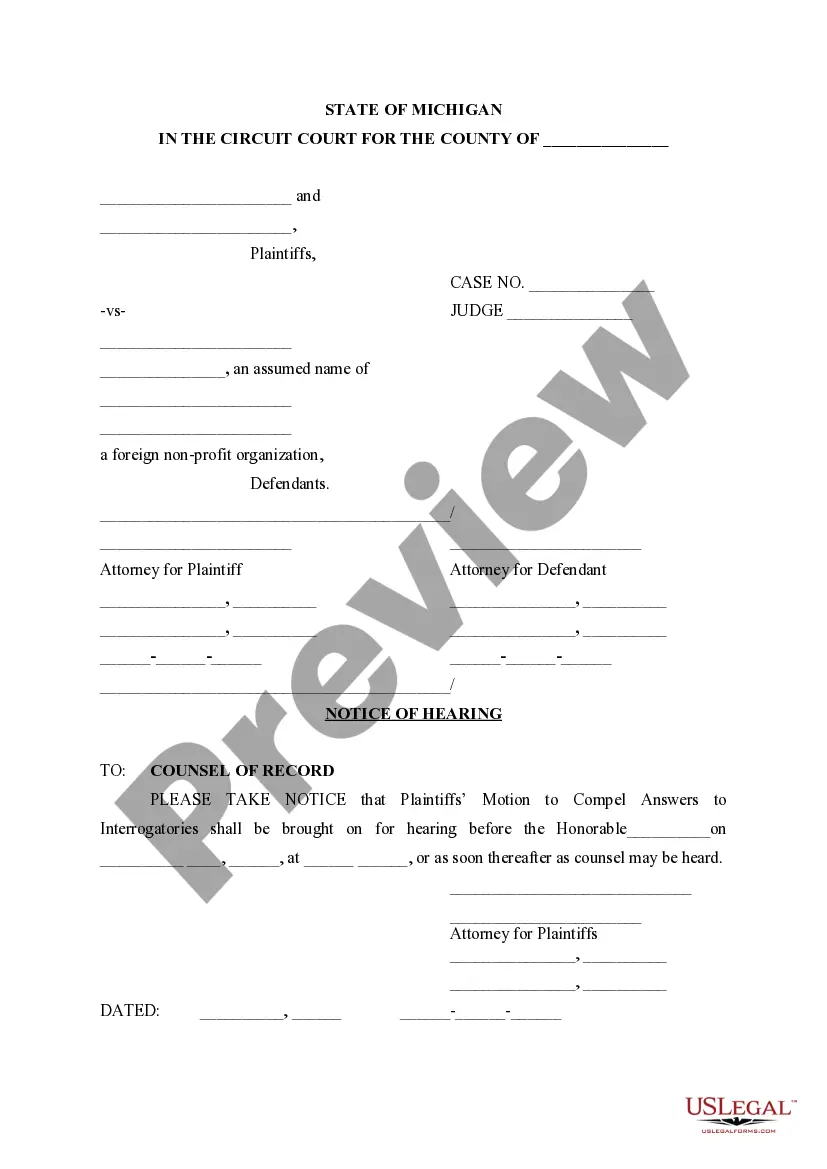

Description

How to fill out Dallas Texas Internal Revenue Service Ruling Letter?

Dealing with legal forms is a must in today's world. However, you don't always need to look for qualified assistance to draft some of them from scratch, including Dallas Internal Revenue Service Ruling Letter, with a service like US Legal Forms.

US Legal Forms has more than 85,000 forms to select from in various types varying from living wills to real estate papers to divorce documents. All forms are organized based on their valid state, making the searching process less overwhelming. You can also find detailed resources and guides on the website to make any tasks related to document execution straightforward.

Here's how you can locate and download Dallas Internal Revenue Service Ruling Letter.

- Go over the document's preview and outline (if provided) to get a basic information on what you’ll get after downloading the form.

- Ensure that the template of your choice is adapted to your state/county/area since state laws can affect the legality of some records.

- Check the similar document templates or start the search over to find the right file.

- Click Buy now and register your account. If you already have an existing one, choose to log in.

- Pick the pricing {plan, then a needed payment gateway, and purchase Dallas Internal Revenue Service Ruling Letter.

- Select to save the form template in any offered file format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the needed Dallas Internal Revenue Service Ruling Letter, log in to your account, and download it. Of course, our website can’t replace a legal professional entirely. If you need to deal with an exceptionally challenging case, we advise getting a lawyer to review your form before executing and filing it.

With over 25 years on the market, US Legal Forms proved to be a go-to provider for various legal forms for millions of customers. Join them today and get your state-compliant paperwork effortlessly!