The Maricopa Arizona Internal Revenue Service (IRS) Ruling Letter is an official document issued by the IRS that provides guidance and clarification regarding the tax-exempt status or compliance of organizations located in Maricopa, Arizona. This ruling letter serves as an essential tool for individuals and entities seeking information about specific tax-related matters in the region. The Maricopa Arizona IRS Ruling Letter outlines the IRS's decision on various tax matters, including the eligibility for tax exemption, proper filing procedures, compliance with tax laws, and more. It aims to ensure transparency, fairness, and consistency in tax-related issues and offers valuable insights into the IRS's position on specific matters. This letter is particularly important for organizations such as nonprofits, charities, educational institutions, and religious institutions, as it helps them understand the IRS's interpretation and application of the tax laws in Maricopa, Arizona. It enables them to make informed decisions, establish their tax-exempt status, and ensure compliance with IRS regulations. Different types of Maricopa Arizona IRS Ruling Letters may include: 1. Tax Exemption Ruling Letters: These letters confirm an organization's eligibility for tax exemption status under the relevant IRS guidelines. It provides organizations with a detailed explanation of their provided information, activities, and purpose, indicating whether they meet the requirements for tax-exempt classification. 2. Compliance Ruling Letters: These letters address specific tax compliance issues, clarifying whether an organization has adhered to the necessary filing requirements, documentation, or amendments. 3. Interpretation Ruling Letters: These letters provide clarifications and interpretations of tax laws and regulations. They aim to ensure consistency and understanding among taxpayers regarding the application of tax laws in Maricopa, Arizona. 4. Private Letter Rulings (PLR): These letters address specific tax matters related to an individual or organization's unique circumstances. These rulings are issued in response to private inquiries and provide answers for more personalized tax situations. They have limited applicability to the individual/institution that requested them. It is important to note that the Maricopa Arizona IRS Ruling Letters should not be seen as universal rulings. They are specific to the circumstances and organizations mentioned in each letter and may not apply to others in the same manner. Overall, the Maricopa Arizona IRS Ruling Letter plays a crucial role in providing guidance, clarity, and direction to organizations and individuals in Maricopa, Arizona, regarding their tax-related concerns, thus ensuring compliance with IRS regulations and promoting transparency in tax matters.

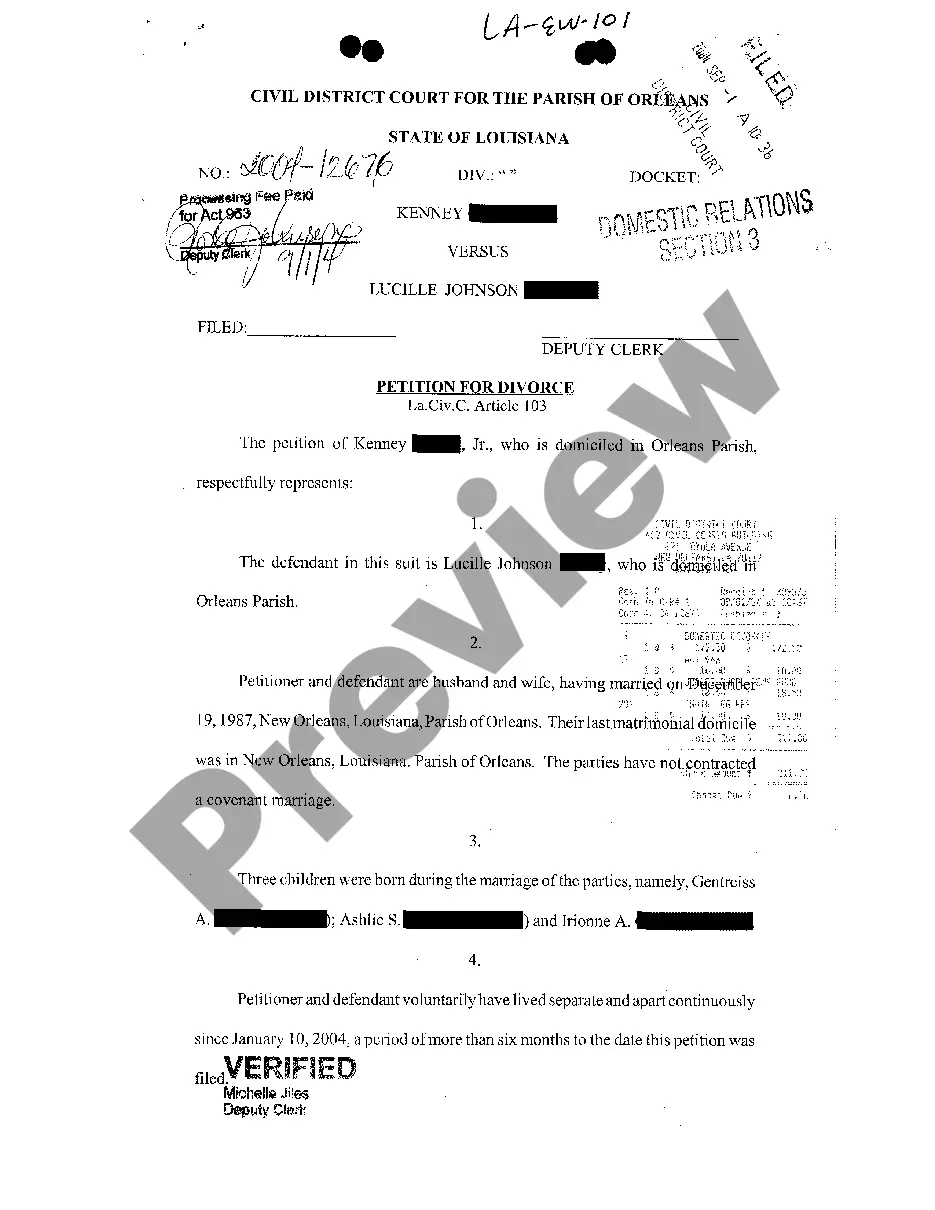

Maricopa Arizona Internal Revenue Service Ruling Letter

Description

How to fill out Maricopa Arizona Internal Revenue Service Ruling Letter?

Laws and regulations in every sphere differ from state to state. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid pricey legal assistance when preparing the Maricopa Internal Revenue Service Ruling Letter, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal forms. It's an excellent solution for professionals and individuals looking for do-it-yourself templates for different life and business occasions. All the documents can be used multiple times: once you pick a sample, it remains accessible in your profile for subsequent use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Maricopa Internal Revenue Service Ruling Letter from the My Forms tab.

For new users, it's necessary to make some more steps to get the Maricopa Internal Revenue Service Ruling Letter:

- Analyze the page content to make sure you found the appropriate sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to get the document once you find the proper one.

- Opt for one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the document on paper after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!