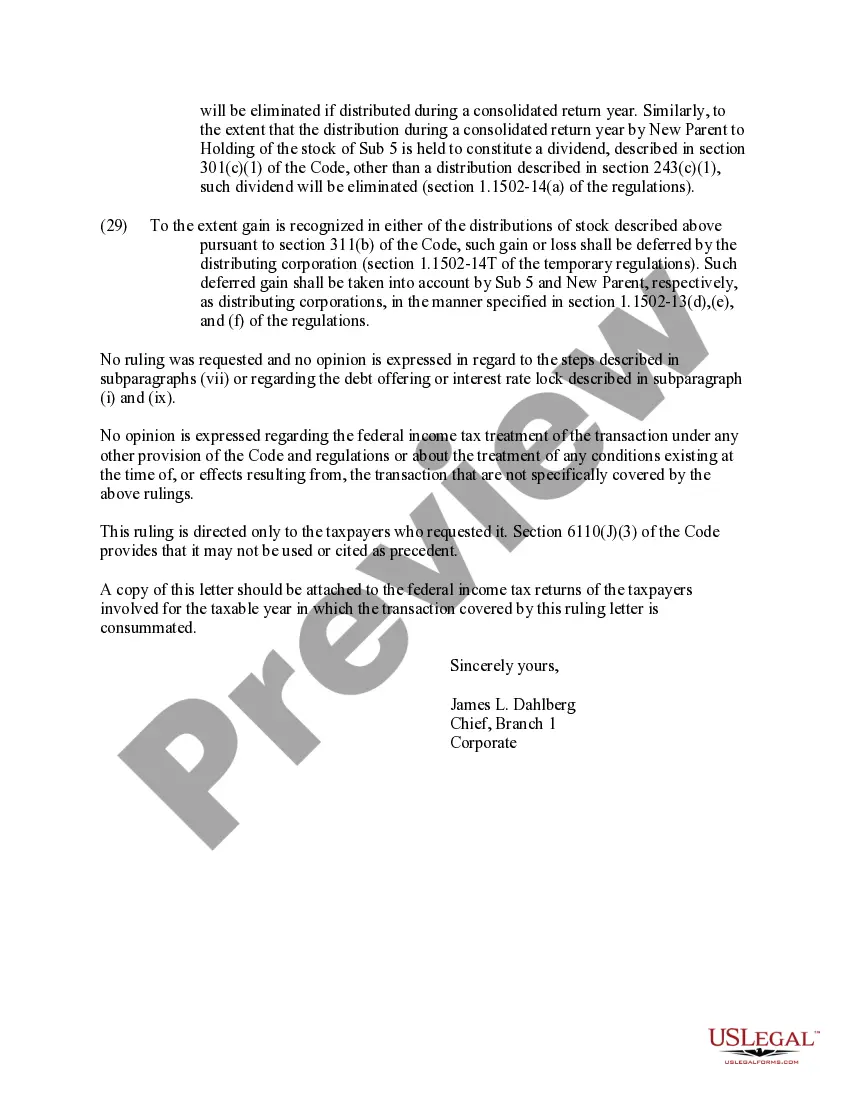

Phoenix Arizona Internal Revenue Service Ruling Letter

Description

How to fill out Internal Revenue Service Ruling Letter?

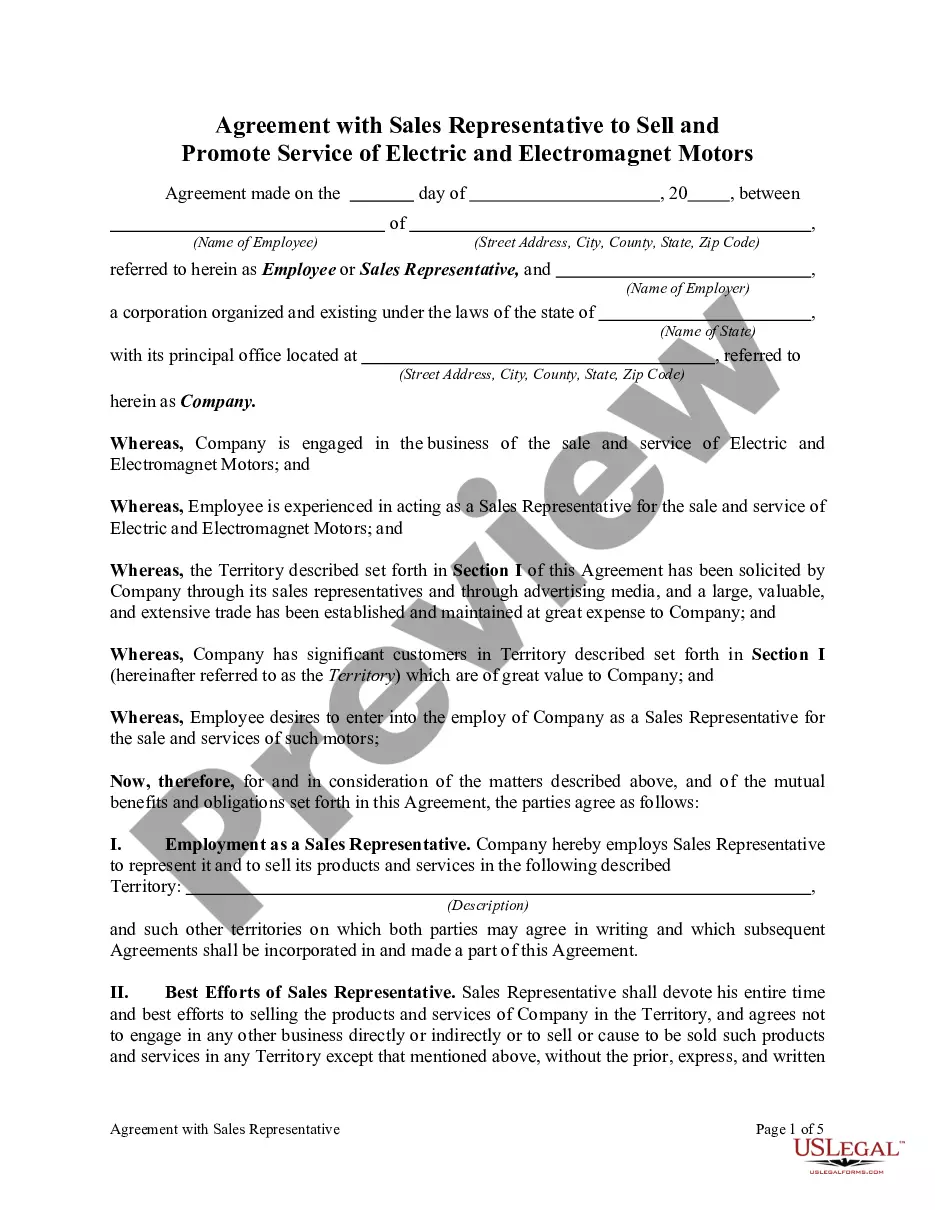

A document process consistently accompanies any legal endeavor you undertake.

Establishing a business, applying for or accepting a job proposal, transferring real estate, and numerous other life situations necessitate you prepare formal paperwork that differs from region to region.

That’s why having everything gathered in one location is highly beneficial.

US Legal Forms is the largest online repository of current federal and state-specific legal templates.

This is the easiest and most reliable method to procure legal documents. All the templates available in our library are expertly drafted and confirmed for compliance with local laws and regulations. Prepare your documentation and manage your legal matters efficiently with US Legal Forms!

- Here, you can effortlessly discover and download a document for any personal or commercial purpose utilized in your jurisdiction, including the Phoenix Internal Revenue Service Ruling Letter.

- Finding samples on the platform is exceedingly straightforward.

- If you currently hold a subscription to our library, Log In to your account, locate the sample via the search bar, and click Download to save it on your device.

- Following this, the Phoenix Internal Revenue Service Ruling Letter will be accessible for future use in the My documents section of your profile.

- If you are utilizing US Legal Forms for the first time, follow this straightforward guideline to acquire the Phoenix Internal Revenue Service Ruling Letter.

- Ensure you have accessed the appropriate page with your local form.

- Utilize the Preview mode (if available) and navigate through the sample.

- Read the description (if available) to confirm the template meets your requirements.

- Search for another document using the search function if the sample does not suit you.

- Click Buy Now once you find the necessary template.

- Choose the suitable subscription plan, then Log In or create an account.

- Select the preferred payment method (via credit card or PayPal) to continue.

- Choose file format and download the Phoenix Internal Revenue Service Ruling Letter on your device.

- Utilize it as needed: print it or complete it electronically, sign it, and file it where needed.

Form popularity

FAQ

The timeframe for a private letter ruling can vary, but generally, you can expect a response within 4 to 6 months. This duration depends on several factors, including the complexity of your request and the caseload of the relevant authorities. To expedite the process, ensure you submit all necessary documentation clearly and accurately. If you're considering a Phoenix Arizona Internal Revenue Service Ruling Letter, using platforms like uslegalforms can help guide you through the application efficiently.

Receiving a letter from the Arizona Department of Revenue often relates to tax compliance or clarifications about your tax responsibilities. This communication may request additional information or inform you about changes affecting your tax status. It is essential to review the letter carefully and address any concerns promptly to prevent future complications. In certain situations, you might benefit from a Phoenix Arizona Internal Revenue Service Ruling Letter to clarify your tax position.

To contact the Arizona Department of Revenue, you can visit their official website for the most up-to-date contact information. They provide various ways to reach out, including telephone support and online resources. If you require specific guidance regarding your Phoenix Arizona Internal Revenue Service Ruling Letter, their representatives can assist you directly. You may also find useful information on their website to help answer your questions.

The main difference lies in their purposes and public availability. A letter ruling is a response to a taxpayer's request for guidance on a specific tax situation, while a determination letter typically addresses requests for status or qualification under tax laws. Determination letters are more accessible to the public compared to private letter rulings. Knowing these distinctions can greatly benefit you when seeking a Phoenix Arizona Internal Revenue Service Ruling Letter.

The IRS is not required to make private letter rulings public due to their confidential nature. However, they may release information that summarizes certain rulings for public knowledge. If you are looking for information on a specific ruling, contacting the IRS directly or checking reliable sources can be beneficial. For tailored assistance, uslegalforms is an excellent resource when dealing with a Phoenix Arizona Internal Revenue Service Ruling Letter.

Yes, you can look up certain IRS letters online, but the availability might be limited. Public documents, like determination letters, are generally easier to find compared to private rulings. For an effective search, ensure you visit the correct IRS website or rely on trustworthy platforms like uslegalforms. They can help streamline your search for a Phoenix Arizona Internal Revenue Service Ruling Letter.

An IRS ruling letter is an official document issued by the Internal Revenue Service, providing guidance on tax-related questions. This letter addresses specific issues and clarifies how tax laws apply to particular situations. It serves as a valuable resource for individuals and businesses seeking certainty in their tax affairs. Understanding how to obtain a Phoenix Arizona Internal Revenue Service Ruling Letter can simplify your decision-making.

No, IRS private letter rulings are not public documents. They are issued in response to specific requests, so sensitive information remains confidential. However, the IRS does summarize these rulings in their publications, which can be quite helpful. For those needing detailed advice, consulting uslegalforms can provide the necessary support regarding a Phoenix Arizona Internal Revenue Service Ruling Letter.

Yes, the IRS determination letter is generally considered a public document. You can access it if you know where to look. However, it may not always be straightforward to find. Many people rely on platforms like uslegalforms to help navigate the process of obtaining a Phoenix Arizona Internal Revenue Service Ruling Letter.

To email Arizona tax help, you can visit the official Arizona Department of Revenue website where you will find contact information and relevant resources. Consider keeping your questions direct and concise to ensure a swift response. For a detailed understanding related to your Phoenix Arizona Internal Revenue Service ruling letter, it might be helpful to include specific details about your situation.