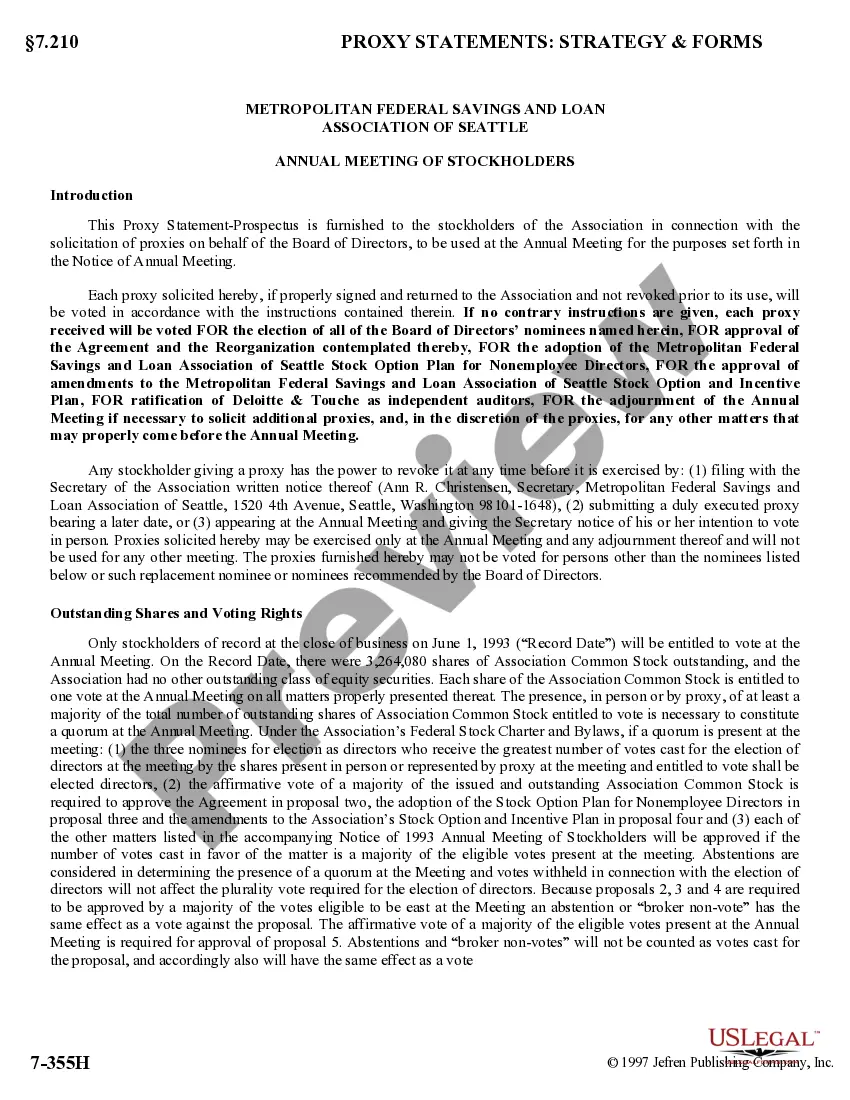

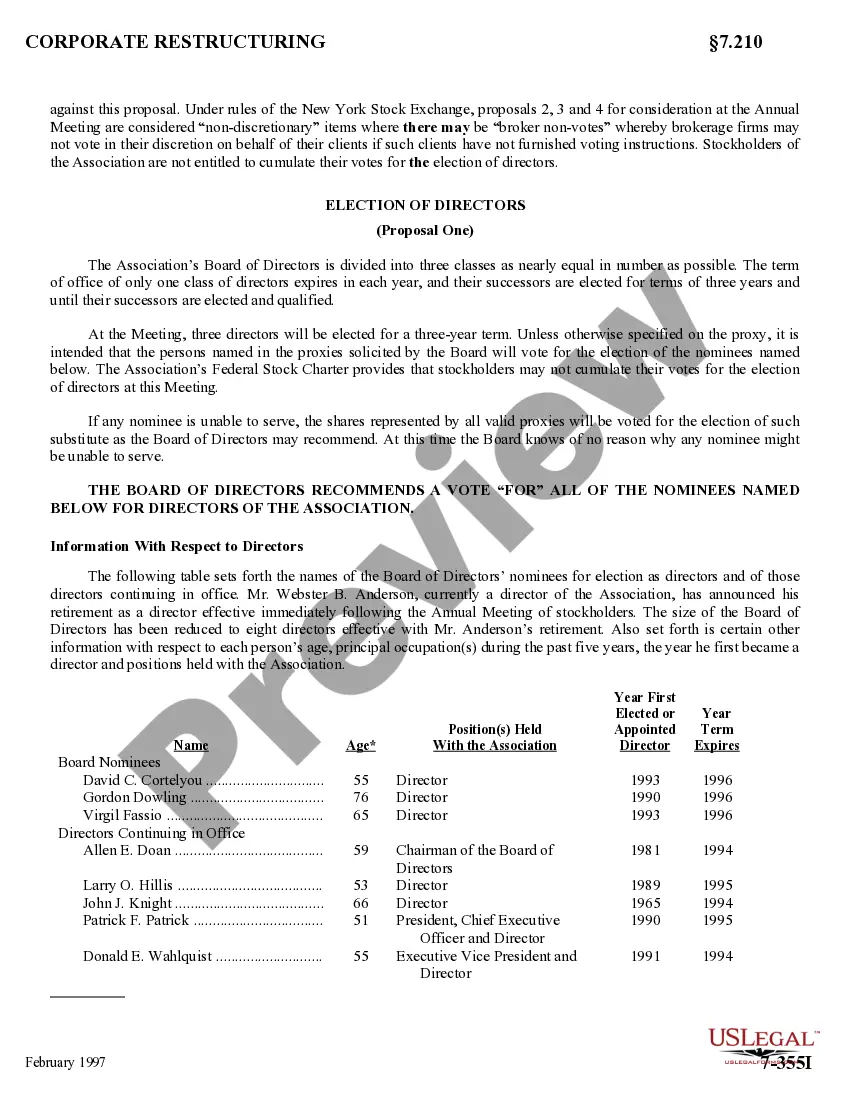

Montgomery Maryland Proxy Statement Metropolitanan corprp: A Comprehensive Guide Introduction: The Montgomery Maryland Proxy Statement Metropolitanan corprp is a crucial document provided to shareholders of Metropolitan Ban corp, a prominent financial institution based in Montgomery, Maryland. This statement aims to relay important information regarding corporate governance and decision-making processes to ensure transparency and empower shareholders to make well-informed decisions. Accompanied by significant appendices, these statements offer essential insights into the company's operations, financial performance, executive compensation, and corporate governance policies. Types of Montgomery Maryland Proxy Statements Metropolitanan corprp: 1. Annual Proxy Statements: These are released once every fiscal year and cover a comprehensive overview of the bank's financial performance, strategic initiatives, election of directors, executive compensation, and other vital matters requiring shareholder approval. 2. Special Proxy Statements: In exceptional circumstances, Metropolitan Ban corp may issue special proxy statements. These typically address matters beyond the scope of the annual statements, such as proposed mergers, acquisitions, significant corporate restructuring, or changes to the company's bylaws. Contents of Montgomery Maryland Proxy Statements: 1. Letter from the Chairman of the Board: The proxy statement usually begins with a letter from the Chairman, summarizing the bank's accomplishments, challenges, and future plans. 2. Summary of Matters to be Voted On: This section outlines the specific resolutions and proposals that will be addressed during the forthcoming shareholder meeting. It provides shareholders with a clear understanding of the decisions they need to vote on. 3. Corporate Governance Practices: Corporate governance is of utmost importance to Metropolitan Ban corp. This section discusses the bank's approach to governance, including board composition, committee structures, and other policies in place to ensure effective oversight and compliance. 4. Director Nominees and Executive Compensation: Shareholders have the opportunity to review the qualifications and biographies of the director nominees, enabling them to make informed choices when electing board members. Additionally, the section provides details on executive compensation, highlighting the bank's commitment to equitable pay practices and aligning incentives with long-term shareholder value. 5. Financial Performance and Shareholder Returns: This section outlines Metropolitan Ban corp's financial highlights, including revenue, net income, earnings per share, and returns on equity. It may also compare the bank's performance to industry benchmarks or previous years, providing shareholders with a comprehensive evaluation of the bank's financial health. 6. Risk Factors and Mitigation Strategies: This segment delves into the potential risks that the bank faces, such as economic downturns, regulatory changes, and cyber threats. It also outlines the mitigation strategies employed by Metropolitan Ban corp to address these risks and safeguard shareholder interests. 7. Appendices: The Montgomery Maryland Proxy Statement is supplemented with various appendices, which include comprehensive financial statements, auditor reports, voting procedures, and other relevant information. These appendices provide additional details and necessary context, enabling shareholders to delve deeper into the bank's financial position and decision-making processes. Conclusion: The Montgomery Maryland Proxy Statement — Metropolitan Bancorp, along with its appendices, serves as a vital communication tool between Metropolitan Ban corp and its shareholders. It ensures transparency and encourages active shareholder participation in important decision-making processes. By diligently reviewing and understanding the contents of the proxy statement, shareholders can make well-informed choices that impact the future direction of Metropolitan Ban corp.

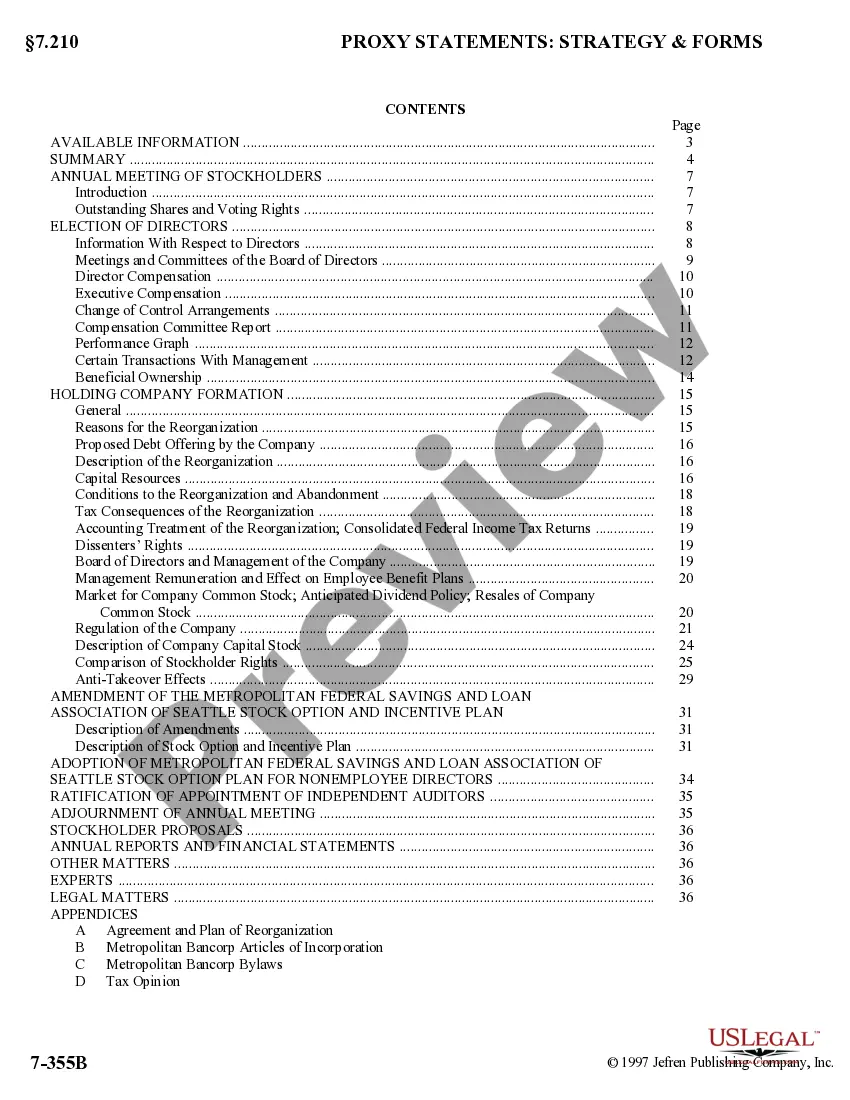

Montgomery Maryland Proxy Statement - Metropolitan Bancorp with appendices

Description

How to fill out Montgomery Maryland Proxy Statement - Metropolitan Bancorp With Appendices?

A document routine always goes along with any legal activity you make. Creating a business, applying or accepting a job offer, transferring property, and lots of other life scenarios demand you prepare official documentation that varies throughout the country. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal templates. Here, you can easily locate and get a document for any personal or business objective utilized in your county, including the Montgomery Proxy Statement - Metropolitan Bancorp with appendices.

Locating samples on the platform is extremely straightforward. If you already have a subscription to our library, log in to your account, find the sample through the search field, and click Download to save it on your device. After that, the Montgomery Proxy Statement - Metropolitan Bancorp with appendices will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this quick guideline to get the Montgomery Proxy Statement - Metropolitan Bancorp with appendices:

- Make sure you have opened the right page with your regional form.

- Use the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the form meets your needs.

- Search for another document using the search tab if the sample doesn't fit you.

- Click Buy Now when you locate the necessary template.

- Select the appropriate subscription plan, then log in or create an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and download the Montgomery Proxy Statement - Metropolitan Bancorp with appendices on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most trustworthy way to obtain legal paperwork. All the samples provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!