The Alameda California Nonqualified Stock Option Plan of MIX Carriers, Inc. is a compensation program offered by the company to its employees. This plan allows eligible employees to purchase company stock at a predetermined price, known as the exercise price. The Alameda California Nonqualified Stock Option Plan is designed to incentivize and reward employees for their contributions to the company's growth and success. It serves as a tool to attract and retain talented individuals who are vital to the company's overall success. Under this plan, employees are granted stock options, which give them the right to purchase a certain number of company shares at a specified price within a set period of time. One of the key advantages of this type of plan is that it provides employees with a potential financial benefit when the company's stock value increases over time. Different types of Alameda California Nonqualified Stock Option Plans within MIX Carriers, Inc. may include: 1. Standard Stock Options: This type of stock option plan grants employees the right to purchase company stock at a predetermined exercise price. These options usually have a vesting period, during which employees have to wait before they can exercise their options. 2. Incentive Stock Options (ISO): Although these options are similar to nonqualified stock options, SOS have special tax advantages. Employees who meet specific criteria can benefit from favorable tax treatment upon exercising their options. 3. Performance Stock Options: This type of stock option plan is based on the achievement of specific performance goals by the employee or the company as a whole. These options are typically granted to key executives or top-performing individuals as a way to align their interests with the company's overall performance. The Alameda California Nonqualified Stock Option Plan of MIX Carriers, Inc. provides employees with an opportunity to share in the company's success and potentially reap financial rewards. It serves as a valuable incentive for employees to perform at high levels and contribute to the long-term growth and profitability of the company.

Alameda California Nonqualified Stock Option Plan of MNX Carriers, Inc.

Description

How to fill out Alameda California Nonqualified Stock Option Plan Of MNX Carriers, Inc.?

How much time does it usually take you to draft a legal document? Since every state has its laws and regulations for every life sphere, finding a Alameda Nonqualified Stock Option Plan of MNX Carriers, Inc. meeting all regional requirements can be exhausting, and ordering it from a professional attorney is often costly. Many web services offer the most common state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive web collection of templates, collected by states and areas of use. In addition to the Alameda Nonqualified Stock Option Plan of MNX Carriers, Inc., here you can get any specific document to run your business or personal affairs, complying with your regional requirements. Professionals check all samples for their validity, so you can be sure to prepare your paperwork correctly.

Using the service is fairly easy. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the required sample, and download it. You can get the file in your profile anytime in the future. Otherwise, if you are new to the website, there will be a few more steps to complete before you obtain your Alameda Nonqualified Stock Option Plan of MNX Carriers, Inc.:

- Examine the content of the page you’re on.

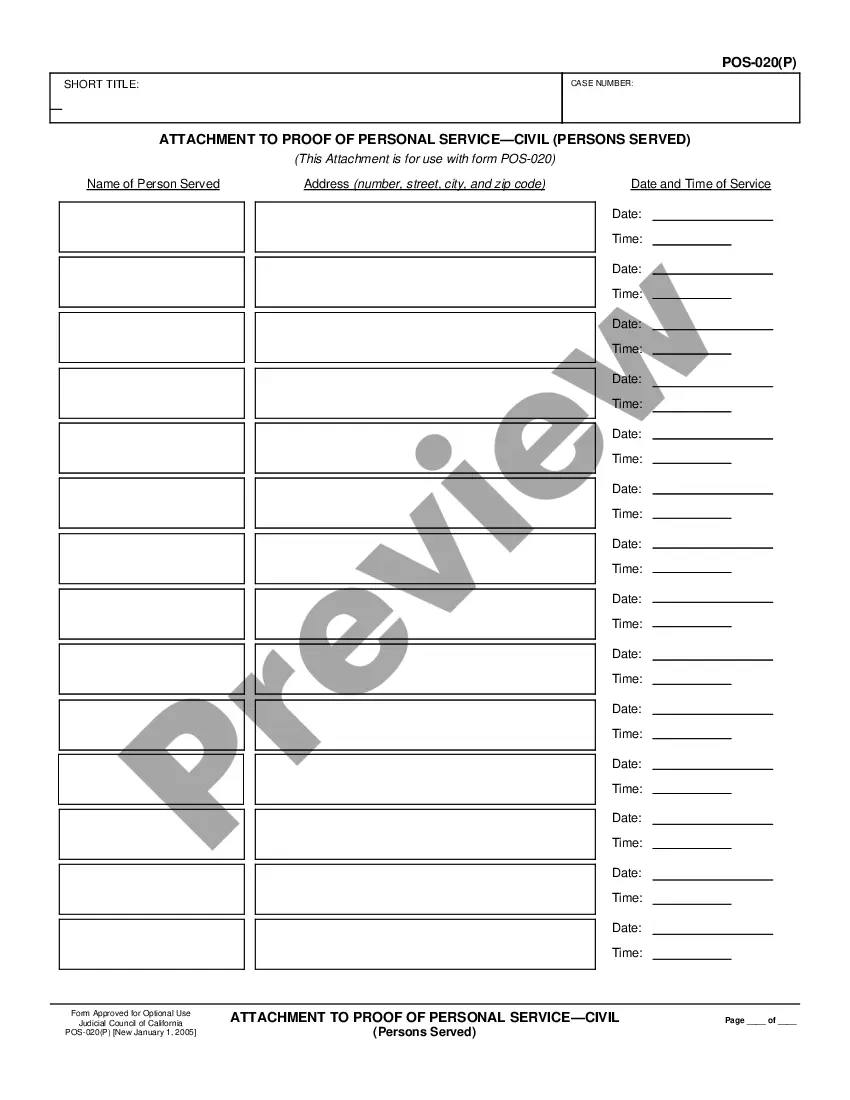

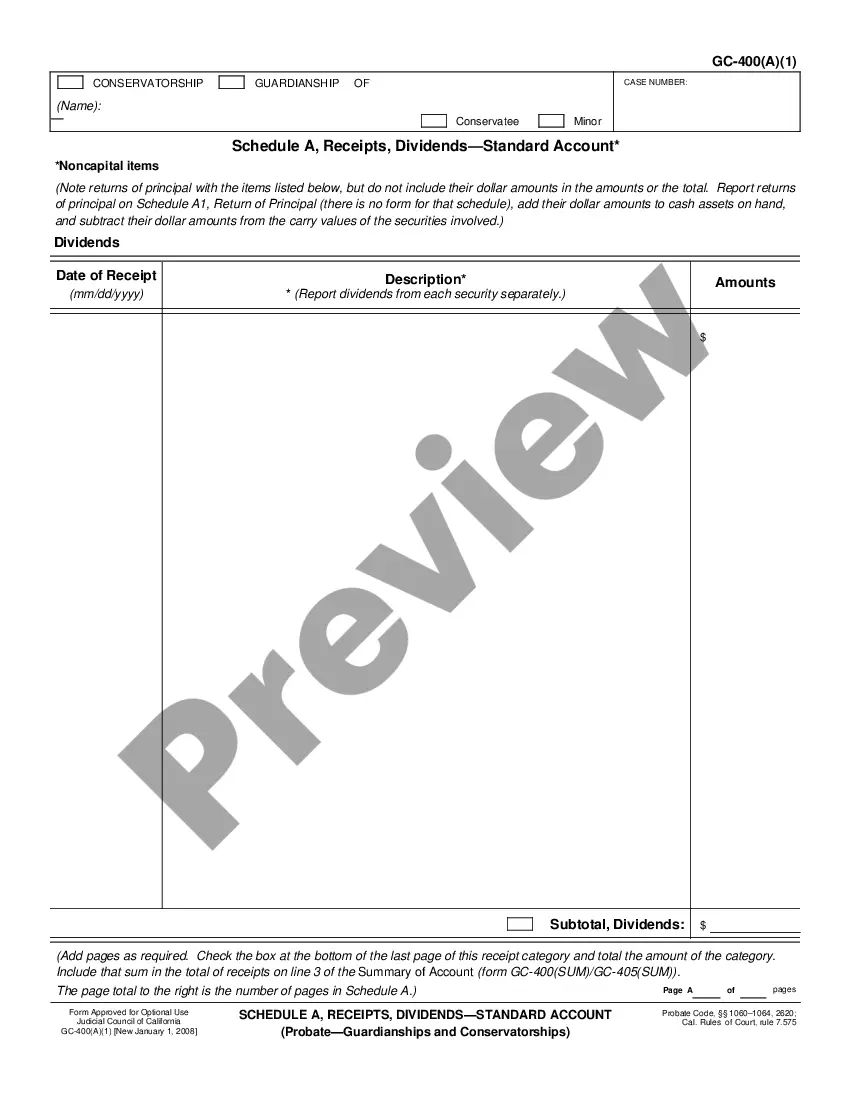

- Read the description of the sample or Preview it (if available).

- Look for another document utilizing the corresponding option in the header.

- Click Buy Now once you’re certain in the selected file.

- Select the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Alameda Nonqualified Stock Option Plan of MNX Carriers, Inc..

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired document, you can find all the files you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!

Form popularity

FAQ

There are two key differences who the stock can be issued to and the tax treatment. Qualified stock options, also known as incentive stock options, can only be granted to employees. Non-qualified stock options can be granted to employees, directors, contractors and others.

Once you exercise your non-qualified stock option, the difference between the stock price and the strike price is taxed as ordinary income. This income is usually reported on your paystub. There are no tax consequences when you first receive your non-qualified stock option, only when you exercise your option.

Non-qualified stock options are stock options that do not receive favorable tax treatment when exercised but do provide additional flexibility for the issuing company. Gains from non-qualified stock options are taxed as normal income.

A nonqualified stock option, also known as an NSO, is a form of employee compensation offered by employers wherein the option holder pays ordinary income tax on the profit made when they exercise the shares.

The most common expiration of NSOs is 10 years, but this does vary from company to company. Since time is often your friend when it comes to stock options, you can simply sit out the first couple of years to allow for growth and start to exercise your NSOs in a systematic way when you are nearing expiration.

Key Takeaways. Non-qualified stock options require payment of income tax of the grant price minus the price of the exercised option. NSOs might be provided as an alternative form of compensation. Prices are often similar to the market value of the shares.

Non-qualified stock options (NSOs) are a type of stock option that does not qualify for favorable tax treatment for the employee. Unlike with incentive stock options (ISOs), where you don't pay taxes upon exercise, with NSOs you pay taxes both when you exercise the option (purchase shares) and sell those shares.

The most common expiration of NSOs is 10 years, but this does vary from company to company. Since time is often your friend when it comes to stock options, you can simply sit out the first couple of years to allow for growth and start to exercise your NSOs in a systematic way when you are nearing expiration.

Profits made from exercising qualified stock options (QSO) are taxed at the capital gains tax rate (typically 15%), which is lower than the rate at which ordinary income is taxed. Gains from non-qualified stock options (NQSO) are considered ordinary income and are therefore not eligible for the tax break.

Employers must report the income from a 2021 exercise of Non-qualified Stock Options in Box 12 of the 2021 Form W-2 using the code V. The compensation element is already included in Boxes 1, 3 (if applicable) and 5, but is also reported separately in Box 12 to clearly indicate the amount of compensation arising from