The Harris Texas Nonqualified Stock Option Plan of MIX Carriers, Inc. is a comprehensive employee compensation program designed to incentivize and reward employees of MIX Carriers, Inc. The plan grants stock options to eligible employees, allowing them to purchase company stock at a predetermined price, called the exercise price, during a specified time period. Under this plan, MIX Carriers, Inc. offers a variety of nonqualified stock options to its employees, tailored to meet individual needs and objectives. Some different types of nonqualified stock options available include: 1. Standard Nonqualified Stock Options: These are the most common type of stock options offered under the plan. Employees are granted the right to purchase a set number of shares at a predetermined exercise price. The exercise price is typically set at or above the fair market value of the company's stock on the grant date. 2. Incentive Stock Options (SOS): Although less common, MIX Carriers, Inc. may also offer SOS as part of the plan. SOS provide certain tax advantages to employees and are subject to specific rules outlined in the Internal Revenue Code. This type of stock option is typically granted to key employees and has stricter eligibility criteria. 3. Performance-Based Stock Options: MIX Carriers, Inc. may introduce performance-based stock options as part of the plan to motivate employees to achieve specific goals or targets. These options are granted based on the company's performance metrics, such as revenue growth, profitability, or market share, and can be an effective way to align employees' interests with the overall success of the company. 4. Restricted Stock Units (RSS): While not technically considered nonqualified stock options, RSS are often included in comprehensive stock incentive plans. RSS grant eligible employees a certain number of shares to be delivered in the future, typically upon meeting specific conditions or vesting periods. MIX Carriers, Inc. may incorporate RSS as an alternative form of equity compensation for certain employees. It is important to note that the Harris Texas Nonqualified Stock Option Plan of MIX Carriers, Inc. is subject to specific terms and conditions, and employees should refer to the plan documents and consult with company administrators for detailed information regarding eligibility, vesting schedules, exercise periods, and other key aspects of the plan.

Harris Texas Nonqualified Stock Option Plan of MNX Carriers, Inc.

Description

How to fill out Harris Texas Nonqualified Stock Option Plan Of MNX Carriers, Inc.?

Preparing papers for the business or individual needs is always a big responsibility. When creating a contract, a public service request, or a power of attorney, it's important to consider all federal and state regulations of the particular region. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it tense and time-consuming to generate Harris Nonqualified Stock Option Plan of MNX Carriers, Inc. without professional help.

It's easy to avoid wasting money on lawyers drafting your paperwork and create a legally valid Harris Nonqualified Stock Option Plan of MNX Carriers, Inc. by yourself, using the US Legal Forms online library. It is the greatest online catalog of state-specific legal templates that are professionally cheched, so you can be sure of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to download the needed form.

In case you still don't have a subscription, adhere to the step-by-step instruction below to obtain the Harris Nonqualified Stock Option Plan of MNX Carriers, Inc.:

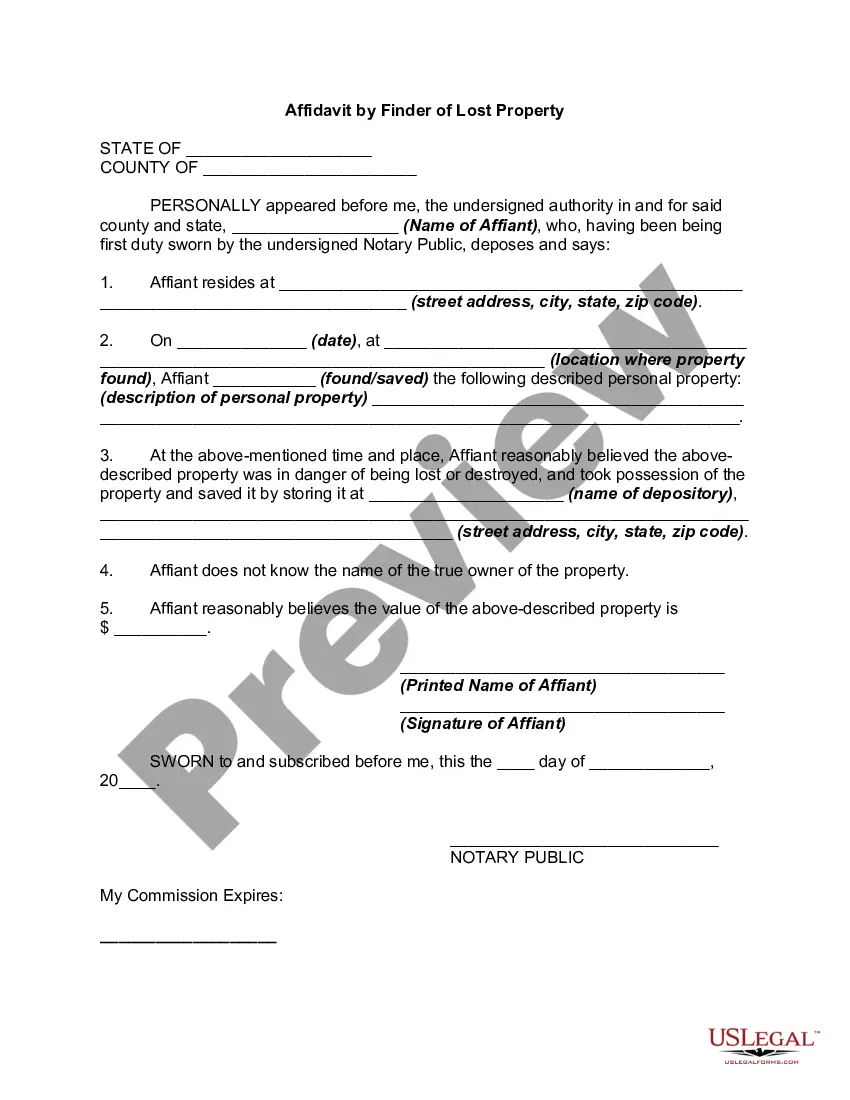

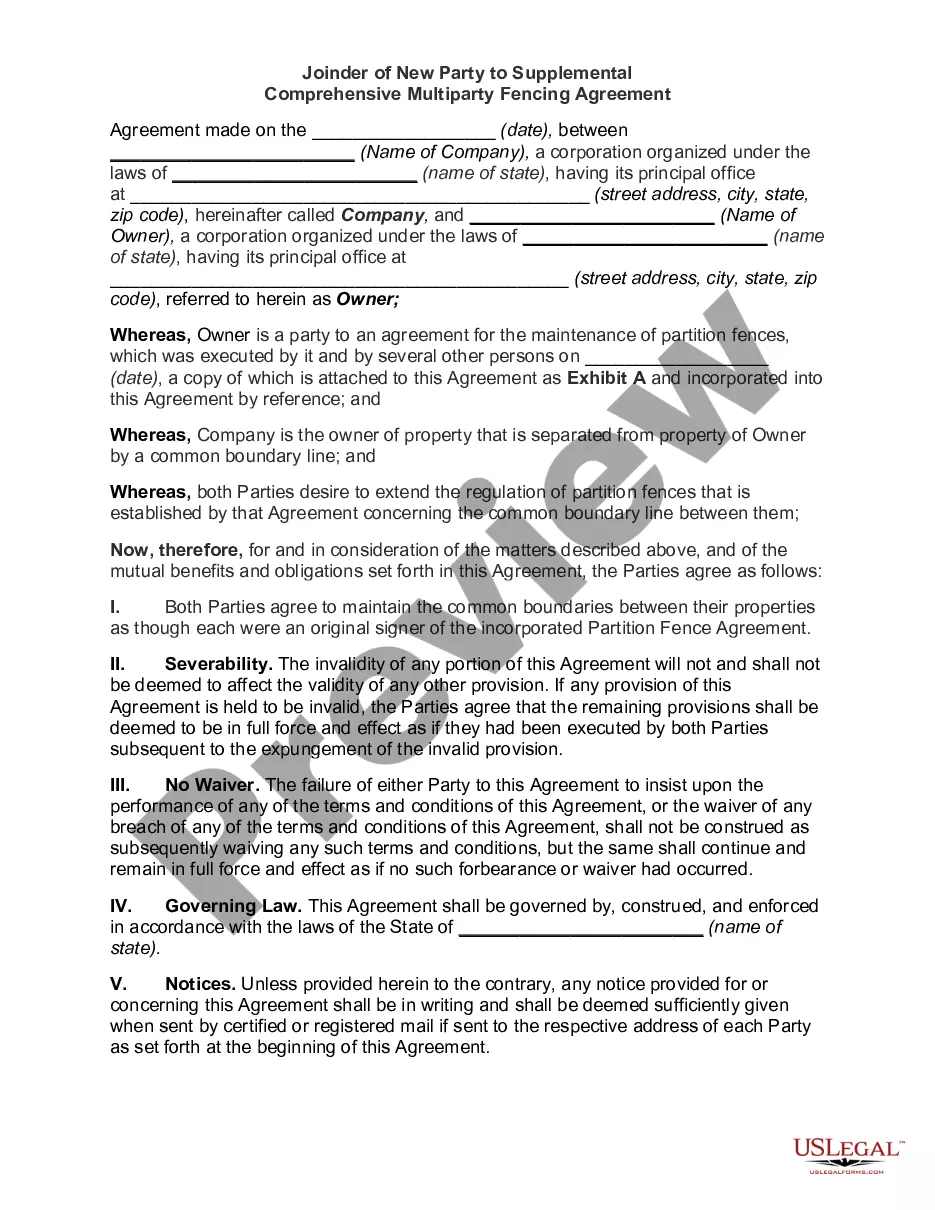

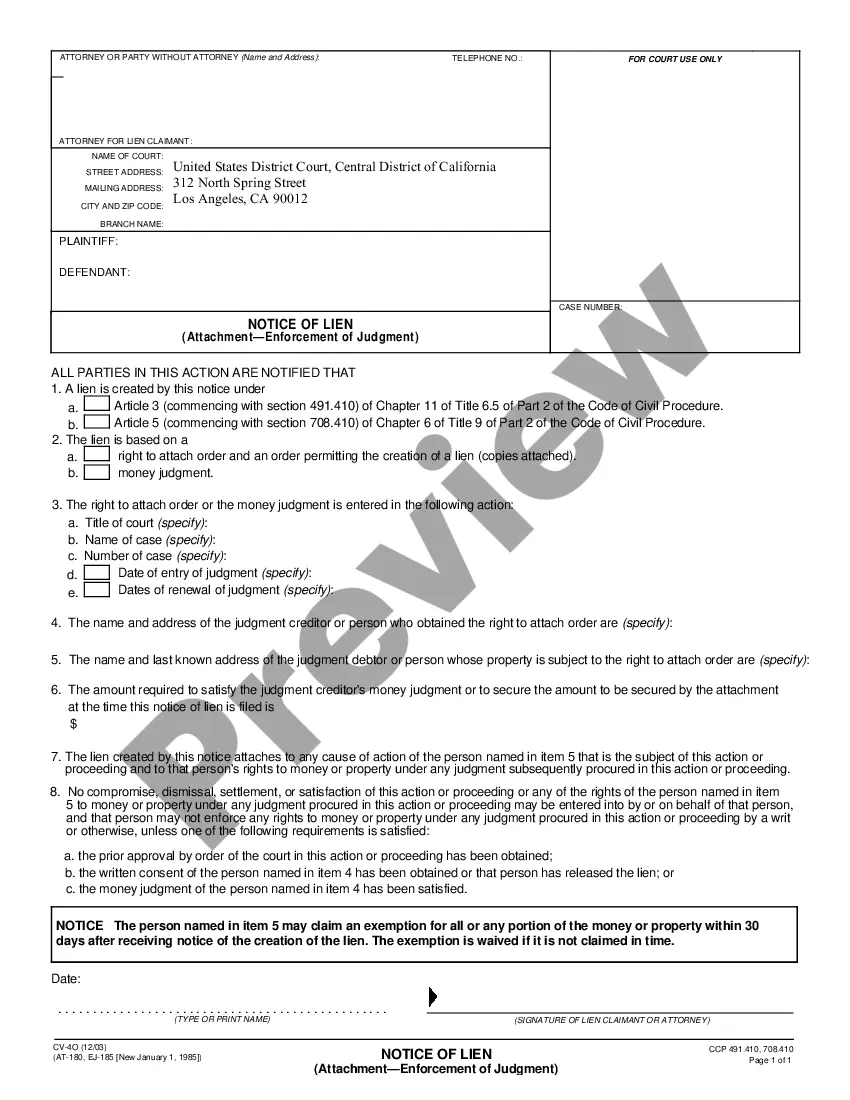

- Look through the page you've opened and check if it has the sample you need.

- To do so, use the form description and preview if these options are presented.

- To find the one that meets your requirements, utilize the search tab in the page header.

- Recheck that the sample complies with juridical criteria and click Buy Now.

- Pick the subscription plan, then log in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly obtain verified legal templates for any situation with just a few clicks!

Form popularity

FAQ

Tax Treatment of Non-Qualified Stock Options Stock acquired from exercising a non-qualified stock option is treated as any other investment property when sold. The employee's basis is the amount paid for the stock, plus any amount included in income upon exercising the option.

Non-qualified stock options (NSOs) are a type of stock option that does not qualify for favorable tax treatment for the employee. Unlike with incentive stock options (ISOs), where you don't pay taxes upon exercise, with NSOs you pay taxes both when you exercise the option (purchase shares) and sell those shares.

Tax Treatment of Non-Qualified Stock Options Stock acquired from exercising a non-qualified stock option is treated as any other investment property when sold. The employee's basis is the amount paid for the stock, plus any amount included in income upon exercising the option.

Non-qualified stock options may be sold at any market price, either higher or lower than the grant price. While non-qualified stock options carry less favorable tax treatment for the holder than qualified stock options, they offer other benefits.

There are two key differences who the stock can be issued to and the tax treatment. Qualified stock options, also known as incentive stock options, can only be granted to employees. Non-qualified stock options can be granted to employees, directors, contractors and others.

Profits made from exercising qualified stock options (QSO) are taxed at the capital gains tax rate (typically 15%), which is lower than the rate at which ordinary income is taxed. Gains from non-qualified stock options (NQSO) are considered ordinary income and are therefore not eligible for the tax break.

Non-qualified stock options (NSOs) are a type of stock option that does not qualify for favorable tax treatment for the employee. Unlike with incentive stock options (ISOs), where you don't pay taxes upon exercise, with NSOs you pay taxes both when you exercise the option (purchase shares) and sell those shares.

Non-qualified stock options (NSOs) are a type of stock option that does not qualify for favorable tax treatment for the employee. Unlike with incentive stock options (ISOs), where you don't pay taxes upon exercise, with NSOs you pay taxes both when you exercise the option (purchase shares) and sell those shares.

With NSOs, you pay ordinary income taxes when you exercise the options, and capital gains taxes when you sell the shares. With ISOs, you only pay taxes when you sell the shares, either ordinary income or capital gains, depending on how long you held the shares first.

The most common expiration of NSOs is 10 years, but this does vary from company to company. Since time is often your friend when it comes to stock options, you can simply sit out the first couple of years to allow for growth and start to exercise your NSOs in a systematic way when you are nearing expiration.