Orange, California Nonqualified Stock Option Plan of MIX Carriers, Inc. is an employee benefit program offered by the company to provide its employees with the opportunity to purchase company stock at a predetermined price. This plan is designed to incentivize and reward employees for their loyalty and contribution to the company's success. The Orange California Nonqualified Stock Option Plan is a type of equity compensation plan, specifically a Nonqualified Stock Option (NO) plan. SOS are different from Incentive Stock Options (SOS) as they do not qualify for the preferential tax treatment. However, SOS still offer certain tax advantages and flexibility for employees. Under the Orange California Nonqualified Stock Option Plan, eligible employees are granted the right to purchase a specified number of shares of the company's stock within a defined time period. The exercise price, or the price at which the employee can buy the stock, is predetermined and usually set at the fair market value of the stock at the time of grant. Employees can choose to exercise their stock options at any time during the vesting period, which is a period of time that must pass before the options can be exercised. Once vested, employees have the flexibility to decide when to exercise their options based on their financial goals and market conditions. When an employee exercises their stock options, they can choose to either hold onto the shares or sell them on the open market. If the employee decides to sell the shares, they may be subject to capital gains tax on any profits made. However, if the employee holds onto the shares for a certain period of time, they may be eligible for favorable tax treatment. The Orange California Nonqualified Stock Option Plan of MIX Carriers, Inc. aims to align the interests of employees with the company's shareholders by providing an opportunity for employees to become partial owners of the company. This can motivate employees to work harder and contribute to the company's success, as they have a personal stake in the company's performance. In conclusion, the Orange California Nonqualified Stock Option Plan of MIX Carriers, Inc. is an employee benefit program that offers nonqualified stock options to eligible employees. This plan aims to incentivize and reward employees for their contributions to the company's success and provides them with an opportunity to become partial owners of the company.

Orange California Nonqualified Stock Option Plan of MNX Carriers, Inc.

Description

How to fill out Orange California Nonqualified Stock Option Plan Of MNX Carriers, Inc.?

A document routine always goes along with any legal activity you make. Staring a business, applying or accepting a job offer, transferring ownership, and many other life situations demand you prepare official paperwork that differs from state to state. That's why having it all accumulated in one place is so valuable.

US Legal Forms is the biggest online library of up-to-date federal and state-specific legal templates. Here, you can easily locate and download a document for any personal or business purpose utilized in your region, including the Orange Nonqualified Stock Option Plan of MNX Carriers, Inc..

Locating samples on the platform is extremely simple. If you already have a subscription to our library, log in to your account, find the sample through the search field, and click Download to save it on your device. Following that, the Orange Nonqualified Stock Option Plan of MNX Carriers, Inc. will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this quick guideline to get the Orange Nonqualified Stock Option Plan of MNX Carriers, Inc.:

- Make sure you have opened the correct page with your localised form.

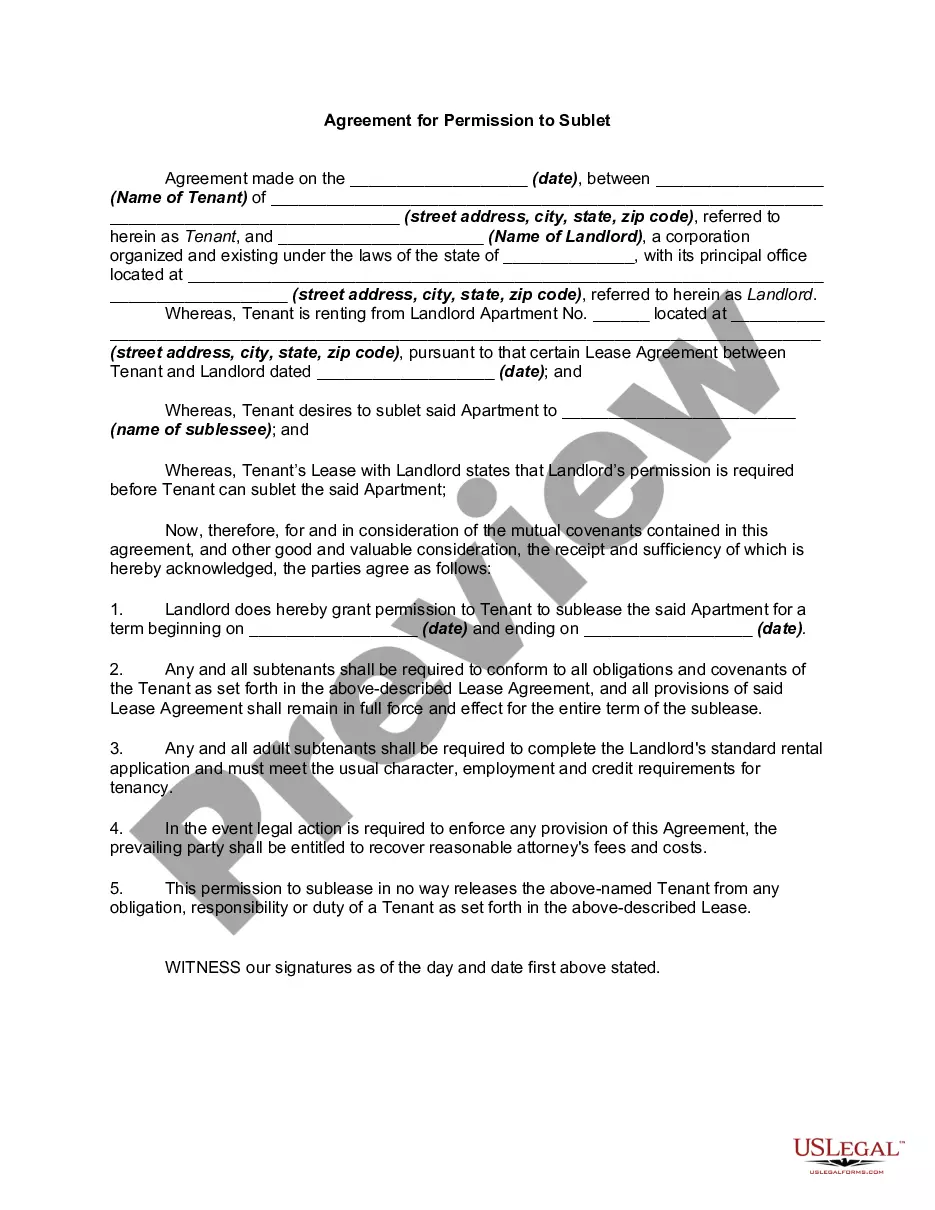

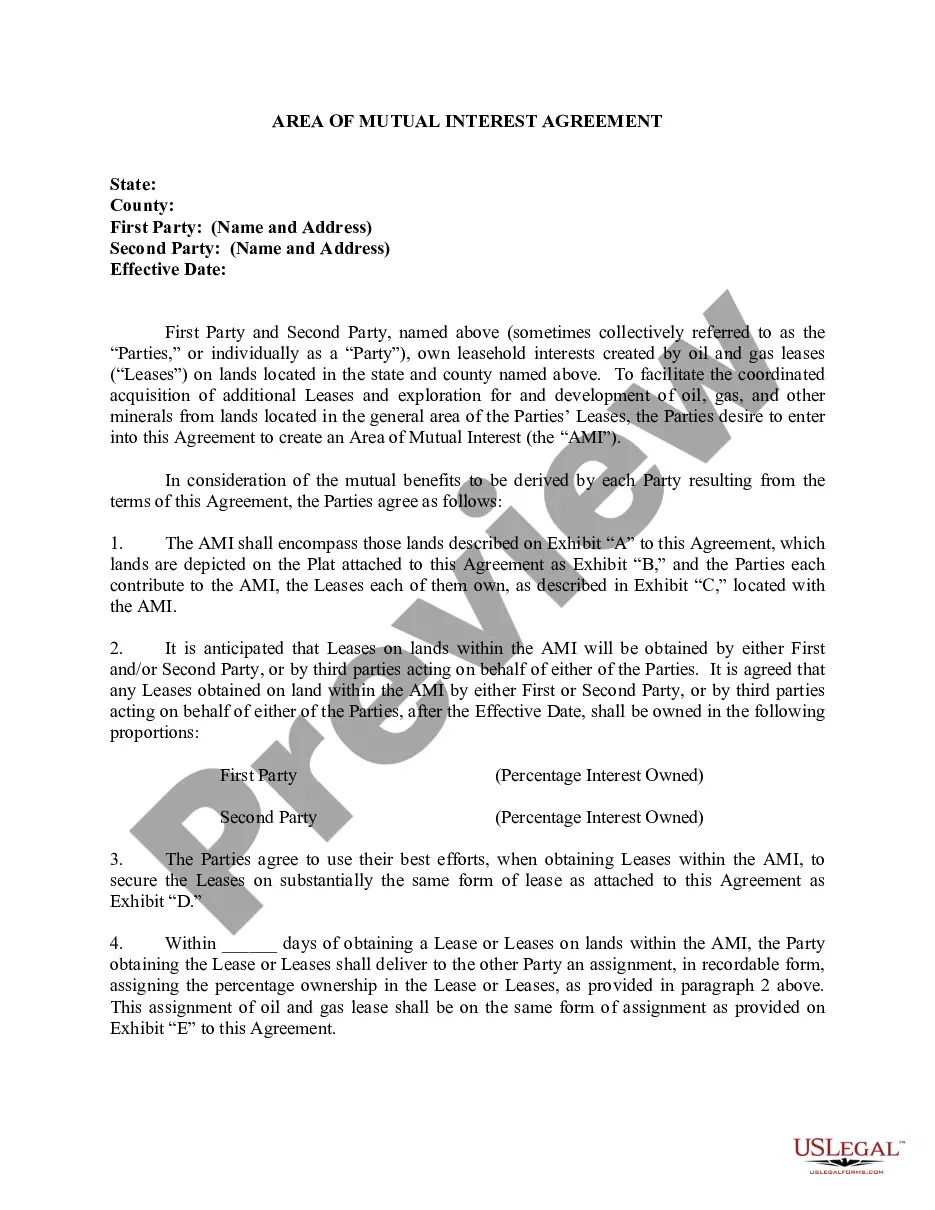

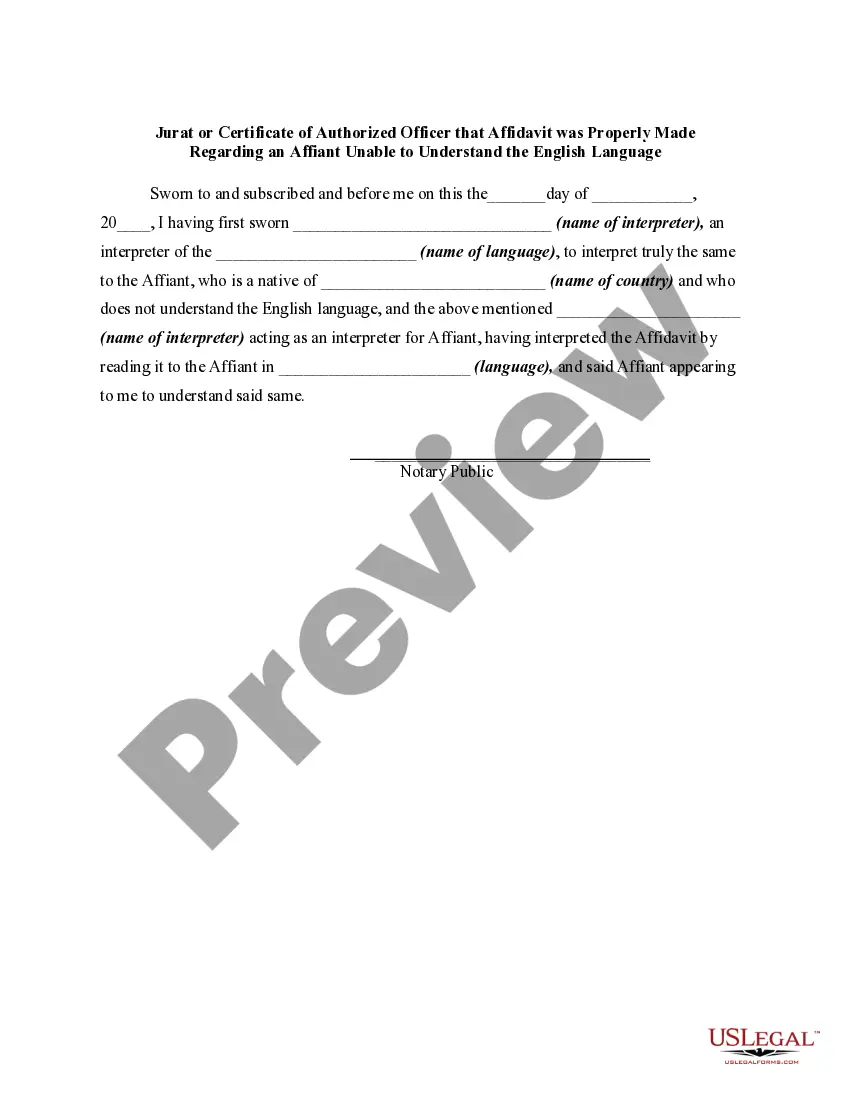

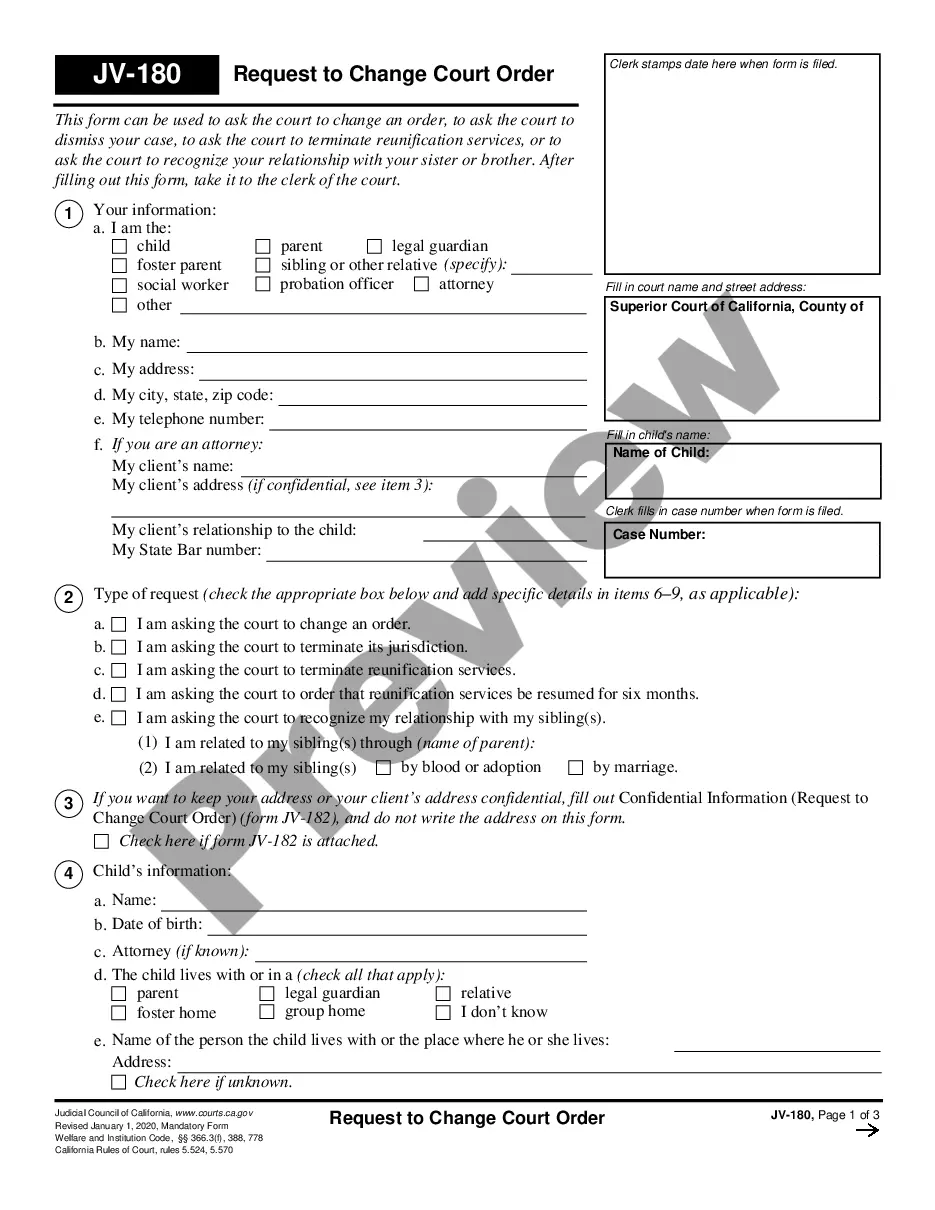

- Use the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the form satisfies your requirements.

- Look for another document via the search option if the sample doesn't fit you.

- Click Buy Now when you find the necessary template.

- Select the suitable subscription plan, then sign in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and save the Orange Nonqualified Stock Option Plan of MNX Carriers, Inc. on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most reliable way to obtain legal paperwork. All the samples available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs efficiently with the US Legal Forms!

Form popularity

FAQ

On the Portfolio page from the top header, click on the issuing company's name or image to see the holdings and other details related to the company. In the Holdings tab, you will see an Exercise button if you have options available to exercise. Click Exercise to begin an exercise request.

Stock options are a form of compensation. Companies can grant them to employees, contractors, consultants and investors.

NQSOs can be transferred during your lifetime to family members, trusts for your benefit, or charities, provided the employer's plan allows for such transfers. A gift of NQSOs is complete only when the employee stock option is vested.

Non-qualified stock options (typically abbreviated NSO or NQSO) are stock options which do not qualify for the special treatment accorded to incentive stock options.

Nonqualified employee stock options commonly have the following characteristics: They are granted at the money (i.e., the strike price equals fair market value at grant); they have a limited life (often ten years); they require the employee to perform services over a period of years (typically three to five years)

Under some circumstances, you may be able to sell shares of private company stock. You will owe income tax once you exercise your non-qualified stock option. For this reason, many option holders sell at least enough shares when they exercise their options to pay the tax owed.

Navigate to Securities > Equity Awards. Click Draft options....Draft and Issue Option Grants The magnifying glass on the left side allows the Admin to search the drafts. Click Import on the left side to import draft information from an external spreadsheet to review on Carta before issuing.

1: Setup Develop your philosophy. Your stock option plan is an expression of your company philosophy.Paper it. Adopt your stock plan and option agreements and get board and stockholder approval.Make it official. Work with your lawyers to obtain all relevant state permits for your option plan.

Non-qualified stock options can go to employees as well as independent contractors, partners, vendors and other people not on the company payroll. NSOs don't qualify for favorable tax treatment for the recipient but allow the company to take a tax deduction when the options are exercised.

Companies generally receive no deduction for qualified stock options, so the tax advantage accrues to the employee, not the employer.