The Phoenix Arizona Nonqualified Stock Option Plan of MIX Carriers, Inc. is a comprehensive employee benefit program that provides employees with a unique opportunity to secure ownership in the company and share in its success. This plan allows eligible employees to purchase company stocks at a predetermined price, generally lower than their market value. By participating in this program, employees can potentially profit from the capital appreciation of the stock. The Phoenix Arizona Nonqualified Stock Option Plan includes several types of stock options, each offering distinct benefits and flexibility for employees: 1. Standard Stock Option: This is a conventional stock option where eligible employees can purchase company stocks at a specific price, known as the exercise price. The exercise price is determined at the beginning of the stock option plan and remains fixed throughout the plan period. Employees can exercise their options at any point during the designated vesting period. 2. Incentive Stock Option (ISO): This type of stock option is intended to incentivize and reward high-performing employees. SOS offer potential tax advantages as the employee can qualify for long-term capital gains tax rates upon exercising the options and holding the stocks for a specific period of time. 3. Nonqualified Stock Option (NO): SOS, sometimes referred to as nonstatutory stock options, are more flexible than SOS. These options are available to a wider range of employees including executives, contractors, and part-time employees. The exercise price for SOS is subject to negotiable terms and does not qualify for the favorable tax treatment like SOS. The Phoenix Arizona Nonqualified Stock Option Plan also provides eligible employees with certain vesting schedules. Vesting determines when employees have the right to purchase the company stocks. Typically, vesting occurs over time, often in increments, to ensure employee commitment to the long-term success of MIX Carriers, Inc. Vesting schedules may vary depending on the specific terms outlined in the stock option agreement. Participating in the Phoenix Arizona Nonqualified Stock Option Plan offers several advantages for employees. It enables them to actively engage in the growth of the company and align their financial interests with the company's performance. Additionally, stock options can serve as a valuable form of compensation to attract and retain talented individuals, motivating them to contribute to MIX Carriers, Inc.'s overall success. In conclusion, the Phoenix Arizona Nonqualified Stock Option Plan of MIX Carriers, Inc. is a comprehensive employee benefit program that allows eligible employees to purchase company stocks at a predetermined price, providing them with an opportunity for financial growth and increased engagement in the company's performance. The plan offers various types of options, including Standard Stock Options, Incentive Stock Options, and Nonqualified Stock Options, each with its own features and benefits. By participating in this plan, employees can actively contribute to MIX Carriers, Inc.'s success while potentially benefiting from the appreciation of their stock holdings.

Phoenix Arizona Nonqualified Stock Option Plan of MNX Carriers, Inc.

Description

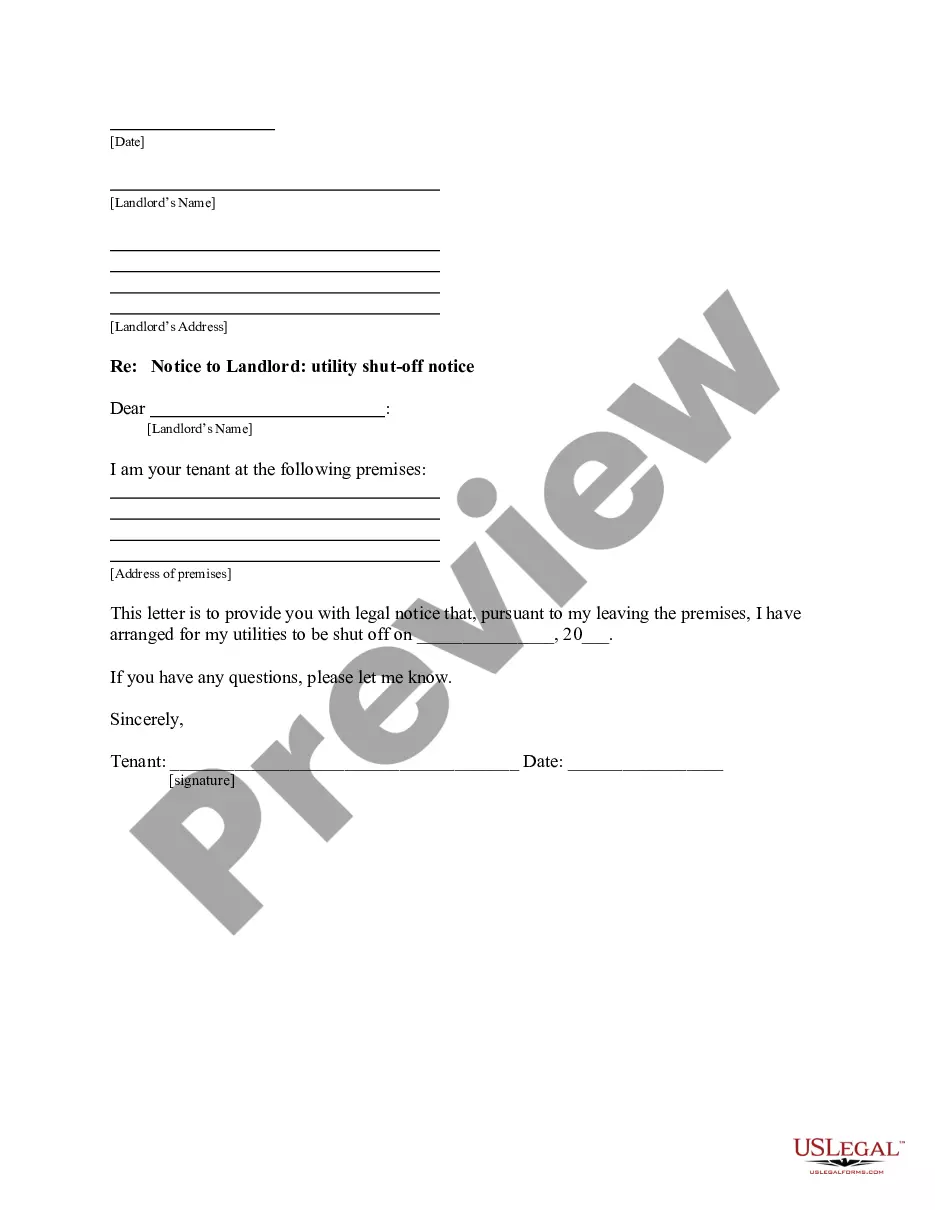

How to fill out Phoenix Arizona Nonqualified Stock Option Plan Of MNX Carriers, Inc.?

Dealing with legal forms is a necessity in today's world. Nevertheless, you don't always need to seek professional help to draft some of them from scratch, including Phoenix Nonqualified Stock Option Plan of MNX Carriers, Inc., with a platform like US Legal Forms.

US Legal Forms has over 85,000 forms to pick from in different categories varying from living wills to real estate papers to divorce papers. All forms are organized based on their valid state, making the searching experience less overwhelming. You can also find information resources and tutorials on the website to make any tasks associated with document execution simple.

Here's how you can purchase and download Phoenix Nonqualified Stock Option Plan of MNX Carriers, Inc..

- Take a look at the document's preview and outline (if provided) to get a basic idea of what you’ll get after getting the form.

- Ensure that the template of your choosing is specific to your state/county/area since state regulations can affect the legality of some documents.

- Examine the similar forms or start the search over to find the appropriate file.

- Click Buy now and create your account. If you already have an existing one, select to log in.

- Choose the pricing {plan, then a needed payment method, and purchase Phoenix Nonqualified Stock Option Plan of MNX Carriers, Inc..

- Choose to save the form template in any available file format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the appropriate Phoenix Nonqualified Stock Option Plan of MNX Carriers, Inc., log in to your account, and download it. Needless to say, our website can’t replace a lawyer completely. If you need to cope with an exceptionally complicated situation, we advise getting an attorney to check your document before signing and filing it.

With more than 25 years on the market, US Legal Forms proved to be a go-to platform for various legal forms for millions of customers. Become one of them today and purchase your state-compliant paperwork with ease!