Cook Illinois is a well-established transportation company that operates in the state of Illinois. The Cook Illinois Information Statement — Common Stock provides detailed information to shareholders and potential investors regarding the company's common stock offerings. This statement aims to provide transparency and ensure that individuals are informed about the company's current financial status and future prospects. The Cook Illinois Information Statement — Common Stock contains relevant, valuable, and up-to-date information, including the company's historical financial performance, operational highlights, risk factors, management team, and future plans. It serves as a comprehensive guide for investors to make informed decisions about purchasing or holding Cook Illinois common stock. The information statement includes a detailed overview of the company's financial statements, such as balance sheets, income statements, and cash flow statements. These statements provide insight into the company's profitability, liquidity, and overall financial health. Shareholders and potential investors can scrutinize these financial statements to evaluate the company's performance over a specific period. Additionally, the Cook Illinois Information Statement — Common Stock outlines the company's business strategies, goals, and development plans. It highlights any significant events, partnerships, or acquisitions that may impact the company's operations or stock value. This information helps investors understand the potential growth prospects and risks associated with Cook Illinois common stock. Moreover, the statement discusses the company's corporate governance, management structure, and executive compensation. It provides detailed profiles of key executives, including their qualifications and experience in the transportation industry. This section ensures investors are aware of the team responsible for guiding Cook Illinois towards its goals. It is worth noting that there may be different types of Cook Illinois Information Statements — Common Stock, depending on the purpose and timing of their release. Some variations may include: 1. Annual Information Statement — Common Stock: Released on an annual basis, this document provides a comprehensive overview of the company's performance throughout the previous fiscal year. It includes audited financial statements, management's discussion and analysis, and other pertinent information. 2. Quarterly Information Statement — Common Stock: Issued every quarter, this statement updates shareholders and potential investors about Cook Illinois' financial performance, progress toward strategic goals, and any significant developments or events that occurred during the quarter. In conclusion, the Cook Illinois Information Statement — Common Stock serves as an invaluable resource for shareholders and potential investors interested in understanding the financial health, operational performance, and future prospects of Cook Illinois. It provides crucial information necessary for making informed decisions concerning investment in the company's common stock.

Cook Illinois Information Statement - Common Stock

Description

How to fill out Cook Illinois Information Statement - Common Stock?

Whether you intend to open your company, enter into a contract, apply for your ID renewal, or resolve family-related legal issues, you need to prepare certain documentation corresponding to your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and verified legal templates for any personal or business occurrence. All files are collected by state and area of use, so picking a copy like Cook Information Statement - Common Stock is quick and simple.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a few more steps to get the Cook Information Statement - Common Stock. Adhere to the guidelines below:

- Make certain the sample fulfills your personal needs and state law requirements.

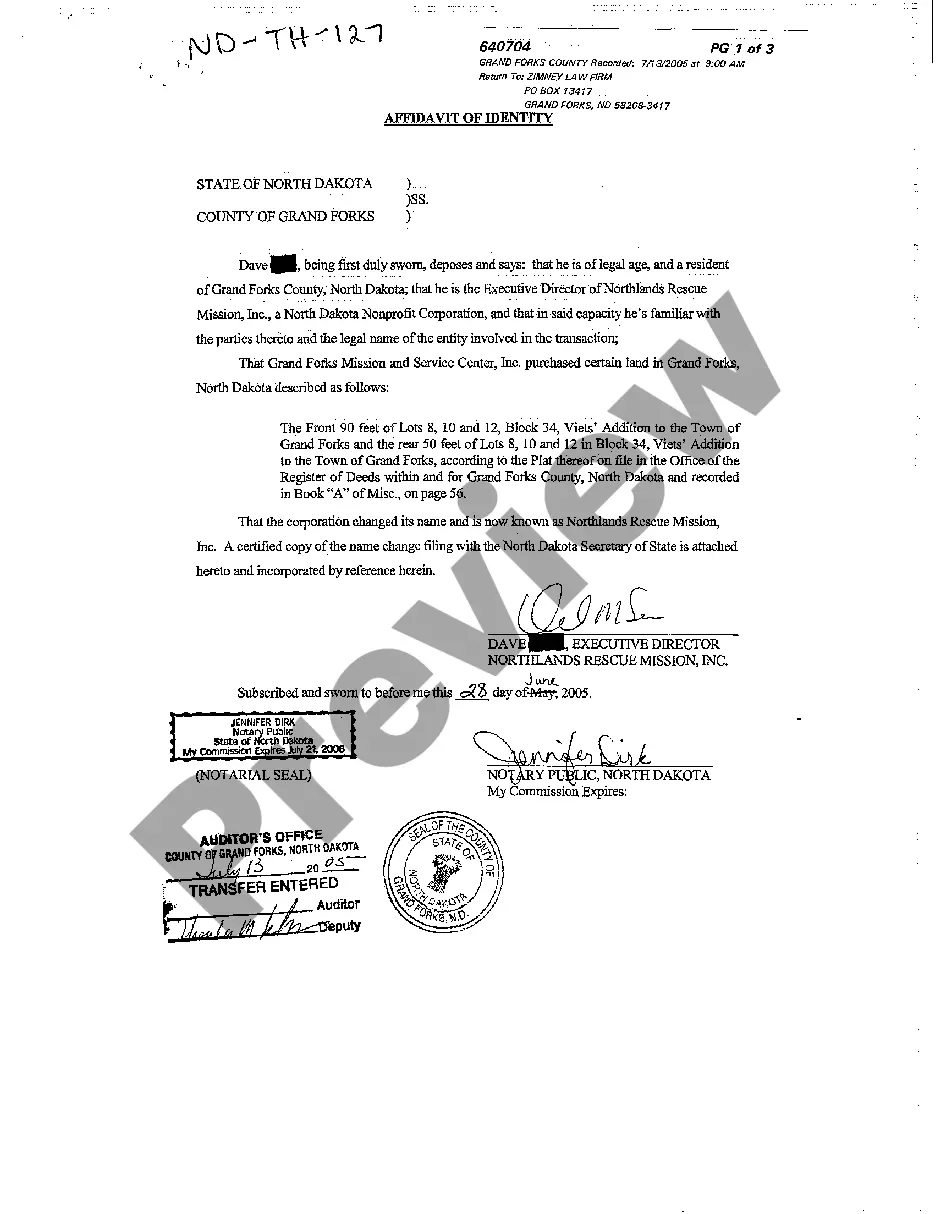

- Look through the form description and check the Preview if there’s one on the page.

- Make use of the search tab providing your state above to find another template.

- Click Buy Now to get the sample once you find the correct one.

- Select the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Cook Information Statement - Common Stock in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our website are multi-usable. Having an active subscription, you are able to access all of your earlier purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!

Form popularity

FAQ

You may have to report compensation on line 1 of Form 1040, U.S. Individual Income Tax Return or Form 1040-SR, U.S. Tax Return for Seniors, and capital gain or loss on Schedule D (Form 1040), Capital Gains and Losses and Form 8949, Sales and Other Dispositions of Capital Assets when you sell the stock.

You only need to supply PDF of 1099-B covered transactions with adjustments that are not listed on your e-Filed Form 8949. and all non-covered transactions not listed there. in other words, for active investors, generally this is a list of the Wash Sales.

SEC Form 11-K records all insider or employee activity involving the buying and selling of a company's stock. The form is used to report employee transactions as well as transactions involving employee stock purchase savings or retirement plans.

Form 8949 tells the IRS all of the details about each stock trade you make during the year, not just the total gain or loss that you report on Schedule D.

If you sold stock, bonds or other securities through a broker or had a barter exchange transaction (exchanged property or services rather than paying cash), you will likely receive a Form 1099-B. Regardless of whether you had a gain, loss, or broke even, you must report these transactions on your tax return.

If you sold stocks at a profit, you will owe taxes on gains from your stocks. If you sold stocks at a loss, you might get to write off up to $3,000 of those losses. And if you earned dividends or interest, you will have to report those on your tax return as well.

A separate Form 1099-B must be filed for every single transaction involving the sale of (including short sales) stocks, commodities, regulated futures contracts, foreign currency contracts (pursuant to a forward contract or regulated futures contract), forward contracts, debt instruments, options, or securities futures

SEC Filings are regulatory documents that companies and issuers of securities must submit to the Securities and Exchange Commission (SEC) on a regular basis. The purpose is to provide transparency and information to investors, analysts, and regulators.

What Is a 10-K? A 10-K is a comprehensive report filed annually by a publicly-traded company about its financial performance and is required by the U.S. Securities and Exchange Commission (SEC).