The Bronx New York Employee Stock Option Plan of Emblem Corp. is a comprehensive program designed for employees of Emblem Corp. who are based in the Bronx, New York. This plan offers various stock options to eligible employees as a part of their compensation package. Emblem Corp. is a leading technology company operating in the Bronx, New York. They specialize in providing advanced networking solutions, including high-speed Ethernet and fiber channel products. As one of the leading employers in the area, Emblem Corp. understands the importance of attracting and retaining top talent, which is why they offer an Employee Stock Option Plan to their Bronx-based employees. The Employee Stock Option Plan is a type of equity compensation plan that grants employees the right to purchase company stocks at a predetermined price, often referred to as the exercise price. These options typically have a vesting period, which means that employees need to fulfill specific conditions, such as completing a certain number of years of service, before they can exercise their options. Vesting periods encourage long-term commitment and loyalty among employees. There are various types of stock options offered under the Bronx New York Employee Stock Option Plan of Emblem Corp. Here are a few common types: 1. Incentive Stock Options (SOS): SOS are typically provided to key employees and are intended to provide tax advantages. These options are subject to certain tax requirements and must meet specific statutory requirements outlined by the Internal Revenue Code. 2. Non-Qualified Stock Options (SOS): SOS are more flexible than SOS as they do not have to meet the same statutory requirements. They are generally offered to a broader group of employees and do not offer the same tax advantages as SOS. 3. Restricted Stock Units (RSS): RSS are a form of stock-based compensation but differ from stock options. Instead of granting employees the right to purchase stock in the future, RSS offer employees the actual stock at a future date or after meeting specific conditions. These units typically vest over a certain period, often based on the employee's performance or time of service. The Bronx New York Employee Stock Option Plan of Emblem Corp. aims to align the interests of employees with that of the company's shareholders. By providing employees with the opportunity to own a stake in the company, Emblem Corp. encourages them to contribute to the long-term success and growth of the organization. Note: The information provided above is a fictional description of a Bronx New York Employee Stock Option Plan of Emblem Corp. It is important to conduct thorough research and consult with professionals before making any investment or financial decisions.

Bronx New York Employee Stock Option Plan of Emulex Corp.

Description

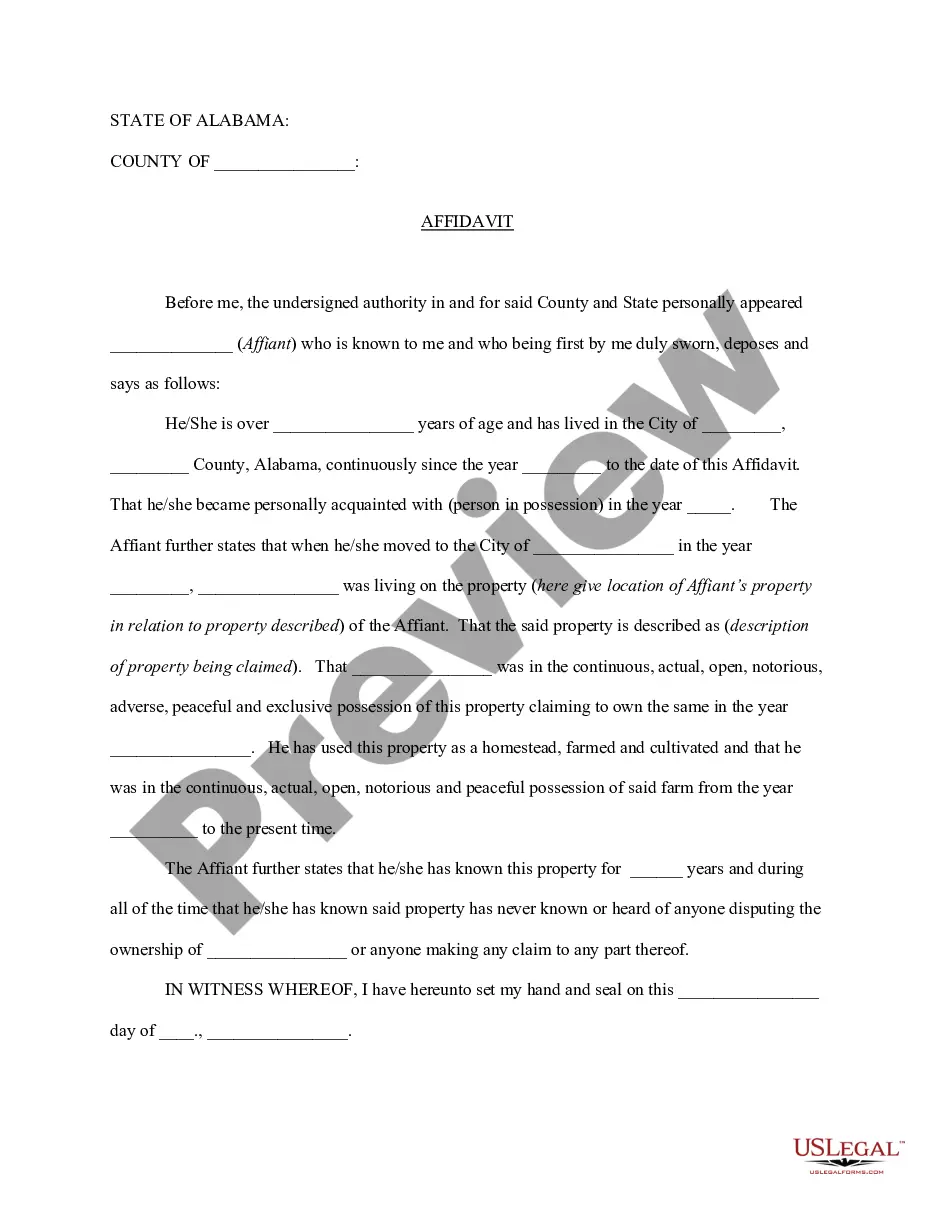

How to fill out Bronx New York Employee Stock Option Plan Of Emulex Corp.?

Preparing legal documentation can be cumbersome. In addition, if you decide to ask a legal professional to draft a commercial agreement, papers for ownership transfer, pre-marital agreement, divorce paperwork, or the Bronx Employee Stock Option Plan of Emulex Corp., it may cost you a lot of money. So what is the most reasonable way to save time and money and create legitimate forms in total compliance with your state and local laws? US Legal Forms is a perfect solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is largest online library of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any use case collected all in one place. Consequently, if you need the recent version of the Bronx Employee Stock Option Plan of Emulex Corp., you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Bronx Employee Stock Option Plan of Emulex Corp.:

- Glance through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - look for the correct one in the header.

- Click Buy Now once you find the needed sample and select the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a transaction with a credit card or via PayPal.

- Opt for the document format for your Bronx Employee Stock Option Plan of Emulex Corp. and download it.

Once finished, you can print it out and complete it on paper or upload the template to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the paperwork ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!

Form popularity

FAQ

Request the distribution forms from the ESOP company. These forms will transfer the shares from the control of the ESOP to you. You will need to fill out the forms completely and sign them. Sell the shares using your broker or online brokerage house if you wish to transfer the vested stock to cash.

Here are 5 ways to use your ESPP to improve your financial life. Contribute To Long Term Wealth. Contributing to an ESPP can boost your efforts towards building wealth through long-term investing.Reinvest Into A Roth IRA.Supplement Cash Flow.Short Term Savings Goals.Pay down debt.

At present, ESOPs are taxable as perquisites (salary income) in the hands of employees. The value is the difference between the fair market price of the stock on the day the option is exercised and the price at which it is exercised.

At present, ESOPs are taxable as perquisites (salary income) in the hands of employees. The value is the difference between the fair market price of the stock on the day the option is exercised and the price at which it is exercised.

With most employee stock purchase plans, you can withdraw from your plan at any time before the purchase.

You make your contributions into the plan via payroll deductions and on set dates, the company purchases shares on your behalf (at a discount!) with the funds accumulated and delivers them to you. Like most company benefits, participation is optional for employees.

You can sell your ESPP plan stock immediately to lock in your profit from the discount. If you hold the company stock for at least a year and sell it for more than two years after the offering date, you pay lower taxes.

An ESOP qualifies as a retirement plan, such as a 401 (k) or individual retirement account, while corporations use stock options as an employee benefit, like health insurance. In an ESOP, the company contributes to employee retirement plans with its own stock.

Are ESPPs good investments? These plans can be great investments if used correctly. Purchasing stock at a discount is certainly a valuable tool for accumulating wealth, but comes with investment risks you should consider. An ESPP plan with a 15% discount effectively yields an immediate 17.6% return on investment.

How Does ESOP Payout Work? You can either issue the shares or pay them in cash or both. If you issue shares, there is a 60-day window where the employee can sell the stock back to the company before it expires. If the employees choose the distribution of stock, you have to provide them with stock certificates.