The Chicago Illinois Short-Term Incentive Plan is a performance-based reward system designed to motivate and incentivize employees working in various organizations across the city of Chicago, Illinois. This plan aims to drive productivity, foster employee engagement, and ultimately contribute to the overall success of companies in the region. Under this incentive plan, employees are offered additional compensation or rewards based on achieving specific short-term goals and targets set by their respective employers. These goals are typically related to individual or team performance metrics, such as meeting sales targets, exceeding customer satisfaction levels, or accomplishing specific project milestones. The Chicago Illinois Short-Term Incentive Plan typically takes into consideration the organization's overall objectives and ensures alignment between individual and company goals. By incentivizing employees through this plan, companies aim to boost employee motivation and performance, leading to enhanced productivity and higher levels of job satisfaction. Different variations of the Chicago Illinois Short-Term Incentive Plan may exist depending on the industry, company size, and organizational goals. Some common types include sales incentive plans, performance-based bonus programs, profit-sharing schemes, and discretionary bonus plans. Sales Incentive Plan: This type of short-term incentive plan primarily focuses on rewarding sales professionals for achieving or exceeding predetermined sales targets. It often includes a combination of fixed salaries and variable commissions or bonuses tied to sales performance. Performance-Based Bonus Program: This type of short-term incentive plan extends to a broader range of job roles and measures performance against specific performance metrics relevant to each job function. The bonuses or rewards are usually based on individual or team achievements related to key performance indicators (KPIs) such as revenue growth, cost reduction, or customer retention. Profit-Sharing Scheme: In this variation of the plan, a portion of the company's profits is distributed among employees as a form of short-term incentive. The distribution may be proportionate to an employee's salary or performance level, providing a sense of shared success and fostering a unified company culture. Discretionary Bonus Plan: Unlike the previously mentioned plans that rely on predefined metrics, this type of short-term incentive plan allows management or employers to distribute bonuses or rewards based on their discretion. It provides flexibility to recognize exceptional efforts or achievements that may not fit within specific metrics, fostering employee loyalty and motivation. The Chicago Illinois Short-Term Incentive Plan plays a crucial role in attracting and retaining top talent in the region. By providing employees with clear goals and rewards tied directly to their performance, it helps organizations create a culture of high achievement and encourages employees to give their best efforts towards achieving company objectives. This comprehensive and results-driven incentive plan serves as a valuable tool in driving employee productivity, enhancing job satisfaction, and ultimately contributing to the overall growth and success of companies in Chicago, Illinois.

Chicago Illinois Short-Term Incentive Plan

Description

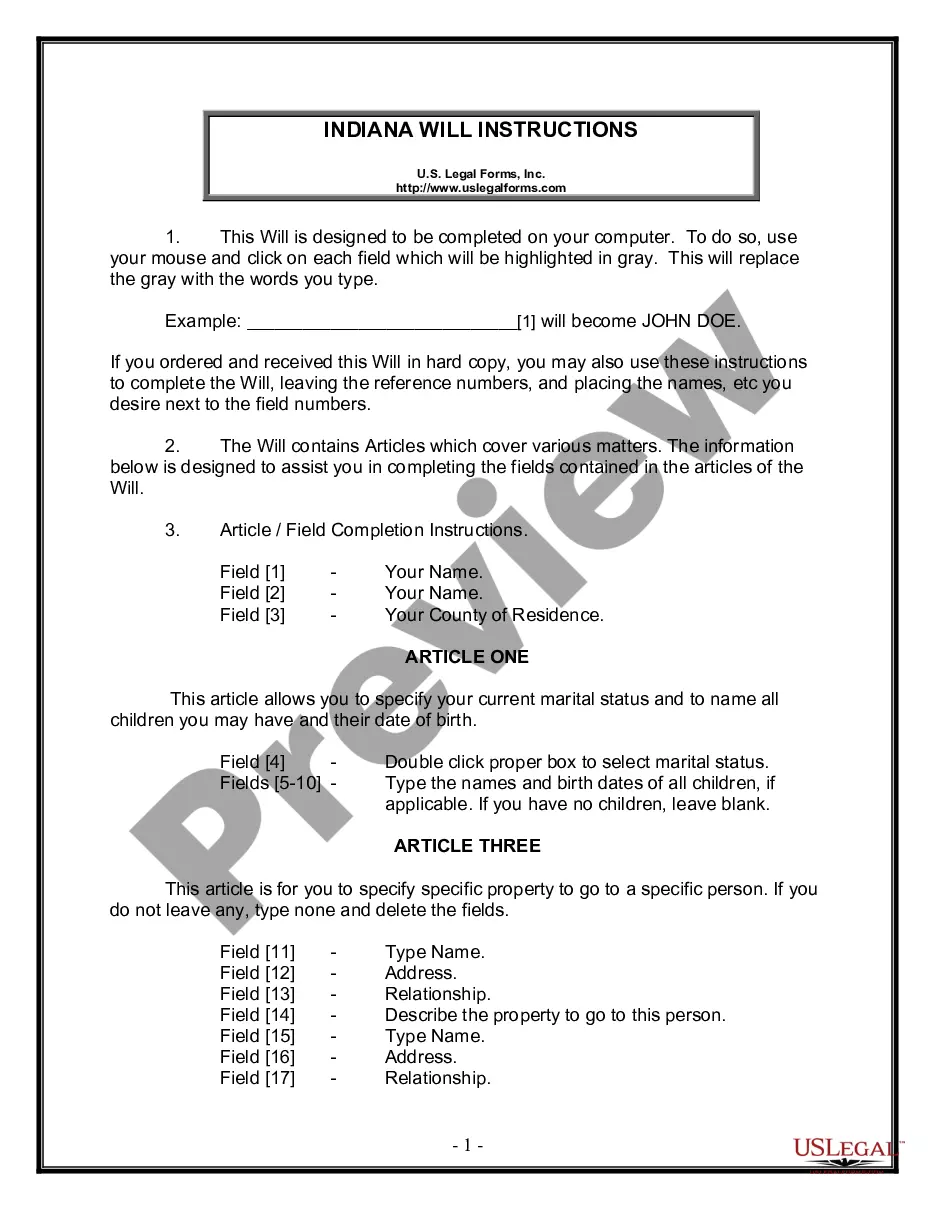

How to fill out Chicago Illinois Short-Term Incentive Plan?

If you need to find a trustworthy legal document supplier to get the Chicago Short-Term Incentive Plan, consider US Legal Forms. No matter if you need to launch your LLC business or take care of your asset distribution, we got you covered. You don't need to be well-versed in in law to find and download the appropriate form.

- You can select from over 85,000 forms categorized by state/county and case.

- The self-explanatory interface, variety of learning resources, and dedicated support team make it easy to get and execute various papers.

- US Legal Forms is a trusted service providing legal forms to millions of users since 1997.

Simply type to search or browse Chicago Short-Term Incentive Plan, either by a keyword or by the state/county the document is intended for. After finding the required form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's simple to get started! Simply locate the Chicago Short-Term Incentive Plan template and check the form's preview and short introductory information (if available). If you're comfortable with the template’s legalese, go ahead and hit Buy now. Register an account and select a subscription option. The template will be immediately ready for download as soon as the payment is completed. Now you can execute the form.

Taking care of your law-related matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our rich collection of legal forms makes these tasks less costly and more affordable. Set up your first company, organize your advance care planning, draft a real estate contract, or execute the Chicago Short-Term Incentive Plan - all from the comfort of your sofa.

Join US Legal Forms now!

Form popularity

FAQ

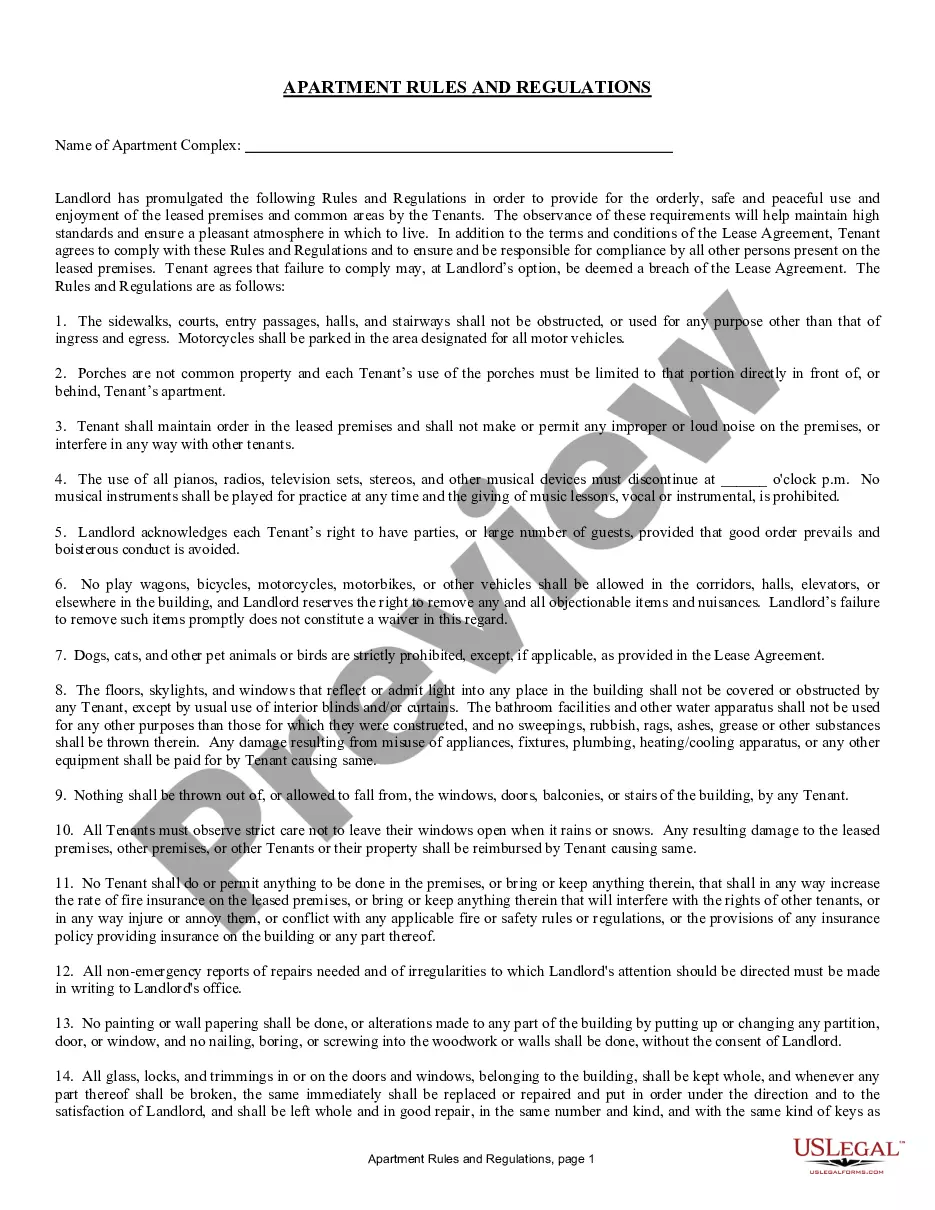

Submit your application and wait for BACP to approve your application. Once approved, pay your application fee of $125 for each approved registration. Go to your Airbnb host account page. Click on your listing Policies and rules > Laws and Regulations > Regulations.

The city requires hosts to register with the city before listing and renting their property on Airbnb. Luckily, Airbnb makes it easy by allowing you to apply for a registration number directly from their website or app.

CHICAGO REGULATIONS FOR AIRBNB RENTALS In other words, renting out an entire single-family home is not allowed in some cities, but renting out a single room within the home is acceptable. Chicago passed regulations in 2016 to control home sharing.

CHICAGO REGULATIONS FOR AIRBNB RENTALS In other words, renting out an entire single-family home is not allowed in some cities, but renting out a single room within the home is acceptable.

Airbnb Chicago has pretty harsh rules on their short-term rental properties. The single-night stay ban is one of the biggest factors that turn investors away. This can make Airbnb property management difficult, as you may not get as many bookings from potential guests who only wish to stay overnight.

Paris, Barcelona, Amsterdam, Miami, and Santa Monica have some of the strictest policies regarding who can and cannot rent out Airbnbs. Berlin, London, San Francisco, and New York have looser requirements, but are still regulated.

Airbnb Chicago has pretty harsh rules on their short-term rental properties. The single-night stay ban is one of the biggest factors that turn investors away. This can make Airbnb property management difficult, as you may not get as many bookings from potential guests who only wish to stay overnight.

The Airbnb data comes after a SmartAsset.com study earlier this year that found Chicago is the third best city for Airbnb hosts in terms of expected profits from a full-home, two-bedroom rentals. Chicago hosts can expect to make $24,175 per year by renting a two-bedroom home full-time, behind only San Diego and Miami.

The updated ordinance continues to regulate short-term residential rental activities in the City of Chicago. As of June 1, 2021, all individuals who wish to participate in short-term residential rental activities must now begin the registration process directly with the City of Chicago.