The Maricopa Arizona Management Agreement between Advisers Managers Trust and Berger and Berman Management Inc. is a comprehensive document that outlines the terms and conditions of the partnership between these two entities in managing the financial assets of clients in Maricopa, Arizona. This agreement is designed to provide a clear understanding of the roles, responsibilities, and expectations of both parties involved. The agreement encompasses various aspects of the management process, including investment strategies, fee structure, reporting requirements, and confidentiality clauses. It serves as a legally binding contract that ensures transparency and accountability in the financial management services provided. Keywords: Maricopa Arizona, management agreement, Advisers Managers Trust, Berger and Berman Management Inc., partnership, financial assets, clients, investment strategies, fee structure, reporting requirements, confidentiality. Different types of Maricopa Arizona Management Agreements between Advisers Managers Trust and Berger and Berman Management Inc. may include: 1. Investment Management Agreement: This type of agreement primarily focuses on the investment strategies and portfolio management services provided by Advisers Managers Trust and Berger and Berman Management Inc. It outlines the investment objectives, risk tolerance, asset allocation, and reporting frequency. 2. Wealth Management Agreement: This agreement encompasses a broader range of financial services, including investment management, financial planning, tax planning, estate planning, and similar comprehensive wealth management services. It may also include provisions for additional services such as trust administration or philanthropic advising. 3. Institutional Management Agreement: This agreement caters to institutional clients, such as endowments, foundations, or pension funds, that require specialized investment management services. It may have specific provisions related to compliance with regulations, fiduciary responsibilities, and reporting requirements unique to institutional clients. 4. Family Office Agreement: This type of agreement is tailored to high-net-worth families or individuals who require comprehensive financial management services. It covers a range of services, including investment management, estate planning, tax optimization, risk management, bill payment, and financial reporting. Each type of management agreement may have specific variations and customized terms based on the unique needs and preferences of the clients and the capabilities and expertise of Advisers Managers Trust and Berger and Berman Management Inc.

Maricopa Arizona Management Agreement between Advisers Managers Trust and Neuberger and Berman Management Inc.

Description

How to fill out Maricopa Arizona Management Agreement Between Advisers Managers Trust And Neuberger And Berman Management Inc.?

Laws and regulations in every sphere vary throughout the country. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal paperwork. To avoid pricey legal assistance when preparing the Maricopa Management Agreement between Advisers Managers Trust and Neuberger and Berman Management Inc., you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal forms. It's an excellent solution for professionals and individuals looking for do-it-yourself templates for different life and business scenarios. All the forms can be used multiple times: once you pick a sample, it remains accessible in your profile for further use. Therefore, if you have an account with a valid subscription, you can simply log in and re-download the Maricopa Management Agreement between Advisers Managers Trust and Neuberger and Berman Management Inc. from the My Forms tab.

For new users, it's necessary to make several more steps to get the Maricopa Management Agreement between Advisers Managers Trust and Neuberger and Berman Management Inc.:

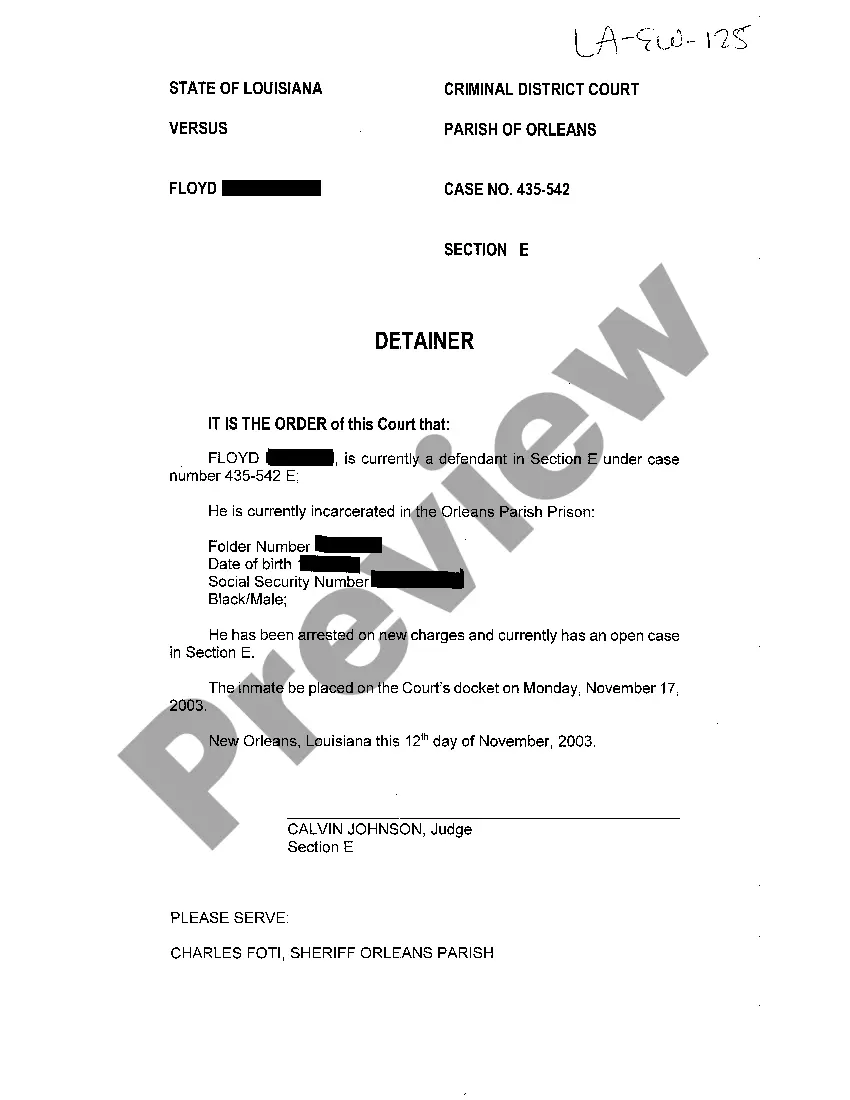

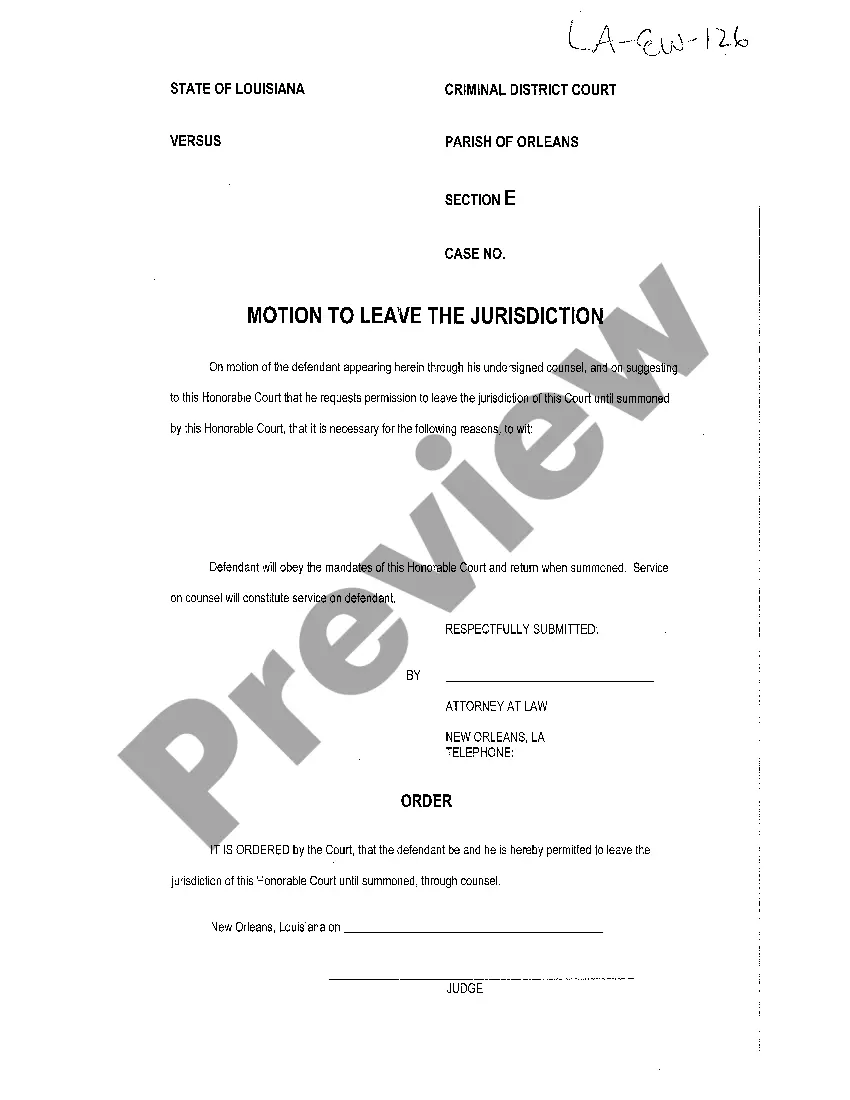

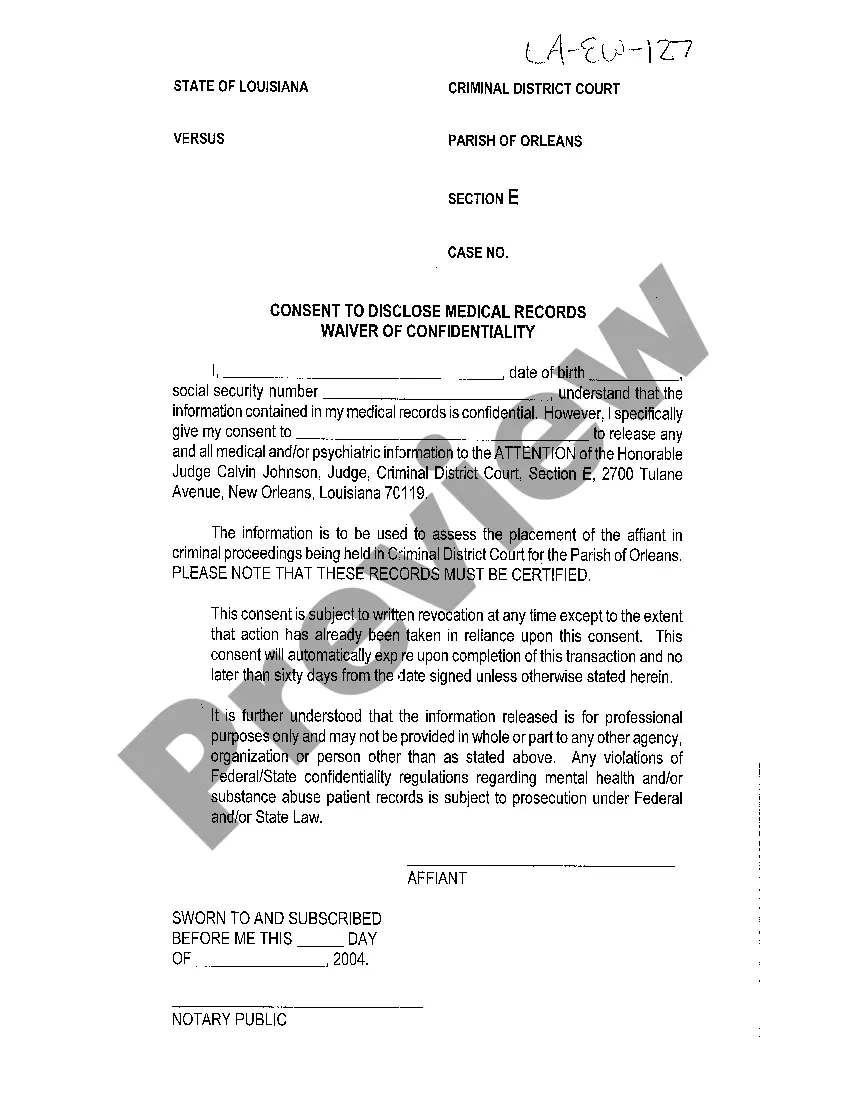

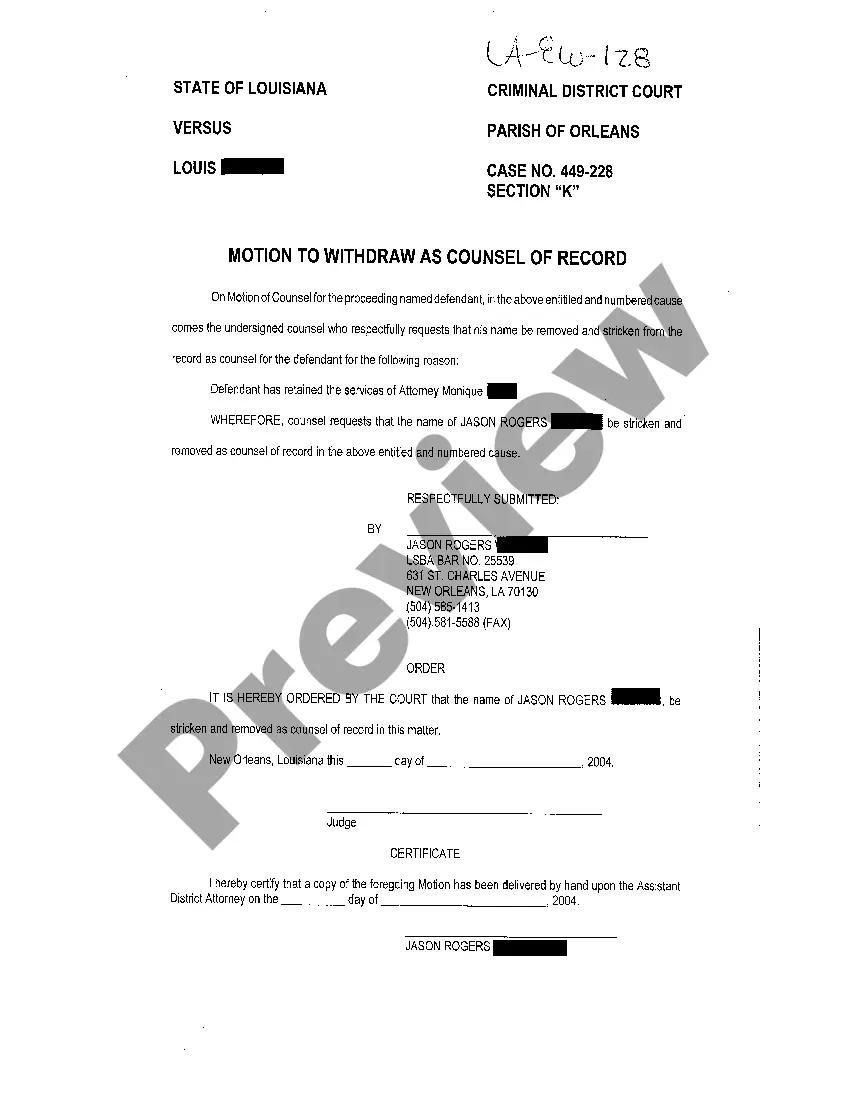

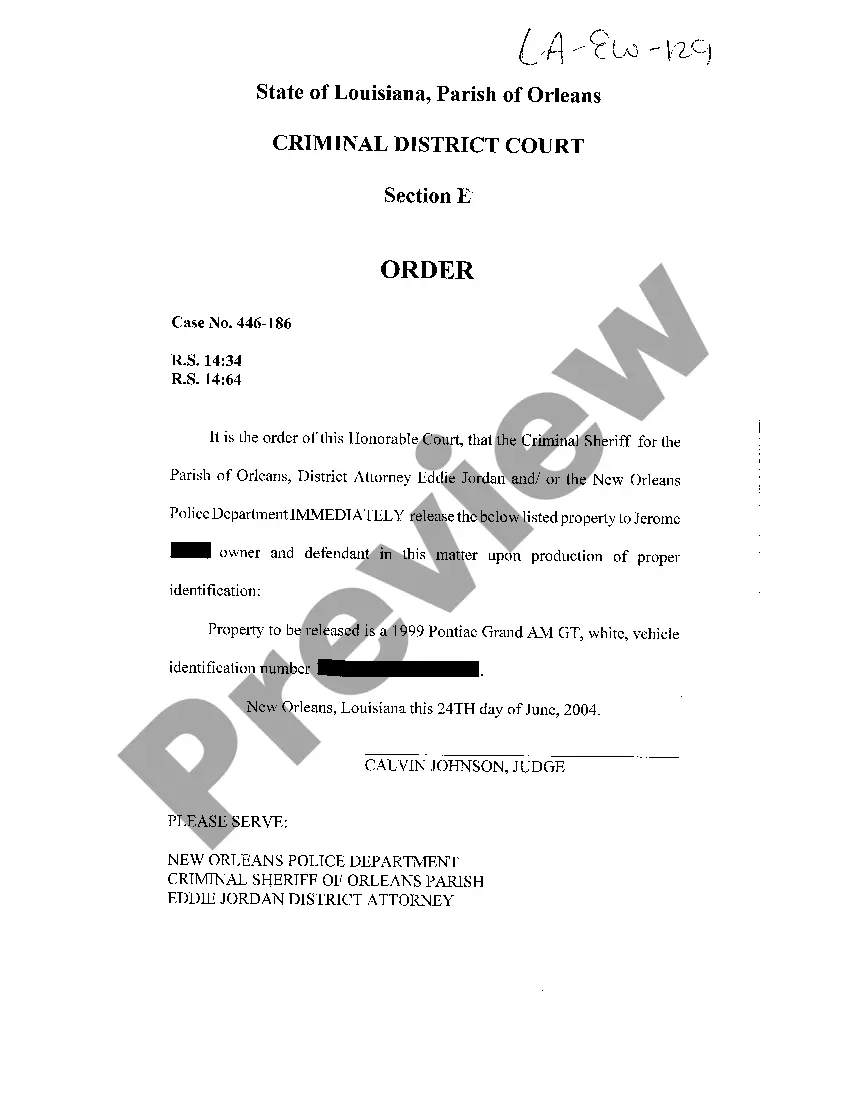

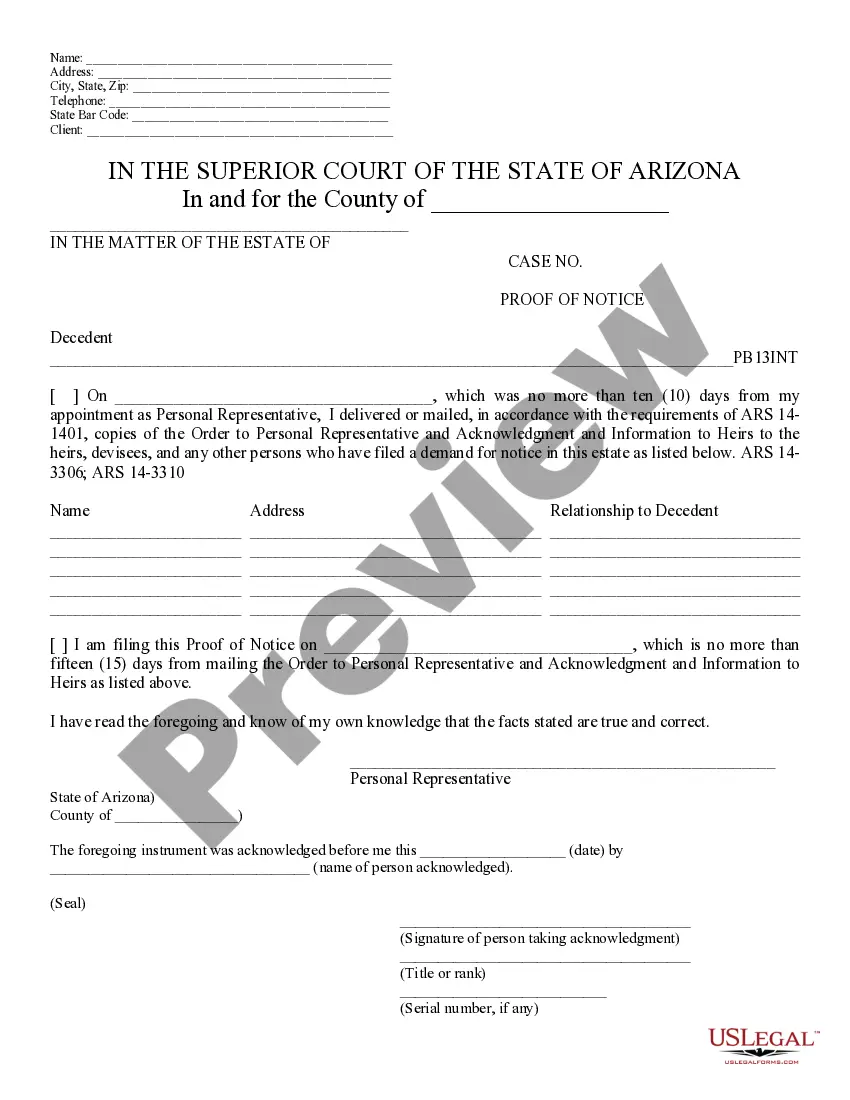

- Examine the page content to make sure you found the appropriate sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to get the template once you find the right one.

- Opt for one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Complete and sign the template in writing after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

Neuberger Berman Group LLC is a private, independent, employee-owned investment management firm. The firm manages equities, fixed income, private equity and hedge fund portfolios for global institutional investors, advisors and high-net-worth individuals.

Neuberger Berman is an experienced hedge fund solutions provider investing on behalf of institutional, high-net-worth and retail clients via registered liquid alternative funds, custom portfolios, and commingled products.

Firm assets under management (AUM) includes $125.5 billion in Equity assets, $183.7 billion in Fixed Income assets and $92.6 billion in Alternatives assets.

Neuberger Berman is a private, independent, employee-owned investment managera rare structure for a large asset management firm, almost all of which are either public or owned by other financial institutions.

New York, NY, December 14, 2020 Neuberger Berman, a private, independent, employee-owned investment manager, is honored to be ranked second among companies with 1,000 employees or more in the 2020 Best Places to Work in Money Management survey by Pensions & Investments.

However, Berman is a registered investment advisor with the U.S. Securities and Exchange Commission (SEC), and is therefore bound by fiduciary duty. This means the firm must act in clients' best interests at all times.

New York, December 12, 2016 Neuberger Berman, a private, independent, employee-owned investment manager, is honored to be named as the top ranked firm among those with 1,000 employees or more in the 2016 Best Places to Work in Money Management survey by Pensions & Investments, the global news source of money

Neuberger Berman BD LLC (Neuberger Berman) is a member of FINRA and SIPC and is regulated by the United States Securities and Exchange Commission and Financial Industry Regulatory Authority.