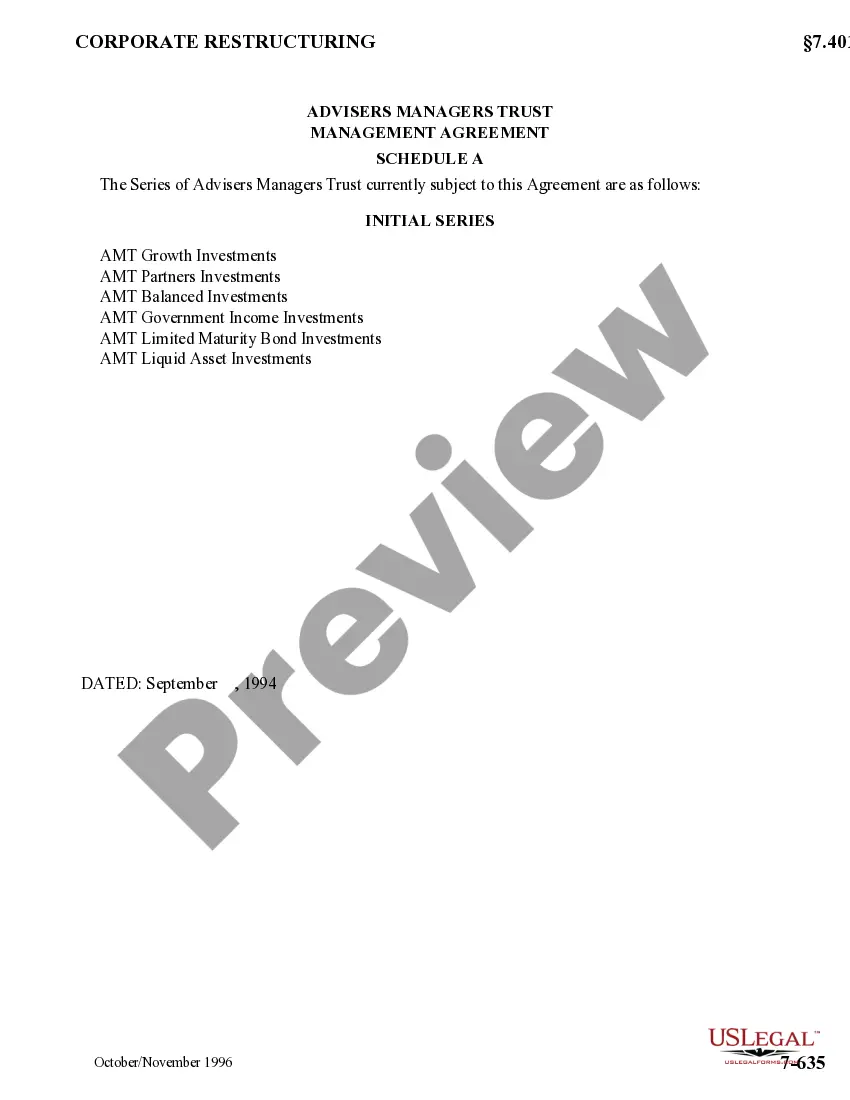

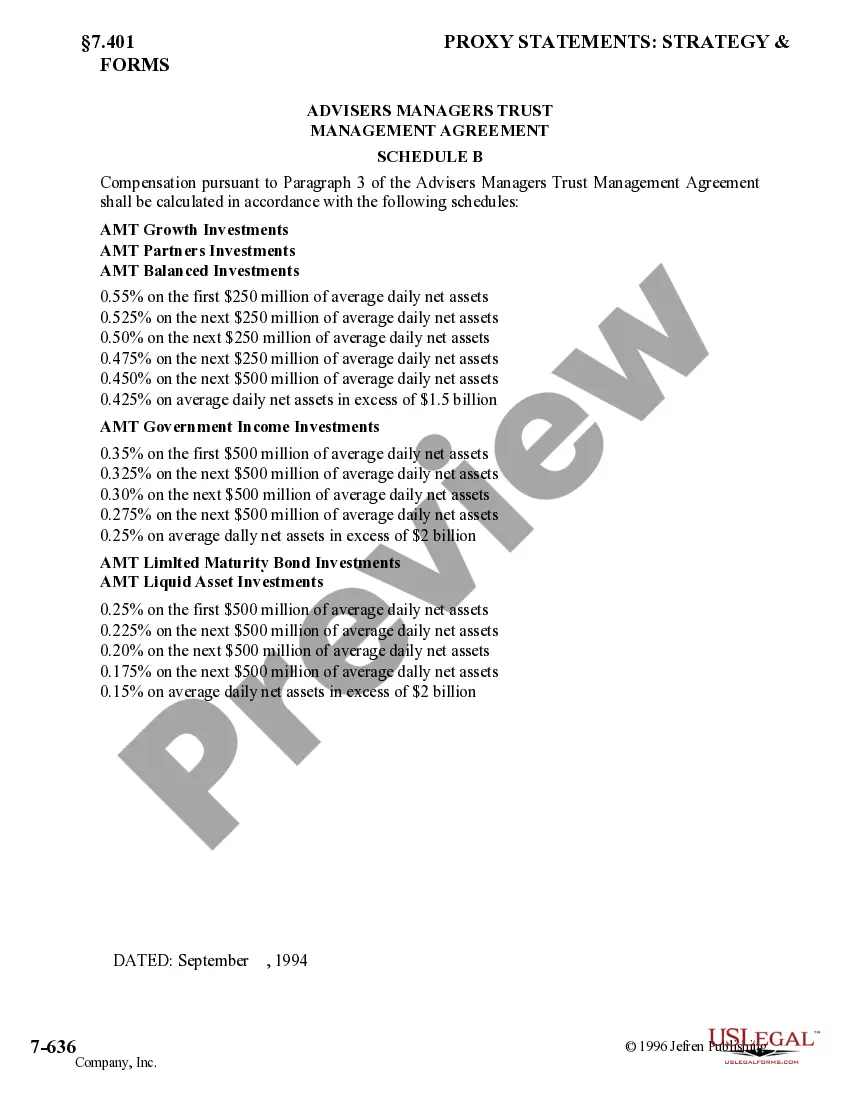

A San Jose California Management Agreement between Advisers Managers Trust and Berger and Berman Management Inc. is a legally binding contract that outlines the terms and conditions agreed upon by the parties involved in the management of various assets and investments. This agreement typically covers the following aspects: 1. Parties involved: The agreement identifies the parties involved, including Advisers Managers Trust and Berger and Berman Management Inc. It clarifies the roles and responsibilities of each party throughout the duration of the agreement. 2. Asset management: The agreement outlines the specific assets and investments that will be managed by the parties. This may include stocks, bonds, real estate, or other financial instruments. 3. Investment objectives: The agreement defines the investment objectives to be pursued, such as capital preservation, growth, income generation, or a combination thereof. It ensures that both parties have a clear understanding of the goals and strategies to be employed. 4. Fee structure: The management agreement specifies the fees and compensation arrangements for the services provided by Advisers Managers Trust and Berger and Berman Management Inc. This includes management fees, performance fees, and any other associated costs. 5. Risk management: The agreement discusses the risk management strategies and practices being employed to mitigate potential risks and losses. It may include provisions for diversification, risk monitoring, and compliance with regulatory requirements. 6. Reporting and communication: The agreement establishes the frequency and format of reports that will be provided to clients by Advisers Managers Trust and Berger and Berman Management Inc. It ensures transparent communication regarding investment performance, account activity, and other relevant information. 7. Duration and termination: The agreement specifies the duration of the management relationship and the circumstances under which either party may terminate the agreement. It may also include provisions for the transfer of assets and obligations in case of termination. Some types of San Jose California Management Agreements between Advisers Managers Trust and Berger and Berman Management Inc. may include: 1. Individual portfolio management agreement: This involves the management of assets and investments on an individual basis, typically tailored to the specific needs and objectives of the client. 2. Institutional portfolio management agreement: This type of agreement is designed for institutional clients, such as pension funds, endowments, or foundations. It involves the management of larger pools of assets and may incorporate additional provisions specific to institutional investors. 3. Collective investment scheme agreement: This agreement is related to the management of collective investment schemes, such as mutual funds or exchange-traded funds (ETFs). It outlines the responsibilities of Advisers Managers Trust and Berger and Berman Management Inc. in managing the pooled assets on behalf of multiple investors. In conclusion, a San Jose California Management Agreement between Advisers Managers Trust and Berger and Berman Management Inc. is a comprehensive contract that governs the management of assets and investments. It covers various aspects, including asset management, investment objectives, fee structure, risk management, reporting, and termination provisions. Different types of agreements may exist depending on the nature of the client relationship or the investment vehicle involved.

San Jose California Management Agreement between Advisers Managers Trust and Neuberger and Berman Management Inc.

Description

How to fill out San Jose California Management Agreement Between Advisers Managers Trust And Neuberger And Berman Management Inc.?

Laws and regulations in every sphere differ from state to state. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal paperwork. To avoid pricey legal assistance when preparing the San Jose Management Agreement between Advisers Managers Trust and Neuberger and Berman Management Inc., you need a verified template valid for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal forms. It's a great solution for specialists and individuals looking for do-it-yourself templates for various life and business scenarios. All the documents can be used many times: once you pick a sample, it remains accessible in your profile for future use. Thus, when you have an account with a valid subscription, you can just log in and re-download the San Jose Management Agreement between Advisers Managers Trust and Neuberger and Berman Management Inc. from the My Forms tab.

For new users, it's necessary to make several more steps to get the San Jose Management Agreement between Advisers Managers Trust and Neuberger and Berman Management Inc.:

- Take a look at the page content to make sure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to get the document when you find the correct one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the document on paper after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your documentation in order with the US Legal Forms!