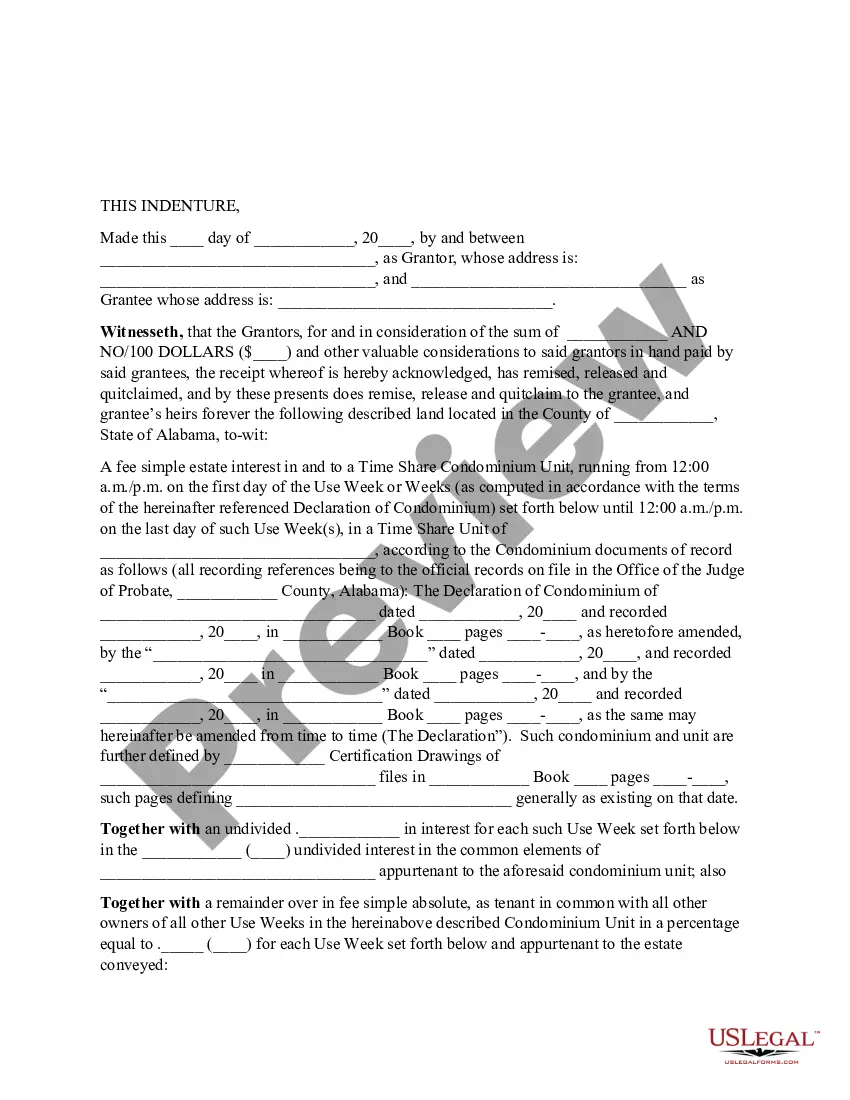

Travis Texas Management Agreement is a contractual agreement between Advisers Managers Trust and Berger and Berman Management Inc., two prominent entities in the financial industry. This agreement outlines the responsibilities, terms, and conditions agreed upon by both parties in their collaboration. The primary goal of the agreement is to establish a working relationship between Advisers Managers Trust and Berger and Berman Management Inc., allowing them to efficiently manage the assets and investments of their clients. It sets forth the guidelines for decision-making, investment strategies, reporting requirements, and fee structures. The Travis Texas Management Agreement encompasses various key aspects, including but not limited to: 1. Investment Management: This section outlines the responsibilities and authority of Berger and Berman Management Inc. to manage the investment portfolio on behalf of Advisers Managers Trust. It defines the investment objectives, risk tolerance, and strategies to be implemented. 2. Reporting and Review: The agreement specifies the reporting frequency and format for performance reviews and investment evaluations. It ensures transparency and accountability, allowing Advisers Managers Trust to monitor the progress and performance of their investments. 3. Fee Structure: The management agreement includes details regarding the compensation structure for Berger and Berman Management Inc. These may encompass management fees, performance-based fees, or a combination of both. The agreement also outlines any additional expenses that may be incurred and how they will be handled. 4. Termination and Transition: In the case of termination or expiration of the agreement, the process and responsibilities for transitioning the management of assets to another party are outlined. This includes providing sufficient notice and ensuring a smooth transition without any disruption to the clients' interests. It is important to note that while there may not be different types of Travis Texas Management Agreements between Advisers Managers Trust and Berger and Berman Management Inc., each agreement could be tailored specifically to meet the unique needs and circumstances of their clients. These customized agreements may have varying terms and conditions concerning investment objectives, risk tolerance, and fee structures. Overall, the Travis Texas Management Agreement serves as a crucial legal document that governs the relationship between Advisers Managers Trust and Berger and Berman Management Inc., ensuring effective management of assets and investments while safeguarding the interests of their clients.

Travis Texas Management Agreement between Advisers Managers Trust and Neuberger and Berman Management Inc.

Description

How to fill out Travis Texas Management Agreement Between Advisers Managers Trust And Neuberger And Berman Management Inc.?

If you need to find a trustworthy legal form provider to get the Travis Management Agreement between Advisers Managers Trust and Neuberger and Berman Management Inc., consider US Legal Forms. Whether you need to start your LLC business or manage your belongings distribution, we got you covered. You don't need to be well-versed in in law to find and download the appropriate form.

- You can search from over 85,000 forms categorized by state/county and case.

- The intuitive interface, variety of supporting materials, and dedicated support make it easy to get and execute different papers.

- US Legal Forms is a reliable service offering legal forms to millions of customers since 1997.

You can simply type to search or browse Travis Management Agreement between Advisers Managers Trust and Neuberger and Berman Management Inc., either by a keyword or by the state/county the document is created for. After finding the required form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's easy to get started! Simply locate the Travis Management Agreement between Advisers Managers Trust and Neuberger and Berman Management Inc. template and check the form's preview and description (if available). If you're comfortable with the template’s legalese, go ahead and click Buy now. Create an account and choose a subscription plan. The template will be instantly available for download once the payment is completed. Now you can execute the form.

Taking care of your law-related affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our extensive variety of legal forms makes this experience less pricey and more reasonably priced. Set up your first company, organize your advance care planning, create a real estate contract, or execute the Travis Management Agreement between Advisers Managers Trust and Neuberger and Berman Management Inc. - all from the comfort of your home.

Join US Legal Forms now!