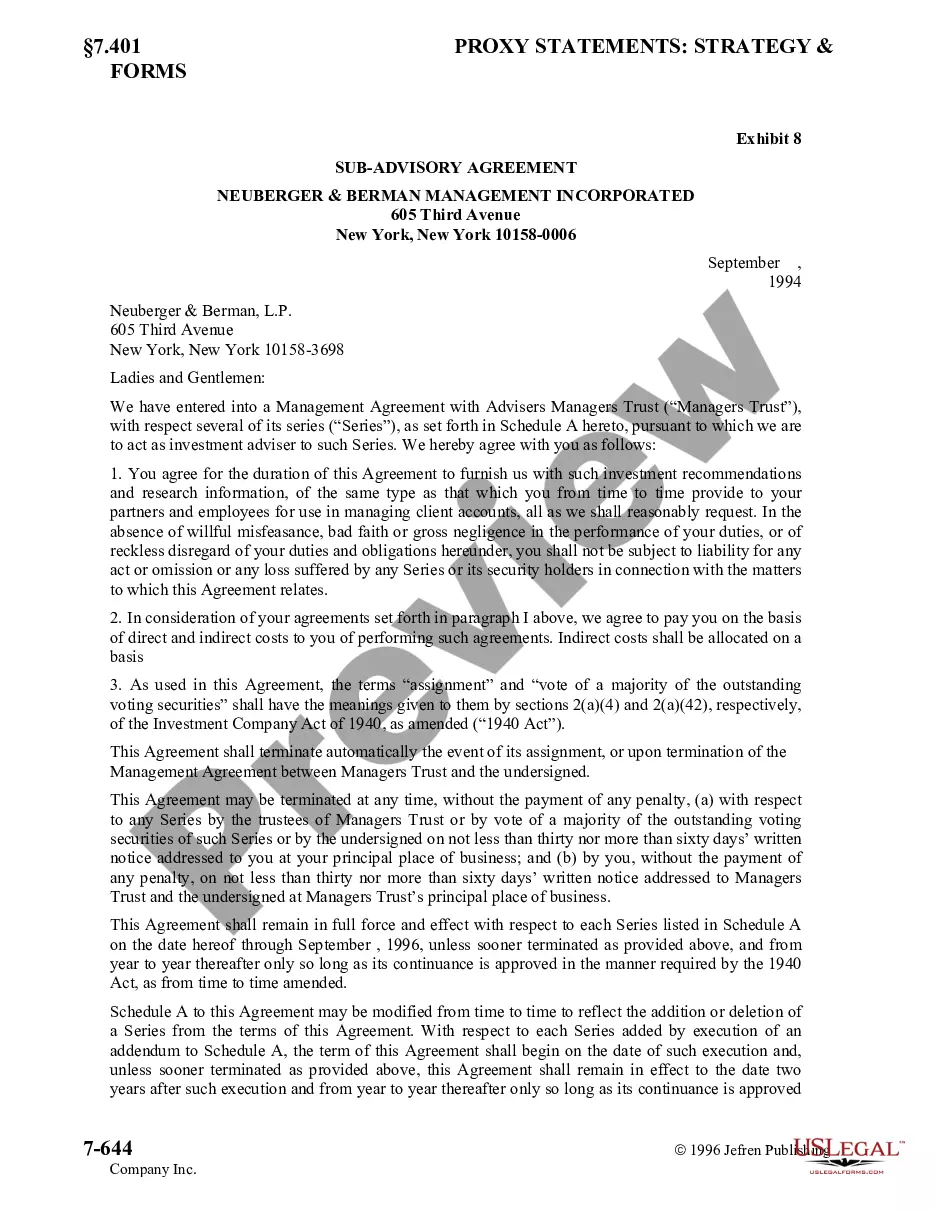

Collin Texas Sub-Advisory Agreement of Berger and Berman Management, Inc. is a legal contract that outlines the terms and conditions between Berger and Berman Management, Inc. (BMI) and a sub-adviser based in Collin, Texas. This agreement establishes the relationship between BMI, as the primary investment adviser, and the sub-adviser, who will provide advisory services to BMI's clients. The Collin Texas Sub-Advisory Agreement typically covers various aspects such as the scope of services, compensation, responsibilities, obligations, and termination procedures. It is designed to ensure a clear understanding between both parties, protecting the interests of all involved. The agreement defines the scope of services that the sub-adviser will provide to BMI. This may include investment research, portfolio management, trading, risk analysis, and reporting. Each agreement may vary depending on the specific services required or the investment strategies involved. Compensation details are a crucial aspect of the agreement. The agreement will outline the sub-adviser's fees, which may be structured as a percentage of assets under management, a fixed fee, or a combination of both. Clauses related to profit-sharing or expense reimbursements may also be included. Roles and responsibilities of both parties will be clearly defined. BMI, as the primary investment adviser, will maintain ultimate discretionary authority over client accounts, while the sub-adviser will be responsible for executing investment decisions, adhering to BMI's guidelines, and providing timely reports. Obligations regarding confidentiality, compliance with regulations, and the duty to act in the best interests of clients are key components of the Collin Texas Sub-Advisory Agreement. Both parties are expected to comply with relevant laws and regulations related to investment management, including disclosure requirements and any applicable restrictions. Termination procedures will be outlined in the agreement to guide either party in case the business relationship needs to be terminated. This may include provisions for notice periods, grounds for termination, and any potential liabilities or outstanding obligations. Different types of Collin Texas Sub-Advisory Agreements may exist based on the specific investment strategies or services being provided. For example, there could be agreements for equity sub-advisory services, fixed income sub-advisory services, or alternative investment sub-advisory services. Each type of agreement will have its unique provisions, tailored to the specific needs and requirements of the parties involved. In summary, the Collin Texas Sub-Advisory Agreement of Berger and Berman Management, Inc. is a comprehensive legal document that establishes the relationship between BMI and a sub-adviser in Collin, Texas. It outlines the scope of services, compensation, responsibilities, obligations, and termination procedures. Different types of agreements may exist depending on the investment strategies or services provided.

Collin Texas Sub-Advisory Agreement of Neuberger and Berman Management, Inc.

Description

How to fill out Collin Texas Sub-Advisory Agreement Of Neuberger And Berman Management, Inc.?

Preparing papers for the business or personal needs is always a big responsibility. When creating an agreement, a public service request, or a power of attorney, it's important to take into account all federal and state laws of the specific region. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it tense and time-consuming to generate Collin Sub-Advisory Agreement of Neuberger and Berman Management, Inc. without professional help.

It's possible to avoid spending money on attorneys drafting your paperwork and create a legally valid Collin Sub-Advisory Agreement of Neuberger and Berman Management, Inc. on your own, using the US Legal Forms online library. It is the largest online collection of state-specific legal documents that are professionally cheched, so you can be certain of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to save the needed form.

In case you still don't have a subscription, adhere to the step-by-step guide below to get the Collin Sub-Advisory Agreement of Neuberger and Berman Management, Inc.:

- Look through the page you've opened and check if it has the document you need.

- To accomplish this, use the form description and preview if these options are presented.

- To find the one that meets your needs, use the search tab in the page header.

- Recheck that the sample complies with juridical criteria and click Buy Now.

- Choose the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal forms for any scenario with just a couple of clicks!

Form popularity

FAQ

Neuberger Berman BD LLC is a registered broker-dealer and member FINRA/SIPC. Tax, trust and estate planning are services offered by Neuberger Berman Trust Company.

Today, $242 billion-in-assets Neuberger Berman is thriving, with products that include traditional long-only fixed income and equities and alternatives for institutional and retail investors.

Neuberger Berman is a private, independent, employee-owned investment managera rare structure for a large asset management firm, almost all of which are either public or owned by other financial institutions.

However, Berman is a registered investment advisor with the U.S. Securities and Exchange Commission (SEC), and is therefore bound by fiduciary duty. This means the firm must act in clients' best interests at all times.

Neuberger Berman Group LLC is a private, independent, employee-owned investment management firm. The firm manages equities, fixed income, private equity and hedge fund portfolios for global institutional investors, advisors and high-net-worth individuals.

Neuberger Berman BD LLC (Neuberger Berman) is a member of FINRA and SIPC and is regulated by the United States Securities and Exchange Commission and Financial Industry Regulatory Authority.

The following table displays all of the mutual funds in our database offered by Neuberger Berman. Click on any of the mutual fund tickers below to see the ETF alternatives to these mutual funds, as selected by our Mutual Fund to ETF Converter tool.

More info

The term “Prospectus Delivery” as used herein means and includes the receipt by the Fund of a Prospectus in respect of the Fund's initial public offering, to the extent that such receipt is required by applicable securities laws. 11 The Fund will also seek to comply with the regulations associated with the registration of investment companies that sell the shares of a fund in secondary trading. The Fund has an active market day and day of the week. The Adviser's role is similar to that of any registered broker-dealer in the United States. The Adviser's fiduciary responsibilities include the performance of its duty of loyalty at all times to the shareholders of the Fund and the duty to act with reasonable skill, care, and diligence in the performance of its duties. These obligations may be further enhanced by the Fund's role as a “protector” of the shareholders of the Fund which may include recommending to the shareholders to purchase shares of the Fund.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.