The Chicago Illinois Agreement and Plan of Reorganization by Wedge stone Realty Investors Trust and Wedge stone Advisory Corp. is a significant legal document that outlines the terms and conditions of the reorganization process between these two entities. This agreement serves as a blueprint for the consolidation, restructuring, or merging of Wedge stone Realty Investors Trust and Wedge stone Advisory Corp. into a single entity, ensuring a seamless transition and alignment of their operations. By engaging in this agreement, Wedge stone Realty Investors Trust and Wedge stone Advisory Corp. aim to optimize their resources, streamline their business activities, and potentially enhance their overall efficiency and profitability. The Chicago Illinois Agreement and Plan of Reorganization acts as a guide, ensuring that the entire process adheres to the legal framework established in the state of Illinois. The key points covered in the Chicago Illinois Agreement and Plan of Reorganization may vary depending on the specific circumstances and objectives of the restructuring. Some common components of such agreements include: 1. Consolidation of Operations: This agreement lays out the intention to combine the operations, assets, and liabilities of Wedge stone Realty Investors Trust and Wedge stone Advisory Corp. into a single entity. 2. Shareholder and Investor Rights: The agreement defines how shareholders' rights, interests, and investments will be treated during and after the reorganization process, ensuring equitable treatment for all parties involved. 3. Corporate Governance: This section addresses the new corporate governance structure that will be established post-reorganization, including the composition of the board of directors, decision-making processes, and other related matters. 4. Transfer of Assets and Liabilities: The agreement outlines how the transfer of assets and liabilities will take place, including real estate properties, contracts, intellectual property, and financial obligations, ensuring a smooth transition without disruptions to ongoing operations. 5. Employee Transition: If applicable, the agreement may detail how employee transfers, terminations, or reassignments will be handled, addressing any potential concerns related to employment contracts, benefits, and labor laws. It is important to note that the Chicago Illinois Agreement and Plan of Reorganization can be customized to meet the specific needs and goals of Wedge stone Realty Investors Trust and Wedge stone Advisory Corp. Different types of reorganizations, such as mergers, acquisitions, or spin-offs, may require the agreement to be tailored accordingly. The specific terms, conditions, and legal provisions will vary on a case-by-case basis, providing a comprehensive framework for the reorganization process.

Chicago Illinois Agreement and Plan of Reorganization by Wedgestone Realty Investors Trust and Wedgestone Advisory Corp.

Description

How to fill out Chicago Illinois Agreement And Plan Of Reorganization By Wedgestone Realty Investors Trust And Wedgestone Advisory Corp.?

Laws and regulations in every area differ throughout the country. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal documents. To avoid costly legal assistance when preparing the Chicago Agreement and Plan of Reorganization by Wedgestone Realty Investors Trust and Wedgestone Advisory Corp., you need a verified template valid for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal templates. It's an excellent solution for specialists and individuals looking for do-it-yourself templates for various life and business occasions. All the forms can be used many times: once you pick a sample, it remains accessible in your profile for subsequent use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Chicago Agreement and Plan of Reorganization by Wedgestone Realty Investors Trust and Wedgestone Advisory Corp. from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Chicago Agreement and Plan of Reorganization by Wedgestone Realty Investors Trust and Wedgestone Advisory Corp.:

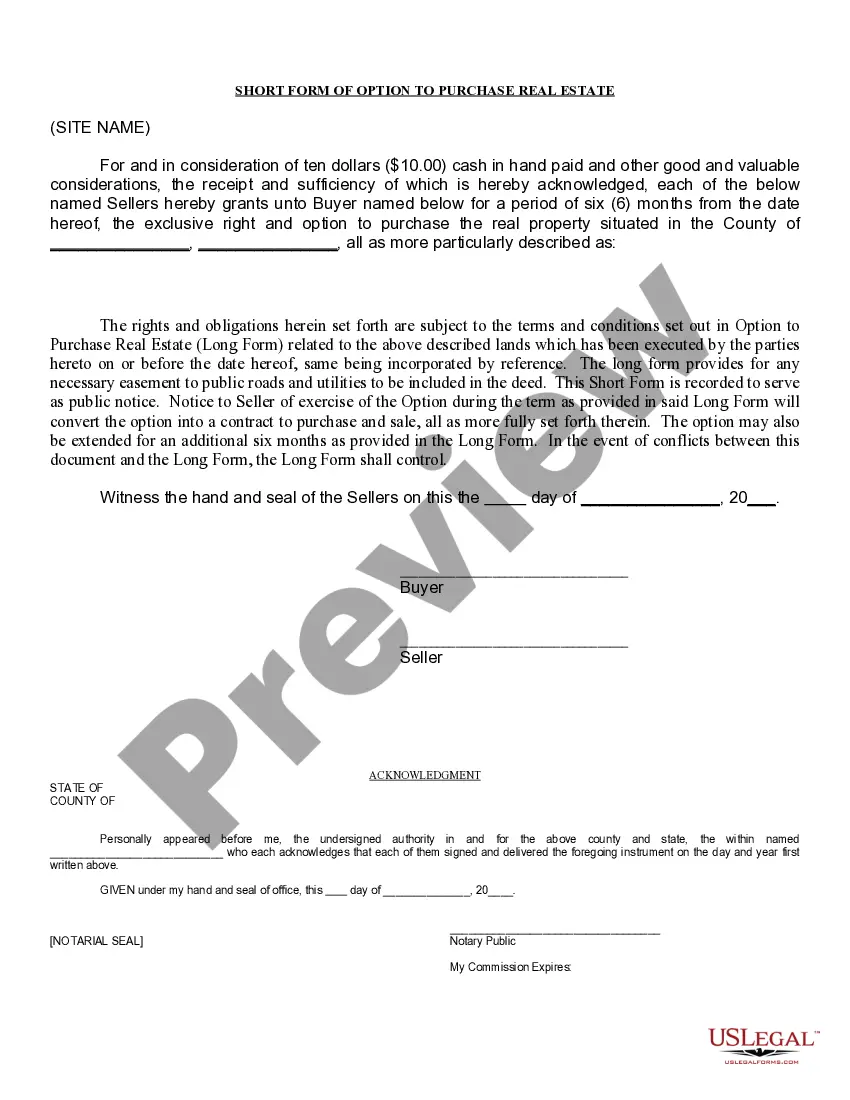

- Examine the page content to make sure you found the right sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to get the document when you find the proper one.

- Choose one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Complete and sign the document in writing after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your documentation in order with the US Legal Forms!