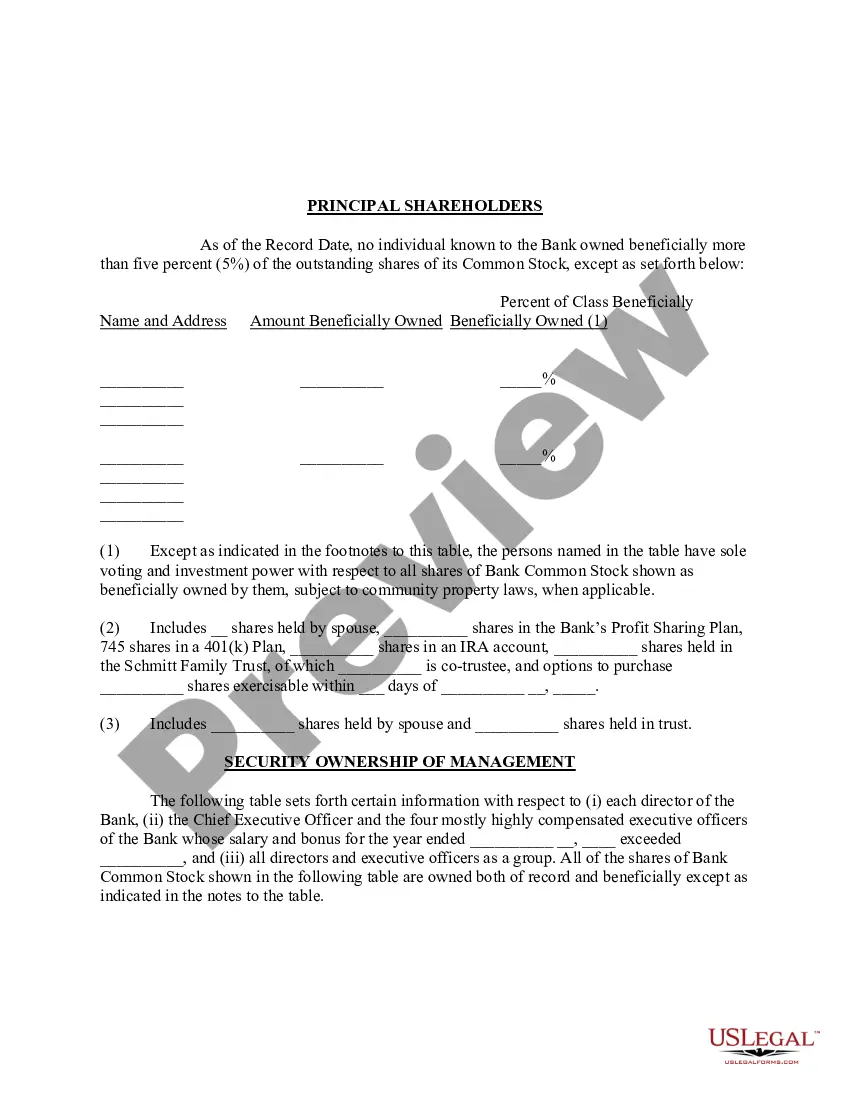

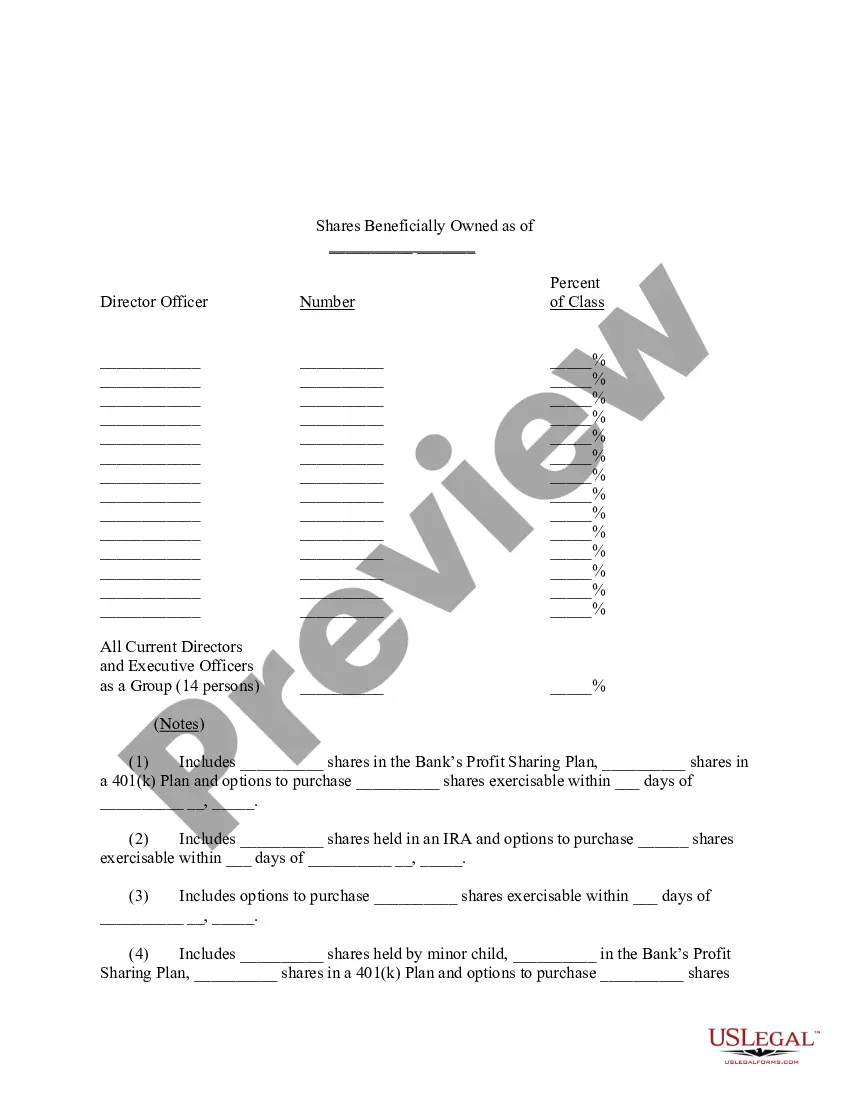

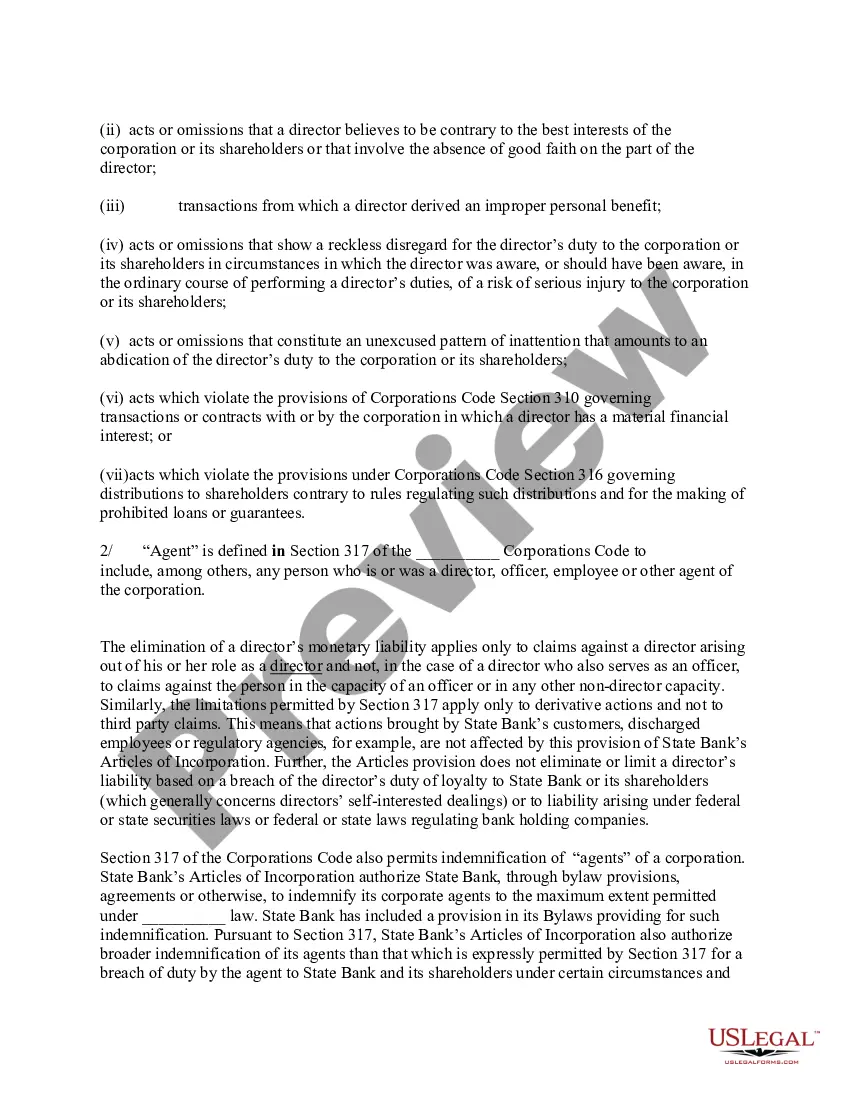

Queens, New York Proxy Statement — University National Bank and Trust Co. is a comprehensive document released by the bank to its shareholders providing important information about corporate governance, executive compensation, and voting procedures before an annual shareholder meeting. It is essential for shareholders to review and understand the content of the proxy statement to make informed decisions regarding the bank's policies and management. University National Bank and Trust Co., based in Queens, New York, is a prominent financial institution committed to serving the community's banking needs. As part of its transparency initiatives, the bank produces the Queens, New York Proxy Statement to ensure its shareholders receive accurate and relevant insights into the bank's operations. Key elements covered in the Queens, New York Proxy Statement may include: 1. Corporate Governance: The proxy statement outlines the bank's corporate governance structure, providing details about the board of directors, committees, and their specific responsibilities. It highlights the qualifications, skills, and experience of directors, ensuring they align with shareholders' interests. 2. Executive Compensation: This section discloses the compensation packages of the bank's executives, including the CEO, CFO, and other senior management. Details about salary, bonuses, stock options, retirement plans, and other benefits are provided to ensure transparency and accountability. 3. Shareholder Proposals: The proxy statement includes proposals made by shareholders and provides information on their significance and potential impact on the bank's operations. Shareholders also have the opportunity to vote on these proposals during the annual meeting. 4. Voting Information: The document outlines the voting process, including procedures for shareholders to cast their votes, whether electronically or via mail. It also provides insight into the matters on which shareholders are required to vote, such as the election of directors or approval of auditors. 5. Financial Performance and Risk Overview: The proxy statement may include summarized financial information, such as the bank's revenue, net income, assets, and liabilities. Additionally, it may discuss risk management procedures and strategies to ensure that shareholders are aware of potential risks and the bank's efforts to mitigate them. Different types of Queens, New York Proxy Statements released by University National Bank and Trust Co. may include: 1. Annual Proxy Statement: Released annually to shareholders ahead of the annual meeting, this document provides a comprehensive overview of the bank's operations, governance, and financial performance for the preceding year. 2. Special Proxy Statement: Issued when there are specific matters requiring shareholder approval outside the annual meeting, such as mergers, acquisitions, amendments to the bank's bylaws, or major corporate changes. This statement details these significant events and includes associated voting procedures. By providing this detailed proxy statement, University National Bank and Trust Co. demonstrates its commitment to transparency, accountability, and shareholder engagement, ensuring that shareholders have access to all necessary information to make informed decisions.

Queens New York Proxy Statement - University National Bank and Trust Co.

Description

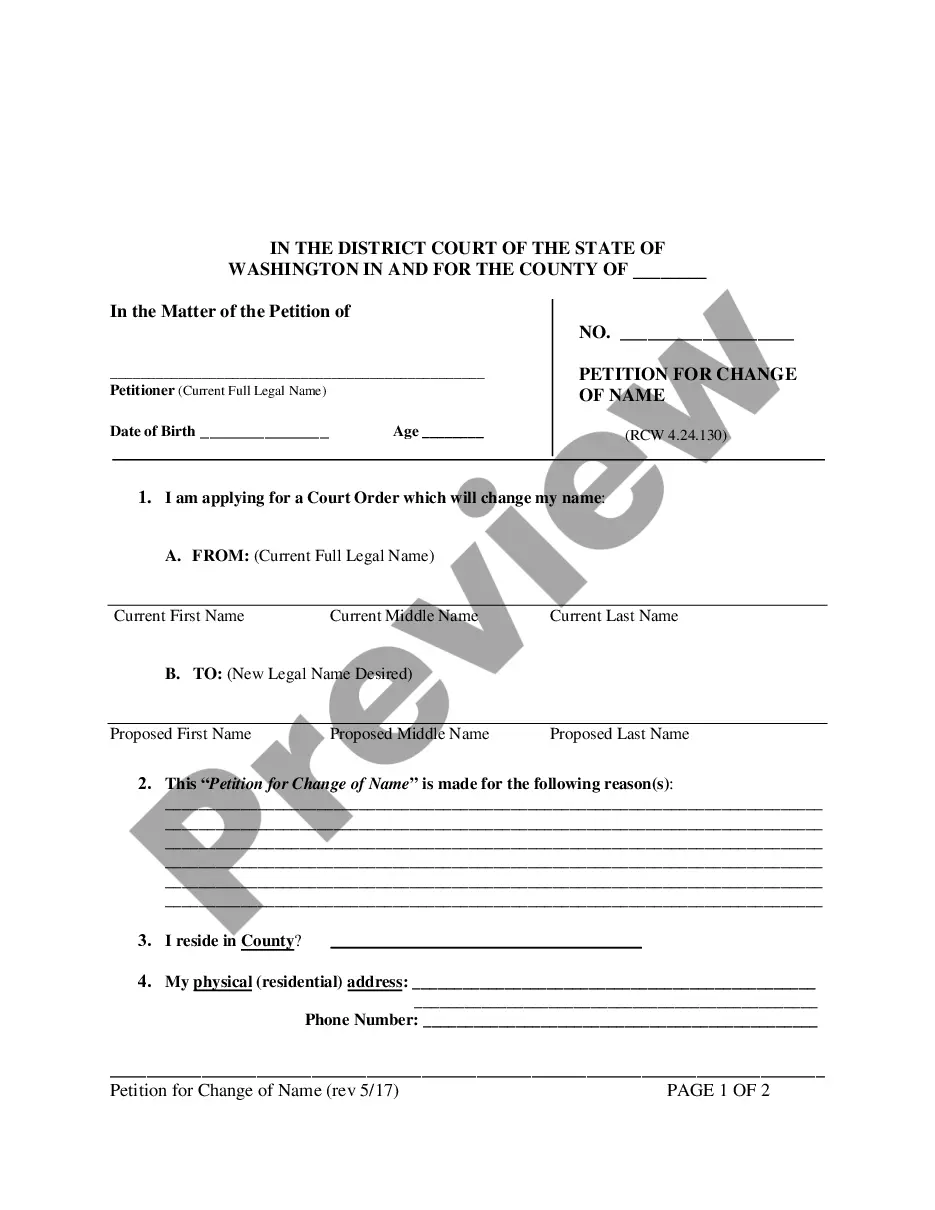

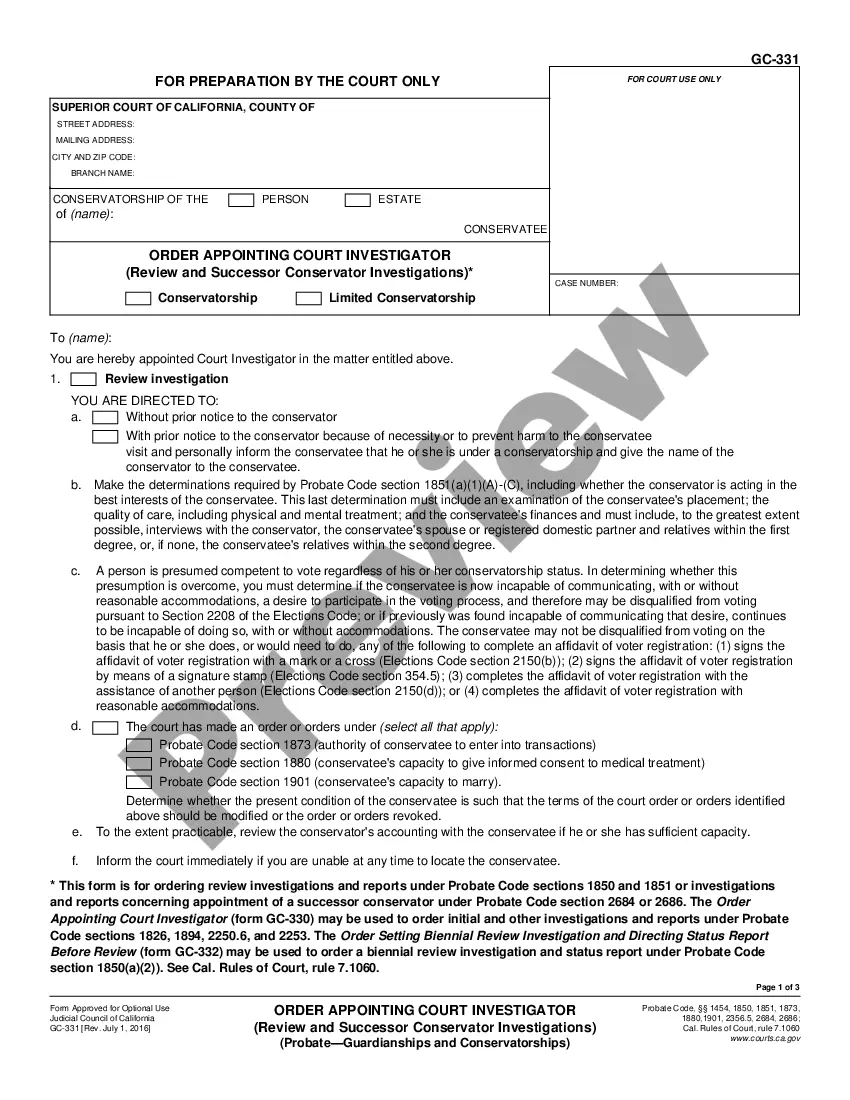

How to fill out Queens New York Proxy Statement - University National Bank And Trust Co.?

Laws and regulations in every sphere differ around the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid expensive legal assistance when preparing the Queens Proxy Statement - University National Bank and Trust Co., you need a verified template valid for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal forms. It's an excellent solution for professionals and individuals searching for do-it-yourself templates for various life and business occasions. All the documents can be used many times: once you pick a sample, it remains available in your profile for future use. Therefore, when you have an account with a valid subscription, you can simply log in and re-download the Queens Proxy Statement - University National Bank and Trust Co. from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Queens Proxy Statement - University National Bank and Trust Co.:

- Analyze the page content to make sure you found the right sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to obtain the document once you find the appropriate one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the document in writing after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

A proxy statement is a document provided by public corporations so that their shareholders can understand how to vote at shareholder meetings and make informed decisions about how to delegate their votes to a proxy.

WE'RE LOCAL AND RESPONSIVE Queensborough prides itself on our local decision-making, excellent customer service, and simple yet effective banking. We are here to help you whenever you may need it.

Definition. A person designated by another to attend a shareholders' meeting and vote on their behalf. A proxy can be revoked at any time by the grantor, unless it has been coupled with an interest.

WE'RE LOCAL AND RESPONSIVE Queensborough prides itself on our local decision-making, excellent customer service, and simple yet effective banking. We are here to help you whenever you may need it.

A proxy statement is a document containing information that the Securities and Exchange Commission requires public companies to disclose to shareholders when requesting votes ahead of an annual meeting.

These rules get their name from the common practice of management asking shareholders to provide them with a document called a proxy card granting authority to vote the shareholders' shares at the meeting.

We changed our name to First National Bank of Michigan in 1978, before making the final change to First National Bank of America (FNBA) in 1998.

Locating a Proxy Statement Online. Visit the SEC website. The SEC maintains a database, known as EDGAR, which contains financial filings by publicly traded companies. You can visit the SEC website at: .

Queensborough National Bank & Trust Company has been recognized as Georgia's Best Small Bank by Newsweek. This announcement comes with Newsweek's first-ever ranking of the financial institutions that are working to meet the needs of customers during these unprecedented times.