The Clark Nevada Stockholders' Rights Plan is a corporate governance mechanism implemented by Data scope Corp. to safeguard the interests of its stockholders. This plan, also known as a "poison pill" strategy, aims to deter hostile takeovers and protect the long-term value of the company for its shareholders. Under the Clark Nevada Stockholders' Rights Plan, Data scope Corp. issues rights to its stockholders, typically in the form of preferred shares or warrants. These rights are triggered if a hostile party acquires a certain threshold of the company's shares, typically 10-20%. Once triggered, the rights enable stockholders, except the acquiring party, to purchase additional shares of Data scope Corp. at a discounted price, effectively diluting the hostile party's ownership stake and making a takeover more expensive. These stockholders' rights plan is named after Clark County, Nevada, where Data scope Corp. is incorporated. It is a legally binding agreement that is filed with the Securities and Exchange Commission (SEC), ensuring transparency and adherence to regulatory guidelines. There are various types or provisions that can be incorporated into the Clark Nevada Stockholders' Rights Plan. Some examples include: 1. Flip-In Rights: This provision allows existing stockholders to purchase shares of the company at a discounted price if a hostile party acquires a certain threshold of shares. The discounted price ensures that stockholders are incentivized to exercise their rights and maintain control of the company. 2. Flip-Over Rights: In the event of a hostile takeover, this provision enables stockholders to acquire shares of the acquiring company at a discounted price. It gives stockholders the opportunity to benefit from the potential upside of the acquiring company and offset the negative impact of the takeover. 3. Board Approval: The Clark Nevada Stockholders' Rights Plan may include a provision that requires board approval for any potential acquisition or merger. This provision ensures that the board of directors can carefully review and evaluate any proposed transaction, thereby protecting the best interests of the stockholders. 4. Ownership Limitation: This provision sets a cap on the maximum percentage of shares any individual or entity can own, effectively preventing any single shareholder from gaining undue control of Data scope Corp. This limitation helps prevent concentrated power and preserves the board's ability to act in the best interests of the company and its stockholders. 5. Redemption: The Clark Nevada Stockholders' Rights Plan may allow Data scope Corp. to redeem the rights under certain conditions, such as if a merger or acquisition is approved by the board. This provision provides flexibility and allows the company to navigate potential strategic opportunities while still safeguarding stockholder interests. Overall, the Clark Nevada Stockholders' Rights Plan is a comprehensive strategy implemented by Data scope Corp. to protect stockholders from potential hostile takeovers, maintain control over the company, and ensure long-term value creation for its shareholders.

Clark Nevada Stockholders' Rights Plan of Datascope Corp.

Description

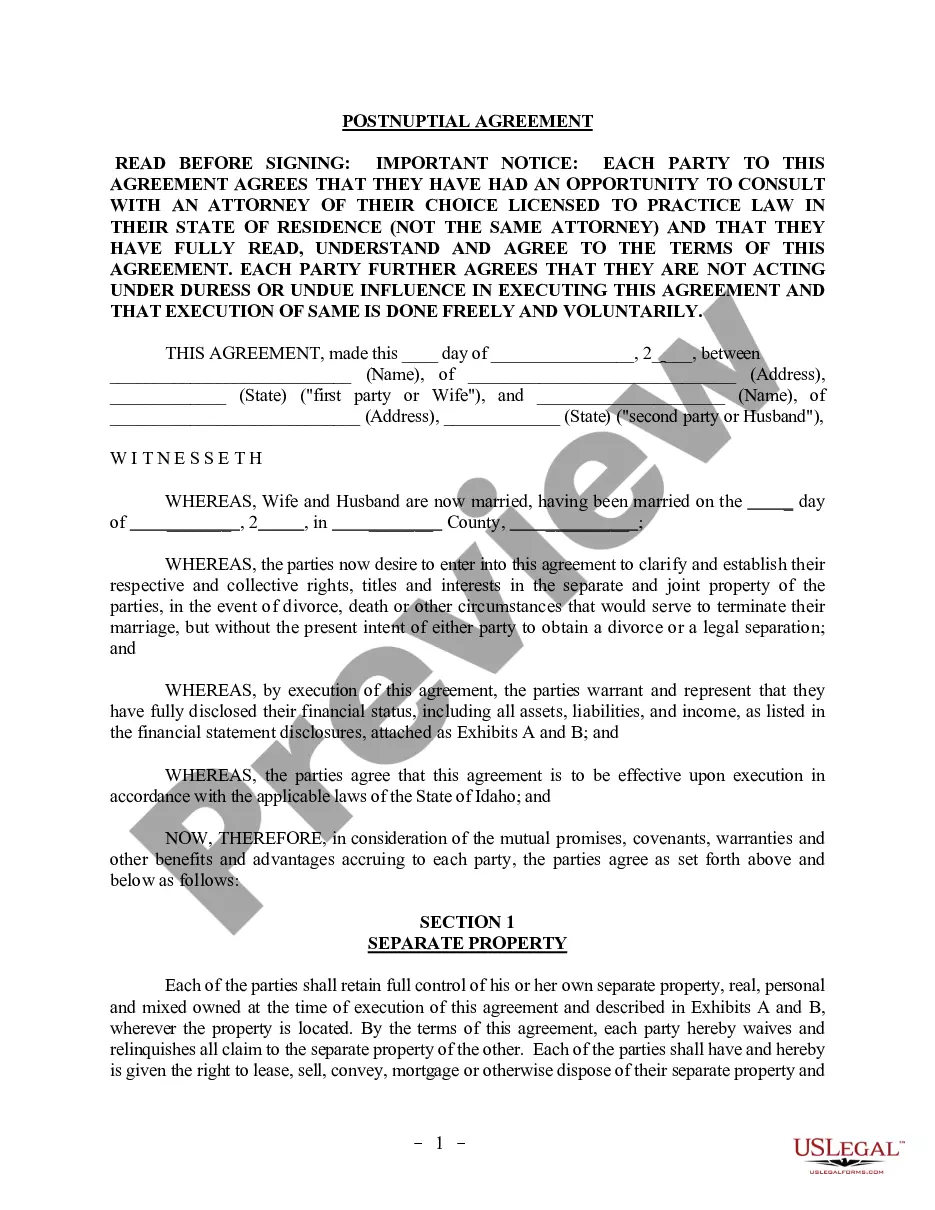

How to fill out Clark Nevada Stockholders' Rights Plan Of Datascope Corp.?

Whether you plan to open your company, enter into a contract, apply for your ID renewal, or resolve family-related legal issues, you must prepare specific paperwork corresponding to your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and checked legal templates for any individual or business occasion. All files are collected by state and area of use, so opting for a copy like Clark Stockholders' Rights Plan of Datascope Corp. is fast and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a couple of additional steps to get the Clark Stockholders' Rights Plan of Datascope Corp.. Follow the instructions below:

- Make certain the sample meets your individual needs and state law requirements.

- Read the form description and check the Preview if there’s one on the page.

- Make use of the search tab specifying your state above to locate another template.

- Click Buy Now to obtain the file when you find the correct one.

- Select the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Clark Stockholders' Rights Plan of Datascope Corp. in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our library are reusable. Having an active subscription, you can access all of your earlier acquired paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documents. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!