The Orange California Stockholders' Rights Plan is a provision established by Data scope Corp., a company based in Orange, California, to protect the rights and interests of its stockholders. This plan, also known as a "poison pill" plan, is designed to prevent hostile takeovers and ensure that shareholders have the opportunity to participate in the decision-making process. The purpose of the Orange California Stockholders' Rights Plan is to trigger certain defense mechanisms that dilute the ownership stake of any acquirer attempting to gain control of Data scope Corp. without the approval of the board of directors or majority shareholders. This plan acts as a deterrent by making it economically unattractive for a potential acquirer to accumulate a substantial number of shares. Under this plan, Data scope Corp. issues rights or options to its existing shareholders, allowing them to purchase additional shares at a significant discount if a hostile takeover is attempted. These rights typically become exercisable when a certain event occurs, such as a significant accumulation of shares by an acquirer. The Orange California Stockholders' Rights Plan of Data scope Corp. aims to provide the board of directors with more time to respond to an unsolicited takeover bid, evaluate strategic alternatives, and negotiate with potential acquirers. It can also provide the board with leverage during negotiations by imposing certain conditions on the acquirer, such as a requirement to divest certain assets or maintain certain business operations post-acquisition. It's important to note that there may be different variations or amendments to the Orange California Stockholders' Rights Plan, depending on the specific terms agreed upon by Data scope Corp. and its shareholders. These variations could include different triggers for the rights' excitability, different discount rates for purchasing additional shares, or different conditions imposed on potential acquirers. In conclusion, the Orange California Stockholders' Rights Plan of Data scope Corp. is a safeguard mechanism implemented to protect the rights and interests of shareholders by deterring hostile takeovers and giving the board of directors more time and leverage to evaluate potential transactions while safeguarding shareholder value.

Orange California Stockholders' Rights Plan of Datascope Corp.

Description

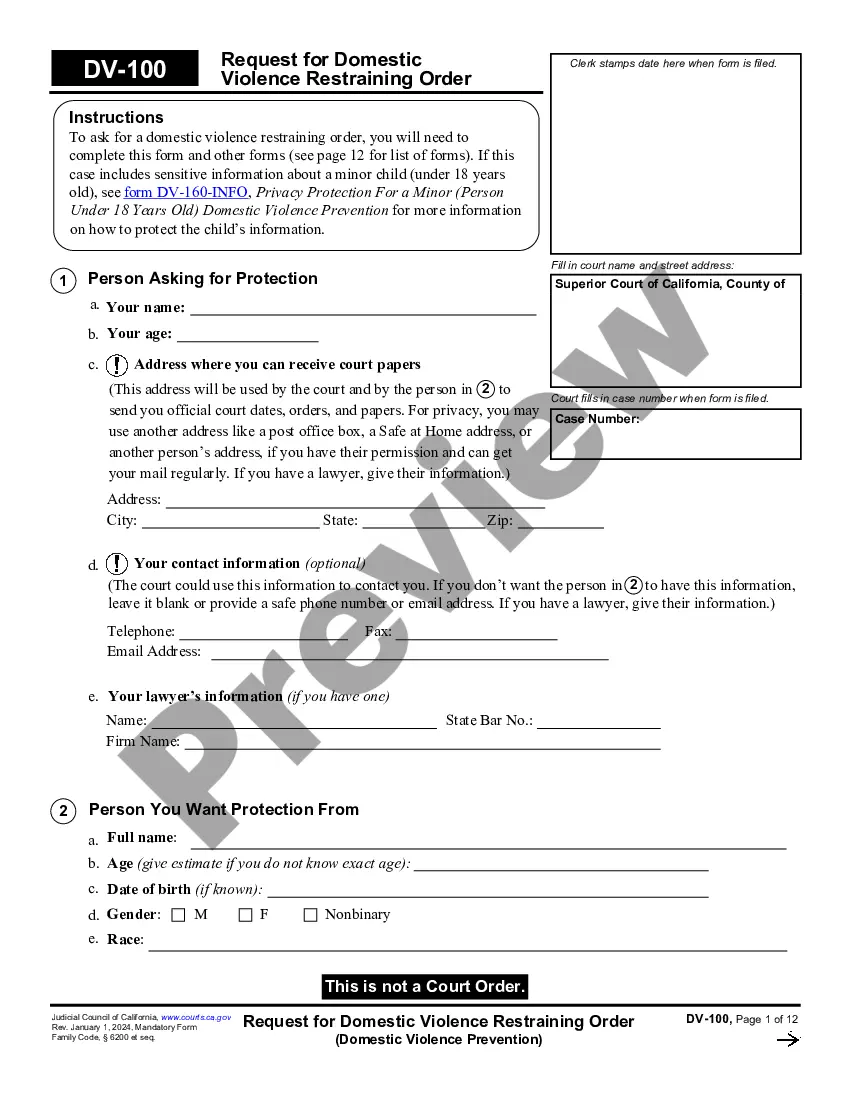

How to fill out Orange California Stockholders' Rights Plan Of Datascope Corp.?

Creating legal forms is a must in today's world. However, you don't always need to seek professional help to draft some of them from the ground up, including Orange Stockholders' Rights Plan of Datascope Corp., with a platform like US Legal Forms.

US Legal Forms has over 85,000 forms to select from in different types ranging from living wills to real estate papers to divorce documents. All forms are organized according to their valid state, making the searching experience less overwhelming. You can also find information materials and tutorials on the website to make any tasks associated with document completion straightforward.

Here's how you can find and download Orange Stockholders' Rights Plan of Datascope Corp..

- Go over the document's preview and description (if provided) to get a basic information on what you’ll get after getting the form.

- Ensure that the document of your choice is specific to your state/county/area since state laws can impact the validity of some documents.

- Examine the similar document templates or start the search over to find the appropriate file.

- Click Buy now and register your account. If you already have an existing one, choose to log in.

- Pick the option, then a needed payment method, and buy Orange Stockholders' Rights Plan of Datascope Corp..

- Choose to save the form template in any offered file format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the needed Orange Stockholders' Rights Plan of Datascope Corp., log in to your account, and download it. Of course, our website can’t replace an attorney entirely. If you have to deal with an exceptionally challenging situation, we advise using the services of an attorney to review your form before executing and filing it.

With over 25 years on the market, US Legal Forms became a go-to platform for various legal forms for millions of users. Become one of them today and get your state-specific paperwork effortlessly!