Queens New York Stockholders' Rights Plan of Data scope Corp. is a mechanism implemented by Data scope Corp., a prominent company based in Queens, New York, to safeguard the rights and interests of its stockholders. This plan, commonly known as a "poison pill," is designed to deter hostile takeovers and protect the company's shareholders from potential unfair tactics. The Queens New York Stockholders' Rights Plan grants existing stockholders certain rights that help maintain the integrity of the corporation and prevent any unwanted changes in ownership or control. These rights can be triggered if a hostile entity, often referred to as an "activist investor," acquires a specified percentage of the company's outstanding shares, typically 10% or more. Under this plan, Data scope Corp. issues rights to its shareholders in the form of preferred stock or rights certificates. These rights are exercisable if a hostile acquirer or group attempts to acquire a significant portion of the company's outstanding shares without the approval of the board of directors. The rights provide stockholders with the opportunity to purchase additional shares at a discounted price, thus diluting the holdings of the acquiring entity and making the takeover more difficult and costly. One variant of the Queens New York Stockholders' Rights Plan is the "flip-in" provision. In this scenario, when triggered, the rights permit existing shareholders, excluding the hostile acquirer, to purchase shares of the target company at a reduced price, effectively diluting the acquirer's ownership stake. Another variation is known as the "flip-over" provision. In this case, if a hostile acquirer successfully takes over the target company, the rights held by existing shareholders are triggered, allowing them to purchase shares of the acquiring company at a discounted price, thereby diluting the acquirer's ownership and influencing the control of the merged entity. The Queens New York Stockholders' Rights Plan serves as a defensive strategy to protect stockholders from potentially unfavorable outcomes resulting from hostile takeovers. It is intended to provide the board of directors with additional time to evaluate and negotiate better terms for the benefit of the shareholders while preserving the company's long-term interests. Keywords: Queens New York, Stockholders' Rights Plan, Data scope Corp., poison pill, hostile takeovers, activist investor, preferred stock, rights certificates, flip-in provision, flip-over provision, board of directors, mergers and acquisitions, defensive strategy.

Queens New York Stockholders' Rights Plan of Datascope Corp.

Description

How to fill out Queens New York Stockholders' Rights Plan Of Datascope Corp.?

Laws and regulations in every area vary from state to state. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal paperwork. To avoid expensive legal assistance when preparing the Queens Stockholders' Rights Plan of Datascope Corp., you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal templates. It's a perfect solution for professionals and individuals looking for do-it-yourself templates for various life and business situations. All the documents can be used many times: once you obtain a sample, it remains accessible in your profile for future use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Queens Stockholders' Rights Plan of Datascope Corp. from the My Forms tab.

For new users, it's necessary to make several more steps to obtain the Queens Stockholders' Rights Plan of Datascope Corp.:

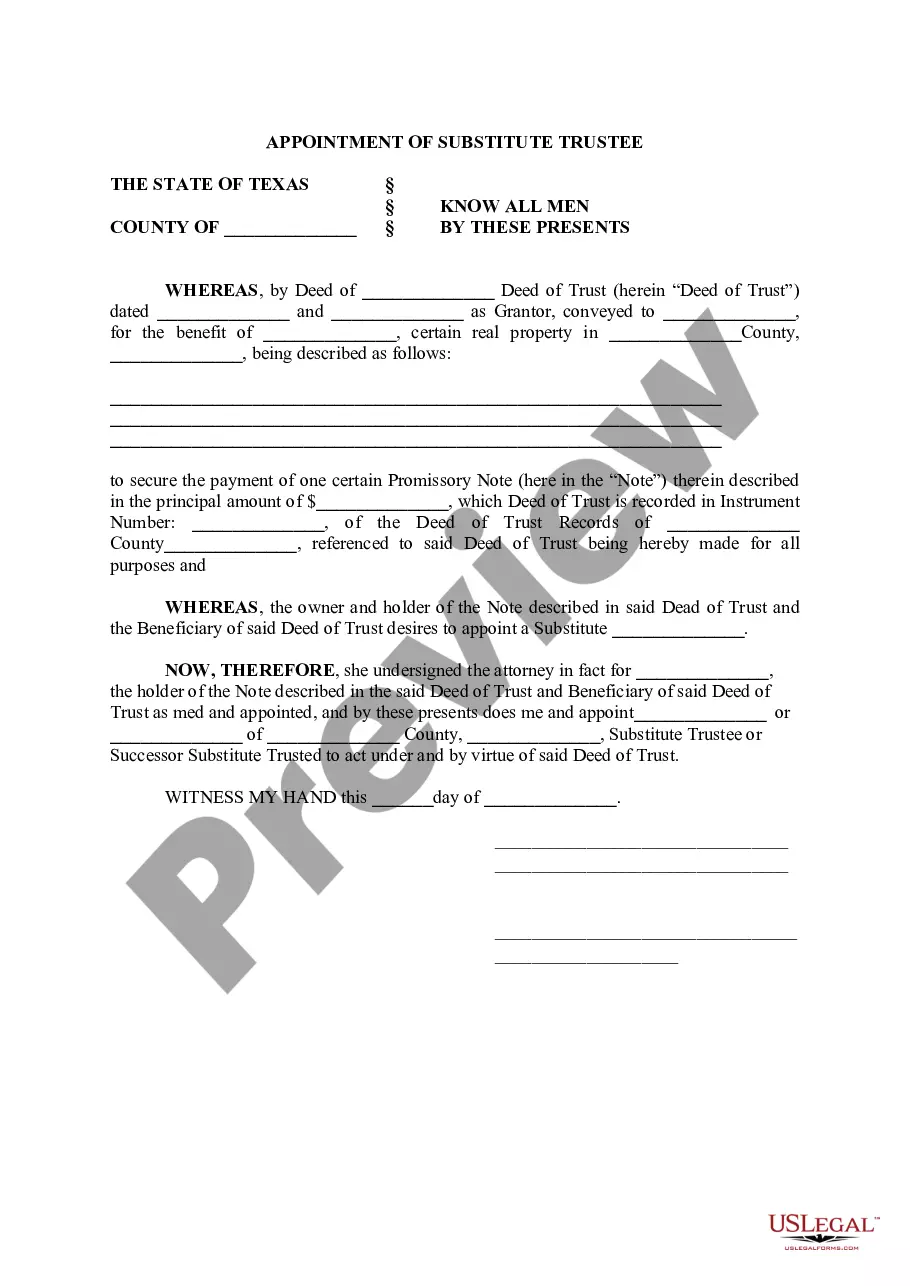

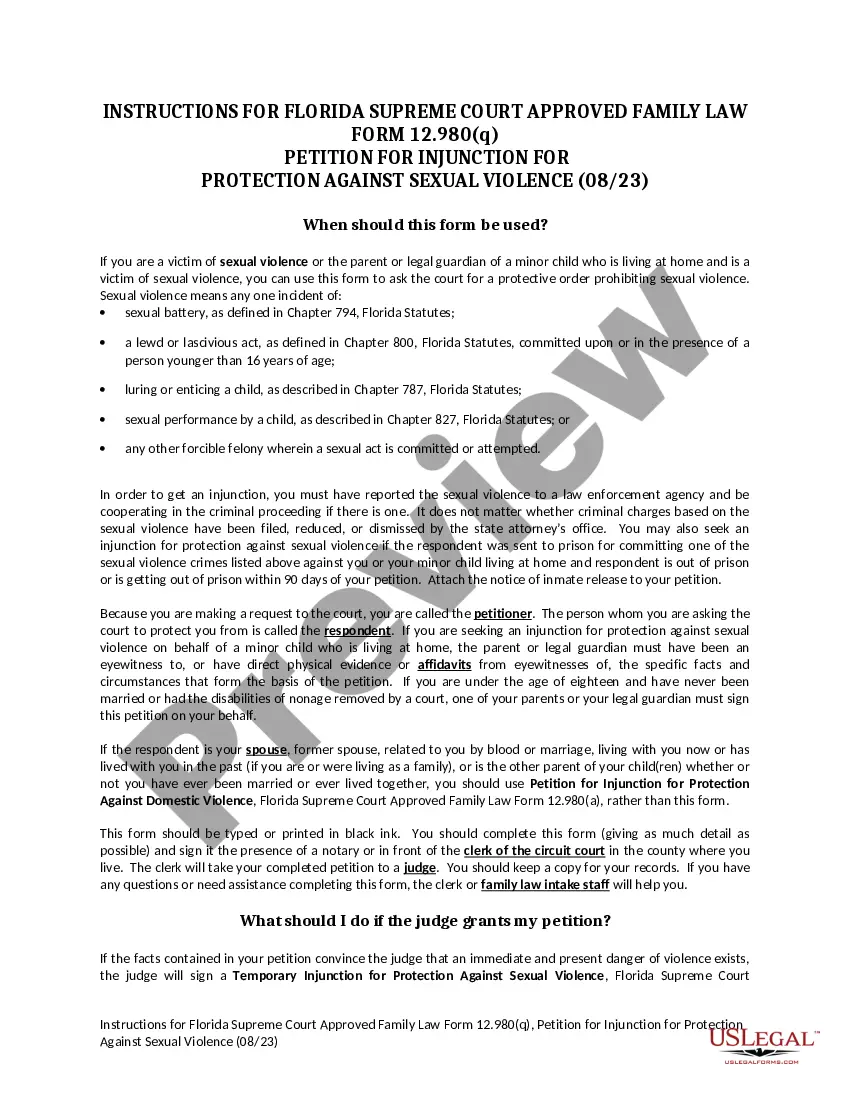

- Take a look at the page content to ensure you found the correct sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to get the document once you find the correct one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Complete and sign the document in writing after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

Basic Rights of Stockholders: Everything You Need to Know Voting Rights. Voting Rights. Right to Appoint a Proxy. Other Shareholder Rights. Justification.

Common shareholders are granted six rights: voting power, ownership, the right to transfer ownership, dividends, the right to inspect corporate documents, and the right to sue for wrongful acts.

A poison pill is a defense tactic utilized by a target company to prevent or discourage hostile takeover attempts. Poison pills allow existing shareholders the right to purchase additional shares at a discount, effectively diluting the ownership interest of a new, hostile party.

8 Common Stockholder Rights Right to inspect records. This one's pretty self-explanatory.Right to vote.Right to participate in the profits.Right to residual claim during liquidation.Right to limited liability.Transfer rights.Preemptive rights.Right to sue for wrongful acts.

A shareholder rights plan, more commonly known as a poison pill, is a company's defense against a potentially hostile, or unsolicited, takeover attempt.

Every company has a hierarchical structure of rights for the three main classes of securities that companies issue: bonds, preferred stock, and common stock.

Rights plans deter unauthorized stock accumulations by imposing substantial dilution upon any shareholder who acquires shares in excess of a specified ownership threshold (typically ten to twenty percent) without prior board approval.

A shareholders' rights plan is a defensive strategy adopted by an organization to keep hostile takeovers at bay. In this strategy, the organization gives its shareholders the right to purchase more shares at a discount with an aim to dilute the ownership interest of the organization that is planning a hostile takeover.