Houston, Texas, Changing State of Incorporation: Understanding the Process and Importance In the ever-evolving business landscape, companies in Houston, Texas may find it necessary or beneficial to change their state of incorporation. This strategic move involves shifting the legal jurisdiction that governs their corporate operations. Houston, being a thriving business hub with a favorable business environment, offers various options to corporations intending to change their state of incorporation. This detailed description aims to shed light on the process and significance of Houston, Texas, changing state of incorporation while incorporating relevant keywords to provide a comprehensive overview. 1. Houston, Texas: A Business Oasis As the fourth-largest city in the United States, Houston boasts a robust economy and diverse industries. With a thriving energy sector, a prominent medical center, a dynamic shipping port, and a rich cultural tapestry, Houston offers a multitude of business opportunities. Its business-friendly policies, extensive infrastructure, and talented workforce make it an attractive choice for companies both large and small. Companies incorporated in Houston are bound by the state laws and regulations of Texas. 2. Changing State of Incorporation: Strategic Considerations Sometimes, companies may decide to change their state of incorporation to seek enhanced business advantages, including better tax incentives, reduced regulations, improved access to capital markets, or proximity to industry peers. By shifting their state of incorporation, businesses can tap into new opportunities, gain a competitive edge, and address changing market dynamics more effectively. 3. The Process of Changing State of Incorporation in Houston, Texas a. Research and Planning: Companies must conduct thorough research to evaluate potential benefits and implications of relocating their state of incorporation. Constructing a detailed plan that incorporates legal, financial, and operational aspects is crucial. b. Compliance and Documentation: Businesses need to adhere to the legal requirements mandated by both the current state of incorporation and the desired state. This includes filing relevant documents, obtaining necessary permits, and meeting regulatory obligations. c. Shareholder Approval: In many cases, shareholders' approval is required to effectuate the change of state of incorporation. Companies must communicate the proposed changes transparently and seek necessary consents as per relevant laws and regulations. d. Business Entity Conversion: Depending on the specific requirements and desired structure, businesses can choose various methods to change their state of incorporation. This may involve merging with a new entity, forming a subsidiary, or converting their existing legal structure. e. Assets and Liabilities Transfer: Companies need to ensure a smooth transition of assets, liabilities, contracts, and licenses during this process. Legal professionals may need to be engaged to oversee the transfer and ensure compliance. f. Post-Incorporation Considerations: After successfully changing their state of incorporation, businesses must update various legal documents, licenses, permits, and registrations to reflect the new jurisdiction. 4. Types of Houston, Texas, Changing State of Incorporation a. Domestic to Domestic: Companies incorporated in Texas but desiring to move to another state within the United States can undergo a domestic to domestic state of incorporation change. b. Domestic to Foreign: If a Texas-incorporated business wishes to transition its operations to a foreign state, such as Delaware, it can pursue a domestic to foreign state of incorporation change. c. Foreign to Domestic: Companies initially incorporated in a foreign state but seeking to establish their base in Houston, Texas, opt for a foreign to domestic state of incorporation change. d. Foreign to Foreign: Businesses incorporated in a foreign state that wish to change their state of incorporation while remaining in another foreign state pursue a foreign to foreign state of incorporation change. In conclusion, Houston, Texas, changing state of incorporation offers businesses the flexibility to adapt to changing business and legal landscapes. With its vibrant economy, conducive business environment, and strategic advantages, Houston attracts companies looking to enhance their operations by shifting their state of incorporation. By following a systematic process and complying with legal requirements, businesses can successfully transition into new jurisdictions and unlock a realm of opportunities for growth and success.

Houston Texas Changing state of incorporation

Description

How to fill out Houston Texas Changing State Of Incorporation?

Laws and regulations in every area vary from state to state. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal documentation. To avoid high priced legal assistance when preparing the Houston Changing state of incorporation, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal forms. It's a great solution for professionals and individuals searching for do-it-yourself templates for various life and business scenarios. All the documents can be used many times: once you pick a sample, it remains accessible in your profile for subsequent use. Therefore, when you have an account with a valid subscription, you can simply log in and re-download the Houston Changing state of incorporation from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the Houston Changing state of incorporation:

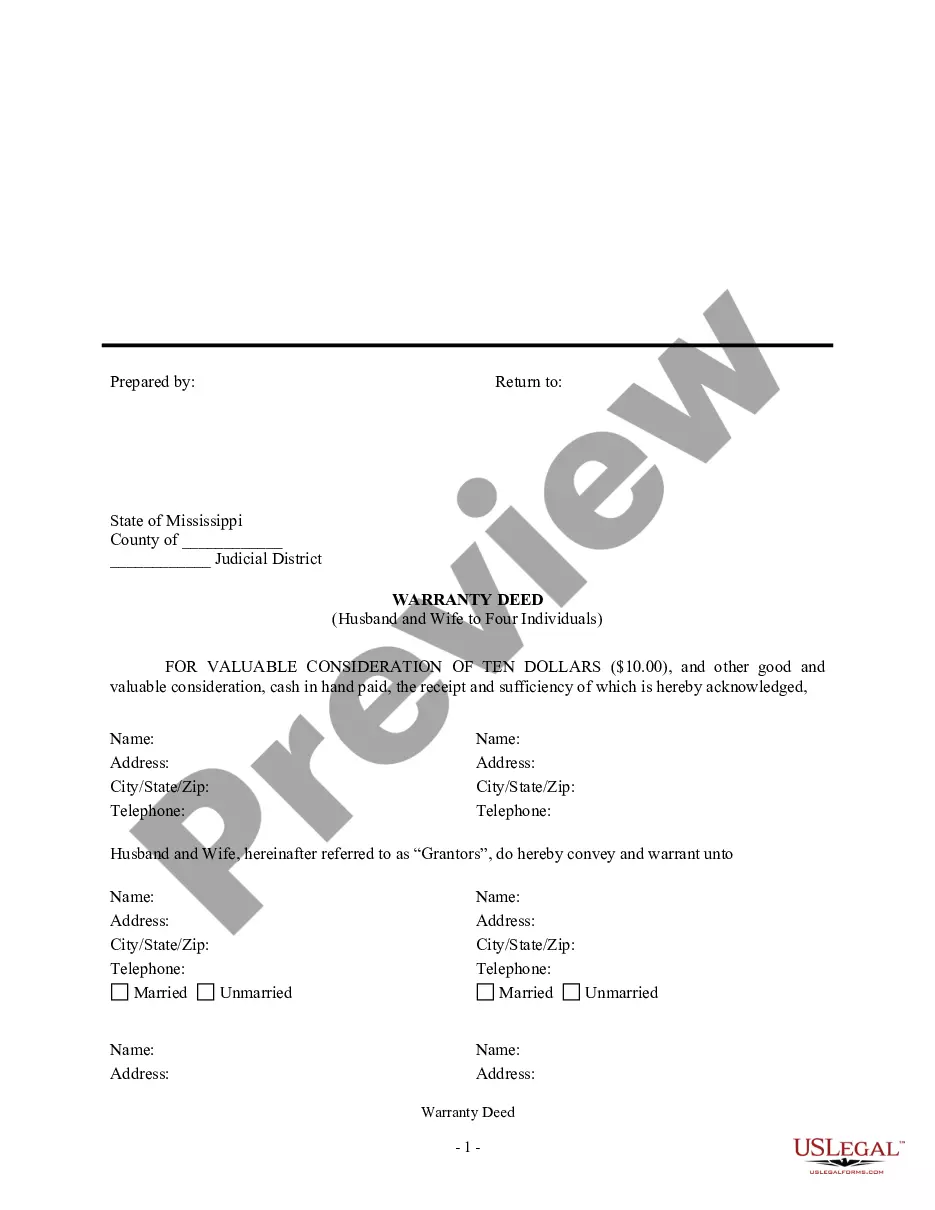

- Analyze the page content to make sure you found the correct sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to obtain the template when you find the right one.

- Choose one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your documentation in order with the US Legal Forms!