Oakland Michigan Plan of Conversion from State Stock Savings Bank to Federal Stock Savings Bank The Oakland Michigan Plan of Conversion from a state stock savings bank to a federal stock savings bank refers to the process through which a financial institution based in Oakland, Michigan transitions its charter from being regulated by the state to being regulated by federal banking authorities. This conversion allows the bank to operate under the supervision and guidelines set forth by the Office of the Comptroller of the Currency (OCC), a division of the United States Department of the Treasury. The conversion process involves various steps and requirements. Firstly, the bank's board of directors must approve the decision to convert and draft a detailed conversion plan. It is essential for the plan to adhere to the rules and regulations set forth by both state and federal authorities. The conversion plan should include a comprehensive analysis of why the bank is seeking to change its regulatory status, the potential benefits of becoming a federal stock savings bank, and the anticipated timeline for completing the conversion. Additionally, the plan must outline the procedural steps that will be taken during the conversion process, such as obtaining necessary approvals, notifying shareholders and customers, and addressing any financial or legal matters. Within the Oakland Michigan Plan of Conversion, there may be various types or variations of the conversion process based on the specific objectives and circumstances of the bank. These could include: 1. Mutual-to-stock conversion: This occurs when a mutual savings bank (owned by its depositors) converts to a stock savings bank (owned by shareholders) as part of the transition to a federal charter. 2. Full-service bank conversion: Some savings banks may choose to expand their services and convert to a full-service bank, providing additional financial products such as loans and checking accounts. This conversion includes the transition to a federal stock savings bank. 3. Regional conversion: In certain cases, a savings bank may opt for a regional conversion, where it expands its operations and customer base by forming branches or merging with other banks within a specific region. This type of conversion may also involve the transition to a federal stock savings bank. It is important for banks considering a conversion to carefully evaluate the advantages and disadvantages of becoming a federal stock savings bank. Benefits may include greater regulatory consistency, expanded lending opportunities, the ability to accept higher-value deposits, and enhanced access to federal deposit insurance programs. However, there are also considerations such as increased regulatory scrutiny, potential changes to corporate governance, and compliance with new reporting requirements. In conclusion, the Oakland Michigan Plan of Conversion from state stock savings bank to federal stock savings bank is a strategic move that allows financial institutions in Oakland, Michigan to transition from state to federal regulatory control. The specific type of conversion may vary based on the bank's objectives, such as mutual-to-stock conversion, full-service bank conversion, or regional conversion.

Oakland Michigan Plan of Conversion from state stock savings bank to federal stock savings bank

Description

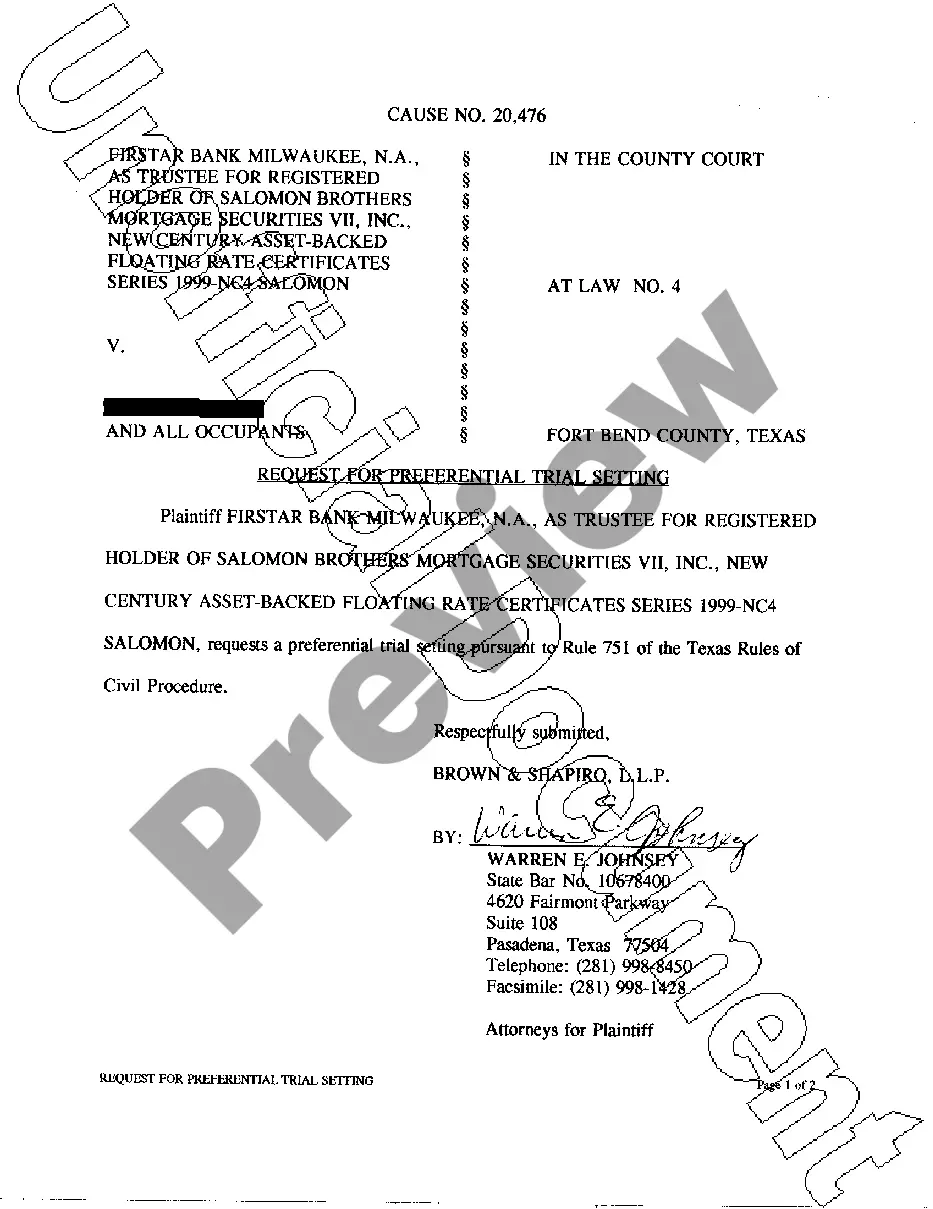

How to fill out Oakland Michigan Plan Of Conversion From State Stock Savings Bank To Federal Stock Savings Bank?

Whether you intend to open your business, enter into a deal, apply for your ID renewal, or resolve family-related legal concerns, you need to prepare specific paperwork corresponding to your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and verified legal templates for any personal or business occurrence. All files are grouped by state and area of use, so opting for a copy like Oakland Plan of Conversion from state stock savings bank to federal stock savings bank is quick and simple.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a couple of additional steps to get the Oakland Plan of Conversion from state stock savings bank to federal stock savings bank. Follow the guide below:

- Make certain the sample meets your personal needs and state law requirements.

- Read the form description and check the Preview if there’s one on the page.

- Make use of the search tab specifying your state above to find another template.

- Click Buy Now to obtain the file once you find the proper one.

- Choose the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Oakland Plan of Conversion from state stock savings bank to federal stock savings bank in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our library are multi-usable. Having an active subscription, you can access all of your earlier purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documents. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!