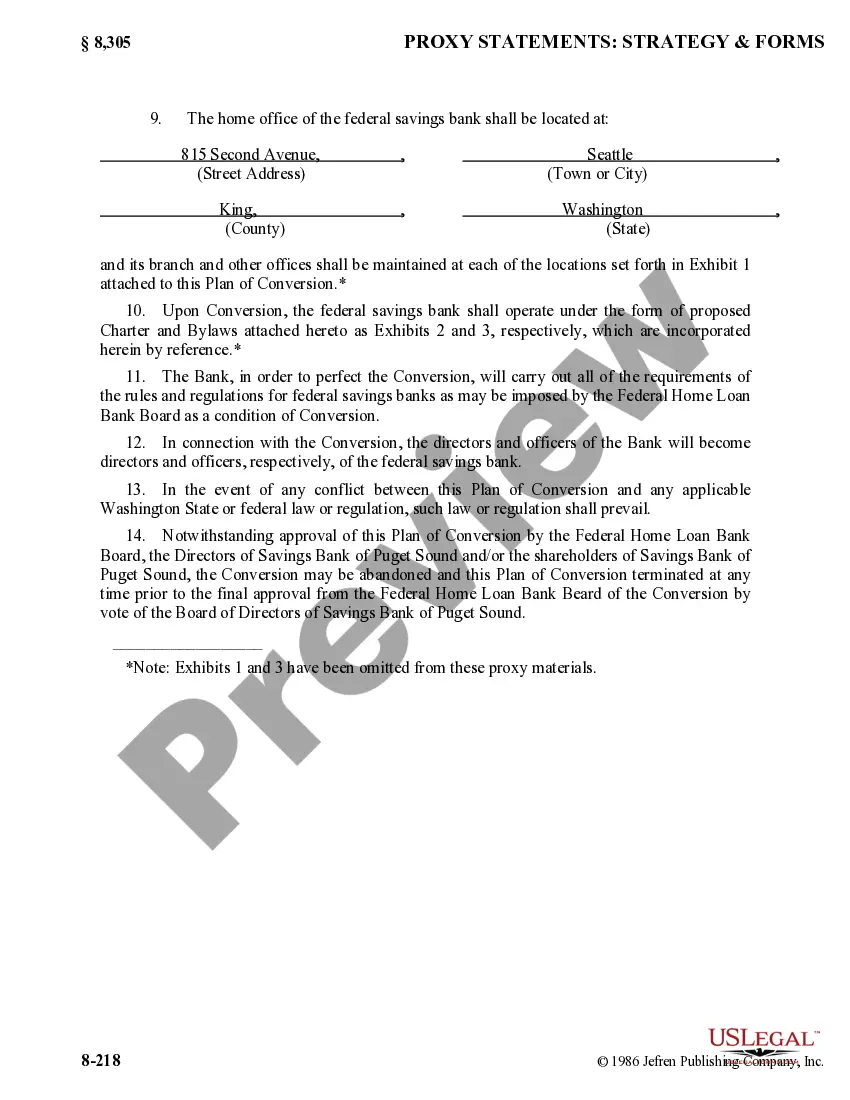

The Orange California Plan of Conversion from state stock savings bank to federal stock savings bank refers to the process where a state stock savings bank in Orange, California transitions its operations and structure to become a federal stock savings bank. This decision might be driven by various factors, including a desire to expand business opportunities, enhance regulatory oversight, access new markets, or gain additional financial resources. The conversion process typically involves thorough evaluation, planning, and execution. Initially, the management of the state stock savings bank in Orange, California would conduct an in-depth analysis of the benefits and potential drawbacks associated with converting to a federal stock savings bank. This evaluation would consider factors such as changes in regulatory compliance, potential tax implications, and the impact on existing shareholders and customers. After careful consideration, the bank's management would proceed with developing a comprehensive plan for the conversion. This plan would outline the steps, timing, and required resources for successfully transitioning from a state stock savings bank to a federal stock savings bank. It would involve obtaining the necessary approvals from regulatory authorities, such as the Office of the Comptroller of the Currency (OCC) or the Federal Deposit Insurance Corporation (FDIC). The Orange California Plan of Conversion would also entail engaging legal and financial experts to ensure compliance with federal banking regulations, drafting updated bylaws and policies, and establishing a new governance structure that aligns with the requirements of federal charters. Additionally, the plan might encompass securing the support and consent of existing shareholders, as their interests and rights might be affected by the conversion. In some cases, there may be specific types of Orange California Plans of Conversion. For example, a bank might pursue a mutual-to-stock conversion, which involves transitioning from a mutual savings association to a stock savings bank. This conversion allows the bank to raise capital by issuing shares to investors. Alternatively, a bank might opt for a full-conversion, where it entirely ceases to operate as a state stock savings bank and becomes a federal stock savings bank. Overall, the Orange California Plan of Conversion from state stock savings bank to federal stock savings bank is a complex process that demands careful planning, regulatory compliance, and stakeholder consent. It aims to provide the bank with enhanced opportunities and resources while ensuring the seamless transition of operations and continuity of services for customers.

Orange California Plan of Conversion from state stock savings bank to federal stock savings bank

Description

How to fill out Orange California Plan Of Conversion From State Stock Savings Bank To Federal Stock Savings Bank?

Dealing with legal forms is a necessity in today's world. Nevertheless, you don't always need to seek professional help to create some of them from the ground up, including Orange Plan of Conversion from state stock savings bank to federal stock savings bank, with a service like US Legal Forms.

US Legal Forms has over 85,000 forms to choose from in different categories varying from living wills to real estate papers to divorce papers. All forms are organized according to their valid state, making the searching experience less challenging. You can also find detailed materials and tutorials on the website to make any tasks related to paperwork completion simple.

Here's how you can locate and download Orange Plan of Conversion from state stock savings bank to federal stock savings bank.

- Take a look at the document's preview and description (if provided) to get a basic information on what you’ll get after getting the document.

- Ensure that the template of your choosing is specific to your state/county/area since state laws can affect the validity of some documents.

- Examine the similar document templates or start the search over to locate the appropriate document.

- Hit Buy now and register your account. If you already have an existing one, choose to log in.

- Pick the option, then a needed payment gateway, and buy Orange Plan of Conversion from state stock savings bank to federal stock savings bank.

- Choose to save the form template in any available format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the needed Orange Plan of Conversion from state stock savings bank to federal stock savings bank, log in to your account, and download it. Needless to say, our website can’t take the place of an attorney completely. If you need to cope with an extremely difficult situation, we recommend getting a lawyer to check your form before executing and submitting it.

With more than 25 years on the market, US Legal Forms proved to be a go-to provider for various legal forms for millions of customers. Become one of them today and purchase your state-specific paperwork effortlessly!