Riverside, California, Plan of Conversion from State Stock Savings Bank to Federal Stock Savings Bank The Riverside, California, Plan of Conversion from state stock savings bank to federal stock savings bank refers to the process in which a state-chartered stock savings bank located in Riverside, California, undergoes a conversion to a federally-chartered stock savings bank. This conversion is a complex and detailed process governed by the regulations set forth by the relevant regulatory authorities. This conversion plan is designed to enable the savings bank to transition from being regulated by the state banking agency to being regulated by the Office of the Comptroller of the Currency (OCC) at the federal level. The conversion allows the bank to benefit from the supervision and oversight of a national regulatory body, expand its reach beyond the state boundaries, and potentially access broader banking services to enhance its offerings to customers. The Riverside, California, Plan of Conversion involves several key steps and considerations. These include obtaining all necessary approvals and permits from regulatory agencies, creating a comprehensive conversion plan outlining the entire process, and ensuring compliance with all federal and state laws governing the conversion. During the conversion, the savings bank must also address certain matters, such as shareholders' rights, financial implications, employee considerations, and customer communications. The conversion plan typically includes a detailed timeline, information about the new governance structure, the rights and responsibilities of shareholders, and the potential impact on existing accounts, loans, and services provided by the bank. In Riverside, California, there may be different types of plans for converting state stock savings banks to federal stock savings banks. These could include: 1. Full Conversion Plan: This type of conversion plan involves a complete transition of the bank's regulatory jurisdiction from the state to federal level. It encompasses all aspects of the conversion process, ensuring full compliance with the necessary regulations. 2. Partial Conversion Plan: In some cases, a savings bank may opt for a partial conversion, whereby only certain aspects of its operations are transferred to federal jurisdiction. This type of plan allows the bank to retain some state regulatory benefits while gaining certain federal regulatory advantages. 3. Merger Conversion Plan: Sometimes, a state stock savings bank may choose to convert by merging with an existing federal stock savings bank. In this scenario, the conversion plan details the merger process, including the integration of systems, regulatory compliance, and the merging of operations. 4. Mutual Holding Company (MHC) Conversion Plan: A MHC conversion plan involves the formation of a mutual holding company structure and the conversion of the subsidiary savings bank from state to federal stock savings bank status. This plan offers additional benefits such as enhanced capital flexibility and potential expansion opportunities. The Riverside, California, Plan of Conversion from state stock savings bank to federal stock savings bank aims to ensure a smooth transition for the bank, its shareholders, employees, and customers. It is crucial for the savings bank to work closely with legal and regulatory advisors to navigate the complexities involved in the conversion process, ultimately paving the way for the successful establishment of a federally-chartered stock savings bank in Riverside, California.

Riverside California Plan of Conversion from state stock savings bank to federal stock savings bank

Description

How to fill out Riverside California Plan Of Conversion From State Stock Savings Bank To Federal Stock Savings Bank?

Laws and regulations in every area differ throughout the country. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal documentation. To avoid costly legal assistance when preparing the Riverside Plan of Conversion from state stock savings bank to federal stock savings bank, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal templates. It's an excellent solution for specialists and individuals searching for do-it-yourself templates for different life and business situations. All the documents can be used multiple times: once you purchase a sample, it remains accessible in your profile for further use. Thus, if you have an account with a valid subscription, you can simply log in and re-download the Riverside Plan of Conversion from state stock savings bank to federal stock savings bank from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Riverside Plan of Conversion from state stock savings bank to federal stock savings bank:

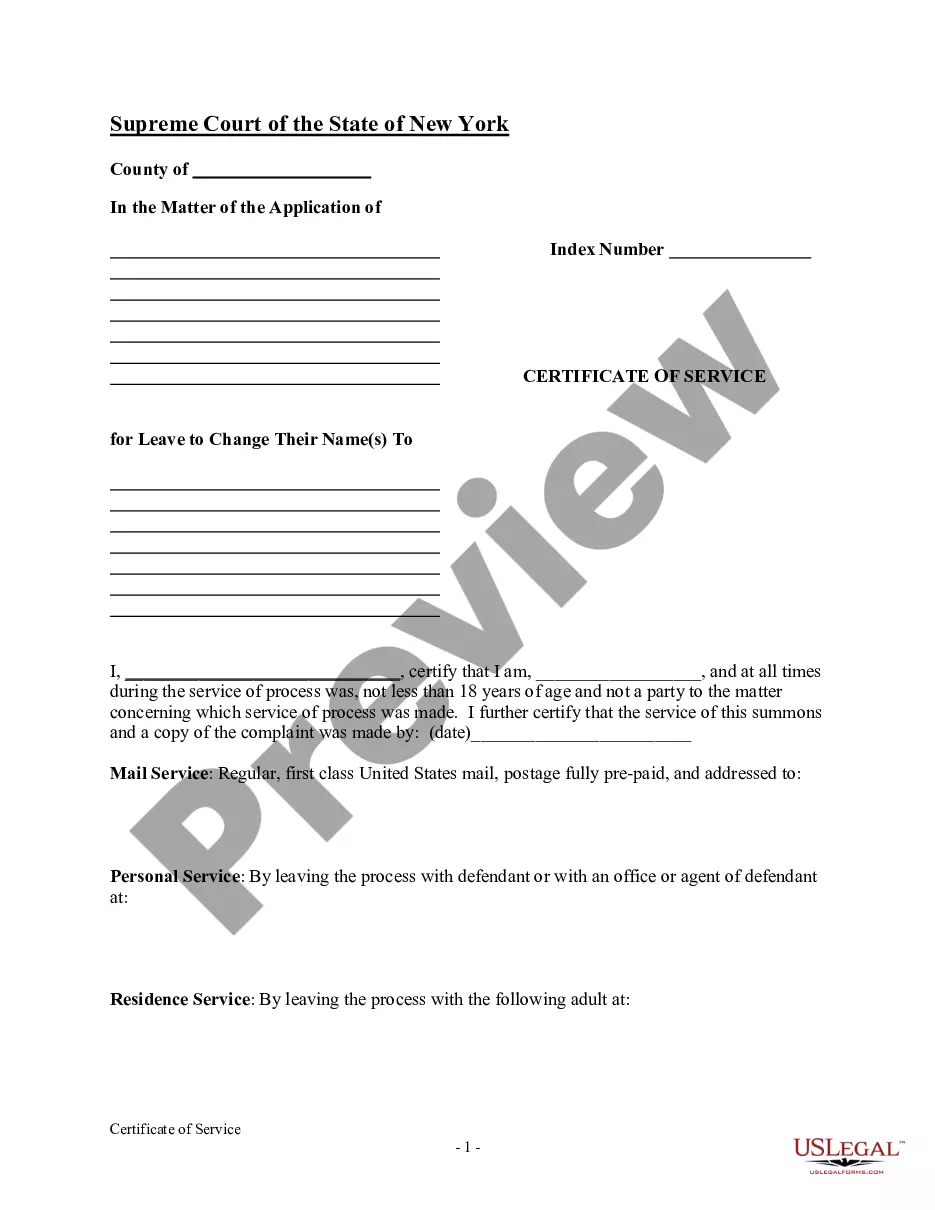

- Analyze the page content to make sure you found the correct sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to obtain the template when you find the correct one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

1 : the act of changing : the process of being changed They've finished the conversion of the old school into an apartment building. 2 : a change of religion. conversion. noun. con·200bver·200bsion \\ k0259n-02c8v0259r-zh0259n, -sh0259n \\

Mutual to stock conversions are highly complex corporate reorganizations where a company which is owned by its depositors (if it is a financial institution such as a savings bank) or by its members or policyholders (if it is a mutual insurer) changes its form of organization to one where the mutual members' rights

With a bank or savings association mutual-to-stock conversion, however, eligible depositors have a unique opportunity to participate and purchase shares because federal and state banking regulations require that the bank or savings association give depositors first priority to purchase the stock over all other

Check conversion is a reformatting service offered by banking merchants. Check conversion allows banks to convert paper checks into electronic ones and then send them to the appropriate receiving bank. The electronic check is forwarded via the automated clearing house (ACH).

Mutual banks are owned by their borrowers and depositors. Ownership and profit sharing are what differentiate mutual banks from stock banks, which are owned and controlled by individual and institutional shareholders that profit from them.

A thrift holding company that is owned by shareholders but controlled by the depositors of the subsidiary thrift. A mutual holding company holds a majority of the voting stock of the subsidiary thrift, while the remaining 49.9% of the thrift's stock can be sold to outside investors.

A conversion merger is when a mutual institution simultaneously acquires a stock institution at the same time it completes a standard stock conversion. A mutual FSA may acquire another insured institution that is already in the stock form of ownership at the time of its stock conversion transaction.

No member control: Mutual savings banks are mutual associations, meaning they are owned, but not controlled, by depositors. Instead, control goes to a board of trustees that often remains the same for years. The board self governs and answers to no one.

A conversion is defined as an exchange from one unit of measure to another. An example of conversion is exchanging dollars for euros. An example of conversion is figuring out how many cups are in a liter.