Dallas Texas Plan of Liquidation refers to a legal process wherein a company or organization creates a detailed strategy for winding up its affairs and distributing its assets among its stakeholders. This plan is designed to outline the steps, procedures, and timelines to be followed during the liquidation process. The Dallas Texas Plan of Liquidation can vary based on the nature of the entity being liquidated. Here are different types of Dallas Texas Plans of Liquidation: 1. Corporate Liquidation: This type of plan is relevant for corporations that have decided to dissolve and liquidate their assets due to financial difficulties, expiration of the business term, merger/acquisition, or any other reason. The Dallas Texas Plan of Liquidation for corporations typically includes the appointment of a liquidator, sale of assets, payment of creditors, and distribution of remaining funds to shareholders. 2. Bankruptcy Liquidation: When a business entity in Dallas Texas becomes insolvent and files for bankruptcy, it may opt for a liquidation plan under Chapter 7 bankruptcy. This plan involves the appointment of a trustee who oversees the sale of assets, settlement of debts, and distribution of funds among creditors according to a predetermined priority order. 3. Partnership Liquidation: In the case of a partnership dissolution in Dallas Texas, partners may create a Plan of Liquidation to outline the procedures for selling partnership assets, paying off outstanding debts, and distributing the remaining assets among the partners. This plan typically addresses the rights and responsibilities of the partners during the liquidation process. 4. Non-Profit Organization Liquidation: Non-profit organizations based in Dallas Texas may decide to cease operations and liquidate their assets. The Plan of Liquidation for non-profits includes steps to notify beneficiaries and creditors, sell assets, settle outstanding obligations, and allocate remaining funds to other charitable organizations in accordance with the organization's mission. 5. Estate Liquidation: When an individual passes away in Dallas Texas, their estate may need to go through liquidation to settle debts, pay taxes, and distribute assets among heirs. The Plan of Liquidation for estates involves identifying and appraising assets, repaying creditors, filing tax returns, and adhering to legal requirements. In conclusion, the Dallas Texas Plan of Liquidation is a structured approach followed by various entities, such as corporations, partnerships, non-profits, bankrupt entities, and estates, when they decide to dissolve and distribute their assets and liabilities. This plan outlines the necessary steps and procedures required to wind up affairs and ensure a fair distribution of funds among stakeholders.

Dallas Texas Plan of Liquidation

Description

How to fill out Dallas Texas Plan Of Liquidation?

Laws and regulations in every sphere vary from state to state. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal documents. To avoid costly legal assistance when preparing the Dallas Plan of Liquidation, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal templates. It's a perfect solution for professionals and individuals searching for do-it-yourself templates for different life and business occasions. All the forms can be used many times: once you pick a sample, it remains accessible in your profile for future use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Dallas Plan of Liquidation from the My Forms tab.

For new users, it's necessary to make several more steps to get the Dallas Plan of Liquidation:

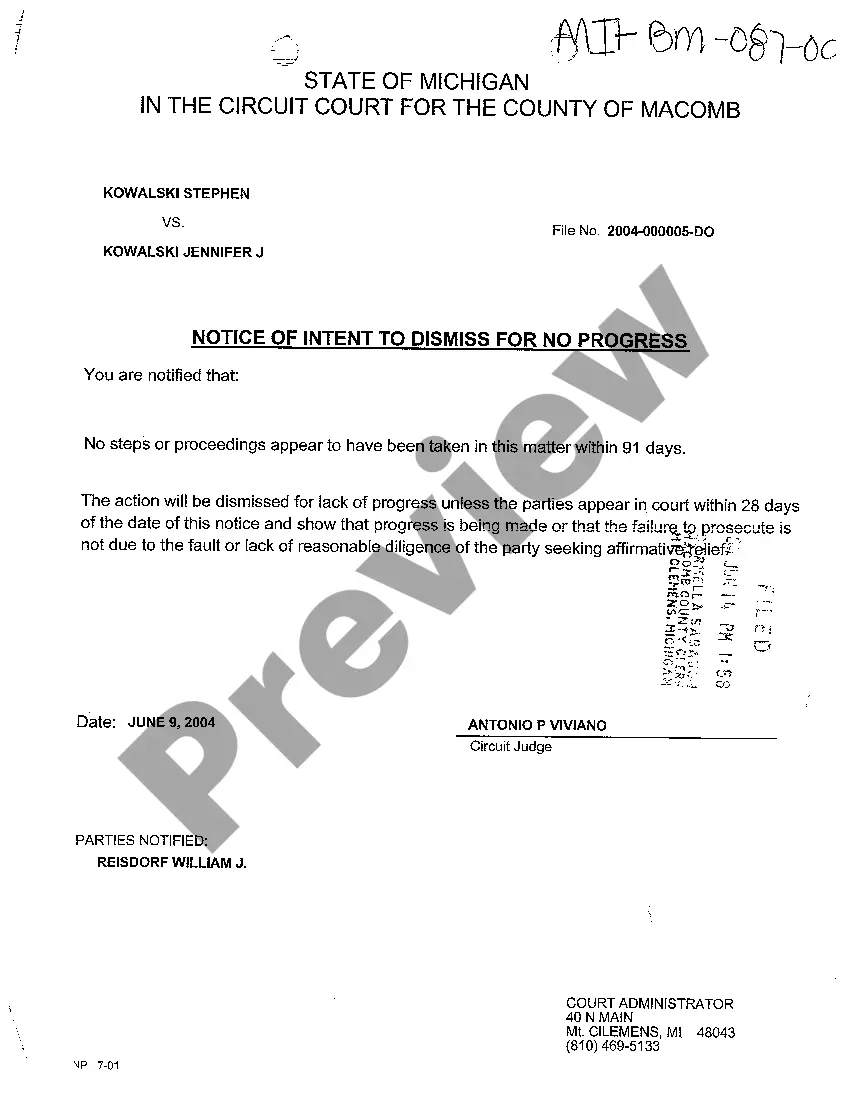

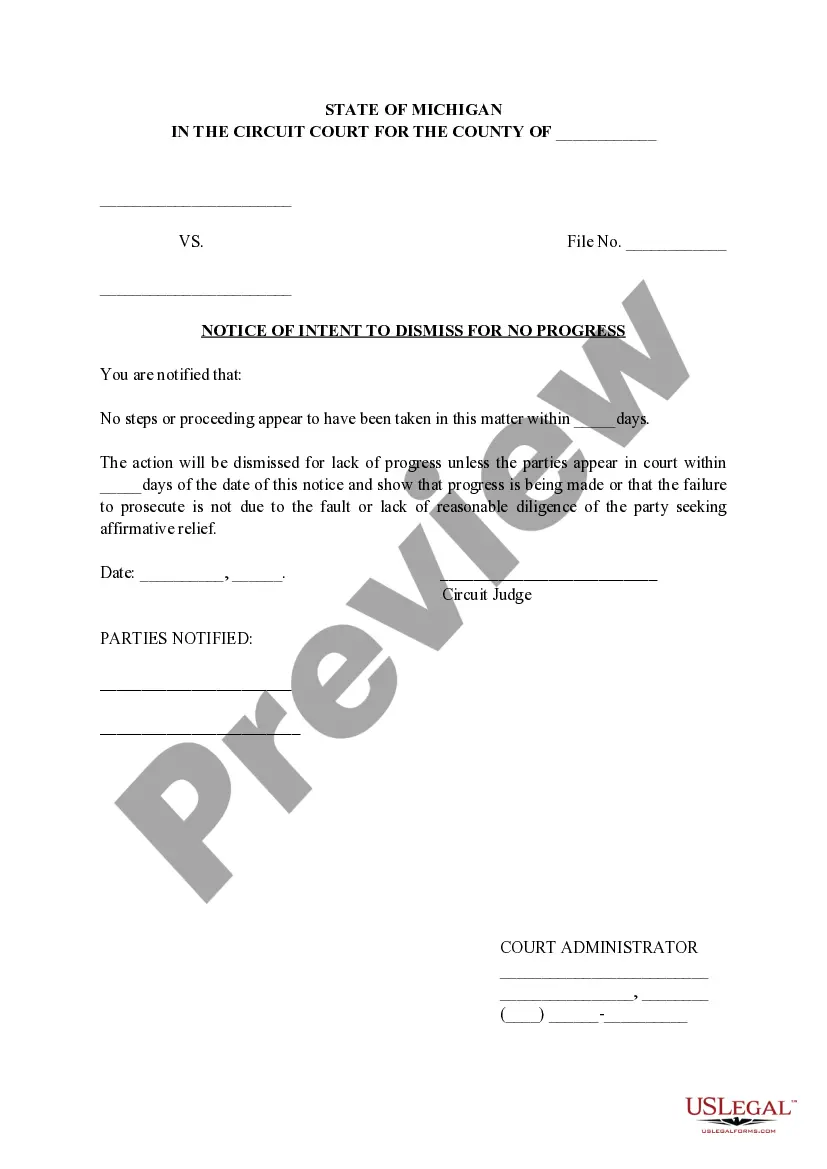

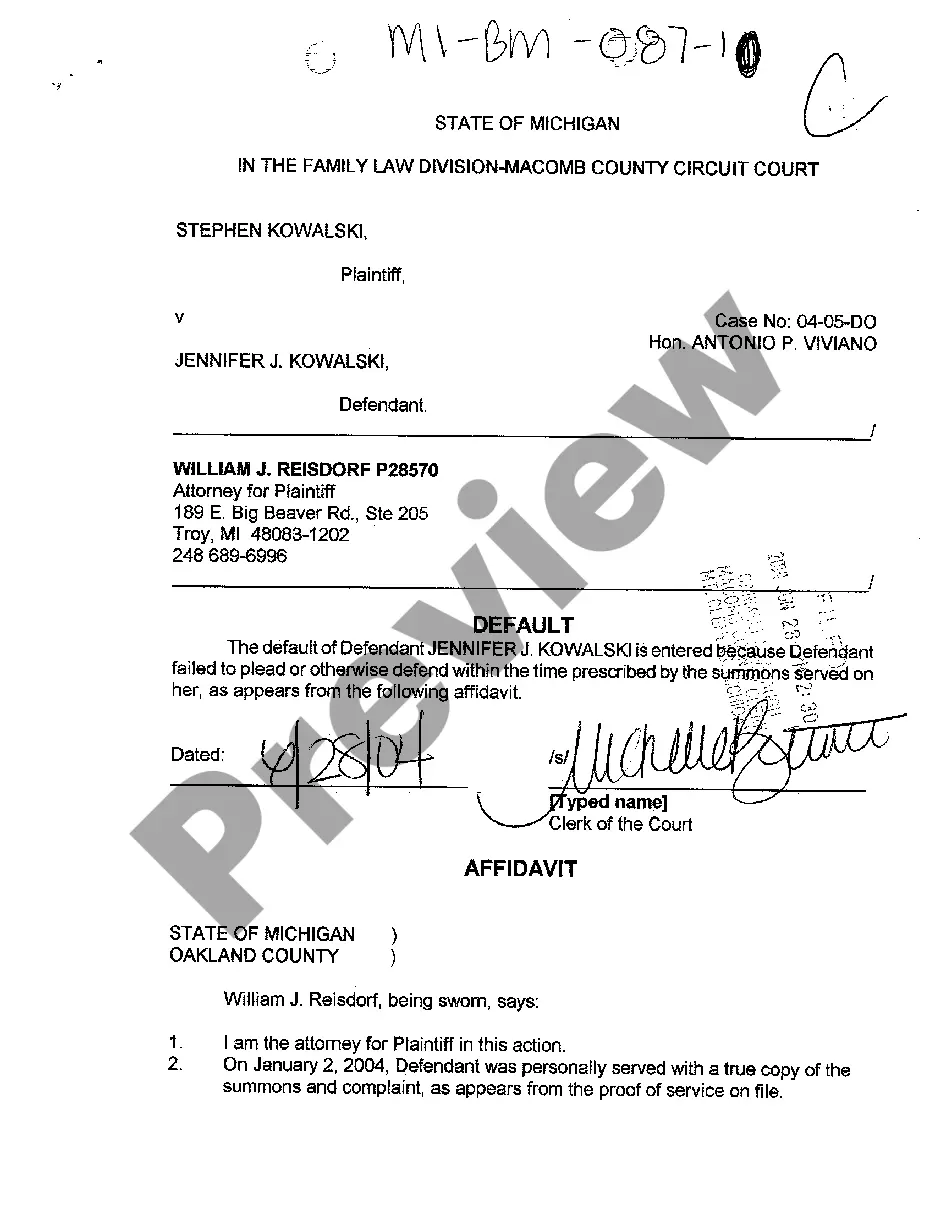

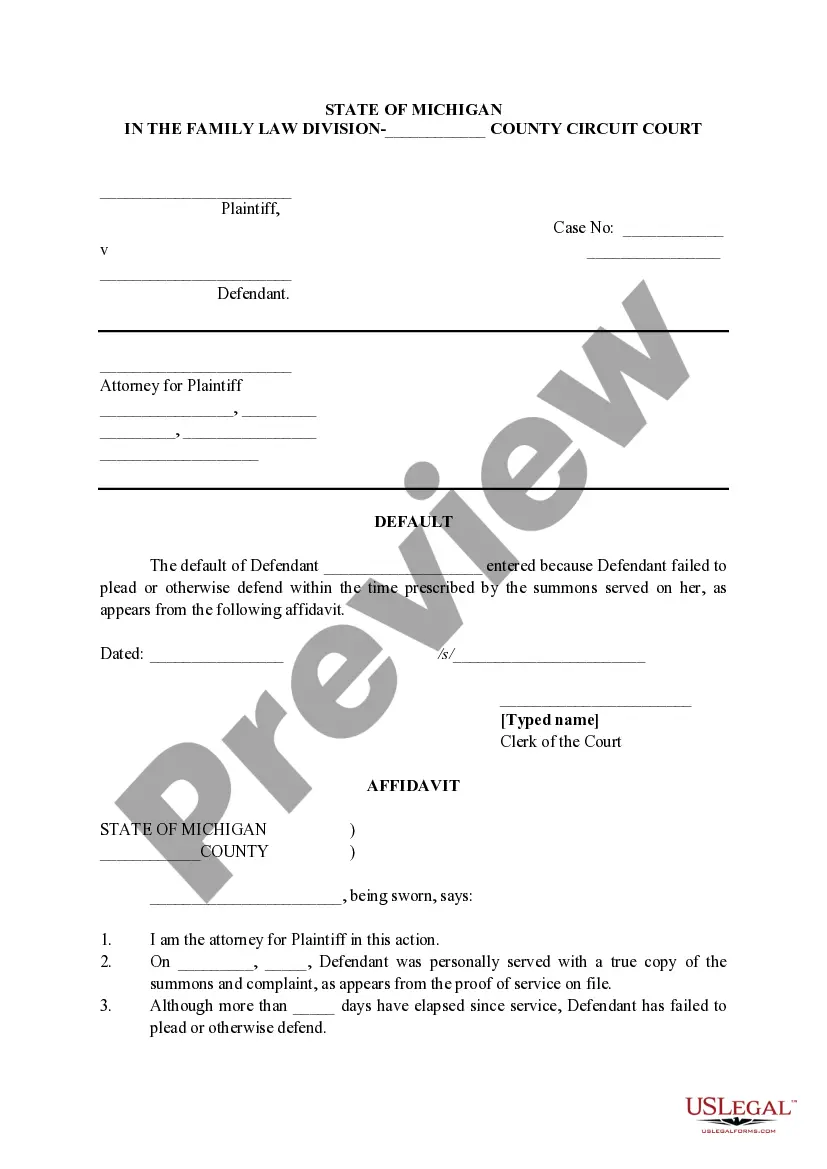

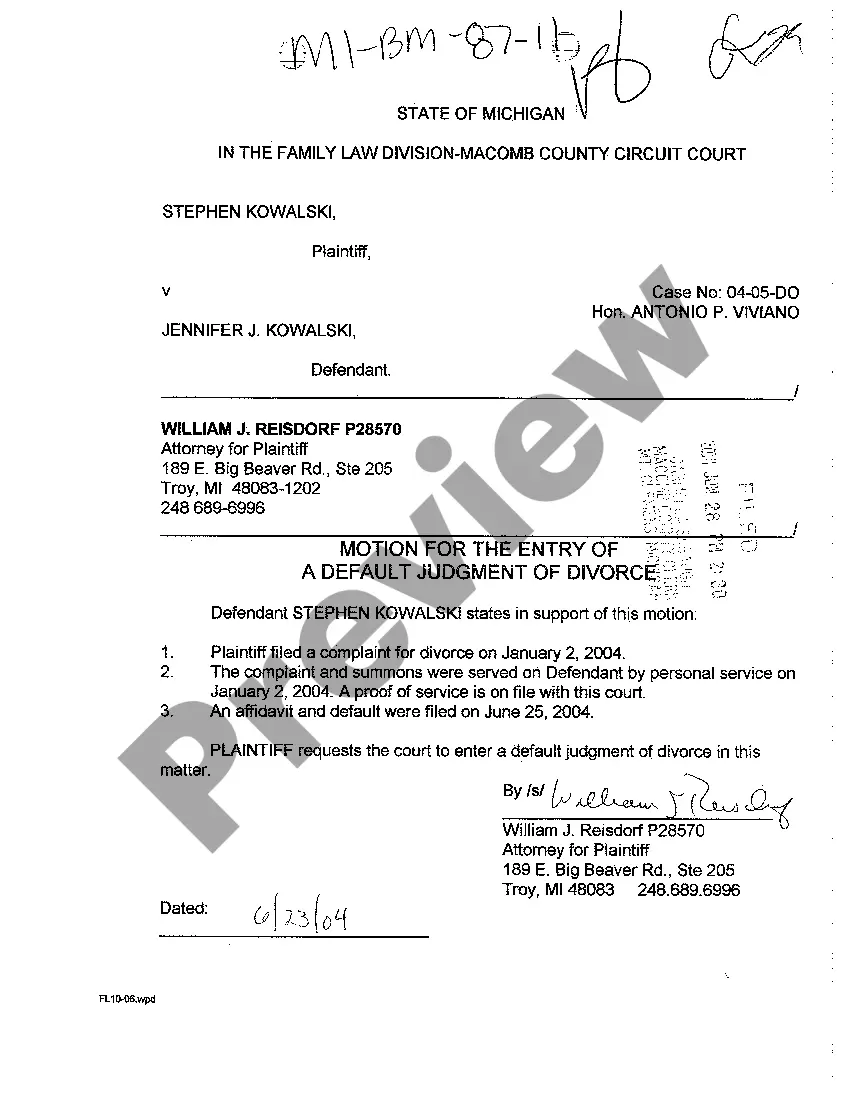

- Examine the page content to make sure you found the correct sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to obtain the document when you find the right one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Complete and sign the document on paper after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your documentation in order with the US Legal Forms!