The Kings New York Plan of Liquidation refers to a specific legal process followed by the Kings New York company to wind up its affairs and distribute its assets among its creditors and shareholders. This plan outlines the step-by-step procedures and guidelines for the orderly liquidation of the company's assets, maximizing value for all parties involved. The Kings New York Plan of Liquidation can vary based on the specific circumstances of the company's financial situation and the preferences of its stakeholders. While the basic objective remains the same, there might be different types of liquidation plans that can be pursued based on the company's goals. Here are a few possible variations: 1. Voluntary Liquidation: This type of liquidation occurs when the company's management voluntarily decides to wind up its operations and distribute its assets. It can happen due to various reasons such as poor financial performance, insolvency, or a strategic decision to focus on other ventures. The Kings New York Plan of Liquidation would outline the steps to be taken in this voluntary liquidation process. 2. Court-Ordered Liquidation: Sometimes, a company might be forced into liquidation through a court order, typically due to insolvency or failure to meet financial obligations. In such cases, the Kings New York Plan of Liquidation would be formulated in accordance with the court's directives, ensuring compliance with relevant laws and regulations. 3. Members' Voluntary Liquidation: This type of liquidation is applicable when a solvent company decides to cease operations and distribute its assets among its shareholders. The Kings New York Plan of Liquidation in this case will incorporate specific provisions for distributing the company's assets among the shareholders in an equitable manner. 4. Creditors' Voluntary Liquidation: When a company is no longer able to meet its financial obligations, creditors may propose a liquidation plan that aims to recover as much debt as possible. The Kings New York Plan of Liquidation in this scenario would prioritize the repayment of creditors and outline the steps for the sale of assets to generate funds. Overall, the Kings New York Plan of Liquidation plays a crucial role in providing a structured framework for efficiently winding up a company's affairs and ensuring a fair distribution of assets among its stakeholders. It serves as a roadmap for the entire liquidation process, enabling transparency, and safeguarding the interests of all parties involved.

Kings New York Plan of Liquidation

Description

How to fill out Kings New York Plan Of Liquidation?

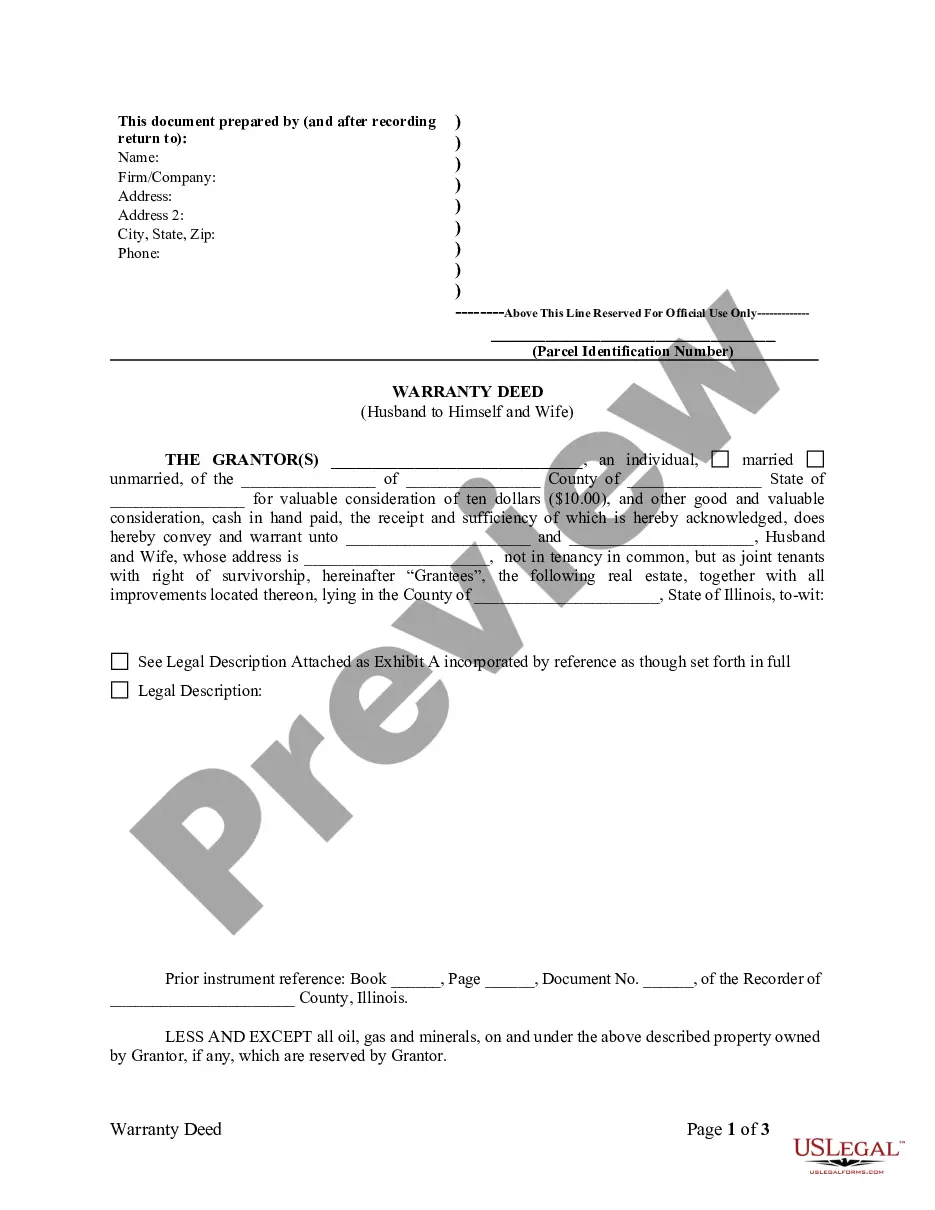

Preparing legal documentation can be cumbersome. Besides, if you decide to ask an attorney to write a commercial contract, documents for ownership transfer, pre-marital agreement, divorce papers, or the Kings Plan of Liquidation, it may cost you a lot of money. So what is the best way to save time and money and draw up legitimate forms in total compliance with your state and local laws? US Legal Forms is an excellent solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is the most extensive online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any scenario gathered all in one place. Therefore, if you need the latest version of the Kings Plan of Liquidation, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Kings Plan of Liquidation:

- Look through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - look for the correct one in the header.

- Click Buy Now when you find the required sample and choose the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a transaction with a credit card or via PayPal.

- Opt for the file format for your Kings Plan of Liquidation and download it.

Once done, you can print it out and complete it on paper or import the template to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the paperwork ever purchased many times - you can find your templates in the My Forms tab in your profile. Give it a try now!

Form popularity

FAQ

While the company structure survives during the liquidation process, once the process is finalised, the company is dissolved. During the process, all control of assets, the conduct of business, and any other financial affairs are transferred to the liquidator. Essentially, directors have no authority.

The liquidator has to verify all the claims of the creditors. He has to take control and custody of all the assets, effects, and actionable claims of debtors, property, etc. To enumerate the property and assets of the corporate debtors in the way prescribed by the Board and has to prepare a report on it.

Distribute money from the collection and sale of assets after payment of the costs of the liquidation, including the liquidator's fees (subject to the rights of any secured creditor) first to priority creditors, including employees, and then to unsecured creditors (noting there can only be one dividend paid to

A simplified liquidation process is a streamlined creditors' voluntary winding up for companies that have liabilities less than $1 million. It applies only to a creditors' voluntary winding up of a company where the event that triggers the start of the winding up occurs on or after 1 January 2021.

The Bottom Line There are a lot of intricacies when navigating the priority list of creditors during a liquidation process. In general, secured creditors have the highest priority followed by priority unsecured creditors. The remaining creditors are often paid prior to equity shareholders.

The company's assets are then assessed and realised (liquidated). If there are any creditors they are then paid in order of priority. Surplus cash is distributed to the shareholders. The company is finally dissolved and struck-off the registrar of companies (Companies House).

There is no legal time limit on business liquidation. From beginning to end, it usually takes between six and 24 months to fully liquidate a company. Of course, it does depend on your company's position and the form of liquidation you're undertaking.

1. When a company goes bankrupt, secured creditors get paid first. This includes secured bondholders. These are creditors who offered loans secured by physical assets.

Step 1 - A Creditor Issues a Statutory Payment Demand. Step 2 A Winding Up Petition is Issued. Step 3 A winding up order is granted. Step 4 The Company is Liquidated. Step 5 Post-Liquidation Investigation.

Each group must be paid in full before the liquidator can start to repay the next. These are generally banks and other asset based lenders that hold a fixed charge over the asset in question vehicles, for example, property, or land.