Orange California Plan of Liquidation is a legal process undertaken by businesses or organizations in the city of Orange, California, to wind up their affairs and distribute their assets among stakeholders in an orderly manner. This plan outlines the systematic steps that need to be followed to dissolve a company or terminate an entity's existence properly. The purpose of the Orange California Plan of Liquidation is to ensure the fair and transparent distribution of assets, liabilities, and responsibilities among all parties involved. There are various types of Orange California Plans of Liquidation, depending on the specific circumstances and nature of the entity. Some common types include: 1. Corporate Liquidation Plan: This plan is typically initiated by a corporation that has decided to cease its operations and liquidate its assets. It involves selling or distributing assets, paying off outstanding debts and liabilities, and distributing remaining assets to shareholders or other beneficiaries, as per the legal requirements and priorities. 2. Partnership Dissolution Plan: When a partnership in Orange, California, decides to dissolve, it requires a comprehensive dissolution plan. The plan outlines the process of selling partnership assets, settling partnership debts and liabilities, and distributing remaining assets among the partners, whether equally or according to a predetermined agreement. 3. Limited Liability Company (LLC) Dissolution Plan: LCS in Orange, California, also require a liquidation plan to dissolve their operations. This plan includes selling or transferring company assets, paying off debts and obligations, and distributing any remaining assets among members or as stipulated in the operating agreement. 4. Nonprofit Organization Liquidation Plan: Nonprofit organizations based in Orange, California, that decide to wind up their activities need to follow a liquidation plan. This plan addresses the orderly closure of the organization, settling any outstanding liabilities, distributing remaining assets in accordance with legal and tax requirements, and ensuring compliance with nonprofit regulations. Throughout the Orange California Plan of Liquidation process, it is crucial to adhere to legal obligations, including notifying creditors, filing appropriate documentation, addressing employee matters, and fulfilling tax obligations. Hiring the services of experienced attorneys or consultants well-versed in Orange, California, business law and dissolution procedures can ensure a smooth and legally compliant liquidation process. Overall, the Orange California Plan of Liquidation serves as a roadmap for businesses and organizations in Orange, California, to conclude their operations, wind up affairs, and distribute assets in a fair and equitable manner, while complying with legal requirements and safeguarding the rights and interests of all stakeholders involved.

Orange California Plan of Liquidation

Description

How to fill out Orange California Plan Of Liquidation?

Preparing legal documentation can be difficult. Besides, if you decide to ask an attorney to draft a commercial contract, documents for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Orange Plan of Liquidation, it may cost you a fortune. So what is the most reasonable way to save time and money and draw up legitimate forms in total compliance with your state and local laws? US Legal Forms is a great solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is biggest online collection of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any use case gathered all in one place. Therefore, if you need the recent version of the Orange Plan of Liquidation, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Orange Plan of Liquidation:

- Glance through the page and verify there is a sample for your area.

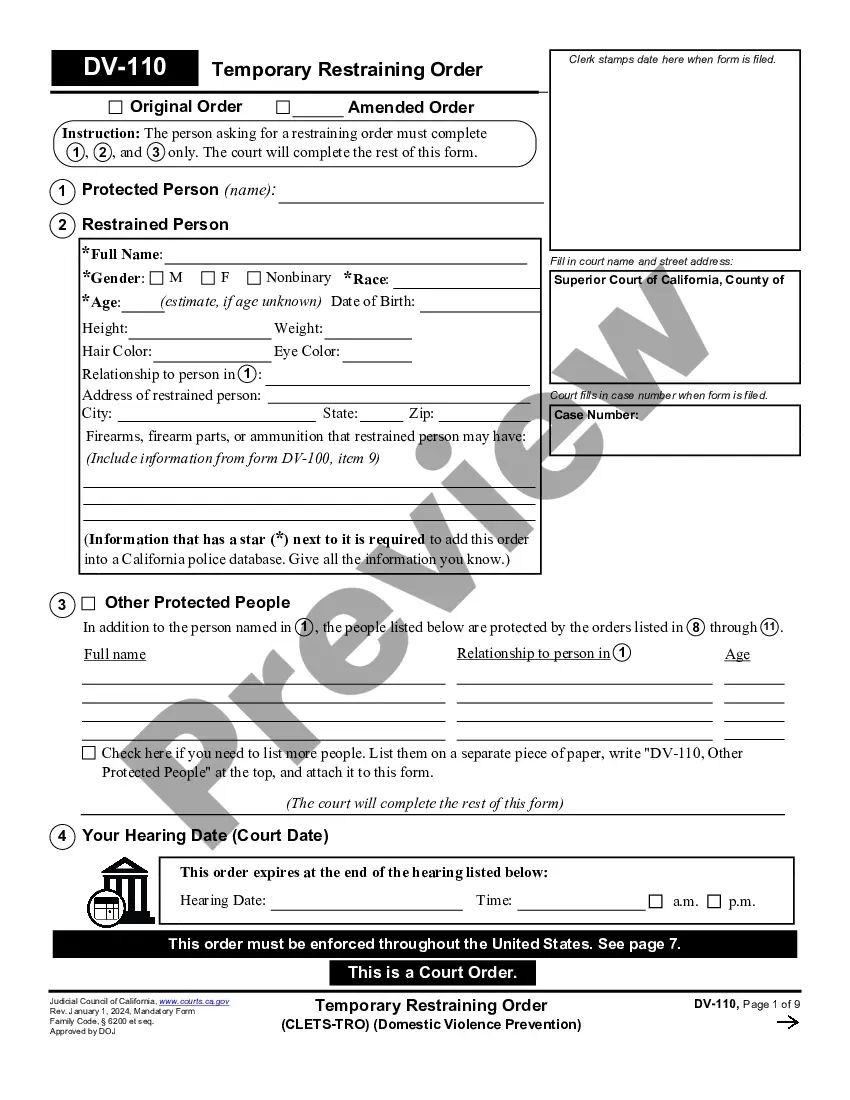

- Examine the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't suit your requirements - search for the correct one in the header.

- Click Buy Now when you find the required sample and pick the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a payment with a credit card or through PayPal.

- Choose the document format for your Orange Plan of Liquidation and save it.

When done, you can print it out and complete it on paper or import the samples to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the paperwork ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!