Chicago Illinois Plan of Complete Liquidation and Dissolution: A Comprehensive Guide Introduction: In the corporate world, businesses may decide to cease their operations and undergo a process known as liquidation and dissolution. Chicago, Illinois, being a hub for various industries and corporations, follows specific regulations and procedures for companies wishing to implement a plan of complete liquidation and dissolution. This article will delve into the details of the Chicago Illinois Plan of Complete Liquidation and Dissolution, exploring its various types, procedures, and relevant terms. Key terms: 1. Liquidation: The process of converting a company's assets into cash or selling them to pay off its debtors before ceasing operations. 2. Dissolution: The legal termination of a corporation's existence, often following the completion of the liquidation process. 3. Fiduciary: A person or organization entrusted with the responsibility of managing, protecting, and distributing assets during the liquidation and dissolution process. Types of Chicago Illinois Plan of Complete Liquidation and Dissolution: 1. Voluntary Liquidation and Dissolution: This type occurs when the stakeholders of a company, including shareholders and directors, voluntarily decide to dissolve the corporation. It is typically initiated when the business is unable to sustain operations or when its objectives have been achieved. 2. Involuntary Liquidation and Dissolution: In certain cases, a corporation may face legal action from creditors or regulators, leading to an involuntary liquidation and dissolution. The court may appoint a receiver or liquidator to oversee the process. Procedures and Steps Involved: 1. Board of Directors' Resolution: The company's board must pass a resolution authorizing the complete liquidation and dissolution of the corporation. This resolution sets the wheels in motion and initiates the process. 2. Notice to Creditors: Creditors of the corporation must be formally notified of the decision to liquidate and dissolve the company. This involves submitting notices to known creditors and publishing public notices for any potential unknown creditors to come forward. 3. Appointment of Liquidator: A liquidator, often a fiduciary appointed by the court or chosen by the stakeholders, takes charge of managing the liquidation process. Their duties include identifying and inventorying the corporation's assets, valuing them, and appropriately distributing the liquidated funds to creditors. 4. Asset Liquidation: The liquidator oversees the sale or disposition of the company's assets, ensuring maximum value realization. These assets may include physical properties, equipment, inventory, intellectual property rights, and investments. 5. Debt Repayment: The proceeds obtained from the liquidation are used to pay off outstanding debts and obligations of the corporation. Creditors are paid according to their priority, typically following Chicago law and regulations. 6. Residual Distribution: If any funds remain after the payment of debts, these are distributed to the corporation's shareholders according to their ownership interests. 7. Dissolution Filings: Once the liquidation process is complete, the corporation must file dissolution documents with the appropriate authorities to terminate its legal existence. Conclusion: The Chicago Illinois Plan of Complete Liquidation and Dissolution comprises various types and detailed procedures to wind up a business entity effectively. Understanding the specific laws and regulations surrounding this process is essential for businesses operating in Chicago. This guide has provided an overview of this plan, including key terms, types of liquidation and dissolution, and the steps involved, offering valuable insights for anyone navigating this crucial phase in a corporation's lifecycle.

Chicago Illinois Plan of complete liquidation and dissolution

Description

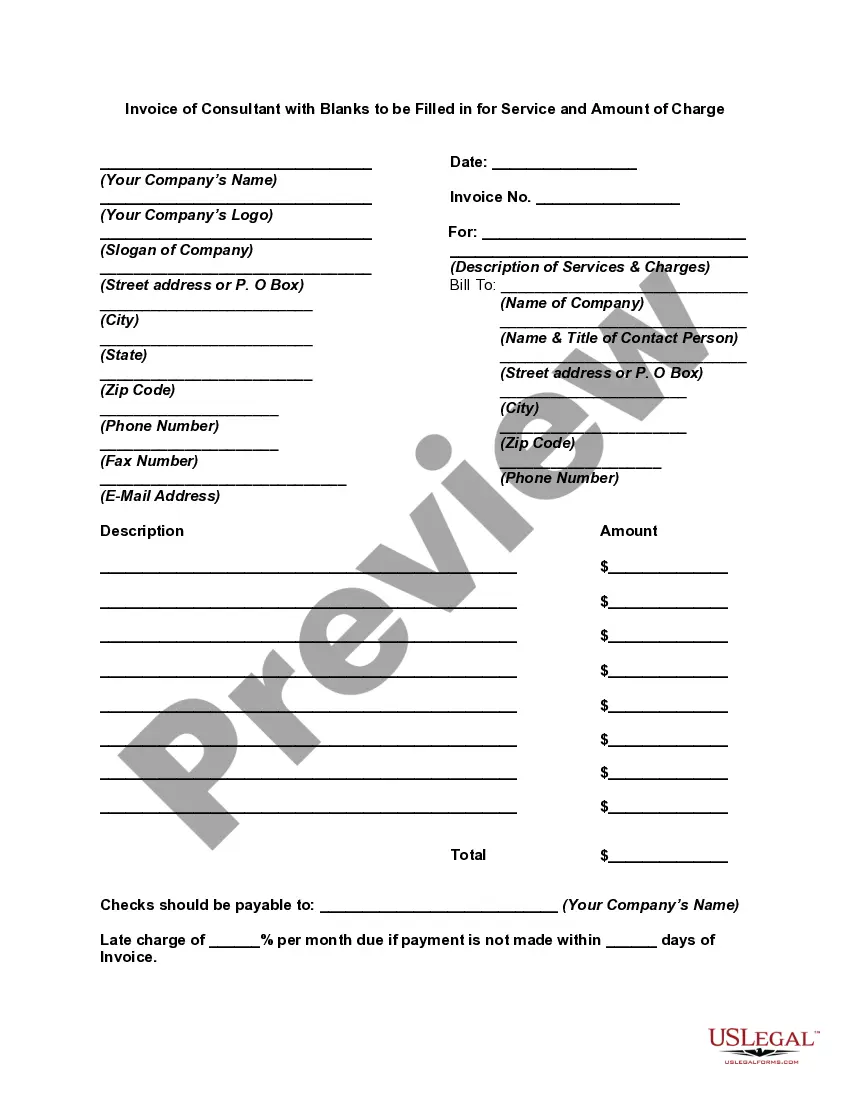

How to fill out Chicago Illinois Plan Of Complete Liquidation And Dissolution?

Laws and regulations in every sphere vary from state to state. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid pricey legal assistance when preparing the Chicago Plan of complete liquidation and dissolution, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal forms. It's a perfect solution for professionals and individuals looking for do-it-yourself templates for different life and business occasions. All the forms can be used multiple times: once you purchase a sample, it remains available in your profile for further use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Chicago Plan of complete liquidation and dissolution from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the Chicago Plan of complete liquidation and dissolution:

- Analyze the page content to ensure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to obtain the template when you find the right one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

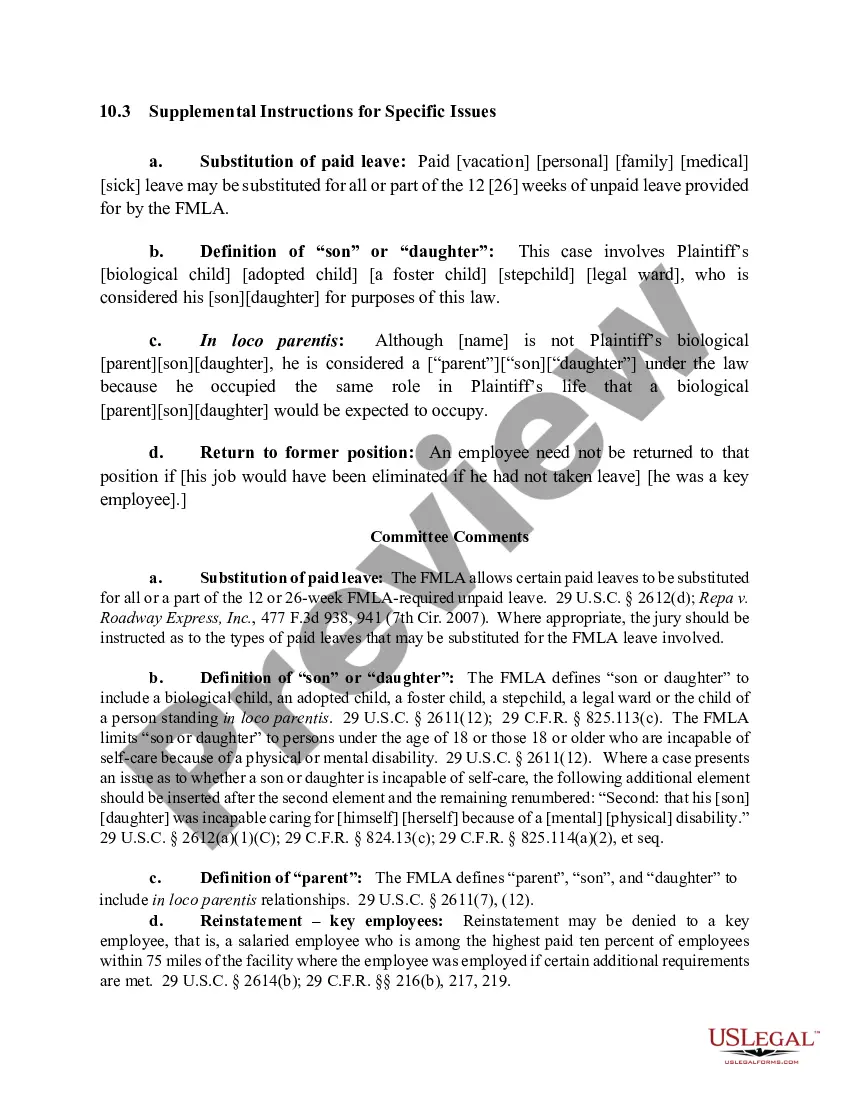

Secured Claims (1st Lien): Secured claims often have the top priority during liquidation proceedings. This is usually due to their money being guaranteed against collateral and secured by a contract with a debtor.

The administration of the liquidation begins. selling or closing the business. identifying and selling the company's assets. contacting and receiving claims from creditors. sending progress reports to creditors.

The liquidation or dissolution process for partnerships is similar to the liquidation process for corporations. Over a period of time, the partnership's non-cash assets are converted to cash, creditors are paid to the extent possible, and remaining funds, if any, are distributed to the partners.

Dissolution is the end of the legal existence of a corporation. It usually occurs after liquidation, which is the process of paying debts and distributing assets.

Answer. Liquidating distributions (cash or noncash) are a form of a return of capital. Any liquidating distribution you receive is not taxable to you until you recover the basis of your stock. After the basis of your stock is reduced to zero, you must report the liquidating distribution as a capital gain.

The quick answer. Liquidate means a formal closing down by a liquidator when there are still assets and liabilities to be dealt with. Dissolving a company is where the business is struck off the register at Companies House because it is now inactive. The two are very different processes.

Liquidation is also referred to as dissolution and the terms are used interchangeably, but technically they describe different actions and their meaning is not the same. In other words, liquidation is seen as a last legal resort for a stressed company, while dissolution is the first step in closing a business.

Liquidate means a formal closing down by a liquidator when there are still assets and liabilities to be dealt with. Dissolving a company is where the business is struck off the register at Companies House because it is now inactive. The two are very different processes.

Complete liquidation When a corporation is completely liquidated, it transfers all of its assets to its shareholders?whether the assets are cash or property?and the shareholders assume the corporation's remaining liabilities.

Winding up comes before dissolution. Winding up refers to closing the operations of a business, selling off assets, paying off creditors, and distributing any remaining assets to the owners. Once the winding-up process is complete, the dissolution step comes into play.

Interesting Questions

More info

The agreement may be terminated before the certificate is executed; and the company will continue to operate as an organization under G.S. 90-113. An organization is dissolved: 1. By an order from the Superior Court, unless the court orders otherwise, and, 2. By the State, unless the State orders otherwise. 3. In a case where the buyer is a for-profit corporation. 4. Under any other circumstance that the court determines appropriate. 5. An order to dissolve a nonprofit corporation may not be issued, although the nonprofit corporation has only one certificate of authority. © Unless an agreement to liquidate the business has been entered into within the preceding 60 days, the dissolution is complete. For example, if the business is conducted entirely under the direction of the buyer and there have been no other transactions with the buyer other than a sale, this does not void the agreement to dissolve.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.