A Phoenix Arizona Plan of Complete Liquidation and Dissolution refers to the legal process through which a business entity in Phoenix, Arizona, winds up its operations, liquidates its assets, and dissolves its existence. It involves a comprehensive plan outlining the procedures to be followed to ensure a smooth and orderly liquidation of assets and distribution of proceeds to stakeholders. Here, we will explore the key components and different types of plans relating to complete liquidation and dissolution in Phoenix, Arizona. 1. Overview of Phoenix Arizona Plan of Complete Liquidation and Dissolution: A Phoenix Arizona Plan of Complete Liquidation and Dissolution is a strategic blueprint or document that guides a business through all necessary steps of winding up operations and finalizing its affairs. The plan typically includes details such as objective, timelines, asset valuation, disposal strategies, creditor payments, tax obligations, and the distribution of remaining funds to stockholders or owners. 2. Key Components of a Plan of Complete Liquidation and Dissolution: a) Objective and Scope: The plan outlines the primary purpose of liquidation and dissolution, such as financial difficulties, retirement, or business restructuring. It defines the scope of the process, including which assets will be liquidated and how the proceeds will be distributed. b) Asset Valuation and Disposal: A detailed analysis of all company assets, including real estate, equipment, inventory, and intellectual property, is conducted. The plan determines the method of asset disposal, which can involve auctions, sales, or other appropriate means, to maximize the return for stakeholders. c) Creditor Payments: The plan addresses outstanding creditor obligations, ensuring a fair and orderly distribution of funds. It identifies debts, liabilities, and legal requirements for satisfying these obligations, such as settling outstanding loans or paying suppliers. d) Tax and Legal Considerations: A comprehensive assessment of tax liabilities, including federal, state, and local taxes, is conducted. The plan outlines the necessary compliance steps and ensures adherence to all legal requirements, such as filing final tax returns and terminating licenses/permits. e) Distribution of Remaining Funds: Once all debts and tax obligations are settled, the plan outlines the method for distributing remaining funds to stockholders or owners based on their ownership interests or agreements. 3. Different Types of Phoenix Arizona Plans of Complete Liquidation and Dissolution: a) Voluntary Liquidation: This occurs when a business decides to wind up its operations voluntarily, either due to financial difficulties, retirement of owners, or strategic business decisions. The plan is prepared by the company's management or its legal representatives. b) Involuntary Liquidation: In some cases, a business entity can be forced into liquidation by external parties, such as creditors or shareholders, to recover outstanding debts or assets. The plan may be devised by the entity seeking the liquidation or mandated by a court. c) Court-Ordered Liquidation: This type of liquidation and dissolution plan is ordered by a court due to bankruptcy or insolvency proceedings. The court appoints a liquidator who creates the plan in accordance with legal requirements and oversees the entire process. d) Creditors' Voluntary Liquidation: This type of liquidation occurs when the company's shareholders, directors, or majority creditors mutually agree to liquidate the business to repay debts. The plan is prepared by the company's directors, and a meeting is held where shareholders and creditors may vote on the proposal. In conclusion, a Phoenix Arizona Plan of Complete Liquidation and Dissolution is a vital document that outlines the necessary steps involved in winding up a business entity in Phoenix, Arizona. It encompasses various aspects, such as asset valuation, creditor payments, tax obligations, and distribution of remaining funds. Different types of plans, such as voluntary, involuntary, court-ordered, and creditors' voluntary liquidation, exist depending on the circumstances of the dissolution.

Phoenix Arizona Plan of complete liquidation and dissolution

Description

How to fill out Phoenix Arizona Plan Of Complete Liquidation And Dissolution?

Laws and regulations in every area differ from state to state. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal documentation. To avoid pricey legal assistance when preparing the Phoenix Plan of complete liquidation and dissolution, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal forms. It's an excellent solution for specialists and individuals searching for do-it-yourself templates for different life and business occasions. All the forms can be used multiple times: once you obtain a sample, it remains accessible in your profile for subsequent use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Phoenix Plan of complete liquidation and dissolution from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Phoenix Plan of complete liquidation and dissolution:

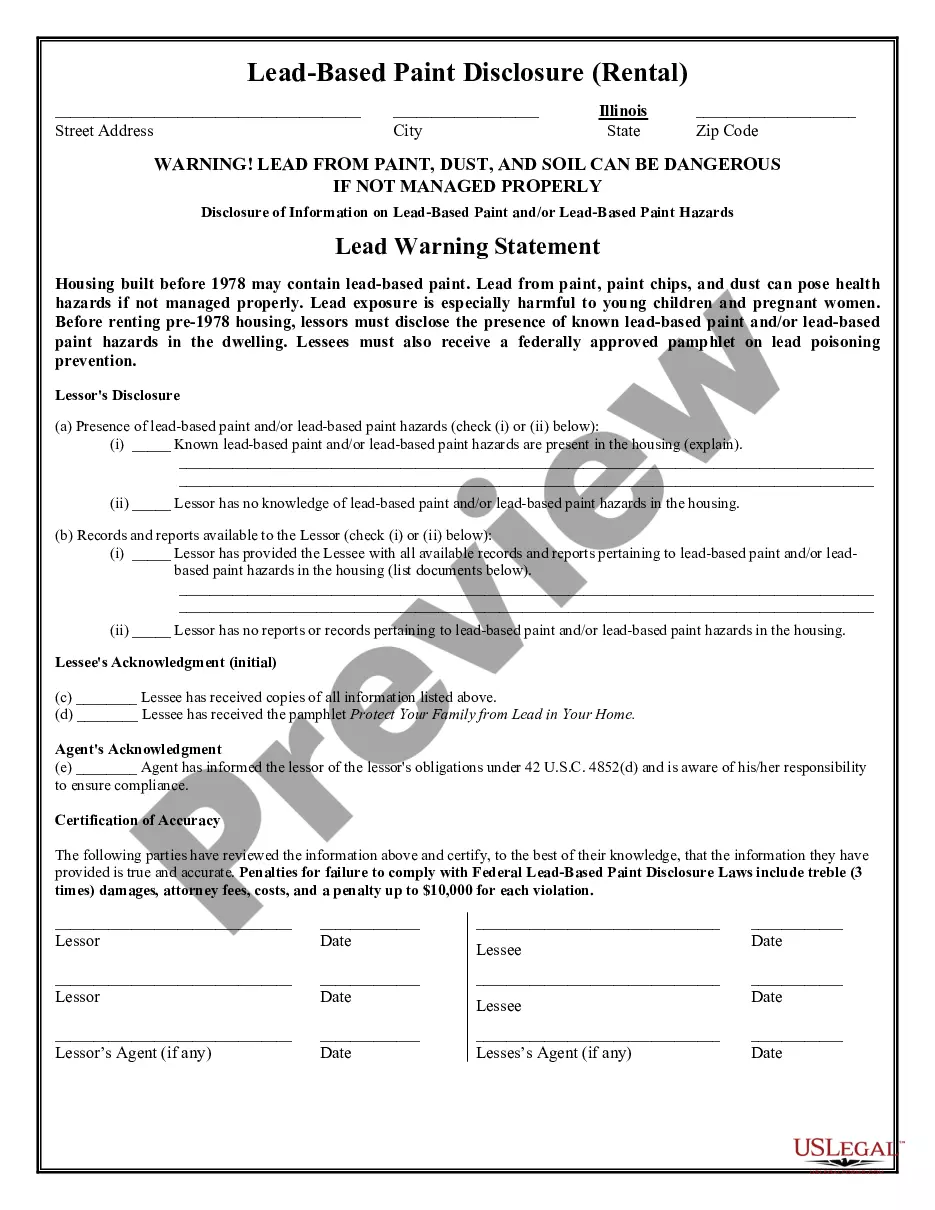

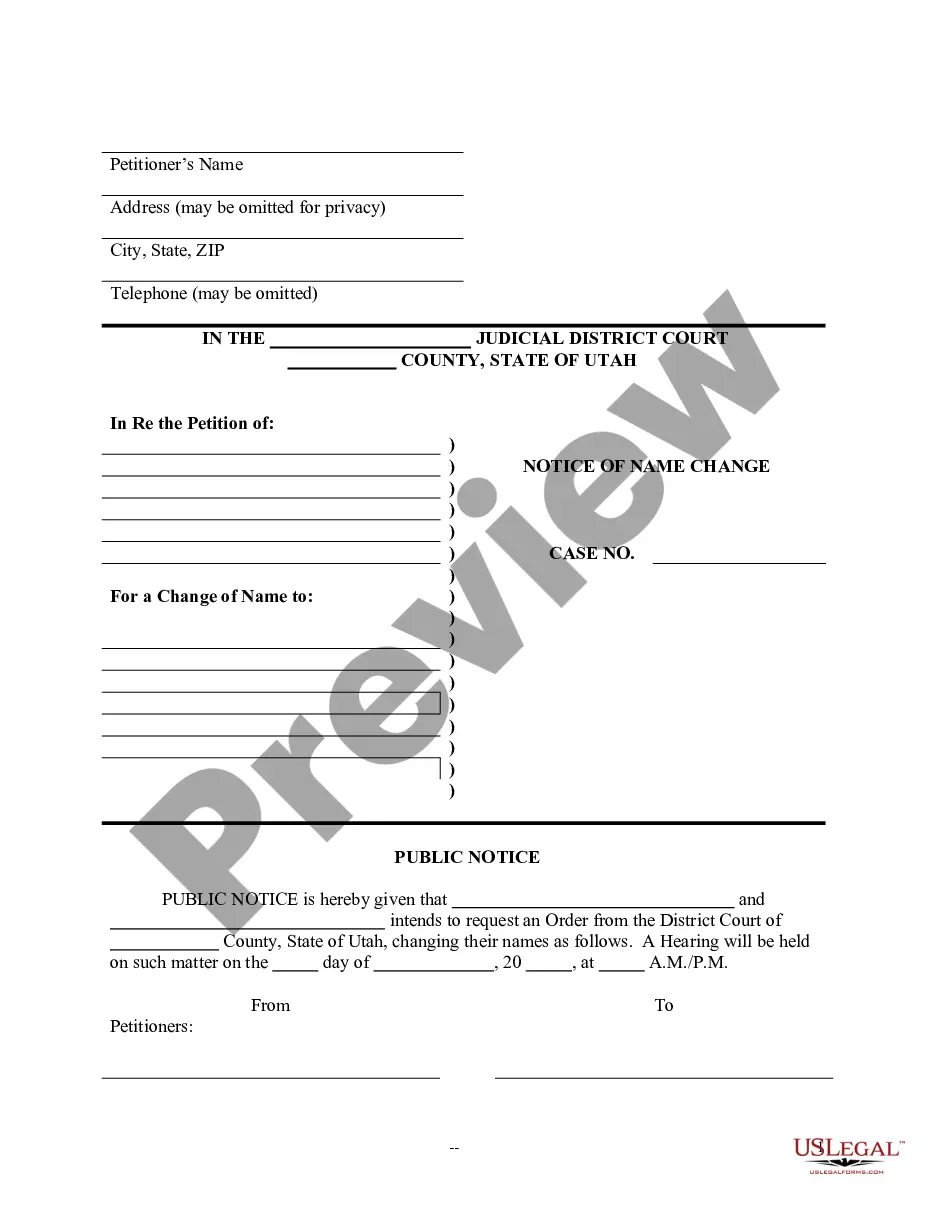

- Take a look at the page content to ensure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to obtain the document when you find the right one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Fill out and sign the document on paper after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your documentation in order with the US Legal Forms!