A San Antonio Texas Plan of complete liquidation and dissolution refers to the process by which a company decides to cease its operations, sell off its assets, pay off its debts, and distribute any remaining funds to its shareholders or owners. This plan is typically executed when a company decides to completely wind up its affairs and close down. There are several types of San Antonio Texas Plans of complete liquidation and dissolution, each varying in their approach and specific circumstances. These may include: 1. Voluntary liquidation: This occurs when a company's shareholders willingly agree to dissolve the company and appoint a liquidator to manage the process. The liquidator is responsible for selling off the company's assets, settling outstanding debts, and distributing any remaining funds to the shareholders or owners. 2. Involuntary liquidation: Also known as compulsory liquidation, this process occurs when a court orders the dissolution of a company due to insolvency or other legal reasons. The court appoints a liquidator to oversee the process and ensure the fair distribution of assets to creditors and shareholders. 3. Creditors' voluntary liquidation: This type of liquidation occurs when a company is unable to pay its debts and initiates the liquidation process voluntarily. The company's directors usually decide to wind up operations and appoint a liquidator to sell the assets, settle debts with creditors, and distribute any remaining funds to shareholders. 4. Members' voluntary liquidation: This form of liquidation is initiated when a solvent company decides to dissolve itself voluntarily. Typically, the shareholders pass a resolution to wind up the company's affairs and appoint a liquidator to oversee the process. The liquidator ensures the company's assets are sold, debts settled, and any surplus funds are distributed to shareholders. When developing a San Antonio Texas Plan of complete liquidation and dissolution, it is essential to consider various factors. These may include the company’s financial situation, existing contracts and agreements, outstanding debts, legal requirements, tax implications, and potential disputes. Engaging legal and financial professionals who specialize in liquidation and dissolution can provide guidance and ensure compliance with relevant laws and regulations. Keywords: San Antonio Texas, plan of complete liquidation, dissolution, voluntary liquidation, involuntary liquidation, compulsory liquidation, creditors' voluntary liquidation, members' voluntary liquidation, liquidator, assets, debts, shareholders, court, insolvency, wind up operations, solvent company, resolution, financial situation, legal requirements, tax implications, disputes, legal professionals, financial professionals, distribute funds.

San Antonio Texas Plan of complete liquidation and dissolution

Description

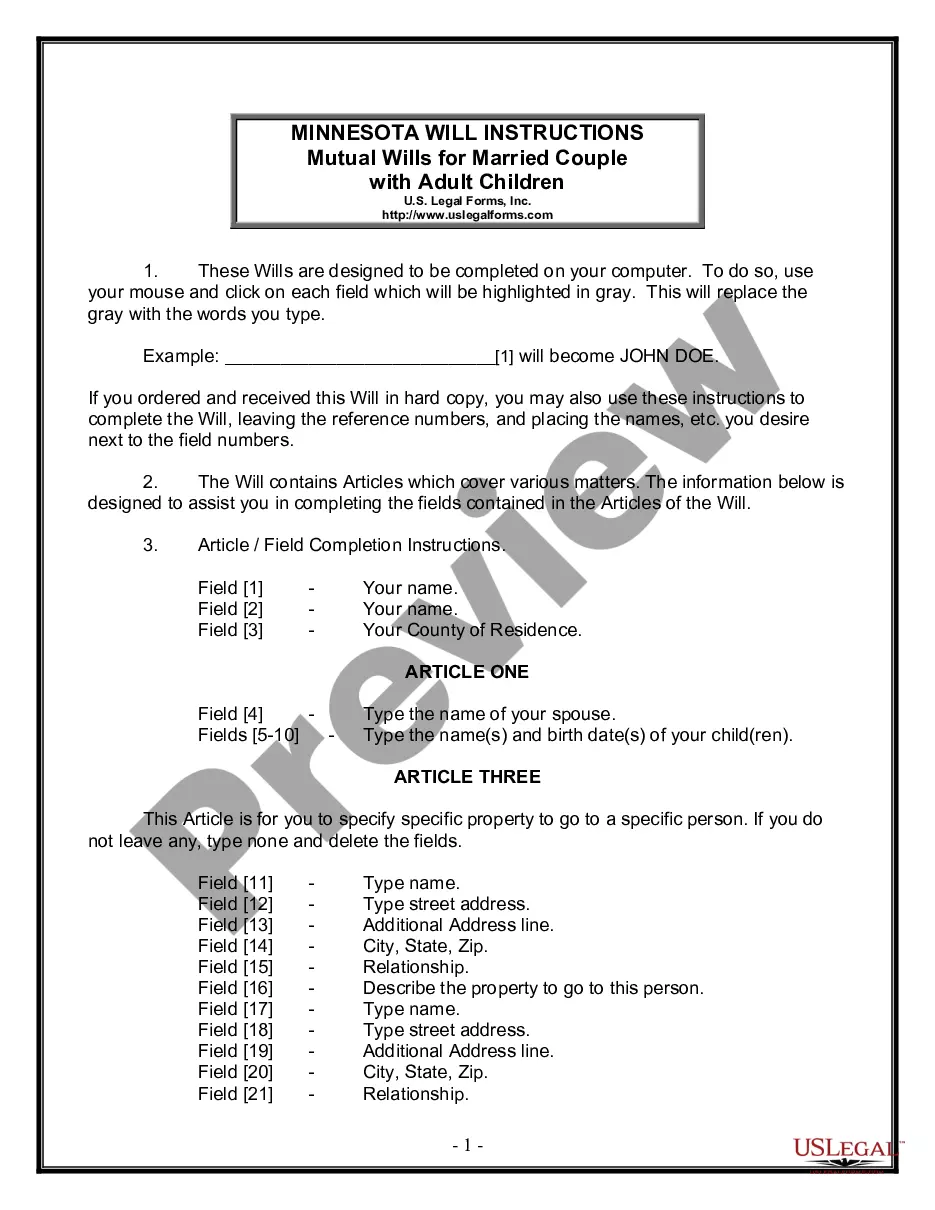

How to fill out San Antonio Texas Plan Of Complete Liquidation And Dissolution?

Whether you plan to start your business, enter into a contract, apply for your ID renewal, or resolve family-related legal issues, you must prepare certain documentation meeting your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and checked legal documents for any individual or business case. All files are collected by state and area of use, so picking a copy like San Antonio Plan of complete liquidation and dissolution is fast and easy.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you several additional steps to get the San Antonio Plan of complete liquidation and dissolution. Follow the instructions below:

- Make sure the sample meets your personal needs and state law regulations.

- Look through the form description and check the Preview if available on the page.

- Utilize the search tab providing your state above to find another template.

- Click Buy Now to get the file when you find the right one.

- Opt for the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the San Antonio Plan of complete liquidation and dissolution in the file format you prefer.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our library are reusable. Having an active subscription, you are able to access all of your earlier acquired paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!