Santa Clara California is a city located in the heart of Silicon Valley, known for its high-tech industries, vibrant culture, and proximity to major tech companies. The Santa Clara California Plan of complete liquidation and dissolution refers to a legal process undertaken by a corporation or business entity based in Santa Clara, California, to wind up its affairs, sell its assets, and distribute the proceeds to its creditors and shareholders. The Santa Clara California Plan of complete liquidation and dissolution is a strategic approach followed by companies seeking to permanently terminate their operations and distribute their remaining assets. This plan involves the systematic sale or disposal of assets, settlement of outstanding debts and obligations, and final distribution of any remaining funds to shareholders. There may be different types of Santa Clara California Plans of complete liquidation and dissolution, including: 1. Voluntary Liquidation: This occurs when the corporation or business entity voluntarily decides to dissolve and liquidate its assets due to various reasons, such as financial difficulties, market changes, or strategic considerations. 2. Involuntary Liquidation: In some cases, a Santa Clara-based corporation or business entity may be compelled to liquidate and dissolve by external forces, such as a court order, failure to meet legal requirements, or violation of regulations. 3. Creditors' Voluntary Liquidation: This type of liquidation occurs when the company is unable to repay its debts and creditors agree to a liquidation plan to recover as much of their outstanding dues as possible. 4. Members' Voluntary Dissolution: This form of dissolution is initiated by the shareholders or members of a Santa Clara-based company who collectively decide to terminate operations when they believe that the company has accomplished its objectives or is no longer viable. During the Santa Clara California Plan of complete liquidation and dissolution, key steps include conducting a thorough assessment of assets, resolving outstanding liabilities, notifying creditors and shareholders, selling assets through auction or private sale, and distributing remaining funds according to a predetermined priority and hierarchy. This process requires adherence to legal guidelines and involves the assistance of legal professionals experienced in corporate dissolution and liquidation. In conclusion, the Santa Clara California Plan of complete liquidation and dissolution serves as a legally structured process for companies based in Santa Clara, California, to wind up their affairs, liquidate assets, settle debts, and distribute proceeds to creditors and shareholders. Various types of liquidation and dissolution plans may exist, including voluntary, involuntary, creditors' voluntary, and members' voluntary dissolution.

Santa Clara California Plan of complete liquidation and dissolution

Description

How to fill out Santa Clara California Plan Of Complete Liquidation And Dissolution?

A document routine always goes along with any legal activity you make. Opening a business, applying or accepting a job offer, transferring ownership, and many other life situations require you prepare formal documentation that varies from state to state. That's why having it all collected in one place is so valuable.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal forms. Here, you can easily find and download a document for any individual or business objective utilized in your county, including the Santa Clara Plan of complete liquidation and dissolution.

Locating forms on the platform is remarkably straightforward. If you already have a subscription to our library, log in to your account, find the sample through the search field, and click Download to save it on your device. Afterward, the Santa Clara Plan of complete liquidation and dissolution will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this quick guide to get the Santa Clara Plan of complete liquidation and dissolution:

- Make sure you have opened the proper page with your regional form.

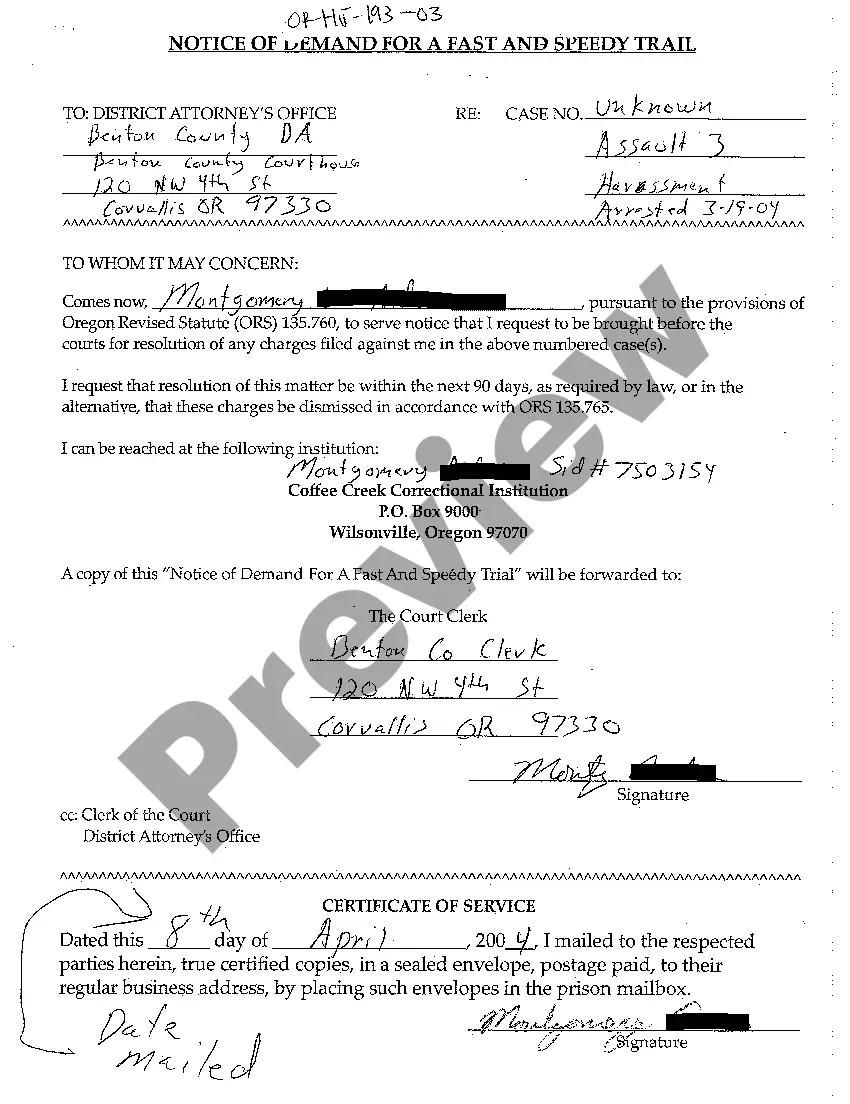

- Use the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the template corresponds to your requirements.

- Look for another document via the search option in case the sample doesn't fit you.

- Click Buy Now once you locate the required template.

- Decide on the appropriate subscription plan, then log in or create an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and download the Santa Clara Plan of complete liquidation and dissolution on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most trustworthy way to obtain legal documents. All the templates available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!